|

市場調查報告書

商品編碼

1439869

聚偏二氯乙烯 (PVDC) 塗佈薄膜:市場佔有率分析、產業趨勢與統計、成長預測 (2024-2029)Polyvinylidene Chloride (PVDC) Coated Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

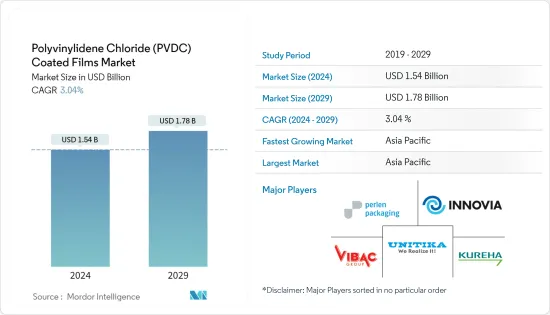

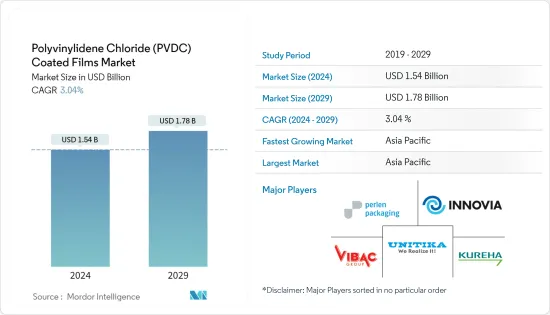

聚偏二氯乙烯(PVDC)塗層薄膜市場規模預計2024年為15.4億美元,預計到2029年將達到17.8億美元,預計在預測期內(2024-2029年)將以年複合成長率為3.04 %。

2020年,新型冠狀病毒(COVID-19)對市場產生了負面影響。然而,目前估計市場已達到大流行前的水平,並預計將繼續穩定成長。

主要亮點

- 推動所研究市場的主要因素是加工食品產業的成長以及食品包裝中對 PVDC 塗層薄膜的需求不斷增加。

- 另一方面,替代品的可用性預計將阻礙預測期內的市場成長。

- 回收含有 PVDC 的薄膜結構的新技術的開發預計將為市場成長提供各種有利可圖的機會。

- 預計亞太地區將主導全球市場,最大的消費來自中國、日本和印度。

PVDC塗膜市場趨勢

食品包裝中的應用不斷增加

- 食品包裝領域佔據了包裝行業的大部分市場。由於 PVDC 塗層薄膜具有高耐化學性、惰性和低氣味等優異性能,預計該細分市場將佔據主導地位。

- PVDC 塗層薄膜光學透明、高光澤,並且具有與金屬化薄膜相當的氧氣和濕氣阻隔性能。 PVDC 對許多化學物質(如油脂和油)也具有高度耐受性。

- PVDC 塗層薄膜因其低拉伸、良好的黏合強度和低吸水性而用於食品包裝。它還具有出色的黏合強度,使其成為食品包裝應用的理想選擇。

- 根據美國農業部統計,2021年印度包裝有機食品和飲料的總消費額為9,600萬美國。美國農業部預測,2022年總消費量將增加至1.08億美元。

- 食品包裝在保存食品並將其運送到需要的地方而不影響味道或品質方面發揮著重要作用。保護內容物免受毒素和濕氣的影響,防止溢出和篡改,並保持形狀和品質。

- 根據聯合國糧食及農業組織預測,2022年全球肉類產量將達到約3.6億噸,較2021年增加1.2%。隨著預測期內需求的增加,全球肉類供應量預計將擴大,到 2031 年將達到 3.77 億噸。

- 因此,由於食品包裝行業的成長,預計預測期內對 PVDC 塗層薄膜的需求將會增加。

亞太地區主導市場

- 預計亞太地區將在預測期內主導 PVDC 塗層薄膜市場。由於中國、印度和日本等國家的高需求,PVDC 塗層薄膜市場正在成長。

- 根據中國政府報告,中國包裝產業預計將實現近 6.8% 的驚人成長率,到 2025 年將達到 2 兆元(2,900 億美元)。中國擁有全世界最大的食品工業。

- 由於微波爐、零食和冷凍食品等食品行業的客製化和軟包裝興起以及出口的增加,預計該國在預測期內將持續成長。這將增加對創新包裝的需求,並在預測期內推動 PVDC 塗層薄膜市場的發展。

