|

市場調查報告書

商品編碼

1440226

申請人追蹤系統:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Applicant Tracking System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

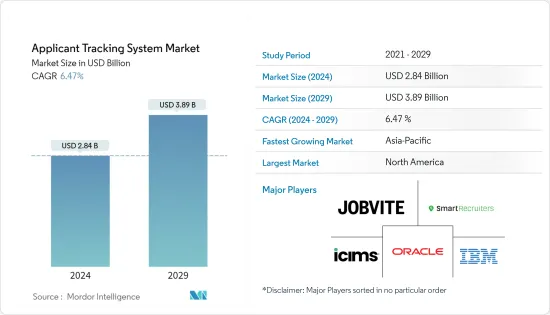

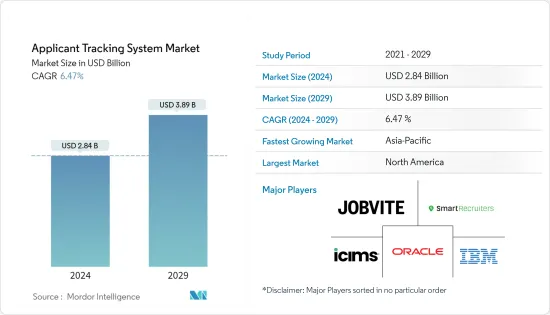

2024年求職者追蹤系統市場規模估計為28.4億美元,預計到2029年將達到38.9億美元,在預測期間(2024-2029年)以6.47%的複合年增長率增長。

由於 COVID-19 大流行的爆發,一些組織允許員工在家工作,並雇用遠端工作者來填補公司內部的空缺。 因此,當辦公室在冠狀病毒封鎖后重新開放時,只有少數工作人員被允許進入辦公室。 工作力的這種轉變正在鼓勵公司轉向高效的求職者追蹤軟體,以找到最合適的招聘和房間調度軟體,以及為返回辦公室的員工和在家工作的員工提供替代時程表,以便在經濟衰退後重建經濟。 由於 COVID-19 大流行而下降。

主要亮點

- 管理招募流程是公司內最複雜和最重要的課題之一。這包括廣告、追蹤申請、篩選履歷、進行面試和尋找理想候選人的成本。最大的風險是,在這個過程中,公司可能會失去頂尖人才,而擁有卓越技能的候選人可能會帶來巨大的價值,並且更適合特定的職位。

- 求職者追蹤系統 (ATS) 是一種招募軟體,用於管理和最佳化公司內部的搜尋和選拔流程,並用於在招募流程的多個階段收集和組織候選人資料。 ATS 不被認為是負責人角色的替代品,而是支持人才招募活動和目標的工具。

- ATS 有助於解決候選人面臨的關鍵課題。一些系統可以由人工智慧 (AI) 和機器學習提供支持,以分析合適的候選人、評估和識別技能並預測成功因素,以最大限度地提高每次招募的效率。這使組織能夠更好地了解候選人的行為,提高品牌知名度,並在他們最常使用的平台和管道上針對特定候選人。

- 求職者追蹤系統允許負責人和招聘經理只需單擊一個依鈕即可查看他們需要的所有資料和 KPI。求職者追蹤工具可以顯著縮短進入時間。這使得管理大型候選人庫帶來的工作量變得更加容易,簡化程序也變得更加容易。

- 然而,如果負責人僅依靠 ATS 來解析履歷並搜尋特定關鍵字,他們可能會錯過適合特定職缺的求職者。此外,切換到 ATS 可能很困難,因為新系統可能難以與先前的招募方法整合。

求職者追蹤系統 (ATS) 市場趨勢

招聘機構採用資料分析策略預計將在預測期內推動市場成長

- 資料分析在招募過程中發揮重要作用。資料驅動驅動的招募是一種利用收集和分析的資料來尋找合格候選人的招募過程,消除了傳統招募方法中的猜測。資料驅動驅動的招募消除了主要關注候選人喜愛度因素的高風險招募決策,並使招募決策更符合公司要求。

- 招募行銷分析和視覺化儀表闆對於組織實現其招募目標至關重要。正確的資料揭示了求職者的資訊來源和興趣偏好,告知雇主如何最佳化行銷投資並加速候選人申請轉換。

- 2022 年 9 月,Knoetic 宣佈在由 EQT Ventures主導、Accel 和 Menlo Ventures 參投的 B 輪融資中籌集了 3,600 萬美元。 Knoetic 與 HR 系統整合,當平台發現離職率問題時,CPO 可以運行分析並自動產生報告,以提高員工保留率。

- 在 COVID-19感染疾病期間,進行視訊訪談的要求顯著增加,多家供應商正在將此功能涵蓋其應用程式追蹤系統中。例如,2021 年 6 月,Epazz Inc. 宣布其 Provitrac 求職者追蹤軟體解決方案包括視訊面試功能,以支援結合兼職辦公室和在家工作的新型混合工作環境。

