|

市場調查報告書

商品編碼

1439871

二甲醚:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Dimethyl Ether - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

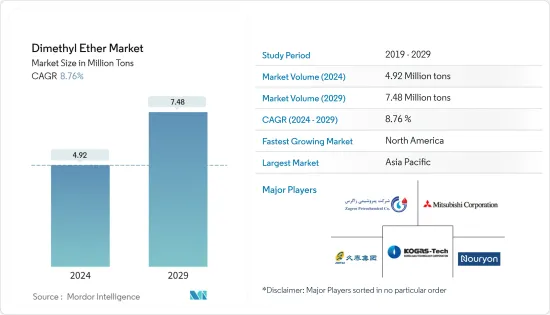

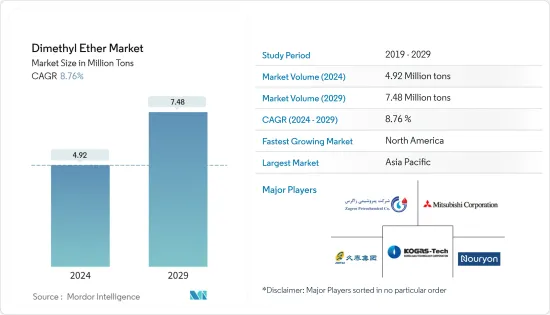

預計2024年二甲醚市場規模為492萬噸,預計2029年將達到748萬噸,在預測期間(2024-2029年)年複合成長率為8.76%。

COVID-19 對市場產生了負面感染疾病,考慮到大流行的情況,由於人們出行不再頻繁,汽車行業對基於 DME 的液化石油氣燃料的需求有所下降。然而,在封鎖放鬆後,該行業有所回升,全球燃料需求不斷增加。

主要亮點

- 短期內,液化石油氣混合應用需求的成長預計將推動市場成長。

- 改造現有基礎設施以使用 DME 和增加電動車的使用的高成本可能是市場的限制因素。

- 擴大使用二甲醚作為替代燃料的研究和尚未建立的市場可能會在未來幾年為市場創造機會。

- 由於對燃料、液化石油氣等的強勁需求,亞太地區可能在預測期內主導調查市場。

二甲醚市場趨勢

液化石油氣混合領域佔市場主導地位

- 液化石油氣(LPG)是二甲醚(DME)的重要應用之一,它可以與傳統液化石油氣以預先指定的比例混合,用於許多應用。

- DME 與 LPG 混合作為替代燃料添加劑,可增強燃燒、減少有害排放並減少對 LPG 的依賴。目前,大約 15-25% 的 DME 用於 DME-LPG 混合物,但更好的混合物可能需要改變所使用的設備,因此可能需要更高比例的混合物。正在研究中。

- 中國、印度和印尼等國家正積極推廣使用二甲基醚作為替代燃料,因為它們嚴重依賴進口來滿足當地液化石油氣的需求。

- 根據中國國家統計局數據,2022年前10個月液化石油氣累計產量為41,071千噸,去年同期為49,09千噸。

- 在印度,2022 年 4 月的液化石油氣消費量為 220 萬噸(MMT)。 2021-2022年,該國約90%的液化石油氣用於家庭消費,8%用於工業部門,2%用於汽車。

- 印尼是另一個積極推廣二甲醚混合液化石油氣以滿足其能源需求的亞洲國家。 Air Products and Chemicals 和 PT Bukit Asam 等公司在該國正在進行重大計劃,利用煤炭生產二甲醚,用於液化石油氣混合應用。

- 據估計,北美是全球市場成長最快的地區。在北美,美國預計將成為預測期內推動需求的最大市場。

- 二甲醚用於汽車丙烷汽車燃氣中所含液化石油氣的混合。據丙烷教育和研究委員會稱,美國有近 26 萬輛道路液化石油氣車輛配備經過認證的燃料系統。許多用於車輛應用,例如校車、接駁車和警車。

- 根據美國能源資訊署的數據,2021年液化石油氣消費量為1,387,320桶/天。

- 因此,預計上述因素將在未來幾年對市場產生重大影響。

亞太地區主導市場

- 亞太地區在液化石油氣混合物、推進劑和燃料等各種最終用途中佔有最大的二甲醚 (DME) 消費佔有率。在亞太地區,中國佔了很大的需求佔有率,其次是日本、韓國和印度。

- 中國是第一個開始商業規模使用二甲醚混合液化石油氣的國家。中國的二甲醚需求大部分用於家庭使用(液化石油氣混合炊事氣供應)。在中國,20%的二甲醚混合液化石油氣產品用於此用途。

- 根據BP統計,2021年亞太地區油基燃料消費量為184.21艾焦耳,而2020年為174.17艾焦耳。

- 根據石油規劃和分析小組的數據,截至 2022 年 4 月,印度全部區域的液化石油氣裝瓶能力約為每年 680 萬噸。整體而言,全國裝瓶能力達到每年約2,150萬噸。

- 據日本經濟產業省稱,日本液化石油氣(LPG)產量從2020年的304萬噸增加至2021年的315萬噸。

- 因此,由於上述因素,預計該地區對DME的需求在預測期內將增加。

二甲醚行業概況

二甲醚市場部分整合,前五家公司佔據主要佔有率。市場主要企業包括(排名不分先後)韓國天然氣公司、ZPCIR、九台能源集團、三菱商事、諾力昂等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 液化石油氣混合應用的需求不斷成長

- 抑制因素

- 更改目前基礎設施以使用 DME 的成本高昂

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 價格情景

第5章市場區隔(市場規模(數量))

- 目的

- 推進劑

- 液化石油氣混合物

- 燃料

- 其他用途

- 材料

- 天然氣

- 煤炭

- 生物基產品

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 合併、收購、合資、合作和協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- DME-AEROSOL

- Grillo-Werke AG

- Jiutai Energy Group

- KOREA GAS CORPORATION

- Mitsubishi Corporation

- Nouryon

- Oberon Fuels, Inc.

