|

市場調查報告書

商品編碼

1439873

生物活性材料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Bioactive Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

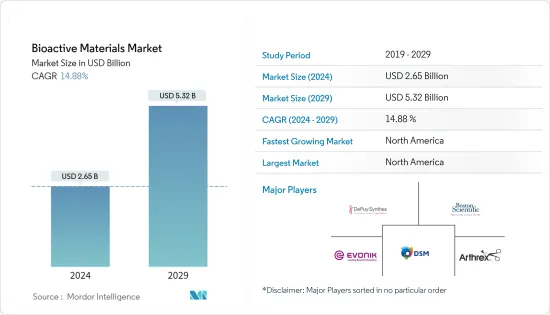

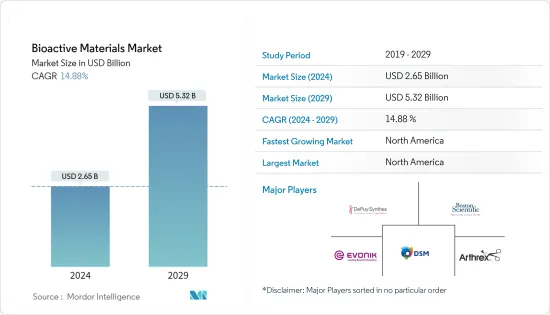

生物活性材料市場規模預計到2024年為26.5億美元,預計到2029年將達到53.2億美元,在預測期內(2024-2029年)成長14.88%,年複合成長率為

由於這種材料廣泛應用於醫療保健行業,COVID-19 對市場產生了積極影響,對醫療保健設備的需求大幅增加。

從長遠來看,牙科治療和根管治療需求的不斷成長預計將推動市場。

主要亮點

- 另一方面,高成本、監管和潛在的毒性極大地阻礙了市場的成長。

- 整形外科不斷成長的需求和新發展預計將為所研究的市場創造機會。

- 預計北美將在預測期內主導市場。

生物活性材料的市場趨勢

整形外科需求增加

- 生物活性物質刺激身體的生物反應,例如與組織的結合。生物活性材料在奈米醫學、生物感測器、機械聯鎖、骨組織癒合和牙科等領域具有應用。

- 在整形外科,羥磷石灰是最常用的生物活性陶瓷材料。生物活性材料在植入表面形成生理活性層,從而在自然組織和材料之間形成連接。透過改變生物活性材料的成分,可以實現不同的結合速率和界面結合層厚度。

- 儘管生物活性玻璃在體內具有很高的生物活性,但與金屬植入相比,生物活性玻璃在整形外科手術中發揮的作用較小。生物活性玻璃是一種具有用於骨科整形外科潛力的新材料。

- 根據歐盟統計局的數據,2021 年,五分之一(20.8%)的歐盟人口年齡超過 65 歲。 2021年至2100年間,歐盟人口中80歲及以上人口的比例預計將增加一倍以上,從6.0%增加至14.6%。

- 根據國家統計局(NSO)的《2021年印度老年人口》調查,2031年印度老年人口(60歲以上)將達到1.94億,比2021年的1.38億成長41%,預計還會增加。

- 所有這些因素預計將在預測期內推動整形外科領域對生物活性材料的需求。

北美地區佔據市場主導地位

- 隨著美國高度發展的醫療保健和醫療技術領域的持續投資,北美有望主導全球市場。

- 美國醫療保健產業是該地區最先進的產業之一。根據醫療保險和醫療補助服務中心的數據,2021年至2028年,國家醫療保健支出預計將平均成長5.5%以上,到2028年將達到約61,920億美元。

- 生物活性材料用於根管和骨缺損治療、牙齒再生、硬組織修復和幹細胞移植。生物活性玻璃和玻璃陶瓷是骨組織工程中使用的主要生物活性材料。

- 根據世界銀行資料,美國65歲以上人口約佔總人口的16.6%。蛀牙和牙齦問題需要更多醫生的關注,並且患關節炎的風險更高。

- 根據美國整形外科醫師學會 (AAOS) 的數據,肌肉骨骼疾病和關節重建(膝關節和髖關節)是美國最常見的手術。這些應用擴大使用生物活性材料。

- 加拿大2022年的醫療支出總額為2,457.2億美元,預計年終將達到2,645億美元。醫療保健產業的醫療設備產業是一個高度多元化、出口導向的產業,生產設備和消耗品。該行業由產品創新驅動。該行業可以利用加拿大大學、研究機構和醫院正在進行的世界一流的創新研究,其中一些研究正在分拆為加拿大醫療設備公司。

- 進行手術需要先進的醫療設備和含有生物活性材料的零件。加上這些材料在藥品中的使用,預計將在未來幾年推動北美生物活性材料市場的發展。

生物活性材料產業概況

全球生物活性材料產業較為分散,主要企業佔了很大的市場。主要企業包括(排名不分先後)Boston Scientific、Depuy Synthes、Evonik Industries、DSM 和 Arthrex。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 牙科治療和根管治療的需求不斷成長

- 醫療產業應用不斷增加

- 抑制因素

- 高成本、法規和潛在毒性

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭程度

第5章市場區隔(收益市場規模)

- 材料類型

- 生物活性玻璃

- 生物活性陶瓷

- 生物活性複合材料

- 其他材料類型

- 目的

- 整形外科

- 牙齒保健

- 奈米醫學和生物技術

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- Arthrex Inc.

