|

市場調查報告書

商品編碼

1440157

汽車聲學工程服務 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Automotive Acoustic Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

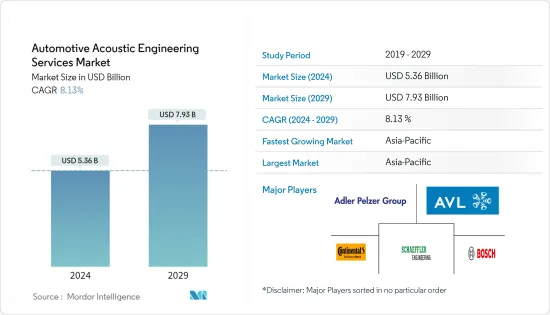

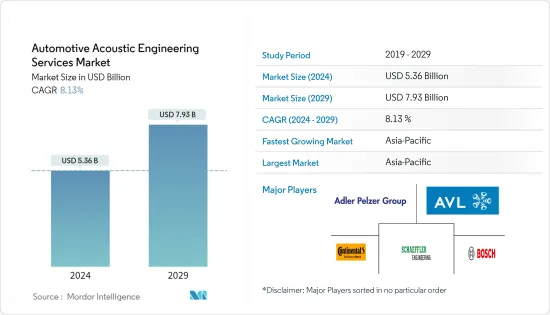

2024年汽車聲學工程服務市場規模預計為53.6億美元,預計到2029年將達到79.3億美元,在預測期內(2024-2029年)CAGR為8.13%。

COVID-19 大流行影響了汽車聲學工程服務市場的成長。2020年乘用車和商用車銷量下降以及整車及零件生產設施臨時停產的情況減少。疫情期間主要車輛測試設施已停止,可能會影響市場。

車輛噪音規則日益嚴格以及對車內舒適度和豪華設施的需求等因素預計將推動全球汽車聲學工程服務市場的發展。例如,

從 1970年第70/157/EEC 號指令開始,聯合國歐洲經濟委員會(UNECE)發布了一系列有關車輛噪音的 137 項法律。此外,國際標準化組織(ISO)和第43 技術委員會(ISO/TC 43)解決全球聲學問題,其中一些問題與車輛噪音問題有關。因此,全球規則的執行推動了對汽車聲學工程設備的需求,推動了全球汽車聲學工程服務市場的成長。

引擎小型化意味著在車輛中使用更小、更輕的引擎來產生更大引擎的動力。它可以透過降低引擎排氣量和汽缸數或採用強制吸氣裝置(例如渦輪增壓器或機械增壓器)和直噴技術來實現。然而,這兩個因素都可能顯著影響車輛的整體噪音、振動和聲振粗糙度(NVH)行為。在預測期內,引擎小型化的趨勢預計將為全球汽車聲學工程市場的發展提供有利的前景。

汽車聲學工程服務市場趨勢

動力總成應用主導市場

根據該應用,動力總成領域在2021年收入中佔據了主要市場佔有率。動力總成噪音、振動和聲振粗糙度(NVH)測試通常關注車輛推進過程中的整體駕駛體驗。這些測試包括影響車輛機動性的一切。允許的噪音水準和聲音品質是最重要的,因為傳動系統中組裝的更多汽車零件會在車輛動態過程中發出令人不快的聲音,使駕駛體驗變得更糟。

多個動力總成零件來源的噪音包括內燃機(ICE)、尾管、排氣系統、變速箱、幫浦、皮帶傳動系統以及冷卻系統中使用的配件。此外,眾所周知,燃油泵會將空氣中和結構上的顆粒傳輸到車輛中,主要有助於提高車輛的整體聲學標準。這些零件噪音受到立法的監管,以增強車輛的駕駛體驗。

聯合國歐洲經濟委員會(UNECE)和噪音與輪胎協調工作小組為其歐洲、亞洲和北美的 56 個成員國制定了相關法規。成員國已在當地執行了某些法規,包括控制動力系統的整體車輛噪音排放。此外,製造商必須確定其通過噪音是否符合現行法規,以確保其噪音排放標準在合規法規限制內。

因此,許多汽車製造商都會進行動力系統測試以保持標準合規性。這些主要測試涵蓋多種負載條件下的聲壓級和動力總成完整性測試,包括車輛啟動、加速、穩態、部分負載和最大負載。

因此,動力傳動系聲學測試的需求預計在預測期內將出現高速成長。

亞太地區將佔據主要市場佔有率

2021年,亞太地區的收入大幅成長。該地區電動車需求的成長為聲學服務提供者提供了機會。

中國是全球最大的汽車市場之一;2021年,中國乘用車銷量超過2,139萬輛,與2020年相比,年銷量成長6%。儘管與美國存在經濟衝突以及COVID-19大流行的影響,中國仍然是全球乘用車市場之一。是汽車聲學工程服務商在中國汽車市場佔據一席之地的絕佳機會。此外,2021年,中國乘用車出口量超過160萬輛,商用車出口量超過40.2萬輛。

