|

市場調查報告書

商品編碼

1440065

專業電子代工服務:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Electronics Manufacturing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

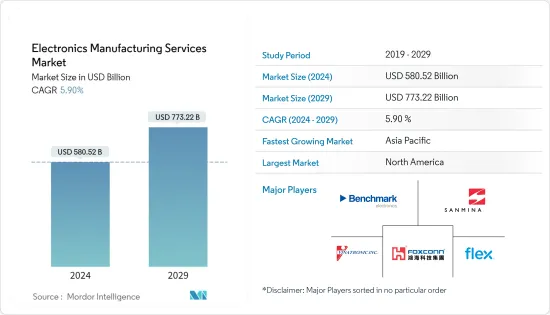

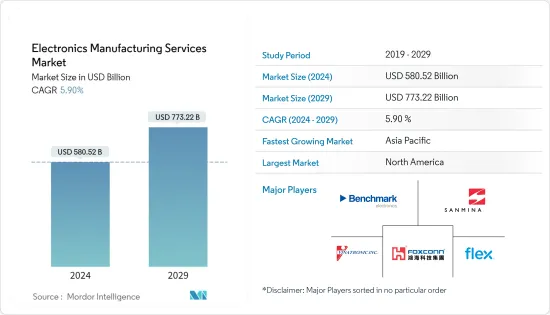

電子製造服務市場規模預計到2024年為5805.2億美元,預計到2029年將達到7732.2億美元,在預測期內(2024-2029年)成長5.90%,年複合成長率成長。

主要亮點

- 隨著電子元件變得越來越小並採用工業物聯網 (IIoT) 和透過 5G 增強通訊等新興技術,電子元件的設計和組裝正在經歷一場革命。例如,5G通訊基地台開發了MIMO等卓越的天線技術,增加了輻射元件的數量和性能。

- 此外,對智慧型手機、智慧型手錶和其他設備等電子設備的需求正在推動市場成長。據 IBEF 稱,印度家用電器和電器行業最近價值 98.4 億美元,預計到 2025 年將增加一倍以上,達到 14.8 億盧比(211.8 億美元)。

- 此外,許多公司尋求減少製造活動中的庫存、廠房和設備,將資本投資的重點轉向銷售、行銷和研發。這增加了對第三方製造服務供應商外包的需求。

- 例如,一家航空電子設備公司決定將 PCBA 的生產轉移給 EMS 合作夥伴,以擴大其產品和服務範圍,而無需在製造方面進行額外投資。主要要求是符合 AS9100 標準以及 PCBA 上有多個 BGA(某些 PCB 上多達 16 層)。

- 多個地區政府不斷採取的措施正在推動市場成長。例如,據 IBEF 稱,政府已根據 IT 硬體生產連結獎勵(PLI) 計劃核准了14 家公司。未來四年,這些公司預計將帶動總合216.4 億美元。該計劃將為印度電子製造業帶來額外投資。

- 此外,印度政府已批准自動路線下電子系統設計和製造領域的 100% 外國直接投資。單一品牌零售業的 FDI 從 51% 增加到 100%。政府計劃將多品牌零售業的 FDI 限制提高至 51%。這些發展可能會推動市場成長。

- 在世界各地,中小企業(SME)和中小微型企業(MSME)擴大僱用第三方製造服務,以避免對生產線進行大量資本投資,並利用服務供應商的設計專業知識和製造能力。國際金融公司 (IFC) 估計,新興經濟體中約 6,500 萬(40%)的正規微企業融資需求未被滿足。世界各地的大多數企業都是中小企業,特別是在新興國家。這種對製造服務供應商的依賴將鞏固 EMS 市場的未來成長。

- 此外,新冠肺炎 (COVID-19) 疫情的爆發嚴重影響了許多最終用戶產業,包括電子製造業。 IPC的研究顯示,消費性電器產品預計受到的影響最大,因為它們高度依賴中國的製造能力,供應鏈也高度依賴中國。

