|

市場調查報告書

商品編碼

1440249

5G形勢:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global 5G Landscape - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

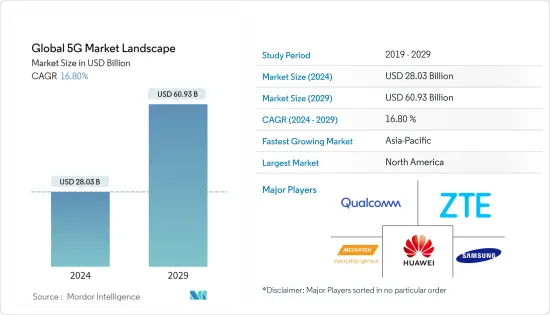

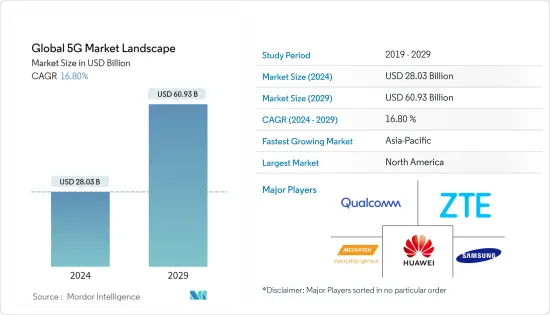

預計2024年全球5G市場規模為280.3億美元,預計2029年將達609.3億美元,預測期內(2024-2029年)年複合成長率為16.80%。

5G 網路是下一代行動網路標準,具有無縫覆蓋、高資料速率、低延遲、更好的性能和高效的通訊,並準備好提供改進的最終用戶體驗。Masu。

智慧型手機產業將是受 5G 連線影響的眾多領域之一。例如,物聯網 (IoT) 和機器對機器 (M2M) 的基礎設施進步長期以來一直受到 4G 緩慢的下載速度和延遲的限制。連接到網路並通訊的設備越多,延遲的累積效應就越明顯。例如,擴增實境憑藉其速度和頻寬的提高,最終將使穿戴式科技無縫融入人們的日常生活。自動駕駛汽車之間的即時通訊也將成為自動駕駛汽車的巨大優勢。

此外,5G 將極大改善公共和保全的智慧城市服務。當發生車禍或恐怖攻擊等情況時,可以即時分析公共場所的視訊記錄,並與生物識別軟體結合,識別危險情況並立即自動向當局發出警報。與目前的CCTV系統相比,支援 5G 的裝置將能夠以無線方式取得更新,資料管理平台將連結不同的服務。此外,5G連接設備將擴展到無人機和機器人等行動設備,使它們能夠安裝在行動網路覆蓋的任何地方,從而消除對固定線路的需求。

此外,政府支持智慧城市計劃的擴張也是一個重要的市場趨勢。在住宅城市事務部的支持下,印度計畫在2023年發展4,000個城市,人口達500萬人。此外,在英國,桑德蘭市議會已與 BAI 建立了長達 20 年的策略合作夥伴關係。 通訊將於 2021 年 10 月開始設計、建置和營運新一代數位基礎設施,包括私有 5G小型基地台網路。新的 5G 網路將實現桑德蘭市議會成為完全數位化智慧城市的雄心壯志。

事實上,在 COVID-19感染疾病之後,消費者和專業人士比以往任何時候都更加依賴可靠、快速的網路效能,從而增加了對連線的需求。例如,大流行的限制導致許多企業和工業設施關閉,擾亂了製造流程和供應鏈。使用 5G通訊的遠端控制設備突然變得不可或缺。這使得人類輔助人員能夠更快、更準確、更遠地操作起重機、無人機和其他工業機械。這只是 5G 對於使企業能夠繼續運作並在面對未來的干擾時保持彈性至關重要的多種方式之一。

