|

市場調查報告書

商品編碼

1440183

衍生設計:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Generative Design - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

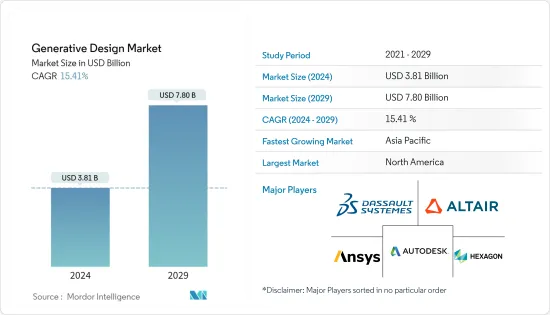

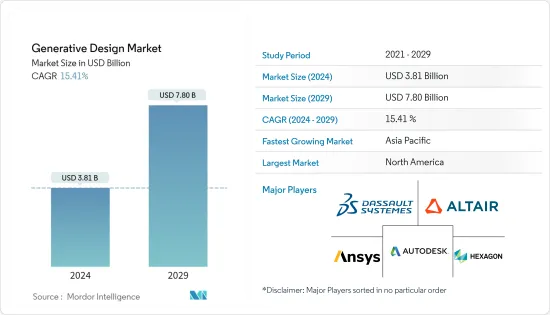

衍生設計市場規模預計到 2024 年為 38.1 億美元,預計到 2029 年將達到 78 億美元,在預測期內(2024-2029 年)複合年成長率為 15.41%。

具有機器學習功能的工具集設計的未來趨勢將有助於所研究市場的成長。去年為幫助設計人員減少錯誤數量從而節省大量時間而進行的重大投資預計將在未來得到回報。

主要亮點

- 對複雜設計的先進製造的需求不斷增加,以及在提高性能的同時縮小汽車尺寸的需求,迫使汽車製造商增加研發投資並採用衍生設計。

- 空中巴士 (Airbus)、百得 (Black & Decker) 和安德瑪 (Under Armour) 等大公司正在將衍生設計視為塑造工程行業未來的趨勢。這使得工程師可以將控制權交給 CAD 軟體,自然地找到針對給定約束集的最佳解決方案。拓展工程師的想像。

- 衍生設計正處於發展的早期階段,早期使用者可能會遇到一定的課題。例如,定義衍生設計軟體必須用可計算術語解決的設計問題需要陡峭的學習曲線。工程師必須獲得發現設計問題的經驗,因為一組參數可能會導致鬆散定義的結構限制和載荷,最終導致設計失敗。

- 每輛車平均有超過 30,000 個零件,製造和組裝所有這些零件需要高度複雜的供應鏈和製造能力。但通用汽車和總部位於舊金山的軟體公司歐特克計劃徹底改變汽車的設計方式,減少每輛汽車的汽車零件數量,同時使汽車更輕、更堅固。

- 衍生設計需要考慮的另一件事是,有時只能創建有效的方法。例如,在雷尼紹案例研究中,工程師對懸吊曲柄進行了拓樸最佳化。必須考慮最佳化零件的可製造性。結果是一個需要大量支撐才能列印的設計,但最好用盡可能少的支撐來設計您的作品。預計此類案例將對市場產生負面影響。

- 然而,衍生設計用於解決與 COVID-19 相關的感染疾病。例如,Digital Blue Foam 正在開發工具來幫助解決因 COVID-19 而導致的與使用和佔用室內空間相關的風險。 Covid Space Planner 會分析空間內的總佔用率和接近性、氣流和通風以及活動時間等因素。基於這些因素,該工具應用 Digital Blue Foam 的衍生設計功能來推薦空間規劃策略,例如入口點、工作區域、家具放置和維修,以降低風險。

衍生設計市場趨勢

汽車佔有很大佔有率

- 汽車產品輕量化的趨勢不斷成長,催生了對衍生設計技術的需求。大眾汽車集團推出了一款老式大眾微型客車,該客車採用了採用高效設計技術生產的幾個重新概念化的組件進行了改裝。大眾汽車正在推廣這款汽車,以突出其認為對未來汽車設計和製造非常重要的技術,特別是在電動車生產方面。 Autodesk 與大眾汽車加州創新與工程中心 (IECC) 合作開展該計劃,以最大限度地提高強度,同時最大限度地減少重量。引入衍生設計,透過減少品質和材料使用來生產輕量化零件,同時保持高性能標準和工程限制。