- 然而,許多電子製造和相關服務已被歸類為基本服務供應商,因為它們執行許多關鍵任務,從組裝產品到設計電路基板,再到為所需的醫療設備。在這次 COVID-19感染疾病期間,電子製造一直是經濟和醫療保健產業不可或缺的一部分。

電子製造服務 (EMS) 市場趨勢

工業應用推動 EMS 需求

- 隨著環境革命的不斷發展,工業馬達控制需要更高的效率。此外,需要以最小的成本實現更大程度的整合,以支援新技術的市場滲透並提高安全性和可靠性。這將進一步增加對用於電壓調節器操作的智慧型馬達數位訊號控制器的電子產品的需求。

- 據 IBEF 稱,到 2025 年,印度電動車 (EV) 市場規模預計將達到 5,000 億印度盧比(70.9 億美元)。此外,CEEW能源金融中心的一項研究發現,到2030年,印度電動車市場規模將達到2,060億美元。

- 此外,工業4.0將顯著提高工廠資料自動化的效率和生產力。工業物聯網和人工智慧 (AI) 的平行進步將推動一些成長。儘管電子產業遠未達到同等水準的智慧化和自動化,但工業 4.0 的發展正在引領潮流,電子製造服務市場的最新趨勢就證明了這一點。

- 例如,2022 年 10 月,羅克韋爾自動化宣布已達成收購 CUBIC 的最終協議,該公司專門生產用於建造配電板的模組化系統。此次合作將縮短上市時間,使馬達控制在工廠範圍內得到更廣泛的應用,並產生智慧資料,為廣大客戶提高永續性和生產力,預計將為公司帶來利潤。

- 工業自動化電子產品製造正在推動該產業的成長。工業自動化領域的參與者需要一致地存取其系統上產生的所有資料。然而,許多操作公共事業應用程式的廣泛範圍使這一級別的資料收集變得複雜。歐洲和北美地區擴大部署監控和資料採集 (SCADA) 以實現準確的資料收集。

- 此外,為工業市場提供高品質硬體和軟體解決方案的開發商DYNICS 將於2022 年10 月被認可為致力於實施數位轉型技術解決方案的墨西哥領先技術組織之一。該公司宣布與SINCI 建立獨特的系統整合商合作夥伴關係。透過這種合作夥伴關係,該公司將繼續與 SINCI 合作,為多個行業的客戶提供工具,以增強他們獲得自動化優勢的機會。

- 大多數 SCADA 系統由單板遠端終端裝置(RTU) 組成,這是一種緊湊、耐用的產品,將所有輸入/輸出 (I/O) 模組放置在單一印刷基板。因此,公共產業部門擴大採用 SCADA 將進一步推動對 EMS 的需求。

亞太地區預計將出現顯著成長

- 預計亞太地區在預測期內將顯著成長。印度和中國由於在消費性電器產品、半導體和其他通訊器材與設備製造業的強勢地位,在全球EMS市場上擁有強大的基礎。例如,塔塔集團最近宣布計劃進軍半導體製造業務,以期在價值1兆美元的高科技電子製造領域分一杯羹。

- 此外,5G 網路和物聯網部署等技術變革正在加速電子產品的採用。 「數位印度」和「智慧城市」計劃等措施正在增加電子設備對物聯網的需求。

- 此外,根據印度電子工業協會的數據,到 2025 年,印度的電子契約製造預計將成長六倍以上,達到約 1,520 億美元。該國也設定了2025年僅行動電話出口額約1,000億美元的目標。 ,這是在政府生產連結獎勵計畫(PLI)計劃的支持下實現的。此外,2022 年 5 月,Voltas 宣布了一項 40 億印度盧比(5,010 萬美元)的資本投資計劃,用於根據 PLI 計劃生產白色家電零件。

