|

市場調查報告書

商品編碼

1440146

電動三輪車 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Electric Three-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

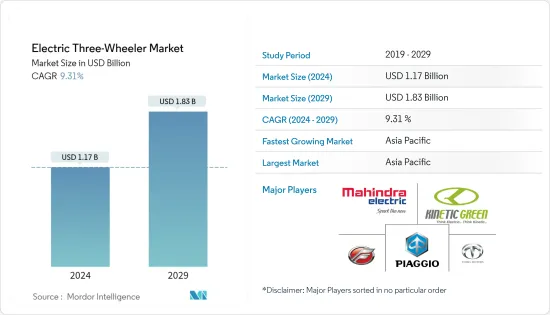

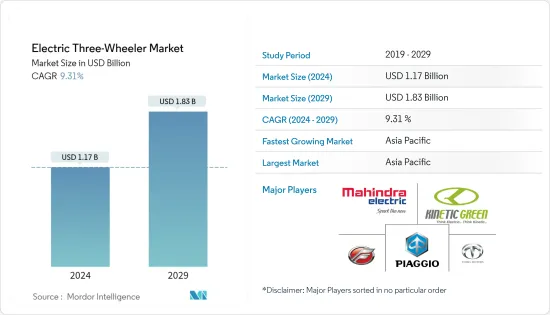

電動三輪車市場規模預計到2024年為 11.7 億美元,預計到2029年將達到 18.3 億美元,在預測期內(2024-2029年)CAGR為 9.31%。

主要亮點

- 該市場主要受到政府嚴格污染控制規範、人們對汽油和柴油汽車排放有害影響的認知不斷提高以及電動車採用率增加等因素的推動。

- 與傳統三輪車相比,電動三輪車的平均運作和維護成本要低得多。

- 然而,續航里程小、電池組笨重是三輪汽車製造商關注的問題。電動三輪車充滿電後可行駛約 125-130 公里,而傳統車輛滿箱燃油可行駛200-220 公里。

電動三輪車市場趨勢

日益關注排放控制推動市場

世界上一些低收入和中等收入國家的三輪車使用率很高,傳統上由內燃機提供動力。然而,許多這些內燃機三輪車陳舊且效率低下,因此排放大量顆粒物(PM)和黑碳(BC),這是一種強效的短期污染物。日益嚴格的排放控制標準促使製造商增加了電動三輪車的研發支出,最終使他們能夠將其作為城市內出行的未來進行行銷。

世界各地的政府和組織發起了各種計劃和舉措,鼓勵買家選擇電動三輪車而不是傳統車輛。例如,聯合國環境署支持發展中國家製定在非洲和亞洲引進電動兩輪和三輪車的國家計畫。聯合國環境署支持非洲和亞洲八個國家的電動兩輪和三輪車計畫:衣索比亞、摩洛哥、肯亞、盧安達、烏干達、菲律賓、泰國和越南。此類活動預計將推動電動三輪車的整合,這可能有助於從基於化石燃料的出行方式向電動出行方式的轉變,推動市場的成長。

亞太地區將引領市場

近年來,亞太地區已成為電動三輪車的新興市場。2018-19年,當所有其他汽車領域的需求成長較上年緩慢時,電動三輪車領域的銷量比2017-18年該國電動三輪車的銷量成長了約 21%。

該地區各國政府也採取措施減少該地區的污染。例如,

- 2019年12月,印度政府宣布了FAME India計畫第二階段,重點支持公共和共享交通的電氣化,目的是透過獎勵措施支持電動巴士、e-3輪汽車。

- 在泰國,節能基金(ECF)批准了 1.06 億泰銖的補貼,以獎勵嘟嘟車車主從液化石油氣(LPG)轉向電動嘟嘟車。

Terra Motors等該地區的幾家主要參與者推出各種電動三輪車,用於前往印度、孟加拉和尼泊爾等潛在市場的客運和貨運,以增加其市場佔有率和佔有率。

電動三輪車產業概況

電動三輪車市場高度分散,多家參與者僅佔較小的市場。電動三輪車市場的一些知名公司包括 Mahindra Electric、Piaggio、Bodo EV、Kinetic Green Energy Solution 等。這些企業大力投資電動三輪車的研發,以提高車輛的負載能力和行駛里程。例如,

- 2020年 2月,Omega Seiki Private Limited 推出了 Singha 和 Singha Max,後者採用電力運行,以滿足 B2B 和電子商務行業的需求。

- 2019年12月,比亞喬在印度推出Ape電動三輪車,配備可更換鋰離子電池,一次充電續航里程約70-80公里

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場促進因素

- 市場挑戰

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第5章 市場細分

- 最終用途

- 客運航空公司

- 貨物承運人

- 電池類型

- 鋰離子電池

- 鉛酸

- 地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太

- 印度

- 中國

- 日本

- 韓國

- 亞太其他地區

- 世界其他地區

- 巴西

- 南非

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市佔率

- 公司簡介

- Mahindra Electric

- Piaggion & C. Spa

- Bodo Vehicle Group Co. Ltd

- Kinetic Green Energy & Power Solutions Ltd

- Terra Motors Corporation

- Lohia Auto Industries

- E-Tuk Factory BV

- Goenka Electric Motor Vehicles Pvt. Ltd

- Omega Seiki Private Limited

- ATUL Auto Limited

第7章 市場機會與未來趨勢

The Electric Three-Wheeler Market size is estimated at USD 1.17 billion in 2024, and is expected to reach USD 1.83 billion by 2029, growing at a CAGR of 9.31% during the forecast period (2024-2029).