- 疫情過後,全球就業持續成長。根據國際勞工組織預測,2019年至2022年全球員工人數將增加,2022年登記員工人數為33.2億,比2019年增加1.3億。

預計北美區域業務在整個預測期內將佔據重要佔有率

- 北美區域市場成長的主要推動力是技術供應商的大量存在。這些公司專注於建立合作夥伴關係、併購提供創新解決方案,以保持在區域和全球競爭形勢中的地位。

- 北美地區代表了世界上技術最先進的工作力。 我們從其他地區僱用和供應技術人才。 美國公司是該地區求職者追蹤系統解決方案需求的主要來源。 在其他國家,如加拿大,人力資源職能的現代化也非常有限。

- 這表明該地區有採用求職者追蹤軟體的巨大機會。此外,在美國等國家實現區域公司人力資源現代化以及增加移動趨勢和雲端運算的採用的需求也支撐了市場的顯著成長。

- 根據國際貨幣基金組織的數據,2021年美國就業人數約為1.5258億人。美國的就業人數不斷增加,促使負責人實施求職者追蹤系統,進一步加速了市場的成長。

- 該地區的領先公司正在進行收購和合作,以滿足不斷增長的需求,併為求職者追蹤軟體提供增強的解決方案。 例如,2022 年 8 月,招聘和人才招聘供應商、JazzHR、Jobvite 和 NXT Tone RPO 品牌的母公司 Hire Inc. 宣佈收購 Lever,這是一個總部位於三藩市的平臺,將候選人追蹤系統與求職者追蹤系統集成在一起。 關係管理能力。

求職者追蹤系統 (ATS) 行業概述

求職者追蹤系統市場競爭適中,由眾多全球和區域參與者組成。這些參與者佔據了很大的市場佔有率,並專注於擴大客戶群。供應商正專注於研發投資,引入新的解決方案、策略合作夥伴關係以及其他有機和無機成長策略,以便在預測期內獲得競爭優勢。

2022 年 10 月,人力資源雲公司 iCIMS 宣佈了新的創新,以説明人力資源團隊獲得無與倫比的人才智慧,自動執行更多任務,並激勵現有員工在內部設計他們的下一個職業機會。

2022 年 3 月,人才招募套件提供者 Jobvite 將推出 Evolve Talent Acquisition Suite,為組織提供 Jobvite 產品的整合解決方案集,以簡化整個招募生命週期中的複雜課題。該套件提供單一用戶體驗,旨在提高招募效率、有效性和每次招募成本。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 市場促進因素

- 招募流程自動化的需求日益成長

- 多元化人才的獲取顯著增加

- 市場課題

- 使用高級 ATS 的技術專業知識有限,且 ATS 軟體與其他系統整合相關的複雜性

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

第5章市場區隔

- 元件類型

- 解決方案

- 服務

- 部署

- 本地

- 雲

- 最終用戶產業

- 資訊科技/通訊

- BFSI

- 零售

- 衛生保健

- 其他最終用戶產業(汽車、工業製造)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- IBM Corporation

- Oracle Corporation

- Jobvite Inc.

- Bullhorn, Inc.(Vista Equity Partners)

- iCIMS, Inc.

- SmartRecruiters, Inc.

- Workday, Inc.

- SAP SE

- Workable Technology Limited

- Greenhouse Software, Inc.

第7章 投資分析

第8章市場的未來

The Applicant Tracking System Market size is estimated at USD 2.84 billion in 2024, and is expected to reach USD 3.89 billion by 2029, growing at a CAGR of 6.47% during the forecast period (2024-2029).

With the onset of the COVID-19 pandemic, several organizations allowed their employees to work from home and hired remote workers to fill company vacancies. As a result, the reopening of the offices, post-COVID lockdowns, is allowing only a few staff to come to the office to work. This change in the work dynamics is prompting companies to utilize efficient applicant tracking software to find the most appropriate hire and room scheduling software to alternate the schedules between return-to-office workers and work-from-home employees to revamp the economy after the economic decline due to the COVID-19 pandemic.

Key Highlights

- Managing the recruitment process is one of the most complex and important challenges within a company. It's an expensive investment that includes posting ads, tracking applications, CV screening, and conducting interviews, searching for the ideal candidate. The most significant risk is that, along the way, the company can lose the best talent, and candidates with superior skills can add substantial value and are well suited to a specific role.

- The Applicant Tracking System (ATS) acts as recruitment software to manage and optimize the search and selection process within a company and is used to collect and organize candidate data during several stages of the recruitment process. An ATS doesn't replace the recruiter's role and is considered a tool to support talent acquisition activities and goals.

- An ATS can help address the critical challenges faced by candidates. Some systems can be enriched with artificial intelligence (AI) and machine learning to create a profile of a suitable candidate, assess and identify skills, and predict success factors to maximize each hire. This helps organizations better understand candidate behavior, amplify brand recognition, and target specific job seekers on the platforms and channels they use most.

- An applicant tracking system can also allow recruiters and hiring managers to view all the data and KPIs they require with a click of a button. Time-to-fill can be significantly minimized with the use of applicant tracking tools. It makes it easier to manage the workload brought on by big candidate pools, and the streamlined procedure would be much easier.

