|

市場調查報告書

商品編碼

1440148

自動化測試 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Automation Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

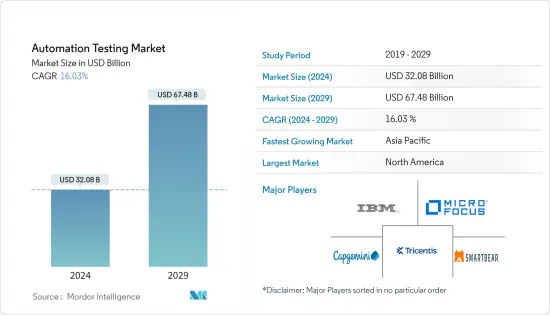

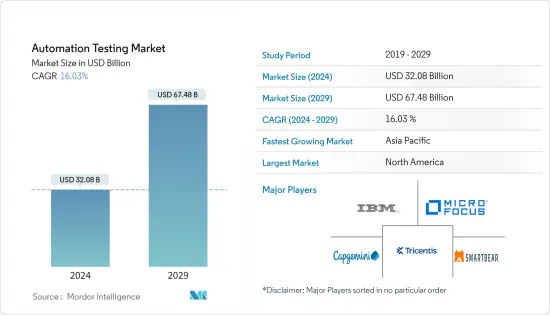

2024年自動化測試市場規模預計為320.8億美元,到2029年將達到674.8億美元,在預測期內(2024-2029年)CAGR為16.03%。

對測試流程自動化、流暢客戶體驗解決方案的需求不斷增加,以及在軟體測試環境中擴大採用尖端人工智慧技術,推動了對自動化測試的需求。隨著測試生命週期的縮短,人工智慧在測試中變得越來越重要。

主要亮點

- 需求的增加推動了測試流程和解決方案自動化的市場,以提供流暢的客戶體驗。但在未來幾年,市場的擴張預計將受到一些問題的阻礙,包括實現從手動測試到自動化測試的轉換變得越來越複雜。

- 此外,隨著「左移方法」的興起,測試人員在需求明確後就開始編寫測試案例,開發與測試並行進行。然而,「右移方法」著重於在生產環境中測試、監控和更新應用程式,而不是完全處理產品對營運團隊的責任。

- 對測試過程自動化和提供流暢客戶體驗的解決方案的需求不斷增加,推動測試自動化市場的發展。然而,從手動測試轉換到自動化測試的難度越來越大等問題將阻礙未來幾年市場的成長。

- 相反,為了保護資料免遭未經授權的存取,政府根據健康保險流通與責任法案(HIPAA)和資料保護指令,採用不同經濟體的資料監管標準。歐盟和美國是關於資料儲存安全和隱私必須遵守的兩個地區法律。然而,保存在雲端的資料存在安全性問題,而保存在現場的資料則完全安全。

- 在 COVID-19 疫情期間,公司集中精力實現 IT 活動自動化,以從危機中恢復過來。隨著企業從 COVID-19 中恢復過來,他們將在認知能力、人工智慧和機器人流程自動化(RPA)方面進行更多投資。這場大流行使自動化和測試成為董事會的要求。隨著業務的增加,其業務連續性策略和風險也在增加。由於自動化測試相對於其他形式的測試在時間和品質方面具有優勢,因此預計這種趨勢將會成長。

自動化測試市場趨勢

不斷發展的 IT 和電信業

- 借助自動化測試,IT 和電信組織可以獲得大型主機的快速回饋,並促進創新,而不會出現中斷營運、阻礙客戶體驗或影響企業收入的瓶頸風險。企業可以提高主機上的品質、速度和效率,同時解決經驗豐富的開發人員短缺的問題。

- 物聯網、人工智慧和機器學習等現代技術迅速擴展,自動化產業擁有測試這些先進技術和應用的絕佳機會。目前,大多數業務流程都是透過數位化和基於規則的軟體進行管理的。

- 此外,智慧型手機和網路的使用已變得不可或缺,智慧型手機的價格實惠、大量基於網路的應用程式的可用性、較低的資料價格以及更高的最終用戶消費能力都有助於市場的成長。

- 最終用戶根據部門下載程序,拒絕是與應用程式效能相關的兩個因素。此外,行動應用程式的開發階段和生命週期更快。因此,公司可以透過自動化行動應用程式測試來測試生產力、改進測試回歸案例並最大限度地縮短時間。

- 例如,今年 4月,是德科技幫助小米驗證了支援智慧型手機的 5G 技術。是德科技的自動化現場到實驗室設備測試平台解決方案利用人工智慧(AI)軟體和通道模擬功能來驗證支援智慧型手機和物聯網(IoT)設備的 5G 技術。

