|

市場調查報告書

商品編碼

1439878

單向膠帶:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Unidirectional Tape - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

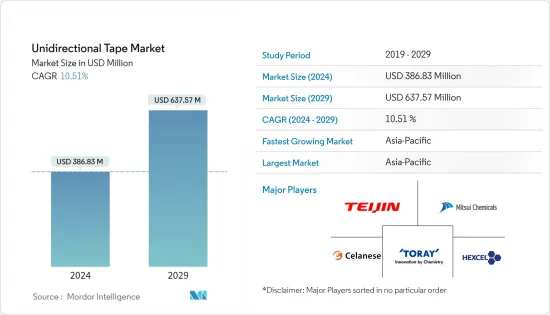

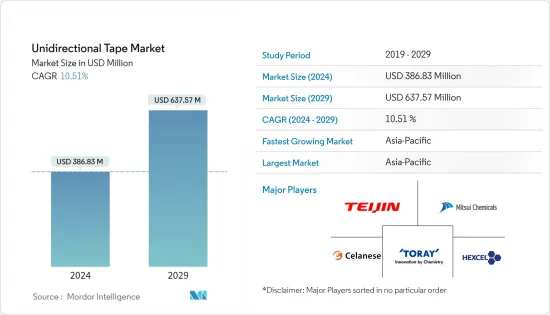

單向磁帶市場規模預計到2024年為3.8683億美元,預計到2029年將達到6.3757億美元,在預測期內(2024-2029年)年複合成長率預計為10.51%。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 中期推動市場的主要因素之一是航太業需求的增加以及風電和汽車行業單向膠帶使用量的增加。

- 另一方面,單向膠帶的製造和加工成本較高,預計將阻礙市場成長。

- 主要企業增加對研發活動的投資以開發新的單向膠帶產品可能是未來幾年有利的市場開拓機會。

- 隨著航太業製造業的增加,亞太地區預計將主導市場。

單向膠帶市場趨勢

航太和國防工業的需求不斷成長

- 單向膠帶是透過將玻璃或碳纖維嵌入熱塑性基體中製造的,並且是針對應用專門客製化的。

- 熱固性 UD 膠帶因其價格低廉、接受性強且易於浸漬而廣泛應用於各個行業。碳纖維/環氧樹脂複合材料在航太工業中的高利用率可以歸因於其重量輕、質量高、模量高以及優異的疲勞性能。

- 由於複合材料在飛機製造中的使用不斷增加以及美國、中國、英國和英國等主要國家在軍事和國防方面的支出增加,全球航太材料市場預計將成長在此期間實現健康成長。

- 斯德哥爾摩國際和平研究所(SIPRI)的資料顯示,2021年美國和中國的軍費開支最高,分別約為8010億美元和2930億美元,其次是印度和英國,為76.6美元。分別為10 億美元和684億美元,其次是美元。

- 2021年,全球軍用飛機和航太製造市場在航太和國防領域的價值約為2,558億美元,其中包括波音、洛克希德、諾斯羅普格拉瑪等主要企業。波音公司和空中巴士等多家航太相關企業加大對先進複合材料研發(R&D)的投資,也支持了單向膠帶市場的成長。

- 因此,由於上述因素,航太工業單向膠帶的應用很可能在預測期內佔據主導地位。

亞太地區主導市場

- 預計亞太地區將在預測期內主導市場。中國和印度等國家國防工業對單向膠帶的需求不斷成長,預計將推動該地區對單向膠帶的需求。

- 單向膠帶用於設計用於高性能汽車應用的輕質、高衝擊、高強度材料。中國汽車製造業全球第一,2021年產量佔有率將超過32.5%。該行業得到了在該國經營大型製造工廠的跨國公司的支持。

- 民航機的增加正在穩步推動中國對單向膠帶的需求。此外,未來20年,中國航空公司計劃採購約7,690架新飛機,價值約1.2兆美元。

- 2021年印度汽車產量成長30%。這一顯著成長得益於政府加強工業生產的改革以及國內最終消費者對汽車的高需求。根據印度汽車工業商協會(SIAM)的報告,2021年4月至2022年3月期間,總合生產了22,933,230輛汽車,包括小客車、商用車、三輪車、兩輪車和四輪車。我做到了。此外,「Aatma Nirbhar Bharat」和「印度製造」計畫等政府改革可能會促進汽車工業的發展。