Key Highlights

- The market is primarily driven by the factors such as strict government norm for pollution control, increasing awareness about harmful effects of emissions from gasoline and diesel vehicles and increase in adoption of electric vehicles.

- The average cost of operation and maintenance of electric three-wheelers are substantially low as compared to conventional three-wheelers.

- However, the low range of distance covered, and heavy battery pack are the areas of concern for the manufacturers of three-wheeler vehicles. As an electric three-wheeler covers around 125-130 kms with full charged battery as compared to 200-220 Kms covered by conventional vehicles on a full tank of fuel.

Electric Three-Wheeler Market Trends

Increasing Focus on Emission Control Driving the Market

Several low- and middle-income countries in the world have a high rate of usage of three-wheelers, which were traditionally powered by IC engines. However, many of these internal combustion engine three-wheelers are old and inefficient, thus, emitting substantial amounts of particulate matter (PM) and black carbon (BC), a potent short-lived pollutant. The growing emission control norms have propelled the manufacturers to increase their expenditure on R&D of electric three-wheelers, which eventually allowed them to market them as the future of intracity mobility.

Governments and organizations across the world have initiated various schemes and initiatives, which encourage buyers to choose electric three-wheelers over conventional vehicles. For instance, the UN Environment is supporting developing countries to develop national programs for the introduction of electric two- and three-wheelers in Africa and Asia. The UN Environment is supporting electric two- and three-wheeler projects in eight countries in Africa and Asia: Ethiopia, Morocco, Kenya, Rwanda, Uganda, the Philippines, Thailand, and Vietnam. Such activities are envisioned to propel the integration of electric three-wheelers, and this may help the transformation from fossil fuels-based mobility to electric mobility, thereby, driving the growth of the market.

Asia-Pacific Will Lead the Market

Over the past few years, the Asia-Pacific region has turned out to be an emerging market for electric three-wheeler. During the year 2018-19, when all other auto segment witnessed a slow demand growth as compared to previous year, sales of electric three-wheeler segment grew around 21 per cent from 2017-18 sales of electric three wheelers in the country.

The Governments in the region are also taking measures to reduce pollution in the region. For instance,

- In December 2019, the government of India announced the phase-II of FAME India scheme, which focus on supporting electrification of public & shared transportation, and aims to support e-buses, e-3 wheelers through incentives.

- In Thaniland, The Energy Conservation Fund (ECF) has approved a subsidy of THB 106 million, to motivate tuk-tuk owners to move from liquefied petroleum gas (LPG) to Electric ones.

Several major players in the region like Terra motors are launching various electric three-wheelers, both for passenger and cargo transportation to prospective markets like India, Bangladesh and Nepal to increase their market presence and share.

Electric Three-Wheeler Industry Overview

The Electric 3-Wheeler Market is highly fragmented, with several players accounting for a smaller portion of market share. Some of the prominent companies in the electric three-wheeler market are Mahindra Electric, Piaggio, Bodo EV, Kinetic Green Energy solution and others. These players are investing heavily in research and development of electric three-wheeler in increasing the load capacity along with the driving range of the vehicle. For instance,

- In February 2020, Omega Seiki Private Limited introduced Singha and Singha Max which runs on electric power to cater to the needs of the B2B and e-commerce industry.

- In December 2019, Piaggio launched Ape electric three wheeler in India, with swappable Lithium-ion battery and offers a range of around 70-80 km on a single charge

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Challenges

- 4.3 Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-Use

- 5.1.1 Passenger Carrier

- 5.1.2 Goods Carrier

- 5.2 Battery Type

- 5.2.1 Li-ion

- 5.2.2 Lead Acid

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Mahindra Electric

- 6.2.2 Piaggion & C. Spa

- 6.2.3 Bodo Vehicle Group Co. Ltd

- 6.2.4 Kinetic Green Energy & Power Solutions Ltd

- 6.2.5 Terra Motors Corporation

- 6.2.6 Lohia Auto Industries

- 6.2.7 E-Tuk Factory BV

- 6.2.8 Goenka Electric Motor Vehicles Pvt. Ltd

- 6.2.9 Omega Seiki Private Limited

- 6.2.10 ATUL Auto Limited