|

市場調查報告書

商品編碼

1440078

連網型馬達:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Connected Motorcycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

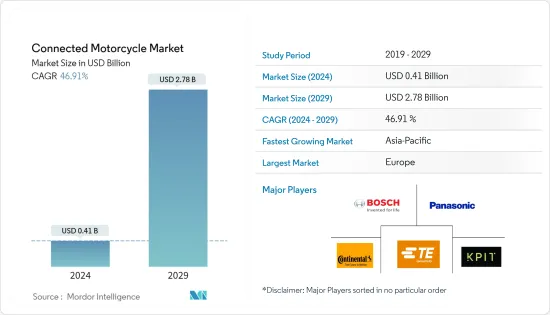

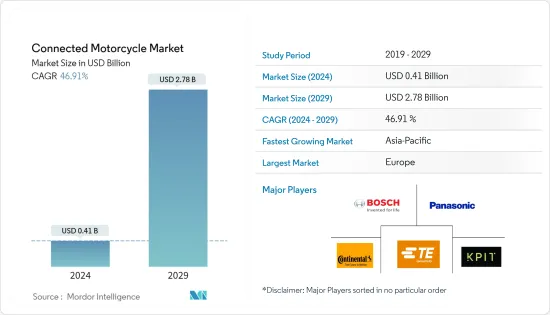

連網型馬達市場規模預計到 2024 年為 4.1 億美元,預計到 2029 年將達到 27.8 億美元,在預測期內(2024-2029 年)將成長 46.91%,年複合成長率成長。

由於製造業關閉和旅行限制,COVID-19感染疾病阻礙了連網型馬達市場的成長。此外,由於幾乎沒有旅遊活動,連網型馬達市場的售後市場出現放緩。然而,隨著疫情後限制的放鬆,需求在 2021 年開始復甦。

技術進步、車輛安全性的進步、兩輪車駕駛輔助系統的引入以及零售和電子商務領域物流的快速成長等因素極大地推動了連網型馬達市場的發展。此外,智慧型手機使用量的增加和網路普及可能會進一步推動預測期內的市場成長。然而,缺乏適當的連接基礎設施和資料駭客等不斷上升的網路威脅預計將限制市場成長。

該市場的推動因素包括網際網路普及的提高以及網際網路連接和 5G 的改進,以支持車輛到車輛和車輛到基礎設施的連接,以及對駕駛員輔助系統、即時安全、導航、和GPS監控,處於領先地位。

在預測期內,亞太地區預計將佔據市場主要佔有率,其次是歐洲和北美。對電動機車和探險旅行等個人出行的需求正在增加。Yamaha、鈴木和本田等全球企業的加入,以及人們對連網型馬達優勢的日益認知,將對區域市場產生積極影響。

馬達連網型趨勢

資訊娛樂領域預計將佔據很大的市場佔有率

由於車輛中對此類系統的需求不斷增加,預計該市場的資訊娛樂領域將在預測期內顯著成長。由於資訊娛樂系統已成為摩托車不可或缺的一部分,它用於在TFT顯示器或電子儀表叢集收集有關摩托車的資訊,並為騎士提供有關車輛的充分資訊。

KTM、哈雷戴維森和川崎等公司正在提供配備此類馬達系統的連網連網型來吸引客戶。它具有高科技功能,例如與智慧型手機和智慧型穿戴裝置的連接。例如,KTM AG 的 KTM My Ride Paid 應用程式(9 美元)允許用戶使用 TFT 顯示器進行導航。

這些資訊娛樂系統還配備了路線引導和導航等功能,使騎士更容易到達並即時提供準確的交通資訊。其他功能包括變換車道警告、交通燈警告和車輛狀態。例如,

- Triumph 推出了 My Triumph 連接系統,適用於 Street Triple RS 和 Tiger 800。此連接系統包括Google導航系統、音樂、電話操作和自行車狀態監控。這是全球首個推出的整合 GoPro 控制的連網系統。騎士可以使用相機捕捉騎乘過程,並透過摩托車的 TFT 儀表和左側開關立方體直覺地存取和控制 GoPro 的關鍵功能。

因此,為了佔領不斷成長的市場佔有率,公司正在向消費者提供創新的解決方案,以鞏固其市場地位。例如,

- 2020年10月,Yamaha Motor Co, Ltd.推出了配備藍牙連接功能的FZ系列。該應用程式具有車輛位置、行程詳細資訊、危險模式和電子鎖功能。 Yamaha Connect X 應用程式售價為 3,000 印度盧比,可安裝在 FZ 和 FZS-Fi V3 版本上。