- However, applicants that could be a good fit for particular job openings might be overlooked if recruiters rely solely on ATS to parse through resumes for certain keywords. Also, switching to an ATS can be difficult, as it can be difficult to integrate the new system with previous recruiting methods.

Applicant Tracking System (ATS) Market Trends

The Adoption of Data Analytics Strategy by Recruitment Companies is Expected to Bolster the Market Growth Over the Forecast Period

- Data analytics plays a major role in the recruitment process. The data-driven recruitment is a hiring process that utilizes data - which is collected and analyzed - to help find a qualified candidate, eliminating the guesswork used in traditional hiring methods. Data-driven hiring eliminates risky hiring decisions that are primarily focused on a candidate's likeability factor and aligns hiring decisions more closely with the requirements of the firm.

- Recruitment marketing analytics and visual dashboards are essential in helping an organization accomplish its hiring goals. The right data reveals job seekers' sources and interest preferences and informs employers how they should optimize marketing investments and accelerate candidate application conversions.

- In September 2022, Knoetic announced that it raised USD 36 million in a Series B round led by EQT Ventures with participation from Accel and Menlo Ventures. Knoetic integrates with HR systems to allow CPOs to run analyses and, automatically generate reports, improve employee retention if the platform identifies an issue with turnover.

- During the COVID-19 pandemic, the requirement to conduct video interviews significantly increased, and multiple vendors have been incorporating this feature in their application tracking system. For instance, in June 2021, Epazz Inc. announced that their Provitrac applicant tracking software solution included a video interviewing feature that assist companies with the new Hybrid Work Environment, a mix of part-time in the office and working from home.

- Employment across the world has been increasing consistently after the pandemic. According to ILO, the number of employees worldwide increased from 2019 to 2022, registering 3.32 billion employees in 2022, with an increase of 0.13 billion as compared to 2019.

North America Geographic Segment is Expected to Hold a Significant Share Throughout the Forecast Period

- The primary driver for the North American geographic segment's growth is the significant presence of technology providers. These players focus on entering partnerships, merger acquisitions, and innovative solutions offerings to stay in the regional and globally competitive landscape.

- The North American region represents the most technologically advanced workforce in the world. It hires and supplies skilled human resources from other regions. Enterprises in the United States are a great source of demand for applicant tracking system solutions in the region. Even in other countries, such as Canada, there is very limited modernization in its HR functions.

- This indicates a substantial opportunity for the adoption of applicant tracking softwares in the region. Moreover, the need to modernize HR across regional companies and increase the adoption of mobility trends and cloud computing in countries like the United States also substantiates the market's significant growth.

- According to the IMF, in 2021, around 152.58 million people were employed in the United States. Employment is increasing in the United States, which is driving recruiters to adopt an applicant tracking system, further boosting the growth of the market.

- The major players in the region are making acquisitions and partnerships in order to meet the rising demand and offer enhanced solutions for applicant tracking softwares. For instance, in August 2022, Employ Inc., a recruiting and talent acquisition provider and the parent company of JazzHR, Jobvite, and NXTThing RPO brands, announced the acquisition of Lever, a San Francisco-based platform that combines applicant tracking system and candidate relationship management capabilities.

Applicant Tracking System (ATS) Industry Overview

The applicant tracking system market is moderately competitive and consists of a significant number of global and regional players. These players account for a considerable share of the market and focus on expanding their customer base. The vendors focus on the research and development investment in introducing new solutions, strategic partnerships, and other organic and inorganic growth strategies to earn a competitive edge over the forecast period.

In October 2022, iCIMS, the talent cloud company, announced new innovations to help talent teams gain unparalleled talent intelligence, automate more tasks and inspire existing employees to design their next career opportunity internally.

March 2022, Jobvite, the talent acquisition suite provider, introduces its Evolve Talent Acquisition Suite to provide enterprise organizations with a unified solution set of Jobvite's offerings to simplify complex challenges across the entire recruiting lifecycle. The Suite offers a single-user experience purpose-built to enhance recruiting efficiency, effectiveness, and cost-per-hire.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Rising Need to Automate Recruitment Processes

- 4.3.2 Significant Growth in Diverse Talent Acquisition

- 4.4 Market Challenges

- 4.4.1 Limited Technical Expertise for Using Advanced ATS and Complexity Involved with the Integration of ATS Software with Other Systems

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Component Type

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 End-user Verticals

- 5.3.1 IT and Telecommunication

- 5.3.2 BFSI

- 5.3.3 Retail

- 5.3.4 Healthcare

- 5.3.5 Other End-user Verticals (Automotive, Industrial Manufacturing)

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 IBM Corporation

- 6.1.2 Oracle Corporation

- 6.1.3 Jobvite Inc.

- 6.1.4 Bullhorn, Inc. (Vista Equity Partners)

- 6.1.5 iCIMS, Inc.

- 6.1.6 SmartRecruiters, Inc.

- 6.1.7 Workday, Inc.

- 6.1.8 SAP SE

- 6.1.9 Workable Technology Limited

- 6.1.10 Greenhouse Software, Inc.