由於政府的計劃,預計日本將在預測期內在電動車中顯著部署汽車聲學工程服務,這可能會促進電動車在該國的迅速崛起。例如,

2021年11月,日本政府宣布將電動車獎勵措施提高一倍,達到每輛車80萬日元,並對充電基礎設施提供補貼,以趕上北美和歐洲等成熟經濟體的步伐。

在印度,汽車製造商與自動駕駛汽車研究機構合作。例如,2021年3月,MG汽車印度公司加入印度理工學院德里汽車研究和摩擦學中心(CART),研究電動和自動駕駛汽車。印度理工學院德里分校將協助名爵進一步致力於CASE出行(互聯-自主-共享-電動);透過支持在印度城市景觀中部署電動和自動駕駛汽車的研究,這將是汽車聲學工程服務成長的明顯標誌。

因此,上述所有因素都將增加汽車聲學工程服務在各種車輛推進系統中的採用。

汽車聲學工程服務業概況

汽車聲學工程服務市場集中,少數參與者佔主要市場佔有率。汽車聲學工程服務市場的一些知名公司包括Siemens、Robert Bosch、Autoneum、Adler Pelzer、Bertrandt AG、Schaeffler Engineering GmbH 等。

主要參與者透過開發新的研究和製造設施來擴大規模,以獲得市場佔有率。例如,

2022年 5月,Adler Pelzer Group(APG)與泰興市政府簽署了一份合作備忘錄,計劃使用其最新的複合材料技術為客戶製造用於內外硬裝飾的零件。

2021年 6月,Autoneum 宣布與比利時軟體公司 Free Field Technologies(FFT)合作。 Autoneum 經過驗證的車輛聲學聲學模擬方法整合到 FFT 領先的建模軟體 Actran 中,為雜訊、振動、聲振粗糙度(NVH)和資料交換的 CAE 設計樹立了新標準。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第5章 市場細分

- 按流程

- 設計

- 發展

- 測試

- 按軟體

- 校準

- 振動

- 其他

- 依應用

- 內部的

- 車身及結構

- 動力總成

- 傳動系統

- 依車型分類

- 搭乘用車

- 商用車

- 依推進類型

- 內燃機

- 電動和插電式混合動力

- 按地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 世界其他地區

- 中東和非洲

- 南美洲

- 北美洲

第6章 競爭格局

- 供應商市佔率

- 公司簡介

- Siemens Digital Industries Software(Siemens AG)

- Robert Bosch GmbH

- Continental Engineering Services GmbH(Continental AG)

- Bertrandt AG

- Schaeffler Engineering GmbH

- Autoneum Holding Ltd

- IAC Acoustics(Catalyst Acoustics Group)

- AVL List GmbH

- EDAG Engineering Group AG

- FEV Group GmbH

- Spectris PLC

- Adler Pelzer Holding GmbH

第7章 市場機會與未來趨勢

The Automotive Acoustic Engineering Services Market size is estimated at USD 5.36 billion in 2024, and is expected to reach USD 7.93 billion by 2029, growing at a CAGR of 8.13% during the forecast period (2024-2029).

The COVID-19 pandemic has affected the growth of the automotive acoustic engineering services market. The decline in passenger and commercial vehicle sales in 2020 and the temporary shutdown of vehicle and component production facilities have decreased. Major vehicle testing facilities have been stopped during the pandemic, which is likely to affect the market.

Factors such as increasing stringency in vehicle noise rules and demand for interior cabin comfort and luxury amenities are expected to raise the global automotive acoustic engineering services market. For instance,

Beginning with Directive 70/157/EEC in 1970, the United Nations Economic Commission for Europe (UNECE) released a series of 137 laws regarding vehicle noise. Furthermore, the International Organization for Standardization (ISO) and Technical Committee 43 (ISO/TC 43) are addressing global acoustics issues, some of which are connected to vehicle noise issues. As a result, the global enforcement of rules drives the need for automotive acoustic engineering equipment, fueling the growth of the global automotive acoustic engineering services market.

Engine downsizing entails using a smaller and lighter engine in a vehicle to produce the power of a bigger engine. It can be accomplished by lowering engine displacement and cylinder count or incorporating a forced aspiration device such as a turbocharger or supercharger and direct-injection technology. Both elements, however, may significantly impact the vehicle's overall noise, vibration, and harshness (NVH) behavior. During the projected period, the rising trend of engine downsizing is expected to provide lucrative prospects for advancing the global automotive acoustic engineering market.

Automotive Acoustic Engineering Services Market Trends

Powertrain Application dominating the market

Based on the application, the powertrain segment held a major market share in revenue in 2021. Powertrain noise, vibration, and harshness (NVH) testing are generally concerned with the overall driver experience during vehicle propulsion. These tests include everything that makes the mobility of a vehicle. The allowed noise levels and sound quality are the most important, as more of the auto parts assembled in the drive train is responsible for making unpleasant sounds during vehicle dynamics, thus making the driving experience worse.