- 同樣在去年 1 月,電動車公司 Arcimoto Inc. 宣布與 XponentialWorks 和 ParaMatters 合作,設計和積層製造風扇公共事業車 (FUV) 的輕量化組件。為了部署 ParaMatters 的人工智慧生成衍生設計軟體,對多個元素進行了重新設計,以生產具有幾乎相同性能特徵的輕型替換零件。

- 減輕重量是電動車效率的關鍵問題,因為汽車越輕,在道路上行駛所需的能量就越少。更有效率的能源消耗意味著每次充電的續航里程更遠。這是消費者在評估電動車時最重要的考慮因素之一。

- 據歐特克稱,通用汽車去年初在一個概念驗證計劃中使用衍生設計,為未來電動車開發原型輕型座椅支架。隨著對此類輕量化汽車零件的需求,通用設計的需求預計將大幅增加。

歐洲將實現顯著成長率

- 歐洲汽車產業在全球產業中正在顯著崛起。它的銷售額創歷史新高,並作為重要的雇主和大量津貼的來源,已成為歐洲社會不可分割的一部分。

- 歐洲是全球多家汽車OEM的所在地,3D列印技術正在大規模引入汽車產業的設計開發和研發應用。梅賽德斯、奧迪、寶馬、捷豹、路虎和大眾等頂級汽車領導者在歐洲市場為3D技術和印表機創造了潛在空間。

- 德國汽車製造商奧迪公司(Audi AG)在其位於德國Bollingerhove工廠的生產線上引入了基於聚合物的3D列印技術。 由於製造商能力的提高以及他們對可能導致故障的關鍵元件的依賴減少,此類採用範例正在增加。 據3D列印公司Sculpteo稱,使用3D列印的歐洲人的首要任務是加速產品開發,並提供定製產品和限量系列。

- 此外,該地區電動車的銷量也在增加。在歐洲,電動車銷量不斷成長,而柴油車銷量持續下降。純電動車註冊量的成長在斯堪地那維亞國家最為明顯,例如丹麥,純電動車銷量翻了兩番,瑞典和芬蘭的銷量成長了兩倍,其次是波蘭、比利時和希臘。電動車的進一步修改,例如延長電池壽命或減輕車輛重量,需要衍生設計軟體。

- 除了汽車業外,該地區還看到了製造業的需求。該地區對積層製造和 3D 列印的需求不斷成長,預計將擴大衍生設計市場。

- 為了幫助工業製造商提升員工技能,法國政府委託AIF建立積層製造參考系統並委託國家技能培訓。在此背景下,Cetim 與其附屬中心 Cetim-Certec 合作,已開始開發專用積層製造的完整培訓計劃,涵蓋整個價值鏈。

- 此外,根據 Worldometers 的數據,該地區在大流行期間爆發的冠狀病毒感染疾病(COVID-19) 影響了超過 120,000 人,並極大地推動了該地區的 3D 列印市場。隨著人工呼吸器製造(尤其是醫療保健領域)對 3D 列印的需求不斷增加,對衍生設計的需求也不斷增加。

衍生設計產業概述

衍生設計市場適度分散。 Altair Engineering Inc. 和 ANSYS Inc. 等多家公司的存在使得競爭環境變得異常激烈。汽車行業需求的增加以及衍生設計試用版或免費版本的可用性等因素為衍生設計製造商提供了巨大的成長機會。本報告涵蓋的主要企業包括 Autodesk Inc.、Dassault Systemes SE 和 Desktop Metal Inc.。

2022 年 6 月 - 全球計算科學與人工智慧 (AI) 公司 Altair 最近收購了英國巴斯大學的 Gen3DStart-Ups。在使用隱式幾何技術說明高度複雜的幾何形狀(例如晶格結構)方面,Gen3D 是積層製造的先驅。

2022 年 10 月 -數位化和積層製造技術市場領導西門子將與 Desktop Metals 宣佈建立合作夥伴關係。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 行業景點-波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

- 產業相關人員分析

- COVID-19 對產業生態系統的影響

第5章市場動態

- 市場促進因素

- 汽車領域最新技術的崛起正在重振市場

- 對先進技術的需求不斷增加,以推動產品創新和生產效率

- 市場課題

- 使用衍生設計軟體的複雜性

第6章市場區隔

- 部署

- 本地

- 雲

- 最終用戶產業

- 車

- 航太和國防

- 建築與建造

- 工業製造

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Altair Engineering Inc.

