|

市場調查報告書

商品編碼

1440236

許可證管理:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)License Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

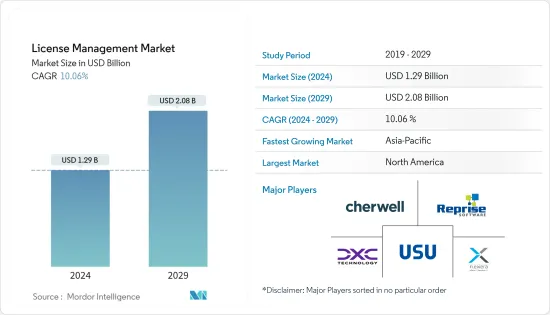

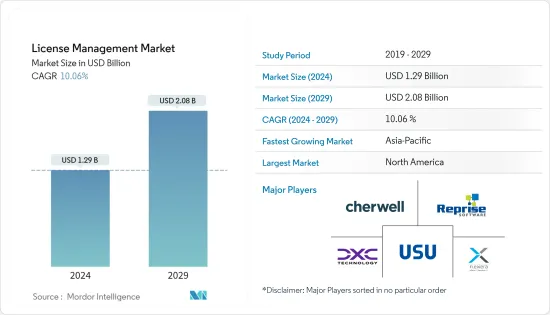

許可證管理市場規模預計到 2024 年為 12.9 億美元,預計到 2029 年將達到 20.8 億美元,預測期內(2024-2029 年)複合年成長率為 10.06%。

主要亮點

- 人們不斷轉向管理 IT 服務及其應用程式以製定短期和長期策略決策。公司在IT基礎設施上投入巨資,以根據其功能取代舊有系統。有競爭力的升級和替代可能會對未來更廣泛的市場佔有率產生重大影響。

- 幾乎每天都有如此多的新技術出現,大大小小的組織都需要了解所使用的軟體。管理軟體許可證一直很困難,而且在當今技術先進的世界中變得越來越困難。然而,每個組織的首要任務應該是避免重複軟體許可證、過度許可以及為了節省資金而支出過多或不足。

- 由於所用軟體功能的快速發展,數位技術正在各個製造業中採用,進一步推動了市場成長。

- 隨著越來越多的公司轉向雲端運算並在各地擁抱數位化,最佳化是這一成長趨勢的重要組成部分。

- 日益激烈的競爭和技術的快速變化正在不斷降低組織的報酬率。因此,各企業越來越注重降低營運成本。當組織尋求最佳化軟體使用並避免因許可證不合規而造成損失時,許可證管理軟體是降低成本的一種方法。許可證管理允許企業集中管理所有協議、協議、許可證權利和軟體庫存。

- 商業軟體聯盟 (BSA) 是一個全球貿易協會,其使命是宣導使用合法軟體並強制公司之間的合規性。 為了履行這一義務,BSA 定期對組織進行法院命令的審計,以確保他們遵守所有軟體許可證,包括小型獨立商店、大型公司、學術機構和政府機構。

- COVID-19感染疾病嚴重擾亂了供應鏈。此外,世界各地的封鎖規定給大大小小的企業帶來了巨大壓力,迫使大多數員工在家工作。這促使世界各地的組織採用多種數位化技術來協調遠距工作,同時最佳化生產力。然而,突然出現的大規模遠距工作和數位化浪潮為這些公司的 IT 團隊帶來了一些課題和威脅。

許可證管理市場趨勢

醫療保健領域推動市場成長

- 就許可證管理市場中採用先進技術和服務而言,醫療保健和生命科學是成長最快的行業之一。事實上,它受到嚴格監管。許可證管理解決方案可協助醫療保健組織、診所和醫院追蹤、監控和管理許可證及其他軟體資產,以提高效率。