另一方面,由於服務的綜合性,5G 連接預計會增加頻譜的多層複雜性。有限的可用頻譜是 5G 發展的主要挑戰。 5G 的頻寬要求意味著更高的頻譜對於提供高速、高品質的連線至關重要。 5G標準使用毫米波,它比4G使用的波長短得多。波長較短意味著 5G 連接可以比 4G 更快地傳輸更多資料,但這也意味著通訊要短得多。 4G 波長的範圍幾乎為 16 英里。 5G 的波長範圍約為 1,000 英尺,不到 4G 覆蓋範圍的 2%。因此,要確保穩定的 5G 訊號,就需要在各處部署大量 5G 基地台和天線,從而增加了設定成本。

5G市場趨勢

5G設備是推動市場的因素之一

- 據 GSMA 稱,中等收入水平的大型經濟體(如巴西、印尼和印度)新一輪 5G 部署可能會促進低收入者更容易使用的 5G 設備的大規模生產。鑑於迄今為止大多數 5G 應用和用例都集中在較發達的市場,它還可能促進發展中地區創建全新的 5G 業務和消費者應用。同時,5G行動電話的平均零售價格現已低於 500 美元,Realme 等一些供應商提供的智慧型手機價格低於 150 美元。

- 此外,愛立信表示,2019年至2027年間,全球5G用戶預計將從1,200萬以上大幅增加至40億以上。預計訂閱人數最多的地區包括東北亞、東南亞、印度、尼泊爾和不丹。此外,GSMA 預測,到 2025 年,已開發亞太地區、北美和大中華區所有行動連線的一半以上將是 5G 連線。

- 此外,筆記型電腦製造商正在引入5G技術以佔領更廣泛的市場佔有率。例如,晶片製造商英特爾去年為宏碁、華碩和惠普的 30 多種筆記型電腦型號提供了新的 5G 解決方案 5000 數據機。此外,英特爾正在增強其 Tiger Lake 系列相容於 5GHz 的超薄筆記型電腦。英特爾 5G 解決方案 5000 是一款 M.2 模組,已獲得 AT&T 和 Spring 等通訊業者的全球覆蓋認證。英特爾可分別提供高達 1.25 Gbps 和 4.7 Gbps 的上傳和下載速度。

- 此外,今年10月,現代摩比斯聲稱已開發出基於5G的汽車通訊模組,以提高包括自動駕駛在內的聯網汽車系統的效能。此模組可實現即時、大容量的資料處理。根據該提供者介紹,新模組採用超高速、超低延遲和超連接技術,將記憶體和通訊操作以及射頻電路和 GPS 結合在一起。

- 相反,大多數美國智慧型手機公司依賴廣泛的5G設備目標受眾,這可能會影響消費者升級到5G的選擇。 NPD Group 表示,美國智慧型手機用戶使用智慧型手機的時間越來越長,這對當今智慧型手機市場來說是一個挑戰。製造商和通訊業者希望5G能夠幫助重新運作昇級週期。然而,定價可能是另一個障礙。

中國佔據壓倒性的市場佔有率

- 由於國內政府在基礎設施能力、當地供應鏈的先進研發以及消費者對國內外即將推出的技術的興趣方面的大力支持,預計中國將引領 5G 汽車的早期主導。這些車輛將專用於中國龐大的國內市場,這一事實將進一步簡化部署,因為 5G 基礎設施和標準很可能在中國各地實現標準化。

- 根據南山區政務服務和資料管理局介紹,南山市作為一流城市發達行政區,為支撐城市級行政管理和服務,堅持周密的頂層設計規劃,利用前沿的5G據說他們正在這樣做。 +技術。該計劃透過考慮管治、公共服務和行業發展來滿足大多數人最迫切的需求。具有5G+物聯網能力的超大規模城市層級認知網路,從終端到網路正在發展。透過全景、分層、動態呈現都市區5G產業發展趨勢,重建5G+智慧城市的綜合效應。