- 據IBEF稱,鼓勵國內製造業的生產連結獎勵計劃(PLI)將針對14家企業,總投資額為30億盧比(389.9億美元),其中約80%將用於投資。據說集中僅在三個部門。 、電子、汽車、太陽能板製造等這項擴張支持了網路、5G、資料中心、汽車/雷射雷達、航太和國防市場新技術產品的快速成長。

- 亞太地區的供應鏈從產品設計、半導體製造和封裝、零件和子系統、組裝和測試開始,逐步延伸到印度和印尼等亞太地區的低成本國家,以降低製造成本,正在轉型。

- 例如,成本上升和先前的貿易緊張局勢迫使台灣昌碩將生產多元化到越南和印尼等國家。貿易緊張局勢帶來的不確定性已導致許多亞洲公司重新調整投資並轉移製造地以避免關稅。

電子製造服務 (EMS) 產業概覽

由於整個行業擴大採用這些服務以及全球多個市場參與者的存在,電子製造服務市場正在走向碎片化。市場相關人員認為產品開發和創新是市場擴張的有利可圖的途徑。

2023年10月,塔塔電子私人有限公司(TEPL)宣布以1.25億美元收購緯創在印度的業務。這使得該公司成為第一家生產蘋果iPhone的印度公司,而緯創資通的收購很可能會促進印度電子製造生態系統的下一個投資週期,並標誌著該國契約製造製造商的成熟。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 市場促進因素

- 小型化趨勢日益明顯

- 介紹 IIoT(工業物聯網)、區塊鏈和通訊增強的新興技術

- 市場挑戰

- 競爭加劇以及嚴格的政府法規和環境法規

- 侵害智慧財產權

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

第5章市場區隔

- 按服務類型

- 電子設計與工程

- 組裝電子元件

- 電子設備製造

- 其他服務類型

- 按用途

- 家用電器

- 車

- 工業的

- 航太和國防

- 衛生保健

- 資訊科技和電信

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 義大利

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 台灣

- 日本

- 韓國

- 印度

- 亞太地區其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Vinatronic Inc.

- Benchmark Electronics Inc.

- Hon Hai Precision Industry Co. Ltd(Foxconn)

- Flex Ltd

- Sanmina Corporation

- Jabil Inc.

- SIIX Corporation

- Nortech Systems Incorporated

- Celestica Inc.

- Integrated Micro-electronics Inc.

- Creation Technologies LP

- Wistron Corporation

- Plexus Corporation

- TRICOR Systems Inc.

- Sumitronics Corporation

第7章 投資分析

第8章市場的未來

The Electronics Manufacturing Services Market size is estimated at USD 580.52 billion in 2024, and is expected to reach USD 773.22 billion by 2029, growing at a CAGR of 5.90% during the forecast period (2024-2029).

Key Highlights

- With increasing miniaturization and adoption of emerging technologies in the Industrial Internet of Things (IIoT) and enhanced communication posed by 5G, electronic component design and assembly have been revolutionized. For instance, the communication base stations for 5G developed a superior antenna technology, such as MIMO, leading to a rise in the number and performance of radiating elements.

- Additionally, the demand for electronic devices, such as smartphones, smartwatches, and other devices, has boosted the market's growth. According to IBEF, the Indian appliances and consumer electronics industry stood at USD 9.84 billion recently, and it is anticipated to more than double to achieve INR 1.48 lakh crore (USD 21.18 billion) by 2025.

- Further, many companies seek to lower their inventory, facilities, and equipment in their manufacturing activities, shifting the focus of their capital investments toward sales and marketing and R&D. This has increased the demand for outsourcing to third-party manufacturing service providers.

- For instance, an avionics company decided to transfer its PCBA production to an EMS partner to broaden its product and service offerings and not make an additional investment in manufacturing. The primary requirements were compliance with AS9100 standards and multiple BGAs on the PCBAs, with up to 16 layers on some PCBs.