- PCC Group

- Shell plc

- The Chemours Company

- ZPCIR

第7章市場機會與未來趨勢

- 擴大使用二甲醚作為替代燃料的研究

- 成熟市場下 DME 成長潛力大

The Dimethyl Ether Market size is estimated at 4.92 Million tons in 2024, and is expected to reach 7.48 Million tons by 2029, growing at a CAGR of 8.76% during the forecast period (2024-2029).

COVID-19 negatively impacted the market, and considering the pandemic scenario, the demand for DME-based LPG fuel from the automotive segment decreased as people were not traveling frequently. However, after the easing of lockdowns, the industry picked up, and the fuel demand has increased worldwide.

Key Highlights

- Over the short term, the growing demand for the LPG blending application will drive the market's growth.

- High costs for altering current infrastructure to use DME and increasing EV use can act as a restraint for the market.

- Growing research for using DME as an alternative fuel and an under-established market will likely create opportunities for the market in the coming years.

- Asia-Pacific is likely to dominate the market studied during the forecast period with robust demand for fuel, LPG, and others.

Dimethyl Ether Market Trends

LPG Blending Segment to Dominate the Market

- Liquefied petroleum gas (LPG) is one of the significant applications of dimethyl ether (DME), which can be blended with traditional LPG at a pre-specified ratio for many applications.

- DME is blended with LPG as an alternative fuel additive for enhancing combustion, reducing hazardous emissions, and reducing dependency on LPG. Currently, around 15-25% of DME is utilized in DME-LPG blends, with higher ratio blends being researched, as a better blend may require equipment changes for usage.

- Countries like China, India, and Indonesia, are aggressively pushing for the use of DME as an alternate fuel, as these countries are highly dependent on imports to meet their local LPG demand.

- According to the National Bureau of Statistics of China, the cumulative value of liquefied petroleum gas production in the first ten months of 2022 accounted for 41,071 kilotons, compared to 40,009 kilotons during the same period in the previous year.

- In India, LPG consumption was 2.2 million metric tons (MMT) in April 2022. In 2021-2022, about 90% of LPG was consumed by households, 8% by industrial sectors, and 2% by vehicles in the country.

- Indonesia is another Asian country aggressively pushing for DME blended LPG for its energy needs. Companies, such as Air Products and Chemicals and PT Bukit Asam, are moving forward with significant projects in the country to produce DME from coal for LPG blending applications.

- North America is estimated to be the fasting growing region in the global market. In North America, the United States is expected to be the largest market expected to drive demand in the forecast period.

- DME is used for LPG blending that is in Propane autogas in vehicles. According to the Propane Education and Research Council, there are nearly 260,000 on-road LPG vehicles with certified fuel systems in the United States. Many are used in fleet applications, such as school buses, shuttles, and police vehicles.

- According to the U.S. Energy Information Administration, the consumption of LPG in the year 2021 was 1387.32 thousand barrels/day.

- Therefore, the factors above are expected to significantly impact the market in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific holds the largest consumption share of dimethyl ether (DME) from various end-use applications such as LPG blending, propellants, fuels, and others. In Asia-Pacific, China has a major demand share, followed by Japan, South Korea, and India, among others.

- China is the first country to start using DME-blended LPG on a commercial scale. The majority of China's DME demand is from households (for LPG blended cooking gas supply). In China, 20% of DME blended LPG products are used for this purpose.

- According to the BP Stats, consumption of oil-based fuel in Asia-Pacific accounted for 184.21 exajoules in 2021, compared to 174.17 exajoules in 2020.

- According to the Petroleum Planning and Analysis Cell, as of April 2022, LPG bottling capacity across the northern region of India amounted to around 6.8 million metric tons per annum. Overall, the bottling capacity across the country stood at around 21.5 million metric tons per annum.

- According to the METI (Japan), the production volume of liquified petroleum gas (LPG) in Japan accounted for 3.15 million metric tons in 2021, compared to 3.04 million metric tons in 2020.

- Thus, the demand for DME is expected to increase during the forecast period in the region due to the factors mentioned above.

Dimethyl Ether Industry Overview

The dimethyl ether market is partially consolidated, with the top five players accounting for a significant share. Some of the key players in the market include KOREA GAS CORPORATION, ZPCIR, Jiutai Energy Group, Mitsubishi Corporation, and Nouryon (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from LPG Blending Applications

- 4.2 Restraints

- 4.2.1 High Costs for the Alteration of Current Infrastructure to Use DME

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Scenario

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Propellants

- 5.1.2 LPG Blending

- 5.1.3 Fuel

- 5.1.4 Other Applications

- 5.2 Source

- 5.2.1 Natural Gas

- 5.2.2 Coal

- 5.2.3 Bio-based Products

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 DME-AEROSOL

- 6.4.2 Grillo-Werke AG

- 6.4.3 Jiutai Energy Group

- 6.4.4 KOREA GAS CORPORATION

- 6.4.5 Mitsubishi Corporation

- 6.4.6 Nouryon

- 6.4.7 Oberon Fuels, Inc.

- 6.4.8 PCC Group

- 6.4.9 Shell plc

- 6.4.10 The Chemours Company

- 6.4.11 ZPCIR

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research for Use of DME as an Alternative Fuel

- 7.2 Under Established Market Offers Huge Potential for DME Growth