- 同樣,根據浙江省麗水市緊急管理局介紹,麗水市是面積最大的地級市。市內約90%為森林,5%為水,5%為農田,因此各種災害頻繁發生,造成巨大損失。視覺化系統對於明智的決策、有效的指揮和調度以及快速解決情況至關重要。麗水5G緊急視覺化系統是根據緊急管理局的需求,為造福平民而打造的集雲、管理、終端於一體的平台。該平台提供災害預警、遠端搜救、5G網路衛星通訊、5G移動艙等功能。

- 此外,在熱帶海南省,中國聯通與華為合作開發的融合MEC和AI的5G智慧醫療網路提高了醫療服務的效率和覆蓋範圍。各市縣醫院、340個鄉鎮衛生院、2693個村衛生室均配備了遠端醫療設備。此網路提供人工智慧輔助的遠距會診和診斷。患者平均等待時間縮短了一半,醫療保健效率提高了 30%。

- 此外,中國的智慧製造工廠也呈現成長趨勢,其中M2M通訊對於整個工廠的高效運作至關重要。因此,由於各個最終用戶產業擴大採用這些技術,5G 連線的發展正在不斷加速。例如,位於江蘇省蘇州市的Robotech工廠正致力於成為一座完全支援5G的智慧工廠。樣板工廠將在營運層安裝5G網路,取代固網和Wi-Fi連接,使設備更加智慧,並促進工業應用向雲端遷移,實現軟性智慧製造。我計劃了。

5G產業概況

5G市場土地空間高度整合。所有參與生產的公司都利用其高研發能力和投資不斷頻繁地增強其產品供應,並且當前的市場競爭非常激烈,市場上的大多數現有參與者都是如此。

2022 年 5 月,聯發科技推出了首款毫米波 5G 晶片組-天璣 1050系統晶片[SoC],可提供無縫連接、顯示、遊戲和功效。天璣 930 和 Helio G99 是另外兩款晶片組,作為該公司擴展其 5G 和遊戲晶片組系列的一部分而推出。天璣1050採用八核心CPU和台積電6nm製造製程打造,結合毫米波5G和sub-6GHz,支援網路頻譜遷移。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 5G 時間表概述

- 目前引進週期- 先驅者、採用者、後來者

- 市場促進因素(全球設備和端點數量的持續成長 | 組件和設備級別的技術創新有助於部署 | 5G 與前幾代相比提供的主要優勢 |虛擬網路架構的採用不斷增加)

- 市場挑戰(缺乏標準化|設計與營運挑戰)

- 市場機會(工業領域需求可望增加 | 新興國家5G導入工作順利)

- 5G 及未來 - 前進之路

- 新型冠狀病毒感染疾病(COVID-19)對5G形勢的影響

- 重點行業法規政策

第5章技術概況

第6章 5G介紹市場形勢

- 全球通訊業者數量 - 按試驗和商業發布細分(2018 年第 2 季 - 2020 年第一季)

- 5G部署的國家級覆蓋範圍-投資和商業化趨勢

- 行動通訊基地台回程傳輸、宏和小型基地台基地回程傳輸總合使用量 - 百分比(微波、衛星、Sub-6GHz)

- 大型基地台站點

- 小型基地台站點

- 市場展望

第7章 5G連結市場形勢

- 5G連線數(百萬)

- 5G連線數(按類型)

- 行動寬頻

- 固定無線存取

- M2M 和物聯網

- 關鍵任務

- 5G覆蓋率、區域百分比

- 5G和4G部署、連線百分比

- 2G、3G、4G、5G市場佔有率- 百分比

- 美國、日本、歐洲、中國、獨立國協、拉丁美洲和 SSA 的 5G 連結數 (2027 年)

- 5G終端數量(2019年3月-2020年4月)

第8章市場區隔(5G設備市場形勢)

- 按外形尺寸分類的 5G 設備數量

- 智慧型手機

- CPE(室內/室外)

