|

市場調查報告書

商品編碼

1439879

乙二醇:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Glycol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

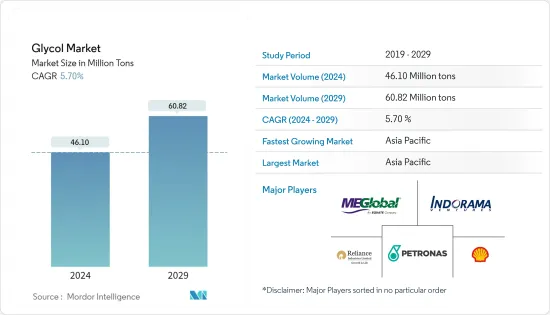

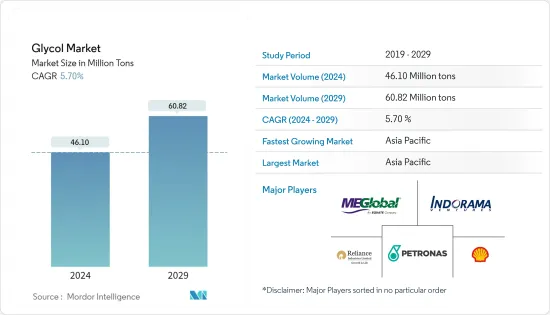

預計2024年乙二醇市場規模為4,610萬噸,預估至2029年將達6,082萬噸,預測期間(2024-2029年)年複合成長率為5.70%。

主要亮點

- 冠狀病毒感染疾病(COVID-19)大流行直接影響了世界各地製造商的供應鏈,關閉生產設施以盡量減少病毒傳播的風險,這已成為一個嚴重的問題。

- 短期來看,聚酯薄膜和PU黏劑需求的增加以及中國紡織業乙二醇消費量的增加是刺激市場需求的因素。

- 有毒乙二醇和冠狀病毒感染疾病(COVID-19)爆發造成的不利條件正在阻礙市場成長。

- 生物基乙二醇的日益普及可能會在未來幾年創造市場機會。

- 亞太地區是最大的市場,由於中國、印度和日本等國家的消費量不斷增加,預計亞太地區將成為預測期內成長最快的市場。

乙二醇市場趨勢

紡織工業中的使用增加

- 丙二醇和乙二醇被用作多種產品的原料,包括服飾、室內裝潢、地毯和枕頭等聚酯纖維。

- 乙二醇最有價值的應用是聚酯纖維,廣泛應用於紡織業。乙二醇醚在紡織染浴市場中用作染浴添加劑,以獲得適當的色調、染色均勻、色牢度、降低染色溫度和循環時間等特性。

- 中國、歐盟、印度是三大紡織品出口國,佔全球市場的65%以上。例如,2022年,中國紡織品服飾及服飾附件出口額達3,233.44億美元,比上年(2021年)小幅成長2.53%。因此,該國紡織品、服裝和服飾配件出口的增加預計將為乙二醇市場創造上行需求。

- 印度紡織業是全球成長最快的工業之一。根據印度品牌股權基金會(IBEF)統計,2022年印度紡織品服飾出口額達444億美元,比2021年成長41%,比2020年成長26%。 2022年,美國位居榜首。它佔紡織品出口的 27%,其次是歐洲(18%)和孟加拉(12%)。因此,該國紡織服裝配件出口的增加預計將為國內乙二醇市場創造上行需求。

- 而且,2022年上半年美國紡織品服飾出口與前一年同期比較%。美國商務部紡織服裝局資料顯示,2022年1月至6月出口額較2021年同期從109.9億美元成長至124.4億美元。

- 此外,奢華時尚品牌 Prada 剛於 2022 年 10 月在羅馬尼亞錫比烏附近開設了一家工廠。普拉達將在新工廠生產部分皮革產品。 Hipic Prod Impex 現隸屬於 Prada 集團,在錫比烏西部工業區經營佔地 31,000 平方英尺的工廠。因此,這種擴張預計將為乙二醇市場創造上行需求。