- 使用這些解決方案進行醫療設備運作活動和管理的醫療機構必須遵守其治理機構法律的規定。近年來,醫療保健和生命科學產業越來越受到全部區域的關注。

- 與選擇和管理適當軟體相關的風險對該行業至關重要。管理醫療保健和生命科學產業的嚴格法律鼓勵醫療保健公司實施有效的許可證管理解決方案和相關服務。

- 滿足醫療保健和生命科學行業的許可要求是保持業務良好運作的基礎。更新您的許可證允許您的組織進入新市場、開設新設施、僱用員工和資金籌措。

- 另一方面,違反許可證可能會導致國家罰款和拖欠,這可能會阻礙業務成長。許可證管理解決方案可以幫助您的組織避免任何此類違規行為。這使您能夠輕鬆有效地管理、監控和追蹤所有類型的許可證和許可證。

- 許多供應商提供直覺式儀表板和介面的授權管理解決方案,只需最少的技術培訓即可讓員工定期使用。這些解決方案還提供及時通知,以告知當局續約截止日期。

北美佔有很大的市場佔有率

- 授權管理軟體市場上的大多數頂級供應商的總部都位於美國,包括 Agilis Software、IBM、Micro Focus 和 Oracle。包括美國和加拿大在內的其成員國主要專注於技術創新,使該地區成為收益最高的地區之一。

- 多年來,尤其是 2014 年,該地區來自全球供應商的新產品正在迅速成長。例如,Chronicle Graphics 發布了新的許可證管理系統。這個新的企業級平台為 OnePager Pro 和 Express 軟體使用者提供了一種快速有效的方法,可以透過 Internet 自動請求和啟動許可證金鑰。該公司向多個行業的財富 500 強公司和眾多政府機構授權其技術,並且是 Microsoft 認證合作夥伴。

- 大約在同一時間,Aspera Technologies 宣布美國市場業務顯著成長。該公司目前與美國石油、電訊和保險業的領導者合作。

- 此外,2021 年,MyMediabox 聽取了 55,000 多名用戶群的意見,並發布了其許可管理軟體的各種補充內容,為用戶提供新的生產力工具並協助許可流程。 Mediabox-GD(世界儀表板)為授權人提供對所有 Mediabox 服務的無縫訪問,以追蹤圖形導向的關鍵績效指標 (KPI)、商業智慧趨勢以及無數的合作夥伴關係和消費產品。

- Site24x7 針對 2020-2021 年 IT 管理狀況調查報告對 613 名 IT 專業人員進行了跨主題、組織規模和地理的調查。在北美,41% 的受訪者使用內部軟體來維護其組織的各種軟體許可證,其次是第三方許可證管理軟體。

- 這份關於未使用軟體成本的報告收集了四年來美國和英國129 家公司的 360 萬用戶的資料。研究人員發現,所有安裝的軟體中有 37% 未使用。這相當於每個桌面 259 美元,使 IT 支出總合超過 370 億美元。

許可證管理產業概述

市場分散,競爭公司之間競爭激烈。市場上的公司與其他公司合作開發和推出先進的解決方案。結果,市場出現了巨大的投資和激烈的競爭。而且,為了維持市場、留住客戶,企業不斷開發先進技術來維持競爭力,加劇了市場競爭企業之間的對抗關係。

- 2022 年 3 月 - 德國中小企業融資合作夥伴、法國興業銀行子公司 GEFA 銀行選擇 DXC Technology 用於其數位轉型計劃。透過「G-Rocket」計劃,GEFA 銀行和 DXC Technology 將該銀行的關鍵任務應用程式和資料從現有資料中心遷移到微軟的 Azure 雲端平台。透過遷移到 Azure,GEFA BANK 和 DXC 將系統地將銀行的應用程式形勢部署到 Azure Kubernetes Service (AKS) 等雲端原生服務。

- 2022 年 1 月 - Miro Consulting 發布 2022 版 Oracle 授權指南。 Miro Consulting 是全球大型公司的軟體資產管理服務 (SAM) 供應商,專門為 Oracle、Microsoft、IBM、Salesforce 和 AWS 提供授權管理、審核建議、談判策略、支援管理和雲端服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場促進因素

- 最佳化軟體投資的需求不斷成長

- 組織之間對審核回應的需求增加

- 市場限制因素

- 監管標準和框架不確定

- 市場機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

第5章市場區隔

- 依成分

- 軟體

- 服務

- 依配置

- 本地

- 雲

- 依應用(定性趨勢分析)

- 審核服務

- 諮詢服務

- 合規管理

- 授權和最佳化

- 營運與分析

- 其他用途

- 依最終用戶

- BFSI

- 醫療保健和生命科學

- 資訊科技/通訊

- 媒體和娛樂

- 其他最終用戶

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- USU Software AG

- Cherwell Software LLC

- DXC Technology Co.

