|

市場調查報告書

商品編碼

1440151

空氣品質監測:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Air Quality Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

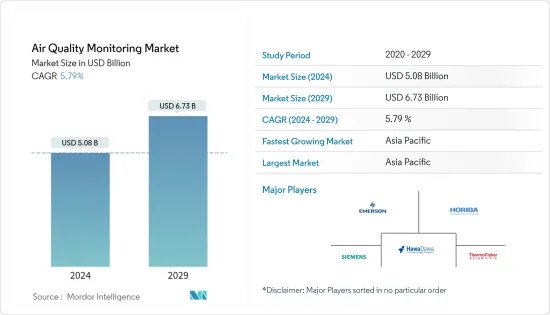

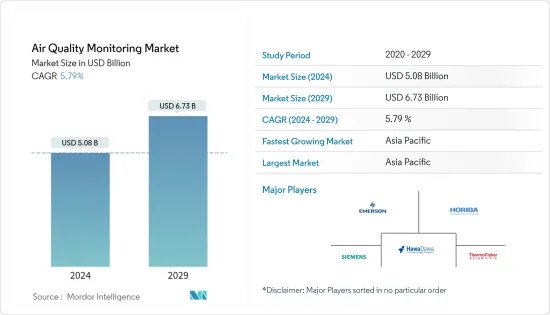

2024年空氣品質監測市場規模估計為50.8億美元,預計到2029年將達到67.3億美元,在預測期間(2024-2029年)以5.79%的複合年增長率增長 。

由於封鎖促使空氣污染減少,市場無疑面臨 COVID-19感染疾病大流行的影響,特別是在運輸和工業領域。例如,印度中央污染控制委員會(CPCB)發布了一份《JANTA宵禁和封鎖對空氣品質的影響》報告,發現封鎖顯著改善了該國的空氣品質。儘管各個領域對空氣品質測量設備的需求正在減少,但由於許多國家對空氣品質的關注不斷增加以及工業化不斷擴大,市場在不久的將來可能會加速成長,但可再生能源市場預計將隨著普及而進一步加速清潔能源來源,例如由於對該產品的需求正在穩步下降,預計核能將阻礙市場成長。

由於政府有關開放空間空氣品質標準的政策,室外空氣品質設備預計將成為預測期內成長最快的部分。

空氣品質監測系統的技術進步為設備及其應用的技術發展創造了重大機會。例如,基於物聯網的設備如今很流行,它們的功能更具互動性,並使用新技術來通訊和分發資料。這些被稱為下一代空氣品質監測系統,是該領域許多研發專家研究的主題。

由於新興國家的都市化和工業活動不斷提高,亞太地區預計將在未來幾年主導市場。

空氣品質監測市場趨勢

戶外監控領域預計將成為成長最快的領域

- 安裝室外空氣品質監測系統來追蹤交通部門、工業部門、建設活動和所有其他外部污染源造成的空氣污染。由於源頭上方存在一個點,密閉空間外的空氣被認為比室內空氣含有更多有害的污染物。

- 根據美國環保署的數據,2022年PM 2.5空氣品質季節性加權年平均值佔比為7.81,低於2021年的8.54。

- 美國政府在過去十年中成功地將全國 PM 2.5 平均濃度水準降低了 41%,達到每立方公尺 8.02 微克。這一目標是透過各行業空氣品質標準的監管政策來實現的,最終促使空氣品質監測系統在基層的先進實施。

- 2022 年 10 月,歐盟委員會發布了更新和整合歐盟空氣品質指令的立法提案。作為修正案的一部分,計劃在2030年制定歐盟範圍內的臨時空氣品質標準,以期到2050年實現零污染。此類提案預計將增加空氣品質設備的使用,從而創造對空氣品質監測市場的需求。