- 基於所有這些因素,乙二醇市場可能在預測期內在全球範圍內成長。

亞太地區主導市場

- 預計亞太地區將主導乙二醇消費市場。此外,在預測期內,中國、印度、韓國、日本和東南亞國家等國家的包裝、食品和飲料、汽車和運輸、化妝品和紡織品等終端用戶行業的需求成長最快。這可能是一個不斷成長的市場。

- 由於出口和國內消費的增加,該地區食品、飲料、消費品和其他行業對包裝材料的需求不斷增加。亞太地區包裝市場的推動因素是對包裝食品的需求不斷成長以及對包括電子商務在內的快速消費品的需求不斷成長。工程塑膠製品由於其優點,在包裝領域(PET容器、瓶子等)的使用顯著增加。 PET 由乙二醇、對苯二甲酸二甲酯 (DMT) 或對苯二甲酸製成。

- 例如,根據印度品牌股權基金會(IBEF)的數據,印度的食品加工業正在快速成長,過去五年平均年增率為8.3%。此外,食品市場預計到2023年將產生9,630億美元的收益,並預計2023年至2027年年複合成長率為7.23%。因此,預計這將導致食品包裝市場對乙二醇的需求上升。

- 此外,乙二醇也用作汽車散熱器的防凍劑,以提高冷凍溫度。例如,根據 OICA 的數據,2022 年該國生產了約 27,020,615 輛汽車,比 2021 年成長了 3%。因此,由於汽車產量的增加,乙二醇市場的需求正在上升。

- 中國電子商務市場由阿里巴巴主導,市場佔有率約44%。本公司2022會計年度全年收益較上年度成長22.91%。不斷成長的電子商務產業需要包裝,預計這將在預測期內推動區域乙二醇市場。

- 亞太地區食品添加劑市場預計在預測期內年複合成長率約為 6%。丙二醇是最常用的食品添加物之一。

- 亞洲化妝品市場在全球越來越受歡迎。預計預測期內年複合成長率將超過5%。日本、新加坡、韓國、中國香港、中國為全球前10大化妝品出口國。丙二醇用於保濕劑中,可透過減少脫皮和恢復彈性來改善皮膚外觀。其他用途包括皮膚調理劑、降黏劑、溶劑和香料成分。

- 根據中國國家統計局數據,2022年1月,中國化妝品零售業收入約91.8億美元。 2023年1月,達到約97.6億美元。隨著中國二、三線城市化妝品需求進一步擴大,預計短期內乙二醇市場將維持成長動能。此外,男性對護膚態度的改變正在推動中國男性化妝品市場的繁榮。

- 根據印度品牌股權基金會預測,印度國內醫藥市場預計到2024年將達到650億美元,到2030年將從1,200億美元擴大到1,300億美元。此外,印度也是全球製藥業的重要新興企業。印度是全球最大的學名藥供應國,佔全球供應量的20%,供應全球約60%的疫苗需求。因此,乙二醇市場需求預計還包括來自國內醫藥市場的成長。

- 因此,上述終端用戶產業不斷成長的需求預計將推動亞太地區的成長。

乙二醇產業概況

乙二醇市場本質上是分散的。市場主要企業包括(排名不分先後)Shell PLC、MEGlobal International FZE、Indorama Ventures Public Company Limited、Reliance Industries Limited、PETRONAS Chemicals Group 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對聚酯薄膜和PU黏劑的需求不斷增加

- 我國紡織業乙二醇消費量增加

- 其他促進因素

- 抑制因素

- 乙二醇毒性

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模、數量)

- 類型

- 乙二醇

- 單乙二醇 (MEG)

- 二伸乙甘醇(DEG)

- 三甘醇 (TEG)

- 聚乙二醇(PEG)

- 丙二醇

- 其他類型

- 乙二醇

- 最終用戶產業

- 汽車和交通

- 包裝

- 食品和飲料

- 化妝品

- 藥品

- 纖維

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- BASF SE

- China Petrochemical Corporation

- China Sanjiang Fine Chemical Co Ltd

- Dow

- Huntsman International LLC

- India Glycols Limited

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited

- INEOS

- LOTTE Chemical Corporation

- LyondellBasell Industries Holdings BV

- Meglobal International FZE

- Mitsubishi Chemical Group Corporation

- Nouryon

- PETRONAS Chemicals Group

- Petrorabigh

- Reliance Industries Limited

- SABIC

- Shell PLC

第7章市場機會與未來趨勢

- 生物基二醇越來越受歡迎

- 其他機會

簡介目錄

Product Code: 69490

The Glycol Market size is estimated at 46.10 Million tons in 2024, and is expected to reach 60.82 Million tons by 2029, growing at a CAGR of 5.70% during the forecast period (2024-2029).