- Flexera Software LLC

- Reprise Software Inc.

- Snow Software AB

- Oracle Corporation

- IBM Corporation

- Thales Group

- ServiceNow Inc.

第7章 投資分析

第8章市場的未來

The License Management Market size is estimated at USD 1.29 billion in 2024, and is expected to reach USD 2.08 billion by 2029, growing at a CAGR of 10.06% during the forecast period (2024-2029).

Key Highlights

- There has been a continuous shift toward managing IT services and their applications for short- and long-term strategic decisions. Depending on their features and capabilities, enterprises are investing heavily in their IT infrastructure to replace their legacy systems. The competitive upgrades and replacements could profoundly impact change on the broader market share in the future.

- With so many new technologies emerging almost daily, large and small organizations need to understand the software used. Managing software licenses has always been challenging and has become increasingly difficult in today's technologically advanced world. However, every organization's priority should be saving money by avoiding duplicate software licenses, over-licensing, and over- or under-spending.

- Digital technologies are being adopted across various manufacturing industries due to the rapidly evolving capabilities of the software used, further boosting the market's growth.

- As more companies increasingly move to cloud computing and embrace digitalization at every turn, optimization is an essential part of this growing trend.

- The profit margins across organizations are continuously declining, owing to increased competition and rapidly changing technologies. As such, various enterprises are increasingly getting focused on saving operational costs. License management software is one of the ways to reduce costs as organizations are on the lookout to optimize software usage and avoid any loss due to license non-compliance. License management lets companies control all agreements, contracts, license entitlements, and software inventory from a centralized location.

- The Business Software Alliance (BSA) is a global industry organization whose mission is to advocate for legal software usage and enforce compliance among businesses. To fulfill this duty, the BSA regularly performs court-ordered audits at organizations to ensure they comply with all software licenses, whether small mom-and-pop shops, massive enterprises, academic institutions, or government agencies.

- The COVID-19 pandemic has significantly disrupted the supply chain. Moreover, it has exerted significant pressure on large and small enterprises due to the global lockdown restrictions, which have forced a majority of employees to work from home. This has prompted organizations globally to adopt several digitalization technologies to collaborate remote working while optimizing productivity. However, large-scale remote working and the sudden wave of digitalization poses several challenges and threats to IT teams across these enterprises.

License Management Market Trends

Healthcare Segment to Drive Market Growth

- Healthcare and life sciences are among the fastest-growing verticals concerning the adoption of advanced technologies and services in the license management market. It is, in fact, a highly regulated one. License management solutions can help healthcare organizations, clinics, and hospitals track, monitor, and manage their licenses and other software assets to improve efficiency.

- Healthcare institutions using these solutions for operational activities and management of medical devices have to adhere to regulations as per the laws of governing bodies. In recent years, the focus on the healthcare and life sciences industry vertical has been increasing across the regions.

- The risks associated with selecting and managing the appropriate software are of utmost importance to this industry. The strict laws governing the healthcare and life sciences industry encourage healthcare companies to adopt effective license management solutions and associated services.

- Fulfilling the licensing requirements of the healthcare and life sciences industry is fundamental to keeping the business operating in a state. Updated licenses will allow the organization to enter new markets, open new facilities, hire staff, and obtain financing.

- On the other hand, license violations may lead to state-imposed penalties or delinquencies, preventing the business from growing. License management solutions save organizations from all such violations. It enables the management, monitoring, and tracking of all types of licenses and permits effortlessly and efficiently.