- 模組

- 熱點

- 筆記型電腦

- 工業級CPE/路由器/閘道器

- 其他外形尺寸(無人機、頭戴裝置、平板電腦、電視、轉接器等)

- 按頻譜支援分類的 5G 設備數量

- 低於 6GHz

- 毫米波

- 兩個頻譜頻寬

- 主要供應商名單

第9章 5G智慧型手機市場形勢

- 智慧型手機出貨貨量

- 品牌市場佔有率,百分比,2022 年

- Samsung

- Huawei

- Vivo

- Xiaomi

- LG

- OPPO

第10章 5G晶片組市場形勢

- 5G晶片市場規模及預測

- 按 IC 類型分類的 5G 晶片組市場區隔

- RFIC

- ASIC

- 毫米波IC

- 蜂窩IC

- 5G 晶片組市場區隔(按部署)

- 裝置

- CPE

- 網路基礎設施

- 其他

- 供應商形勢分析 - 按型號、類型和供應商列出的商用 5G 晶片組清單、DL UL 速度、sub-6GHz、毫米波、LTE 相容性

- 涵蓋高通、三星、聯發科、海思等主要廠商

第11章 5G對連合收益的貢獻

- 5G行動收益預測

- 各地區 5G 行動收益預測

- 歐洲

- 中國

- 日本

- 美國

- 韓國

- 5G 對經濟的貢獻達數兆美元(2024-2030 年)

- 為全球勞動力貢獻 5G

- 主要行業 5G 支出最高的消費者

- 基於行動寬頻、行動物聯網和關鍵任務服務投資的重點產業分析

第12章投資分析

第13章5G市場展望

The Global 5G Market size is estimated at USD 28.03 billion in 2024, and is expected to reach USD 60.93 billion by 2029, growing at a CAGR of 16.80% during the forecast period (2024-2029).

With seamless coverage, high data rates, low latency, much better performance, and efficient communications, the 5G network-the next generation of mobile networking standards-is ready to provide an improved end-user experience.

The sphere of smartphones will be one of many things that will be impacted by 5G connectivity. Infrastructural advancements in the Internet of Things (IoT) and Machine-to-Machine (M2M) have, for example, long been constrained by the slow download speeds and latency of 4G. The cumulative effect of any latency will be more significant and observable as more devices are connected to a network and communicating with one another. For instance, augmented reality will eventually enable wearable technology to seamlessly integrate with people's daily lives due to increased speed and bandwidth. Instantaneous communication amongst autonomous vehicles will be quite advantageous for them as well.

Additionally, 5G will dramatically improve smart city services for public security and safety. In instances like a car accident or terrorist attack, real-time analytics of video recordings from public spaces combined with biometric software will be able to identify unsafe circumstances and automatically warn authorities instantly. Contrary to current CCTV systems, 5G-enabled equipment will be able to get updates wirelessly, and data management platforms will link different services. Additionally, 5G connected equipment will be extended to mobile form factors like drones and robots and be able to be installed everywhere there is mobile network coverage, doing away with the requirement for fixed wire.

Furthermore, national governments aiding the expansion of smart city projects is also a key trend in the market. With the support of the Ministry of Housing and Urban Affairs in India, the nation aims to develop 4,000 cities to house a population of 5,00,000 each by 2023. Moreover, in England, Sunderland City Council awarded a 20-year strategic partnership to BAI Communications to design, build and operate next-generation digital infrastructure, including a private 5G small cell network, in October 2021. The New 5G network will realize Sunderland City Council's ambition to be a fully digitally enabled smart city.

Indeed, more than ever, consumers and professionals depend on reliable, fast internet performance after the COVID-19 pandemic, which has increased demand for connectivity. For instance, pandemic restrictions prompted the closure of numerous enterprises and industrial facilities, causing manufacturing processes and supply chains to be disrupted. Remotely controlled devices with 5G communication suddenly became essential. They made it possible for human drivers to operate cranes, drones, and other industrial machinery more quickly, accurately, and from a distance. This is just one of the many ways that 5G could be important for assisting businesses to continue operating and be resilient in the face of any future disruption.