- The rising government initiatives in several geographies are driving the market's growth. For instance, according to IBEF, the government approved 14 companies under the IT hardware production-linked incentive (PLI) scheme. Over the next four years, these companies are expected to fuel total production of USD 21.64 billion. The project will bring additional investment in electronics manufacturing in India.

- Furthermore, The Government of India authorized 100% FDI in the electronics systems design and manufacturing sector under the automatic route. FDI into single-brand retail has increased from 51% to 100%; the government plans to hike the FDI limit in multi-brand retail to 51%. Such developments would likely drive the market's growth.

- Around the world, SMEs and MSMEs are adopting more and more third-party manufacturing services, so they can avoid huge capital investments in the production lines and take advantage of the service providers' design expertise and manufacturing capabilities. As per the International Finance Corporation (IFC) estimates, 65 million firms (approx.), or about 40% of formal micro, small, and medium enterprises in developing countries, have unfulfilled financial needs. The majority of businesses across the globe are small and medium enterprises, specifically in developing countries. This dependency on manufacturing service providers will solidify the future growth of the EMS market.

- Moreover, the COVID-19 outbreak severely impacted many end-user industries, including electronics manufacturing. According to the IPCs survey, consumer electronics were expected to be the most impacted because of their more substantial reliance on the manufacturing capacity of China and supply chains that rely more heavily on China.

- But many electronics manufacturing and related services were classified as essential service providers, as they carried out many critical tasks from product assembly to circuit board designs that power necessary medical equipment; electronics manufacturing was an integral part of the economy and the healthcare space during this COVID-19 outbreak.

Electronic Manufacturing Services (EMS) Market Trends

Industrial Applications to Drive the Demand for EMS

- With the rising trend of the environmental revolution, electric motor controls are demanding higher efficiency for industrial motors. Furthermore, increased integration at the lowest cost is required to support the market penetration of new technologies and improve safety and reliability. This further drives the demand for electronic products used in smart motors' digital signal controllers for voltage control operations.

- According to IBEF, India's electric vehicle (EV) market is estimated to reach INR 50,000 crores (USD 7.09 billion) by 2025. Further, a study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030.

- Furthermore, Industry 4.0 assures huge gains in factory data automation efficiency and productivity. The parallel advancements in industrial IoT and artificial intelligence (AI) drive growth to some extent. Even though the electronics industry is far from achieving the same level of intelligence and automation, the evolution toward Industry 4.0 is paving the way, as evident by recent trends in the electronics manufacturing services market.

- For instance, in October 2022, Rockwell Automation Inc. announced that it had signed a definitive contract to acquire CUBIC, which specializes in modular systems for constructing electrical panels. The collaboration is expected to benefit a company by offering faster time to market, enabling broader plant-wide applications for intelligent motor control, and generating smart data to increase sustainability and productivity for a wide range of customers.

- The manufacturing of electronics for industrial automation is fueling the growth of this segment. The players in the industrial automation segment need consistent access to all the data generated on the system. However, because of the scope of many operational utility applications, this level of data acquisition is complicated. Regions like Europe and North America are increasingly deploying Supervisory Control and Data Acquisition (SCADA) for accurate data collection.

- Further, in October 2022, DYNICS, a creator of quality hardware and software solutions for the industrial marketplace, announced a unique system integrator partnership with SINCI, one of Mexico's premier technology organizations dedicated to implementing technological solutions for digital transformation. Through this partnership, the company will continue working with SINCI to provide customers across multiple industries with the tools that enhance access to the benefits of automation.

- Most SCADA systems consist of single-board remote terminal units (RTUs), compact, ruggedized products that locate all input/output (I/O) modules on a single printed circuit board. Hence, the increasing deployment of SCADA in the utility sector further drives the demand for EMS.