- Bioactive Bone Substitutes OyJ

- Biomatlante

- BTG(Boston Scientific)

- Cam Bioceramics

- Ceraver

- Collagen Matrix Inc.

- DePuy Synthes(Johnson and Johnson)

- DSM

- Evonik Industries

- Medtronic Inc.

- Noraker

- OSARTIS GmbH

- Pulpdent Corporation

- Septodont Holding

- Stryker Corporation

- Zimmer Holdings Inc.

第7章市場機會與未來趨勢

- 整形外科需求不斷成長和新發展

The Bioactive Materials Market size is estimated at USD 2.65 billion in 2024, and is expected to reach USD 5.32 billion by 2029, growing at a CAGR of 14.88% during the forecast period (2024-2029).

As the material is widely used in the healthcare industry, COVID-19 had a positive impact on the market, as the demand for healthcare equipment grew significantly.

Over the long term, the growing demand for dental care and root canal treatment will drive the market.

Key Highlights

- On the flip side, high costs, regulations, and probable toxicity hinder market growth significantly.

- The rising demand for orthopedics and new developments are expected to create opportunities for the market studied.

- North America is expected to dominate the market during the forecast period.

Bioactive Materials Market Trends

Growing Demand from Orthopedics

- Bioactive materials stimulate a biological response from the body, such as bonding to the tissue. Bioactive materials find their application in nanomedicine and biosensors, mechanical interlocks, bone tissue healings, and dental, amongst others.

- In orthopedic surgery, hydroxyapatite is the most commonly utilized bioactive ceramic material. Bioactive materials create a physiologically active layer on the implant's surface, resulting in a link between the native tissues and the substance. Changing the composition of the bioactive material allows a wide variety of bonding rates and interfacial bonding layer thickness.

- Bioactive glasses, despite their higher bioactivity within the body, serve a minor role in orthopedic surgery compared to metallic implants. Bioactive glass is a new material that has the potential to be employed in surgical orthopedics.

- According to Eurostat, in 2021, a fifth of the EU population (20.8%) was 65 or older. Between 2021 and 2100, the proportion of people aged 80 and up in the EU's population is expected to more than double, from 6.0% to 14.6%.

- According to the National Statistical Office's (NSO) Old in India 2021 study, India's elderly population (aged 60 and more) is expected to reach 194 million in 2031, up by 41% from 138 million in 2021.

- All such factors are expected to drive the demand for bioactive materials in the orthopedics sector during the forecast period.

North America Region to Dominate the Market

- North America is expected to dominate the global market due to the highly developed healthcare sector in the United States and the continuous investments to advance the medical technology sector.

- The healthcare sector in the United States is one of the most advanced in the region. According to the Centers for Medicare and Medicaid Services, during 2021-2028, national healthcare spending is projected to grow at an average of more than 5.5% and reach approximately USD 6.192 trillion by 2028.

- Bioactive materials are used in root canal and bone defect treatment, tooth regeneration, hard tissue repairs, and stem cell transplantation. Bioactive glasses and glass ceramics are major bioactive materials used in bone tissue engineering.

- According to World Bank data, the population above 65 years of age in the United States stood at around 16.6% of the total population. They require more medical attention for tooth decay and gum problems and pose a higher risk of arthritis.

- According to the American Academy of Orthopedic Surgeons (AAOS), musculo skeletal diseases and replacement of joints (knee and hip) are the most common surgeries among the American population. These applications increasingly use bioactive materials.

- In 2022, total health expenditure in Canada was valued at USD 245.72 billion and is expected to reach USD 264.5 billion by end of this year. In the healthcare industry, the medical device sector is a highly diversified and export-oriented industry that manufactures equipment and supplies. The sector is driven by product innovations. The industry can draw on world-class innovative research conducted in Canadian universities, research institutes, and hospitals, some of which are spun off into Canadian medical device companies.

- Performing surgeries requires advanced medical devices and components, including bioactive materials.This, along with the use of these materials in pharmaceutical, is expected to drive the market for bioactive materials through the years to come in North America.

Bioactive Materials Industry Overview

The global bioactive materials industry is fragmented, with the top players accounting for a major share of the market. Some major companies are Boston Scientific, Depuy Synthes, Evonik Industries, DSM, and Arthrex, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Dental Care and Root Canal Treatment

- 4.1.2 Increasing Applications in Medical Industry

- 4.2 Restraints

- 4.2.1 High Cost, Regulations, and Probable Toxicity

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Material Type

- 5.1.1 Bioactive Glass

- 5.1.2 Bioactive Ceramics

- 5.1.3 Bioactive Composites

- 5.1.4 Other Material Types

- 5.2 Application

- 5.2.1 Orthopedics

- 5.2.2 Dental Care

- 5.2.3 Nanomedicines and Biotechnology

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arthrex Inc.

- 6.4.2 Bioactive Bone Substitutes OyJ

- 6.4.3 Biomatlante

- 6.4.4 BTG (Boston Scientific)

- 6.4.5 Cam Bioceramics

- 6.4.6 Ceraver

- 6.4.7 Collagen Matrix Inc.

- 6.4.8 DePuy Synthes (Johnson and Johnson)

- 6.4.9 DSM

- 6.4.10 Evonik Industries

- 6.4.11 Medtronic Inc.

- 6.4.12 Noraker

- 6.4.13 OSARTIS GmbH

- 6.4.14 Pulpdent Corporation

- 6.4.15 Septodont Holding

- 6.4.16 Stryker Corporation

- 6.4.17 Zimmer Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand from Orthopedics and New Developments