.

Key Highlights

- The COVID-19 pandemic has been a significant challenge for the glycol market due to directly affecting the manufacturer's supply chain across the globe and shutting down production facilities to minimize the risk of spreading the virus.

- Over the short term, increasing demand for polyester films and PU adhesives and increasing ethylene glycol consumption from china's textile industry are some factors stimulating the market demand.

- The toxic ethylene glycol and unfavorable conditions from the COVID-19 outbreak hinder the market growth.

- The growing popularity of bio-based glycols will likely create opportunities for the market in the coming years.

- The Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Glycol Market Trends

Increasing Usage in the Textile Industry

- Propylene glycol and ethylene glycol are used as raw materials in producing a wide range of products, including polyester fibers for clothes, upholstery, carpet, and pillows.

- The most valued applications of ethylene glycol are polyester fibers, widely used in textile industries. Glycol ethers are used as dyebath additives within the textile dyebath market to obtain properties such as proper shade, level dyeing, colorfastness, reduced dyeing temperatures, and cycle times.

- China, the European Union, and India are among the three largest exporters of textiles, holding a share of over 65% across the global market. For instance, in 2022, China exported textiles, apparel, and clothing accessories worth USD 323.344 billion, registering a slight growth of 2.53% compared to the previous year (2021). Therefore, increased export of textiles, apparel, and clothing accessories from the country is expected to create an upside demand for the glycol market.

- The Indian textile industry is one of the fastest-growing industries across the globe. According to India Brand Equity Foundation (IBEF), textile and apparel exports in India amounted to USD 44.4 billion in 2022, which shows an increase of 41% compared to 2021 and 26% compared to 2020. In 2022, the United States was the top export destination, accounting for 27% of textile exports, followed by Europe (18%) and Bangladesh (12%). Therefore, increased export of textile and apparel accessories from the country is expected to create an upside demand for the glycol market in the country.

- Moreover, in the first half of 2022, the United States' exports of textiles and clothing increased by 13.10% from the previous year. Compared to the same period in 2021, exports increased to USD 12.44 billion from January through June 2022 from USD 10.99 billion, according to data from the Office of Textiles and Apparel, a US Department of Commerce division.

- Furthermore, in October 2022, Prada, a high-end fashion brand, recently opened a factory near Sibiu, Romania. In the new factory, Prada will manufacture parts of its leather products. Hipic Prod Impex, now part of the Prada group, operates the factory in Sibiu's West Industrial Zone, measuring 31,000 sq ft. Therefore, this expansion is expected to create an upside demand for the glycol market.

- Based on all these factors, the glycol market will likely grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market for glycol consumption. It is also likely to be the fastest-growing market during the forecast period, with increasing demand from end-user industries such as packaging, food and beverage, automotive and transportation, cosmetics, textile, etc., in countries such as China, India, South Korea, Japan, and Southeast Asian nations.

- The demand from industries like food and beverage, consumer goods, and others for packing materials is increasing in the region owing to rising exports and domestic consumption. The packaging market in the Asia-Pacific region is driven by increasing demand for packaged foods and growing demand for fast-moving consumer goods, including E-commerce. The use of engineering plastic products in the packaging sector (PET containers, bottles, etc.) is increasing tremendously, owing to their advantages. PET is produced from ethylene glycol, dimethyl terephthalate (DMT), or terephthalic acid.

- For instance, according to India Brand Equity Foundation (IBEF), the Indian food processing industry grew rapidly, with an average annual growth rate of 8.3% in the past 5 years. Moreover, in 2023, the food market will generate USD 963 billion in revenue, which is anticipated to expand at a CAGR of 7.23% between 2023-2027. Therefore, this is expected to create an upside demand for the glycol market from food packaging.