因此,資訊娛樂領域的此類發展預計將在預測期內推動連網型馬達市場的發展。

預計亞太地區將在預測期內引領市場

隨著消費者對高階自行車的認知迅速提高,以及連網型馬達在市場上尋找空間,整個亞洲的兩輪車趨勢正在改變。 Bajaj、本田和 KTM 等主要兩輪車競爭對手已經進入連網汽車市場。 KTM 已經為 Duke 390 提供了連網型馬達規格。它配備了具有 TFT 顯示器和藍牙智慧型手機連接的資訊娛樂系統。

主要企業的產品發布、策略聯盟和協議可能會在預測期內進一步推動市場成長。例如,

- 2021年4月,小牛RQI針對中國和歐洲市場推出了電動機車。這款電動運動自行車配備了先進的技術功能,例如具有騎乘資料功能的 5G IoT、物聯網連接的電池組、全數位儀表板、防盜 GPS 追蹤和藍牙連接。

- 2021年1月,吉利、貝納利母公司旗下的摩托車製造商錢江汽車推出了電動配備數位TFT儀錶面板的電動運動自行車。它具有藍牙功能和一個應用程式,允許用戶檢查自行車的充電、性能、地理圍欄等。

在預測期內,兩輪車銷售的成長和支援連網型馬達的技術進步可能有助於國內領先製造商開發亞太連網型馬達市場。

連網型馬達產業概述

連網型馬達市場適度整合,多家廠商佔較大市場佔有率。市場主要企業採取了多種成長策略,例如產品發布、合作、夥伴關係並提供技術更新的產品,以鞏固其在市場中的地位。例如,

- 2020 年 9 月,大陸集團宣布投資 Aeye,作為其強化短程LiDAR技術策略的一部分。第一個量產系列計劃於 2024 年推出。

- 2020 年 10 月,Yamaha透過YamahaConnectX 應用程式推出了摩托車藍牙技術。藍牙連接功能最初將在雅馬哈 FZS-FI 黑闇騎士 BS6 車型上提供。這些可以作為附加元件配件安裝在YamahaFZ-FI 和YamahaFZS-FI 150 cc 摩托車的整個系列上。

- 2020年1月,加拿大達蒙摩托車公司推出了一款配備黑莓QNX技術的連網型馬達。 360度先進警報系統配備了攝影機、雷達和非視覺感測器等各種感測器來偵測道路上的這些威脅。

- 2019 年,博世推出了高階騎士輔助系統(ARAS),具有正面防撞功能和幫助連接功能(用於緊急情況)。 ARAS將於2020年年終至2020年底安裝在杜卡迪、川崎和KTM生產的摩托車上。

該市場的主要企業包括羅伯特博世、大陸集團、TE Connectivity 和Panasonic Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 按服務

- 駕駛輔助

- 資訊娛樂

- 安全

- 按最終用戶

- 私人的

- 商業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- BMW Motorrad

- TE Connectivity Ltd

- Autotalks

- Vodafone Group PLC

- Panasonic Corporation

- Continental AG

- Robert Bosch GmbH

- Aeris Communication Inc.

- Starcom Systems Ltd

- KPIT Technologies Ltd

第7章市場機會與未來趨勢

The Connected Motorcycle Market size is estimated at USD 0.41 billion in 2024, and is expected to reach USD 2.78 billion by 2029, growing at a CAGR of 46.91% during the forecast period (2024-2029).

The COVID-19 pandemic hindered the growth of the connected motorcycles market due to shutdowns of manufacturing units and travel restrictions. In addition, virtually with no activity in tourism, the aftermarket segment of the connected motorcycle market witnessed a slowdown. However, post-pandemic, with the easing of restrictions, demand started restoring in 2021.

Factors like technology advancements, advancements in vehicle safety, the introduction of driver-assist systems in motorcycles, and rapidly growing logistics in the retail and e-commerce sectors have been significantly driving the connected motorcycle market. In addition, increased smartphone utilization and internet penetration may further enhance the market's growth during the forecast period. However, a lack of proper connectivity infrastructure and increasing cyber threats like data hacking are anticipated to restrain the market's growth.

The increasing internet penetration and improvements in internet connectivity and 5G to support vehicle-to-vehicle and vehicle-to-infrastructure connectivity and the increased demand for features like driving assistance systems, real-time safety, navigation, and GPS monitoring are driving the market.

Asia-Pacific is expected to hold a significant share in the market, followed by Europe and North America, during the forecast period. The demand for electric motorcycles and individual mobility for adventure trips, etc., is increasing. The presence of global players like Yamaha, Suzuki, and Honda and increasing awareness about the benefits of connected motorcycles will positively impact the regional market.

Connected Motorcycle Market Trends

Infotainment Segment Anticipated to Hold Significant Share in the Market

The infotainment segment of the market is expected to grow significantly over the forecast period, as demand for such systems in vehicles is increasing. As infotainment systems have become an integral part of motorcycles, they are used for gathering information regarding the motorcycle on the TFT displays or electronic instrument clusters to keep the rider well informed about the vehicle.