Asia-Pacific Expected to Witness Major Growth

- The Asia-Pacific region is expected to grow significantly during the forecast period. India and China have strongly based markets for EMS worldwide, owing to their strong position in the consumer electronics, semiconductor, and other telecommunications devices and equipment manufacturing industries. For instance, Tata Group recently announced plans to enter the semiconductor manufacturing business, seeking a proportion of the USD 1 trillion high-tech electronics manufacturing sector.

- Moreover, technology changes, such as the rollout of 5G networks and IoT, are driving the accelerated adoption of electronic products. Initiatives such as 'Digital India' and 'Smart City' projects have increased the demand for IoT in electronic devices.

- Additionally, according to the Electronic Industries Association Of India, The country's electronic contract manufacturing sector is expected to more than sixfold to around USD 152 billion by 2025. The country has also set a target of approximately USD 100 billion in exports of mobiles alone by 2025, which was made possible with the support of the government's production-linked incentive (PLI) scheme. Furthermore, in May 2022, Voltas announced projects of INR 400 crores (USD 50.10 million) capex under the PLI scheme to manufacture components for white goods.

- According to IBEF, about 80% of the Production-Linked Incentive scheme (PLI) to encourage manufacturing in the country, which covers 14 enterprises and has a total investment of INR 3 lakh crore (USD 38.99 billion), is concentrated in only three sectors, such as electronics, automobiles, and solar panel production. This expansion supports rapid growth for new technology products across networking, 5G, data center, automotive/LIDAR, and aerospace and defense markets.

- APAC's supply chain starts with product design, semiconductor fabrication and packaging, components and subsystems, final assembly, and testing, which is also slowly moving toward low-cost countries in APAC, including India and Indonesia, for reducing the manufacturing costs.

- For instance, rising costs and previous trade tensions compelled Taiwan's Pegatron to diversify production to countries such as Vietnam and Indonesia. Such uncertainty due to trade tension led many companies in Asia to readjust investments and shift their manufacturing bases to avoid tariffs.

Electronic Manufacturing Services (EMS) Industry Overview

The electronics manufacturing services market is moving toward fragmentation, owing to the improved adoption of these services across industries and the presence of several market players globally. Market players view product developments and innovations as a lucrative path for market expansion.

In October 2023, Tata Electronics Pvt Ltd (TEPL) announced acquiring Wistron's operations in India for USD 125 million. That will make it the first Indian company to manufacture Apple iPhones., where The Wistron buy will spur the next cycle of investment in the Indian electronics manufacturing ecosystem and signal the maturing of the country's contract manufacturing companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Growing Trends of Miniaturization

- 4.3.2 Adoption of Emerging Technologies in IIoT (Industrial Internet of Things), Blockchain, and Enhanced Communication

- 4.4 Market Challenges

- 4.4.1 Intensifying Competition and Rigorous Government and Environmental Regulations

- 4.4.2 Intellectual Property Rights Infringements

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Electronics Design and Engineering

- 5.1.2 Electronics Assembly

- 5.1.3 Electronics Manufacturing

- 5.1.4 Other Service Types

- 5.2 By Application

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive

- 5.2.3 Industrial

- 5.2.4 Aerospace and Defense

- 5.2.5 Healthcare

- 5.2.6 IT and Telecom

- 5.2.7 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Italy

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Taiwan

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 India

- 5.3.3.6 Rest of the Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Vinatronic Inc.

- 6.1.2 Benchmark Electronics Inc.

- 6.1.3 Hon Hai Precision Industry Co. Ltd (Foxconn)

- 6.1.4 Flex Ltd

- 6.1.5 Sanmina Corporation

- 6.1.6 Jabil Inc.

- 6.1.7 SIIX Corporation

- 6.1.8 Nortech Systems Incorporated

- 6.1.9 Celestica Inc.

- 6.1.10 Integrated Micro-electronics Inc.

- 6.1.11 Creation Technologies LP

- 6.1.12 Wistron Corporation

- 6.1.13 Plexus Corporation

- 6.1.14 TRICOR Systems Inc.

- 6.1.15 Sumitronics Corporation