- Many vendors offer license management solutions on an intuitive dashboard and interface, so the staff requires minimal technical training to use it regularly. These solutions also provide timely notifications informing the authorities about due renewals.

North America to Hold Significant Market Share

- Most top suppliers in the license management software market are headquartered in the United States, including Agilis Software, IBM, Micro Focus, and Oracle. The region is among the highest revenue-generating ones, as the constituent nations, including the United States and Canada, mainly focus on technological innovations.

- For many years, especially in 2014, the region saw exponential growth in new product offerings by global vendors. For instance, Chronicle Graphics released its new license management system. This new enterprise-level platform provided a fast and efficient way for OnePager Pro and Express software users to automatically request and activate their license keys over the internet. The company has licensed its technology to Fortune 500 companies, spanning multiple industries and numerous government agencies, and is a Microsoft Certified Partner.

- Around the same time, Aspera Technologies announced significant business growth in the US market. Now the company works with leaders in the petroleum, telecommunications, and insurance industries in the United States.

- Moreover, in 2021, after listening to its 55,000+ user base, MyMediabox launched a range of additions to its licensing management software to offer users new productivity tools and aid the licensing process. The Mediabox-GD (Global Dashboard) is enhanced with graphically oriented vital performance indicators (KPIs), business intelligence trends, and seamless access to all Mediabox services for licensors keeping track of countless partnerships and consumer products.

- Site24x7 surveyed 613 IT professionals across various topics, organization sizes, and geographies in their State of IT Management Survey Report 2020-2021. In North America, 41% of respondents use internal software to maintain the organization's various software licenses, followed by third-party license management software.

- Over four years, a report on the cost of unused software collected data from 3.6 million users at 129 companies across the United States and the United Kingdom. Researchers found that 37% of all installed software was not being used, amounting to USD 259 per desktop and over USD 37 billion in total wasted IT spend.

License Management Industry Overview

The market has high competitive rivalry and is fragmented. The companies in the market are engaging in partnerships with other companies to develop and launch advanced solutions. As such, huge investments are being witnessed in the market, increasing competition. Additionally, to sustain in the market and retain their clients, companies are developing advanced technologies to remain competitive, thereby intensifying the competitive rivalry in the market.

- March 2022 - GEFA Bank, a financing partner for German SMEs and a subsidiary of Societe Generale, selected DXC Technology for a digital transformation project. With the "G-Rocket" program, GEFA Bank and DXC Technology will migrate the bank's mission-critical applications and data from its existing data center to Microsoft's Azure cloud platform. With the move to Azure, GEFA BANK and DXC will systematically deploy the bank's application landscape to cloud-native services such as Azure Kubernetes Service (AKS).

- In January 2022 - Miro Consulting released the 2022 version of its Oracle Licensing Guide. Miro Consulting is the leading global provider of software asset management services (SAM), specializing in license management, audit advisory, negotiation tactics, support management, and cloud services for Oracle, Microsoft, IBM, Salesforce, and AWS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand to Optimize Software Investments

- 4.2.2 Growing Requirement for Audit-readiness among Organizations

- 4.3 Market Restraints

- 4.3.1 Uncertain Regulatory Standards and Frameworks

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Application (Qualitative Trend Analysis)

- 5.3.1 Audit Services

- 5.3.2 Advisory Services

- 5.3.3 Compliance Management

- 5.3.4 License Entitlement and Optimization

- 5.3.5 Operations and Analytics

- 5.3.6 Other Applications

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 IT and Telecommunication

- 5.4.4 Media and Entertainment

- 5.4.5 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 USU Software AG

- 6.1.2 Cherwell Software LLC

- 6.1.3 DXC Technology Co.

- 6.1.4 Flexera Software LLC

- 6.1.5 Reprise Software Inc.

- 6.1.6 Snow Software AB

- 6.1.7 Oracle Corporation

- 6.1.8 IBM Corporation

- 6.1.9 Thales Group

- 6.1.10 ServiceNow Inc.