On the flip side, a 5G connection is expected to add multiple layers of complexity to the spectrum due to the all-inclusive nature of services. Limited spectrum availability is a big challenge in the development of 5G. The bandwidth requirements of 5G mean a higher frequency spectrum would be fundamental in delivering high-speed, high-quality connectivity. The 5G standard, which uses millimeter waves, is a lot shorter than the wavelengths 4G uses. The shorter wavelength means a 5G connection can carry much data faster than 4G, but it also means a significantly shorter range. 4G wavelengths have a range of almost 10 miles. 5G wavelengths range about 1,000 feet, not even 2% of 4G's coverage. So, to ensure a robust 5G signal, there is a requirement for many 5G cell towers and antennas everywhere, increasing the setup cost.

5G Market Trends

5G Devices are One of the Factors Driving the Market

- According to GSMA, a new wave of the 5G rollouts in large economies with modest income levels (such as Brazil, Indonesia, and India) could encourage the mass production of 5G devices that are more accessible to lower-income people. It might also encourage the creation of brand-new 5G business and consumer applications in developing regions, given that most 5G applications and use cases to date have been concentrated on more developed markets. In the meantime, the average retail price of a 5G phone has now dropped below USD 500, with some suppliers, like Realme, offering smartphones for less than USD 150. This encourages 5G uptake in less developed regions and creates an opportunity for cutting-edge services based on the technology.

- Further, according to Ericsson, global 5G subscriptions are anticipated to jump dramatically between 2019 and 2027, from over 12 million to over 4 billion subscriptions. The regions with the most significant anticipated subscription numbers include North East Asia, South East Asia, India, Nepal, and Bhutan. Additionally, the GSMA predicts that by 2025, 5G connections will make up more than half of all mobile connections in the Developed Asia Pacific, North America, and Greater China.

- Moreover, laptop manufacturers are incorporating 5G technology to capture a wide market share. For instance, last year, Intel, a chipmaker, offered the new 5G Solution 5000 modem in laptops from Acer, ASUS, and HP in more than 30 laptop models. Additionally, Intel is enhancing its Tiger Lake series of 5GHz-capable ultra-thin notebooks. The Intel 5G Solution 5000 is an M.2 module that has received certification for global coverage from AT&T and Spring, among other carriers. Intel can provide upload and download speeds of up to 1.25 and 4.7 Gbps, respectively.

- Further, in October this year, Hyundai Mobis claimed to have created a 5G-based communication module for automobiles to enhance the performance of connected car systems, including autonomous driving. This module enables real-time, large-volume data processing. According to the provider, the new module uses ultra-high speed, ultra-low latency, and hyper-connection technologies to combine memory and communication operations, as well as radio frequency circuits and GPS.

- On the contrary, as most of the smartphone companies in the United States rely on a wide range of target audiences for 5G devices, this may affect the consumers' choice to upgrade to 5G. According to the NPD Group, US smartphone users hold on to their smartphones for more extended periods, which has presented a challenge for the smartphone market in the recent past. Manufacturers and carriers are expecting 5G to help reinvigorate the upgrade cycle. However, pricing could present another hurdle.

China Holds Prominent Share of the Market

- China is expected to lead the early deployment of 5G-capable vehicles, apex from strong early support from the domestic government in infrastructure capabilities, advanced research and development from the local supply chain, and consumers' appetite for the upcoming technology inside and outside of the vehicle. The fact that these vehicles will be exclusive to China's large domestic market further streamlines adoption because 5G infrastructure and standards are very likely to be standardized across the territory.