- Moreover, ethylene glycol is used as an anti-freezing agent in the radiator of cars to increase the freezing temperature. For instance, according to OICA, in 2022, around 2,70,20,615 units of automobiles were produced in the country, which shows an increase of 3% compared with 2021. Therefore, an increase in the production of automobiles is expected to create an upside demand for the glycol market.

- China's E-commerce market is dominated by Alibaba, whose market share is around 44%. The company's annual revenue in FY 2022 saw a 22.91% year-on-year growth. The growing e-commerce industry requires packaging, which is expected to drive the glycol market in the region during the forecast period.

- The Asia-Pacific food additive market is expected to register a CAGR of about 6% during the forecast period. Propylene glycol is one of the most common glycols used as a food additive.

- The Asian cosmetics market is gaining popularity worldwide. It is expected to witness a CAGR of more than 5% during the forecast period. Japan, Singapore, South Korea, Hong Kong, and China are the top 10 global cosmetics exporters. Propylene glycol is used in moisturizers to enhance the appearance of skin by reducing flaking and restoring suppleness. Other uses include as a skin-conditioning agent, viscosity-decreasing agent, solvent, and fragrance ingredient.

- According to the National Bureau of Statistics of China, in January 2022, the retail trade revenue of cosmetics in China amounted to about USD 9.18 billion. It reached about USD 9.76 billion in January 2023. As the demand for cosmetic products expands further in second-and third-tier cities of China, the glycol market is expected to maintain its growth momentum soon. In addition, the changing attitude among men toward skin care fosters the booming men's cosmetics market in China.

- According to the India Brand Equity Foundation, India's domestic pharmaceutical market will likely reach USD 65 billion by 2024 and expand to USD 120- USD 130 billion by 2030. Moreover, India is a significant and rising player in the global pharmaceuticals sector. India is the world's largest supplier of generic medications, accounting for 20% of the worldwide supply by volume and supplying about 60% of the global vaccination demand. Therefore, the demand for the glycol market is expected to include an upside from the country's pharmaceutical market.

- Thus, rising demands from the end-user mentioned above industries are expected to drive growth in the Asia-Pacific region.

Glycol Industry Overview

The Glycol Market is fragmented in nature. Some of the major players in the market (not in a particular order) include Shell PLC, MEGlobal International FZE, Indorama Ventures Public Company Limited, Reliance Industries Limited, and PETRONAS Chemicals Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Drivers

- 4.1.1 Increasing Demand for Polyester Films and PU Adhesives

- 4.1.2 Increasing Ethylene Glycol Consumption From China's Textile Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Toxic Nature of Ethylene Glycol

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 Market Segmentation (Market Size in Volume)

- 5.1 Type

- 5.1.1 Ethylene Glycol

- 5.1.1.1 Monoethylene Glycol (MEG)

- 5.1.1.2 Diethylene Glycol (DEG)

- 5.1.1.3 Triethylene Glycol (TEG)

- 5.1.1.4 Polyethylene Glycol (PEG)

- 5.1.2 Propylene Glycol

- 5.1.3 Other Types

- 5.1.1 Ethylene Glycol

- 5.2 End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Packaging

- 5.2.3 Food and Beverage

- 5.2.4 Cosmetics

- 5.2.5 Pharmaceuticals

- 5.2.6 Textile

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 China Petrochemical Corporation

- 6.4.3 China Sanjiang Fine Chemical Co Ltd

- 6.4.4 Dow

- 6.4.5 Huntsman International LLC

- 6.4.6 India Glycols Limited

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 Indorama Ventures Public Company Limited

- 6.4.9 INEOS

- 6.4.10 LOTTE Chemical Corporation

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Meglobal International FZE

- 6.4.13 Mitsubishi Chemical Group Corporation

- 6.4.14 Nouryon

- 6.4.15 PETRONAS Chemicals Group

- 6.4.16 Petrorabigh

- 6.4.17 Reliance Industries Limited

- 6.4.18 SABIC

- 6.4.19 Shell PLC

7 Market Opportunities and Future Trends

- 7.1 Growing Popularity of Bio-based Glycols

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219