北美預計將佔據重要佔有率

- 自動化測試產業將由北美主導。技術提供者的廣泛存在是該地區市場的主要驅動力。為了在區域和國際範圍內保持競爭力,這些公司強調併購活動、夥伴關係和協作以及提供新穎的解決方案。

- 此外,技術供應商的廣泛分散推動該地區的市場。智慧電視、家用電器和筆記型電腦等創新消費性電子產品在美國越來越受歡迎,並刺激了市場需求。

- 與智慧消費性電子產品一樣,軟體、網路應用程式和作業系統(OS)之間也存在著錯綜複雜的連結。隨著這些智慧消費產品越來越被普遍接受,該地區對測試自動化服務的需求將會增加。

- 此外,各國政府實施舉措,加速新技術的採用,例如人工智慧和機器學習、自動化、物聯網、行動和基於網路的應用程式、基於雲端的服務以及整個地區的其他創新。

- 此外,整合Provarand的計劃是在Canada Drives(一家從事汽車貸款、汽車再融資、抵押貸款、個人貸款和信用重建貸款的金融科技公司)這樣的案例中實現的優勢。 Canada Drives 使用 Provar 的 Salesforce 測試自動化,每次部署節省了 38 小時,手動回歸工作減少了 95%。採用 Provar 後,Canada Drives 的自動化維護工作量也減少了 80%以上,每月節省 33 小時。

自動化測試行業概況

自動化測試市場競爭適中,由許多全球和地區參與者組成。這些佔據相當大市場佔有率的產業參與者正致力於擴大國際客戶。為了在預測期內獲得競爭優勢,這些供應商致力於開發新解決方案、策略聯盟以及其他有機和無機成長計畫的研發投資。

2022年 10月 - Micro Focus 宣布其大型主機應用程式現代化解決方案與 Google Cloud 的 Dual Run 產品平台技術整合,用於將大型主機應用程式遷移到 Google Cloud,加快、自動化並降低風險。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 對自動化測試解決方案提供無縫客戶體驗的需求不斷成長

- 不斷發展的 IT 和電信業

- 市場挑戰

- 實現從手動測試流程過渡到自動化測試流程的複雜性不斷增加

第6章 COVID-19 對自動化測試市場的影響

第7章 市場細分

- 元件類型

- 測試解決方案

- 功能測試

- API測試

- 安全測試

- 合規性測試

- 可用性測試

- 其他解決方案

- 服務

- 專業的服務

- 管理服務

- 測試解決方案

- 最終用戶產業

- 資訊科技與電信

- BFSI

- 衛生保健

- 零售

- 運輸與物流

- 其他最終用途產業(航空、旅館、政府、能源和電力)

- 地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- IBM Corporation

- Micro Focus International plc

- Capgemini SE

- Tricentis USA Corp

- SmartBear Software Inc.

- Parasoft Corporation

- Cigniti Technologies Limited

- Keysight Technologies Inc

- Invensis Technologies Pvt Ltd

- Sauce Labs Inc.

第9章 投資分析

第10章 市場的未來

The Automation Testing Market size is estimated at USD 32.08 billion in 2024, and is expected to reach USD 67.48 billion by 2029, growing at a CAGR of 16.03% during the forecast period (2024-2029).

The need for automation testing gets propelled by increased demand for testing process automation, solutions for a smooth customer experience, and increased adoption of cutting-edge AI-enabled technologies in software testing environments. As it shortens the test lifecycle, AI is becoming more and more important in testing.

Key Highlights

- Increased demand pushes the market for automation of testing processes and solutions for a smooth customer experience. But in the years to come, the market's expansion is anticipated to be hampered by issues, including the growing complexity of implementing the switch from manual to automated testing.

- Moreover, with the rise of the 'shift left approach,' testers started writing test cases just after the requirement was clear, and development continued parallelly with testing. However, the 'shift right approach' focuses on testing, monitoring, and updating the app in production environments rather than completely handling the product's responsibility to the Ops team.

- An increase in demand for testing process automation and solutions that offer a smooth client experience is driving the market for testing automation. However, problems like the increasing difficulty of executing the switch from manual to automated testing will hinder the market's growth in the following years.

- Instead, to safeguard data from unauthorized access, governments adopt data regulation standards from different economies as per the Health Insurance Portability and Accountability Act (HIPAA) and the Data Protection Directive. The European Union and the US are two regional laws that must be abided by regarding data storage security and privacy. However, data kept in the cloud is subject to security issues, whereas data kept on-site is entirely safe.

- During the COVID-19 epidemic, companies concentrated on automating IT activities to recover from the crisis. As firms recover from COVID-19, they will invest more in cognitive capabilities, artificial intelligence, and robotic process automation (RPA). The pandemic has made automation and testing a boardroom requirement. As the businesses increase, so is their business continuity strategies and risks. This trend is expected to grow as automated testing has its advantage in time and quality over other forms of testing.