- 此外,2023年2月,巴林政府和公共產業和環境事務委員會主席決定將污染測量涵蓋購物中心、商店、多用戶住宅甚至住宅。

- 預計這些類型的發展將在預測期內推動戶外監視器市場的發展。

預計亞太地區將主導市場

- 亞洲國家的空氣污染已達到驚人的水平,並對人民的健康產生重大負面影響。目前的情況主要是由於新興國家工業化程度的提高,導致各國化學污染物的增加,其中一些污染物是致命的。

- 根據空氣品質和污染城市排名,截至2023年5月,全球40個污染最嚴重的城市中有20個位於亞太地區。除此之外,中國、日本和印度也出現了嚴重的空氣污染。地區國家正在採取一切可能措施來應對當前局勢。近年來,該地區許多行業和許多地方殖民地和地區都安裝了空氣品質監測系統。

- 根據電子和資訊技術部消息,印度電子和資訊技術部長於2023年1月介紹了透過MeitY支持的計劃開發的空氣品質監測系統(AI-AQMS v1.0)技術。新技術的發展預計將提高空氣品質監測的效率,從而增加該國對空氣品質監測系統的需求。

- 越南政府的國家空氣品質管理計畫(2021-2025年)包括透過安裝連續自動排放監測裝置來監管工業、交通、農業和建設活動等來源的排放。

- 由於這些發展,亞太地區可能在預測期內主導市場。

空氣品質監測產業概況

空氣品質監測市場分散。主要參與者包括(排名不分先後)Siemens AG、Thermo Fisher Scientific Inc.、Horiba Ltd、Emerson Electric Co. 和 Hawa Dawa GmbH。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 調查先決條件

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028年之前的市場規模和需求預測(金額)

- 最新趨勢和發展

- 政府政策法規

- 市場動態

- 促進因素

- 政府支持政策治理空氣污染

- 工業化在世界擴張

- 抑制因素

- 普及可再生能源、核能發電等清潔能源來源

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 產品類別

- 室內監視器

- 室外監視器

- 取樣方式

- 連續的

- 手動的

- 間歇性的

- 最終用戶

- 住宅和商業

- 發電

- 石化產品

- 其他最終用戶

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 西班牙

- 德國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 越南

- 印度

- 亞太地區其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 伊拉克

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、合作與協議

- 主要企業採取的策略

- 公司簡介

- Siemens AG

- Thermo Fisher Scientific Inc.

- Horiba Ltd

- Emerson Electric Co.

- 3M Co.

- Hawa Dawa GmbH

- Honeywell International Inc.

- Teledyne Technologies Inc.

- TSI Inc.

- Merck KGaA

- Agilent Technologies Inc.

第7章市場機會與未來趨勢

- 空氣品質監測系統技術進步

The Air Quality Monitoring Market size is estimated at USD 5.08 billion in 2024, and is expected to reach USD 6.73 billion by 2029, growing at a CAGR of 5.79% during the forecast period (2024-2029).

The market had definitely faced the consequences of the COVID-19 pandemic, as the lockdowns resulted in less air pollution, particularly in the transport and industrial sector. For example, the Central Pollution Control Board (CPCB), India, published a report on "the Impact of JANTA CURFEW and lockdown on air quality, which revealed that the lockdown resulted in significant improvement in the air quality of the country. Thus, the demand for air quality measurement equipment got reduced in various sectors. The market is likely to get accelerated in the near future due to growing concerns about air quality and the expansion of industrialization in many countries. However, the penetration of cleaner sources of energy like renewables and nuclear energy is expected to hinder the market growth due to the steadily decreasing requirement for the product.

Outdoor air quality equipment is expected to be the fastest-growing segment during the forecast period due to government policies on air quality standards in open spaces.

The technological advancements in air quality monitoring systems create enormous opportunities for the techno-development of devices and their applications. For instance, the recent IoT-based equipment, which are more interactive in their functioning and use new technologies for communicating and delivering data, are in vogue these days. They are termed as the Next Generation Air Quality Monitoring Systems, which are becoming the subject of research for many R&D professionals in the area.

The Asia-Pacific region is expected to dominate the market in the coming years due to the growing rate of urbanization and the industrial activities in developing countries.