The noise from several powertrain component sources includes the internal combustion engine (ICE), tailpipe, exhaust system, gearbox, pumps, belt drive system, and accessories used in cooling systems. Moreover, the fuel pump is known for transmitting airborne and structure-borne particles into the vehicle, thus contributing primarily to the overall vehicle acoustic standard. These component noises are regulated by legislation to enhance the vehicle's driving experience.

The United Nations Economic Commission for Europe (UNECE) and the working party on Noise and Tires coordinates gave the regulations for its 56 member states in Europe, Asia, and North America. The member states have executed certain regulations locally, including controlling the overall vehicle noise emission from the powertrain. In addition, manufacturers must determine their pass-by noise compliance with present regulations to ensure their noise emissions standards are within the compliance regulation limits.

Thus, many vehicle manufacturers conduct the powertrain test to maintain the standards compliances. These main tests cover sound pressure levels and powertrain integrity tests under several load conditions, including vehicle launch, acceleration, steady state, partial load, and maximum load.

Thus, the demand for power train acoustic testing is expected to witness high growth during the forecast period.

Asia-Pacific to hold major market share

Asia-Pacific witnessed major growth in terms of revenue in 2021. The rise in demand for electric vehicles across the region offers opportunities to acoustics services providers.

China is one of the world's largest automotive markets; more than 21.39 million passenger cars were sold in the country in 2021 and recorded an increase of 6% in yearly sales compared to 2020. Despite the economic conflicts with the United States and the impact of the COVID-19 pandemic, China is still one of the largest sellers of automobiles, which is a great opportunity for automotive acoustic engineering service providers to make their place in the Chinese automobile market. Moreover, in 2021, China has exported more than 1.6-million-unit passenger vehicles and 402,000 unit commercial vehicles.

Japan is expected to show remarkable deployment of automotive acoustic engineering services in electric vehicles during the forecast period due to the government initiative, which is likely to catalyze the rapid emergence of EVs in the country. For instance,

In November 2021, Japan government announced to double their incentives for electric vehicles to 800,000 Yen per vehicle and subsidizes charging infrastructure to catch up with matured economies, including North America and Europe.

In India, automakers are partnering with institutes for research in autonomous vehicles. For instance, in March 2021, MG Motor India joined IIT Delhi's Centre for Automotive Research and Tribology (CART) to research electric and autonomous vehicles. IIT Delhi will help MG to further focus on CASE mobility (Connected - Autonomous - Shared - Electric); by enabling supporting research for the deployment of electric and autonomous vehicles in the urban landscape in India, which would be an evident sign of the growth of automotive acoustic engineering services.

Thus, all the factors mentioned above will increase automotive acoustic engineering services adoption across various vehicle propulsion systems.

Automotive Acoustic Engineering Services Industry Overview

The Automotive Acoustic Engineering Services Market is concentrated, with a few players accounting for a major market share. Some prominent companies in the Automotive Acoustic Engineering Services Market are Siemens, Robert Bosch, Autoneum, Adler Pelzer, Bertrandt AG , Schaeffler Engineering GmbH, and others.

Key players are expanding by developing new research and manufacturing facilities to gain market share. For instance,

In May 2022, Adler Pelzer Group (APG) signed a Memorandum of Understanding with the Government of Taixing City, where it plans to manufacture parts for its customers using its latest technologies of composite material for interior and exterior hard trims.

In June 2021, Autoneum announced a collaboration with Free Field Technologies, a Belgian software company (FFT). Autoneum's proven acoustic simulation methods for vehicle acoustics are being integrated into FFT's leading modeling software, Actran, setting new standards in CAE design of noise, vibration, harshness (NVH), and data exchange.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Designing

- 5.1.2 Development

- 5.1.3 Testing

- 5.2 By Software

- 5.2.1 Calibration

- 5.2.2 Vibration

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Interior

- 5.3.2 Body and Structure

- 5.3.3 Powertrain

- 5.3.4 Drivetrain

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicle

- 5.5 By Propulsion Type

- 5.5.1 Internal Combustion Engine

- 5.5.2 Electric and Plug-In Hybrid

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.5 Middle-East and Africa

- 5.6.6 South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Siemens Digital Industries Software (Siemens AG)

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Continental Engineering Services GmbH (Continental AG)

- 6.2.4 Bertrandt AG

- 6.2.5 Schaeffler Engineering GmbH

- 6.2.6 Autoneum Holding Ltd

- 6.2.7 IAC Acoustics (Catalyst Acoustics Group)

- 6.2.8 AVL List GmbH

- 6.2.9 EDAG Engineering Group AG

- 6.2.10 FEV Group GmbH

- 6.2.11 Spectris PLC

- 6.2.12 Adler Pelzer Holding GmbH