Automation Testing Market Trends

Growing IT & Telecommunication Industry

- With the help of automated testing, IT & telecom organizations can gain quick feedback on the mainframe, and supercharge innovation without having the risk of bottlenecks that disrupt operations, hinder customer experiences, or impact the enterprise's revenues. The enterprises can improve quality, velocity, and efficiency on the mainframe while lowering the problems of the shortage of experienced developers.

- Modern technologies such as IoT, AI, and machine learning are quickly expanding as the automation industry has an excellent opportunity to test these advanced technologies and applications. Currently, most business processes are managed digitally and rule based-software.

- Moreover, Smartphones and internet usage have become indispensable, and the affordability of smartphones, availability of numerous web-based applications, lower data prices, and more end-user spending power contribute to the market's growth.

- End-users download programs depending on the department, and refusal is two factors related to application performance. Furthermore, the development phase and lifecycle of mobile applications are quicker. As a result, companies test productivity, improve test regression cases and minimize time by automating mobile application testing.

- For Instance, in April this year, keysight enabled Xiaomi to validate 5G technology underpinning smartphones. Keysight's automated field-to-lab device test platform solutions leverage artificial intelligence (AI) software and channel emulation capabilities to validate 5G technology underpinning smartphones and internet of things (IoT) devices.

North America is Expected to Hold Significant Share

- The automated testing industry will get dominated by North America. The widespread presence of technology providers is the primary driver of the market in the area. To remain competitive on a regional and international scale, these firms emphasize merger and acquisition activity, partnerships and collaborations, and the provision of novel solutions.

- Moreover, the widespread dispersion of technology suppliers is driving the region's market. Innovative consumer electronics such as smart TVs, home appliances, and laptops are becoming increasingly popular in the US and are fueling market demand.

- Along with intelligent consumer gadgets, software, web applications, and operating systems (OS) are intricately linked. As these intelligent consumer products become more generally accepted, the region's demand for test automation services will increase.

- Furthermore, Governments are implementing initiatives to hasten the adoption of new technologies such as artificial intelligence and machine learning, automation, the Internet of Things, mobile and web-based apps, cloud-based services, and other innovations across the region.

- Additionally, the plan for integrating Provarand is the advantages they realized in a case like Canada Drives (a Fintech company dealing in vehicle loans, auto refinancing, mortgages, personal loans, and credit rebuilding loans). Canada Drives saved 38 hours per deployment using Provar's test automation for Salesforce to cut their manual regression effort by 95%. Following the adoption of Provar, Canada Drives also saw a reduction in automation maintenance effort of more than 80%, saving 33 hours per month.

Automation Testing Industry Overview

The automation testing market is moderately competitive and consists of many global and regional players. These industry players, who hold a sizeable portion of the market, are concentrating on growing their international clientele. To get a competitive edge over the projection period, these vendors focus on the research and development investment in developing new solutions, strategic alliances, and other organic & inorganic growth initiatives.

October 2022 - Micro Focus announced its mainframe application modernization solution to integrate with Google Cloud's Dual Run product platform technology for mainframe application migration to Google Cloud that will speed up, automate, and lower the risk.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand of Automation Testing Solutions to Provide Seamless Customer Experience

- 5.1.2 Growing IT & Telecommunication Industry

- 5.2 Market Challenges

- 5.2.1 Rising Complexities to Implement Transition from Manual to Automation Testing Process

6 IMPACT OF COVID-19 ON THE AUTOMATION TESTING MARKET

7 MARKET SEGMENTATION

- 7.1 Component Type

- 7.1.1 Testing Solutions

- 7.1.1.1 Functional Testing

- 7.1.1.2 API Testing

- 7.1.1.3 Security Testing

- 7.1.1.4 Compliance Testing

- 7.1.1.5 Usability Testing

- 7.1.1.6 Other Solutins

- 7.1.2 Services

- 7.1.2.1 Professional Services

- 7.1.2.2 Managed Services

- 7.1.1 Testing Solutions

- 7.2 End-user Industry

- 7.2.1 IT & Telecommunication

- 7.2.2 BFSI

- 7.2.3 Healthcare

- 7.2.4 Retail

- 7.2.5 Transportation & Logistics

- 7.2.6 Other End-use Industries (Avaiation, Hospitality, Government, Energy & Power)

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 IBM Corporation

- 8.1.2 Micro Focus International plc

- 8.1.3 Capgemini SE

- 8.1.4 Tricentis USA Corp

- 8.1.5 SmartBear Software Inc.

- 8.1.6 Parasoft Corporation

- 8.1.7 Cigniti Technologies Limited

- 8.1.8 Keysight Technologies Inc

- 8.1.9 Invensis Technologies Pvt Ltd

- 8.1.10 Sauce Labs Inc.