Air Quality Monitoring Market Trends

The Outdoor Monitor Segment is Expected to be the Fastest-growing Segment

- Outdoor air quality monitoring systems are installed to track the air pollution caused by the transport sector, industrial sector, construction activities, and all other external sources of pollution. The air outside the confined spaces is believed to have more harmful pollutants than indoor air due to the presence of the points above sources.

- According to the US Environmental Protection Agency, 2022, the seasonally-weighted annual average of PM 2.5 air quality accounted for 7.81, which was low compared to 8.54 in 2021.

- The US government successfully reduced the nation's average PM 2.5 concentration levels by 41% in the last decade to 8.02 micrograms per cubic meter. The targets were achieved by regulatory policies for air quality standards in various sectors, ultimately leading to the high deployment of air quality monitoring systems even at grassroots levels.

- In October 2022, the European Commission issued a legislative proposal to update and combine the EU Ambient Air Quality Directives. As part of the amendment, it was planned to set interim EU-wide air quality criteria by 2030 to reach zero pollution by 2050. With these types of proposals, the use of air quality devices is expected to increase, which, in turn, will create demand for the air quality monitoring market.

- Additionally, in February 2023, the Bahraini government and the public utilities and environmental affairs committee chairman decided to include measuring pollution in malls, stores, residential compounds, and even residences.

- Such kinds of developments are expected to give a boost to the outdoor monitor segment of the market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Air pollution is at alarming levels in Asian countries, which is highly detrimental to the health of the inhabitants. The incumbent situation is mainly due to growing industrialization in developing countries, which has led to increased chemical pollutants in the nations, some of which are fatal too.

- According to the Air Quality and pollution city ranking, as of May 2023, out of the top 40 most polluted cities in the world, 20 are from Asia-Pacific. Apart from that, high levels of air pollution are recorded in China, Japan, and India. The countries in the region are leaving no stone unturned to cope with the prevailing state. Many industries and many local colonies or areas in the region have installed air quality monitoring systems in recent years.

- In January 2023, according to the Ministry of Electronics & IT, the Secretary of Electronics and Information Technology of India inaugurated the technology for Air Quality Monitoring System (AI-AQMS v1.0), developed through MeitY-supported projects. With the development of new technology, the efficiency of air quality monitoring is expected to increase, thus creating demand for air quality monitoring systems in the country.

- The Vietnamese government's National Plan for Air Quality Management (2021-2025) includes emission controls from sources like industries, transport, agriculture, and construction activities, by installing continuous automatic emissions monitoring equipment.

- The Asia-Pacific region will likely dominate the market during the forecast period due to such developments.

Air Quality Monitoring Industry Overview

The air quality monitoring market is fragmented. Some of the major players (in no particular order) include Siemens AG, Thermo Fisher Scientific Inc., Horiba Ltd, Emerson Electric Co., and Hawa Dawa GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies to Regulate Air Pollution

- 4.5.1.2 Expansion of Industrialization Across the World

- 4.5.2 Restraints

- 4.5.2.1 The Penetration of Cleaner Energy Sources Like Renewables and Nuclear Power

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Indoor Monitor

- 5.1.2 Outdoor Monitor

- 5.2 Sampling Method

- 5.2.1 Continuous

- 5.2.2 Manual

- 5.2.3 Intermittent

- 5.3 End User

- 5.3.1 Residential and Commercial

- 5.3.2 Power Generation

- 5.3.3 Petrochemicals

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of the North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Spain

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Rest of the Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Vietnam

- 5.4.3.4 India

- 5.4.3.5 Rest of the Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.5.4 Iraq

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Horiba Ltd

- 6.3.4 Emerson Electric Co.

- 6.3.5 3M Co.

- 6.3.6 Hawa Dawa GmbH

- 6.3.7 Honeywell International Inc.

- 6.3.8 Teledyne Technologies Inc.

- 6.3.9 TSI Inc.

- 6.3.10 Merck KGaA

- 6.3.11 Agilent Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Technological Advancements in Air Quality Monitoring Systems