- 根據IATA(國際航空運輸協會)的報告,預計到預測期結束時,印度將成為世界第三大航空市場。據印度品牌股權基金會 (IBEF) 稱,未來四年航太領域預計將獲得 3,500 億印度盧比(約 49.9 億美元)的投資。

- 此外,根據全球風力發電理事會(GWEC)《2022年全球風能報告》,印度對2022年和2023年風電市場的展望是,陸上風電裝置容量預計將分別達到3.2和410萬千瓦。

- 亞太地區在運動和休閒產品市場中佔據主要佔有率,預計在預測期內將大幅成長。

- 由於上述因素,亞太單向膠帶市場預計在研究期間將顯著成長。

單向膠帶產業概況

單向膠帶市場具有綜合性,五家主要企業在全球市場中佔據主要佔有率。主要公司(排名不分先後)包括 TEIJIN LIMITED、Hexcel Corporation、Celanese Corporation、TORAY INDUSTRIES INC. 和 Mitsui Chemicals Inc.。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 航太和國防工業的需求不斷成長

- 單向膠帶在風能和汽車產業的使用增加

- 抑制因素

- 製造加工成本高

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 加固型

- 玻璃纖維

- 碳纖維

- 其他加固類型

- 背襯材料

- 聚醚醚酮 (PEEK)

- 聚醯胺 (PA)

- 聚丙烯(PP)

- 聚碳酸酯(PC)

- 聚苯硫(PPS)

- 其他基材

- 黏合劑類型

- 環氧樹脂

- 聚氨酯

- 其他黏劑類型

- 最終用戶產業

- 航太/國防

- 車

- 運動、休閒

- 工業的

- 風力發電

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- BUFA Thermoplastic Composites GmbH & Co. KG

- Celanese Corporation

- Evonik Industries AG

- Hexcel Corporation

- Mitsui Chemicals Inc.

- Oxeon AB(TeXtreme)

- Plastic Reinforcement Fabrics Ltd

- SABIC

- SGL Carbon

- Solvay

- TCR Composites Inc.

- TEIJIN LIMITED

- TOPOLO New Materials

- TORAY INDUSTRIES INC.

- Victrex plc

第7章 市場機會及未來趨勢

- 主要企業加大研發投入開發UD膠帶新產品

The Unidirectional Tape Market size is estimated at USD 386.83 million in 2024, and is expected to reach USD 637.57 million by 2029, growing at a CAGR of 10.51% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, one of the main factors driving the market is the growing demand from the aerospace and rising usage of unidirectional tape in the wind and automotive industries.

- On the flipside, high manufacturing and high processing costs of unidirectional tapes are expected to hinder the market's growth.

- Increasing Investment by major companies worldwide in R&D activities to develop new unidirectional tape products is likely to act as an opportunity for the market studied in the coming years.

- Asia-Pacific region is expected to dominate the market with increasing manufacturing from aerospace industry.

Unidirectional Tapes Market Trends

Growing Demand from the Aerospace and Defense Industry

- Unidirectional tapes are manufactured from glass or carbon fiber embedded in a thermoplastic matrix and are specifically customized based on their different applications.

- Thermoset UD tapes are generally utilized across different industries, as they are less expensive, exceptionally receptive, and have ease of impregnation. High utilization of carbon fiber/epoxy composites in the aerospace Industry inferable from their lightweight, high quality and modulus, and superb fatigue performance.

- The global aerospace materials market is estimated to witness healthy growth over the forecast period due to increasing composites' usage in aircraft manufacturing and increasing government spending on military and defense in the major countries like the United States, China, India, the United Kingdom, and so on.

- According to data by Stockholm International Peace Research Institute(SIPRI), US and China accounted for the largest military expenditure in 2021 which was valued at around USD 801.0 billion and USD 293.0 billion respectively followed by India and UK at USD 76.6 billion and USD 68.4 billionrespectively.

- The global military aircraft and aerospace manufacturing market for aerospace and defense in 2021 were valued at approximately USD 255.8 billion which includes dominant players such as Boeing, Lockheed, and Northrop Grumma. The increasing investments in the research and development (R&D) of advanced composite materials by several aerospace incumbents, like The Boeing Company, and Airbus SE, among others, is also supporting the growth of the unidirectional tapes market.