- According to the Government Services and Data Management Bureau of Nanshan District, to support city-level administration and services, Nanshan, a developed administrative region in the first-tier city, adheres to a thorough top-level design plan powered by cutting-edge 5G + technology. The program addresses the majority's most urgent requirements by considering governance, public services, and industry development. A super-large city-level cognitive network with 5G + IoT capability has been developed from terminals to networks. It reshapes the coupling effects of 5G + smart cities by presenting growth trends of the urban 5G sector in a panoramic, layered, and dynamic manner.

- Similarly, according to the Bureau of Emergency Management of Lishui, in Zhejiang Province, Lishui is the prefecture-level city with the most significant land area. The city experiences a variety of calamities that frequently occur and result in substantial losses due to its almost 90% forest coverage, 5% water content, and 5% farm area. A visualization system is essential for making informed decisions, effective command and scheduling, and resolving situations promptly. Based on the demands of the Bureau of Emergency Management for the benefit of people's livelihood, Lishui 5G emergency visualization system is a platform integrating cloud, management, and terminal. The platform offers features like disaster early warning, remote search and rescue, and satellite communication thanks to the 5G network, 5G mobile cabin, and other capabilities.

- Further, in the tropical province of Hainan, a 5G smart healthcare network integrating MEC and AI, developed by China Unicom and Huawei, has increased the efficiency and reach of medical services. Each municipal and county hospital, as well as 340 township health centers and 2693 village clinics, all have telemedicine equipment installed. The network offers remote consultations and diagnosis with AI assistance. Average patient wait times have been cut in half, while medical treatment effectiveness has increased by 30%.

- Moreover, China is also witnessing an upward trend in smart manufacturing plants where M2M communication is crucial to the efficient function of the entire plant. Therefore, the increasing uptake of these technologies by various end-user industries is leading to increased development in 5G connections. For instance, the RoboTechnik plant in Suzhou, Jiangsu Province, is moving towards a complete 5G-enabled smart plant. The prototype plant planned to install a 5G network to replace the fixed lines and Wi-Fi connections at the operational layer to make the equipment more intelligent and facilitate the transformation of the industrial applications to the cloud to achieve flexible and smart manufacturing.

5G Industry Overview

The 5G market Landspace is highly consolidated. All the companies involved in the production continue to enhance their product offerings frequently, leveraging their high R&D capabilities and investments, leaving the current market scenario highly competitive and mostly market incumbents.

In August 2022, Chinese chip manufacturer UNISOC released its second-generation 5G chip in the second half of 2022 or the first part of 2023. Extreme ultraviolet (EUV) technology, a crucial process for advanced chip manufacturing, was reportedly used by UNISOC to start mass-producing 6nm 5G devices. UNISOC already has three distinct types of 5G chips on the market.

In May 2022, MediaTek introduced Dimensity 1050 system-on-chip [SoC], the company's first mmWave 5G chipset, which offers seamless connection, displays, gaming, and power efficiency. Dimensity 930 and Helio G99 are two other chipsets that were also introduced as part of the company's expansion of its 5G and gaming chipset families. The Dimensity 1050 is constructed using an octa-core CPU and the TSMC 6nm fabrication process, combining mmWave 5G and sub-6GHz to aid network spectrum migration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 5G Timeline Overview

- 4.3 Current Adoption Cycle -Forerunners, Adopters & Laggards

- 4.4 Market Drivers (Sustained increase in number of devices & endpoints worldwide| Technological innovations at a component & device level to aid adoption| Key benefits offered by 5G over its predecessors| Growing adoption of virtual networking architecture)

- 4.5 Market Challenges (Standardization delays| Design & Operational Challenges )

- 4.6 Market Opportunities (Anticipated rise in demand from industrial sector| Ongoing efforts towards introduction of 5G in emerging countries)

- 4.7 5G and Beyond -The Path Ahead

- 4.8 Impact of COVID-19 on the 5G Landscape

- 4.9 Key Industry Regulations & Policies

5 TECHNOLOGY SNAPSHOT

6 5G ADOPTION MARKET LANDSCAPE

- 6.1 Number of Operators Worldwide-Breakdown by Trials & Commercial Launches (Q2'18- Q1 '20)