- Bentley Systems, Inc.

- Autodesk Inc.

- ANSYS inc.

- Desktop Metal Inc.

- Dassault Systemes SE

- MSC Software Corporation(Hexagon AB)

- nTopology, Inc.

- Paramatters

- Diabatix

- Caracol AM

第8章投資分析

第9章市場展望

The Generative Design Market size is estimated at USD 3.81 billion in 2024, and is expected to reach USD 7.80 billion by 2029, growing at a CAGR of 15.41% during the forecast period (2024-2029).

The upcoming trend of designing toolsets with machine learning capabilities contributes to the growth of the market studied. Significant investments made during last year aimed at empowering designers to reduce the number of errors, thereby saving considerable time, are expected to produce results in the future.

Key Highlights

- The growing demand for advanced manufacturing with complex designs and the need to reduce the size while improving the performance of automotive compels automotive manufacturers to increase their R&D investments and adopt generative designing.

- Companies such as Airbus, Black & Decker, Under Armour, and other massive corporations embrace generative design as a trend molding the future of the engineering industry. It enables engineers to hand the reins off to their CAD software to naturally find the best solutions to a given set of constraints. It augments the engineer's imagination.

- Generative design is in the initial development stage, meaning that early users may come across specific challenges. For instance, defining a design problem in computable terms, which generative design software has to solve, will include a steep learning curve. Engineers need to be more experienced with revealing the design problem as a set of parameters may end up with loosely defined structural restraints or loads, ultimately resulting in a failed design.

- There are over 30,000 parts in an average car, and creating all these pieces and then putting them together requires an incredibly complex supply chain and manufacturing capabilities. However, General Motors and the San Francisco-based software company Autodesk plan to upend how cars are designed, reducing the number of car parts that go into each vehicle while making cars both lighter and more robust.

- Another point to consider with the generative design is that efficient methods can only sometimes be manufactured. For instance, in a Renishaw case study, engineers topologically optimized a suspension bell crank. They should have considered the optimized part's manufacturability. It resulted in a design that demanded a lot of supports to be printed, whereas a good practice is to design pieces with fewer supports as needed as possible. Such instances are anticipated to lay a negative impact on the market.

- However, generative design is used to help address the risks related to COVID-19. For instance, Digital Blue Foam is developing a tool to help address the risks associated with the use and occupancy of interior spaces due to COVID-19. Covid Space Planner analyses factors such as total occupancy and proximity, airflow and ventilation, and the duration of activity in the space. Based on these factors, the tool applies Digital Blue Foam's generative design capabilities to recommend spatial planning strategies, such as the location of entry points, work areas, furniture placement, and retrofits, to mitigate the risk.

Generative Design Market Trends

Automotive To Hold Significant Share

- The growing trend of lightweight vehicle products has generated demand for generative design technology. Volkswagen Group unveiled a vintage VW Microbus, retrofitted with several reconceptualized components produced by productive design technology. VW is promoting this vehicle to highlight technologies they believe would be significant to the future of automotive design and manufacturing, particularly concerning electric vehicle production. Autodesk partnered with VW's Innovation and Engineering Center, California (IECC), on this project to maximize its strength while minimizing its weight. The generative design was deployed to produce lighter-weight parts by reducing mass and material use while maintaining high-performance standards and engineering constraints.

- Also, in January last year, Electric vehicle company Arcimoto Inc announced that it is working with XponentialWorks and ParaMatters to design and additively manufacture lightweight components for its Fun Utility Vehicle (FUV). For deploying ParaMatters' AI-powered generative design software, several elements are being redesigned to generate alternative parts with much of the same performance characteristics but at a lighter weight.

- Weight reduction has become a critical concern for electric vehicle efficiency as the less an automobile weighs, the less energy is required to propel down the road. More efficient energy consumption equates to a more excellent range per charge, which is one of the most important considerations for consumers when evaluating electric vehicles.

- According to Autodesk, General Motors used generative design earlier in the previous year in a proof-of-concept project to develop a lightweight seat bracket prototype for its future electric cars. With such demand for light parts in automobiles, the demand for generative design is anticipated to increase significantly.