- Hence, owing to the above-mentioned factors, the application of unidirectional tape from aerospace industry is likely to dominate during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market during the forecast period. The rising demand for unidirectional tape from the defense industry in countries like China and India is expected to drive the demand for unidirectional tape in this region.

- Unidirectional tapes are used to design lightweight, high-impact, strong materials for high-performance automotive applications. The Chinese automotive manufacturing industry is the largest in the world, with a production share of just over 32.5% in 2021. The industry is supported by multinational players operating large manufacturing facilities in the country.

- The growing civil aircraft fleet steadily boosts the demand for unidirectional tape in China. Moreover, in the next 20 years, the Chinese airline companies plan to purchase about 7,690 new aircraft, which are valued at about USD 1.2 trillion.

- Automotive production in India witnessed a 30% growth in 2021. The significant growth was supported by government reforms to enhance industrial production and high demand for automobiles from the end consumers in the country. As per the reports by the Society of Indian Automobile Manufacturers, SIAM, the country produced a total of 22,933,230 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, between April 2021 to March 2022. Moreover, the government's reforms, such as "Aatma Nirbhar Bharat" and "Make in India" programs, are likely to boost the automotive industry.

- According to IATA (International Air Transport Association) report, India is poised to become the third-largest aviation market in the world by the end of the forecast period. In the aerospace sector, according to the India Brand Equity Foundation (IBEF), the country's aviation industry is expected to witness INR 35,000 crore (~USD 4.99 billion) investment in the next four years.

- Furthermore, according to the Global Wind Report, 2022, by the Global Wind Energy Council (GWEC), the Indian wind market outlook for 2022 and 2023 is projected at 3.2 GW and 4.1 GW of onshore wind installations respectively.

- Asia-Pacific holds a significant share in the sports and leisure equipment market, and it is expected to grow significantly during the forecast period.

- Owing to the above-mentioned factors, the market for unidirectional tape in the Asia-Pacific region is projected to grow significantly during the study period.

Unidirectional Tapes Industry Overview

The unidirectional tape market is consolidated in nature, with the top five players accounting for a significant share in the global market. Some of the major companies (not in any particular order) are TEIJIN LIMITED, Hexcel Corporation, Celanese Corporation, TORAY INDUSTRIES INC., and Mitsui Chemicals Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Aerospace and Defense Industry

- 4.1.2 Rising Usage of Unidirectional Tape in the Wind and Automotive Industries

- 4.2 Restraints

- 4.2.1 High Manufacturing and Processing Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Reinforcement Type

- 5.1.1 Glass Fiber

- 5.1.2 Carbon Fiber

- 5.1.3 Other Reinforcement Types

- 5.2 Backing Material

- 5.2.1 Polyether Ether Ketone (PEEK)

- 5.2.2 Polyamide (PA)

- 5.2.3 Polypropylene (PP)

- 5.2.4 Polycarbonate (PC)

- 5.2.5 Polyphenylene Sulfide (PPS)

- 5.2.6 Other Backing Materials

- 5.3 Adhesive Type

- 5.3.1 Epoxy

- 5.3.2 Polyurethane

- 5.3.3 Other Adhesive Types

- 5.4 End-user Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive

- 5.4.3 Sports and Leisure

- 5.4.4 Industrial

- 5.4.5 Wind Energy

- 5.4.6 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BUFA Thermoplastic Composites GmbH & Co. KG

- 6.4.2 Celanese Corporation

- 6.4.3 Evonik Industries AG

- 6.4.4 Hexcel Corporation

- 6.4.5 Mitsui Chemicals Inc.

- 6.4.6 Oxeon AB (TeXtreme)

- 6.4.7 Plastic Reinforcement Fabrics Ltd

- 6.4.8 SABIC

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 TCR Composites Inc.

- 6.4.12 TEIJIN LIMITED

- 6.4.13 TOPOLO New Materials

- 6.4.14 TORAY INDUSTRIES INC.

- 6.4.15 Victrex plc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investment in R&D of Major Companies Across the Globe to Develop New UD Tape Products