- 6.2 Country-level coverage on 5G Adoption - Investment & Commercialization Trends

- 6.3 Total Cell-site Backhaul, Macro & Small Cell-site Backhaul Usage - In Percentage (Microwave, Satellite, Sub-6 GHz)

- 6.3.1 Macro-Cell Site

- 6.3.2 Small-Cell Site

- 6.3.3 Market Outlook

7 5G CONNECTION MARKET LANDSCAPE

- 7.1 Number of 5G Connections, In Millions

- 7.2 Number of 5G Connections, by Type

- 7.2.1 Mobile Broadband

- 7.2.2 Fixed Wireless Access

- 7.2.3 M2M & IoT

- 7.2.4 Mission-Critical

- 7.3 5G Coverage, % of Geography

- 7.4 Adoption of 5G vs 4G, Percentage of Connections

- 7.5 Market share of 2G, 3G, 4G, 5G-Percentage Share

- 7.6 Number of 5G Connections by US, Japan, Europe, China, CIS, LATAM MENA, SSA (2027)

- 7.7 Number of 5G Devices (March 2019 - April 2020)

8 MARKET SEGMENTATION (5G DEVICES MARKET LANDSCAPE)

- 8.1 Number of 5G Devices, by Form Factor

- 8.1.1 Smartphone

- 8.1.2 CPE (Indoor/Outdoor)

- 8.1.3 Modules

- 8.1.4 Hotspots

- 8.1.5 Laptops

- 8.1.6 Industrial Grade CPE/Router/Gateway

- 8.1.7 Other Form Factors(Drones, HMDs, Tablets, TV, Dongles, etc.)

- 8.2 Number of 5G Devices, by Spectrum support

- 8.2.1 Sub-6 GHz

- 8.2.2 mmWave

- 8.2.3 Both Spectrum Bands

- 8.3 List of Major Vendors

9 5G SMARTPHONE MARKET LANDSCAPE

- 9.1 Smartphone Shipments - in Million Units

- 9.2 Brand Market Share, In Percentage, 2022

- 9.2.1 Samsung

- 9.2.2 Huawei

- 9.2.3 Vivo

- 9.2.4 Xiaomi

- 9.2.5 LG

- 9.2.6 OPPO

10 5G CHIPSET MARKET LANDSCAPE

- 10.1 5G Chipset Market Size & Forecasts

- 10.2 5G Chipset Market Segmentation, By IC Type

- 10.2.1 RFIC

- 10.2.2 ASIC

- 10.2.3 mmWave IC

- 10.2.4 Cellular IC

- 10.3 5G Chipset Market Segmentation, By Deployment

- 10.3.1 Device

- 10.3.2 CPE

- 10.3.3 Network Infrastructure

- 10.3.4 Others

- 10.4 Vendor Landscape Analysis - List of Commercially Available 5G Chipsets, by Model, Type, Vendor, DL UL Speed, Sub-6 GHz,mmWave& LTE Compatibility

- 10.5 Key Vendor coverage to include Qualcomm, Samsung, Mediatek, HiSilicon

11 5G CONSOLIDATED REVENUE CONTRIBUTION

- 11.1 5G Mobile Revenue Forecast, In USD Trillion

- 11.2 5G Mobile Revenue Forecast, by Region, In USD Billion

- 11.2.1 Europe

- 11.2.2 China

- 11.2.3 Japan

- 11.2.4 United States

- 11.2.5 South Korea

- 11.3 5G Contribution to Economy, In USD Trillion (2024 - 2030)

- 11.4 5G contribution to global workforce

- 11.5 Major spenders on 5G across key industry verticals

- 11.6 Analysis of key industry verticals based on their investment on Mobile Broadband, M-IoT and Mission Critical Services