Companies such as KTM, Harley-Davidson, and Kawasaki are offering connected motorcycles equipped with such infotainment systems to attract customers. They are being equipped with hi-tech features, such as connecting to a smartphone or a smart wearable. For instance, KTM AG's KTM My Ride Paid app (USD 9) allows users to use the TFT display for navigation.

These infotainment systems are also installed with features like route guidance and navigation, which help the rider reach easily and provide accurate traffic information in real-time. Other features include lane change warnings, traffic signal warnings, and vehicle conditions. For instance,

- Triumph launched the My Triumph Connectivity System, available for Street Triple RS and Tiger 800. The connectivity system has an inbuilt Google navigation system, music, phone operation, and bike status monitoring. It is the first connectivity system globally to be launched with integrated GoPro control. The rider can capture their ride on a camera and intuitively access and control key GoPro functions through the motorcycle's TFT instruments and left-hand switch cube.

Thus, to capture the growing market share, companies are offering innovative solutions to their consumers to strengthen their position in the market. For instance,

- In October 2020, Yamaha Motor Company launched the FZ series with Bluetooth-connected features. This app features vehicle location, trip details, hazard mode, and an e-lock feature. The Yamaha Connect X app costs INR 3,000 and can be installed in FZ & FZS-Fi V3 variants.

Thus, such developments in the infotainment segment are expected to boost the connected motorcycle market during the forecast period.

Asia-Pacific Anticipated to Lead the Market During the Forecast Period

The two-wheeler trend is changing across Asia, as consumers' awareness of high-end specs bikes is growing rapidly, allowing connected motorcycles to make space in the market. Major motorcycle competitors such as Bajaj, Honda, and KTM have already entered the connected vehicle market. KTM has already provided the Duke 390 with connected motorcycle specs. It has an infotainment system with a TFT display and smartphone connection through Bluetooth.

Product launches, strategic collaborations, and agreements by key players may further enhance the market's growth during the forecast period. For instance,

- In April 2021, Niu RQI launched an electric motorcycle for the Chinese and European markets. The electric sports bike has advanced technology features that include 5G IoT with ride data capabilities, an IoT-connected battery pack, a fully digital dashboard, anti-theft GPS tracking, and Bluetooth connectivity.

- In January 2021, Qianjiang Motor, a two-wheeler manufacturer owned by Geely and the parent company of Benelli, launched an electric sports bike with a digital TFT instrument panel. It has Bluetooth capability and an app, allowing users to check motorcycle charge, performance, geo-fencing, etc.

With growing motorcycle sales and advancements in technology supporting connected motorcycles, large manufacturers in the country may contribute to the development of the connected motorcycles market in Asia-Pacific over the forecast period.

Connected Motorcycle Industry Overview

The connected motorcycles market is moderately consolidated, with several players accounting for a significant share in the market. The major players in the market are adopting several growth strategies, including product launches, collaborations, and partnerships, and offering technologically updated products to strengthen their position in the market. For instance,

- In September 2020, Continental AG announced an investment in Aeye, as a part of its strategy to enhance its short-range LiDAR technology. The first production series is scheduled for launch in 2024.

- In October 2020, Yamaha introduced a Bluetooth-enabled technology for motorcycles with the introduction of the Yamaha Connect X Application. The Bluetooth connectivity features will be initially available with the Yamaha FZS-FI Dark Knight BS6 variant. They can be installed as an add-on accessory in the entire series of Yamaha FZ-FI and Yamaha FZS-FI 150 cc motorcycles.

- In January 2020, Canada's Damon motorcycles launched a connected motorcycle equipped with the BlackBerry QNX technology. Its 360-degree advanced warning system has various sensors, such as cameras and radar and non-visual sensors, to detect these threats on the road.

- In 2019, BOSCH introduced its Advanced Rider Assistance Systems (ARAS) with front collision avoidance and Help Connect (for emergencies). The ARAS were to be equipped in motorcycles manufactured by Ducati, Kawasaki, and KTM by mid to end of 2020.

Some of the major players in the market are Robert Bosch, Continental AG, TE Connectivity, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Driver Assistance

- 5.1.2 Infotainment

- 5.1.3 Safety

- 5.2 By End User

- 5.2.1 Private

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BMW Motorrad

- 6.2.2 TE Connectivity Ltd

- 6.2.3 Autotalks

- 6.2.4 Vodafone Group PLC

- 6.2.5 Panasonic Corporation

- 6.2.6 Continental AG

- 6.2.7 Robert Bosch GmbH

- 6.2.8 Aeris Communication Inc.

- 6.2.9 Starcom Systems Ltd

- 6.2.10 KPIT Technologies Ltd