Europe to Witness Significant Growth Rate

- The European automotive sector has risen significantly in the global industry. It has achieved record sales, and as a significant employer and a source of considerable grantmaking, it is an integral part of European society.

- With the presence of several global automotive OEMs, Europe has the broad-scale implementation of 3D printing technology for design formulation and R&D applications in the automotive industry. Top automotive leaders, such as Mercedes, Audi, BMW, Jaguar, Land Rover, Volkswagen, and many others, have produced a potential space for 3D technology and printers in the European market.

- AUDI AG, a German automaker, has implemented polymer-based 3D printing technology for its production line at the Bollinger Hofe plant in Germany. Such instances of adoption are high, owing to the enhanced capabilities of manufacturers and lessened dependency on the supply chain for critical components that may result in a breakdown. According to Sculpteo, a 3D printing company, the highest priorities for Europeans using 3D printing are stimulating product development and offering customized products and limited series.

- Moreover, the region is witnessing growth in the sales of electric vehicles. Electric vehicle sales are rising in Europe as diesel vehicle sales continue downward. The increase in BEV registrations was most noticeable in Scandinavian countries such as Denmark, which saw a quadrupling of BEV sales, and Sweden and Finland, which saw a tripling, followed by Poland, Belgium, and Greece. Further modifications in electric vehicles, such as increasing the battery time, and reducing the vehicle's weight, would demand generative design software.

- Apart from the automotive sector, the region is witnessing demand from the manufacturing industry. The increasing demand for additive manufacturing and 3D printing in the region is anticipated to augment the generative design market.

- To help industrial manufacturers improve the skills of their workforce, the French government has entrusted AIF with establishing a reference system of additive manufacturing and training skills across the nation. Within this context, Cetim, in partnership with Cetim-Certec, its associated center, has already begun to develop a full training program dedicated to additive manufacturing, which covers the entire value chain.

- Further, the significant outbreak of COVID-19 in the region, affecting more than 120,000 people in the region, according to Worldometers during the pandemic, has significantly driven the market for 3D printing in the region. With the increased in demand for 3D printing, especially in the healthcare sector for manufacturing ventilators, the need for generative design has been witnessing growth.

Generative Design Industry Overview

The market for Generative Design is moderately fragmented. The presence of several companies, including Altair Engineering Inc. and ANSYS Inc., makes the competitive environment quite intense. Factors such as the growing demand from the automotive industry and the availability of trial or free versions of the generative design will provide considerable growth opportunities for generative design manufacturers. The major companies covered in this report are Autodesk Inc., Dassault Systemes SE, and Desktop Metal Inc.

In June 2022 - The global computational science and artificial intelligence (AI) company Altair recently purchased the Gen3D startup from the University of Bath in the United Kingdom. When it comes to using the implicit geometry method to describe highly complex geometries, like lattice structures, Gen3D is a pioneer in additive manufacturing.

In October 2022 - To accelerate the adoption of additive manufacturing (AM) for production applications with a focus on the biggest manufacturers in the world, Siemens and Desktop Metal, Inc., market leaders in digitalization and additive manufacturing technologies, have announced a multifaceted partnership.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Stakeholder Analysis

- 4.4 Impact of COVID-19 on the Industry Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in latest technology in automobile segment to boost the market

- 5.1.2 Growing Demand for Advanced Technologies to Drive Product Innovation and Production Efficiency

- 5.2 Market Challenges

- 5.2.1 Complexity in Using Generative Design Software

6 MARKET SEGMENTATION

- 6.1 Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 End User Vertical

- 6.2.1 Automotive

- 6.2.2 Aerospace and Defense

- 6.2.3 Architecture and Construction

- 6.2.4 Industrial Manufacturing

- 6.2.5 Other End User Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Rest of North America

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Altair Engineering Inc.

- 7.1.2 Bentley Systems, Inc.

- 7.1.3 Autodesk Inc.

- 7.1.4 ANSYS inc.

- 7.1.5 Desktop Metal Inc.

- 7.1.6 Dassault Systemes SE

- 7.1.7 MSC Software Corporation (Hexagon AB)

- 7.1.8 nTopology, Inc.

- 7.1.9 Paramatters

- 7.1.10 Diabatix

- 7.1.11 Caracol AM