- 根據印度包裝工業協會(PIAI)的數據,印度包裝產業是印度經濟的第五大產業。該協會預測,到2025年,包裝產業的產值將達到2,048.1億美元。這可能會增加預測期內對 PVDC 塗層薄膜的需求。

- 日本目前是全球第三大、成長最快的電子商務市場之一。日本政府預計,到2023年,日本電商市場收益預計將達2,322億美元,2023年至2027年預計年增率為11.23%,市場規模預估為3,554億美元。電子商務在該國的日益滲透預計將增加預測期內對 PVDC 塗層薄膜的需求。

- 上述因素和政府支持可能會導致預測期內 PVDC 塗層薄膜的需求增加。

PVDC塗佈膜產業概況

聚偏二氯乙烯(PVDC)塗層薄膜市場本質上是分散的。市場主要企業包括(排名不分先後)Innovia Films、KUREHA CORPORATION、UNITIKA LTD、Vibac Group Spa、Perlen Packaging 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 不斷發展的加工食品工業

- PVDC塗膜在生肉包裝的應用

- 抑制因素

- 確保更換

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 片基類型

- 雙軸延伸聚丙烯(BOPP)

- 聚對苯二甲酸乙二酯(PET)

- 聚氯乙烯(PVC)

- 其他薄膜基材類型

- 目的

- 食品包裝

- 藥品泡殼包裝

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- ACG

- Cosmo Films

- Innovia Films

- Jindal Poly Films Limited

- Kaveri Metallising &Coating Ind. Private Limited

- Perlen Packaging

- POLINAS

- UNITIKA LTD

- Vibac Group Spa

- Glenroy Inc.

- KUREHA CORPORATION

- Asahi Kasei Corporation

- Huawei Pharma Foil Packaging

- Klockner Pentaplast

- Liveo Research

- Polyplex

- Qingdao Kingchuan Packaging

- RMCL

- Solvay

- Tekni-Plex Inc.

- Tipack Group

- Transparent Paper Ltd.

- Valtec Italia SRL

- Bilcare Limited

- Caprihans India Limited

第7章市場機會與未來趨勢

- 擴大 PVDC 回收研究

The Polyvinylidene Chloride Coated Films Market size is estimated at USD 1.54 billion in 2024, and is expected to reach USD 1.78 billion by 2029, growing at a CAGR of 3.04% during the forecast period (2024-2029).

In 2020, COVID-19 had a detrimental effect on the market. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The major factors driving the market studied are the growing processed food industry and the increasing demand for PVDC-coated films in food packaging.

- On the other hand, the availability of substitutes is expected to hinder the growth of the market during the forecast period.

- Developing new technologies to recycle film structures involving PVDC is expected to offer various lucrative opportunities for market growth.

- Asia-Pacific is expected to dominate the global market, with the largest consumption coming from China, Japan, and India.

PVDC Coated Films Market Trends

Increasing Application in Food Packaging

- The food packaging segment captures the major portion of the market regarding the packaging sector. This segment is expected to dominate the market, owing to the superior properties of PVDC-coated films, such as their high chemical resistance, inertness, and low odor.

- PVDC-coated films are optically clear with a high degree of gloss and have oxygen and moisture barrier properties comparable to metalized films. PVDC is also highly resistant to many chemicals, including grease and oil.

- PVDC-coated films are used for packaging food as they have low stretch, excellent bond strength, and low water absorption. They also have good cling properties, making them an ideal choice for food wrapping applications.

- According to the United States Department of Agriculture, the total consumption value of packaged organic food and beverages in India in 2021 was 96 million US dollars. In 2022, the USDA projected that the total consumption value would increase to 108 million dollars.

- Food packaging plays an essential role in preserving and transporting food items to the required location without affecting the taste or quality. It protects the contents from toxins and moisture, prevents spillage and tampering, and helps retain their shape and quality.

- According to the Food and Agriculture Organization, world meat production reached around 360 million metric tons in 2022, up by 1.2 percent from 2021. Global meat supply will expand to meet rising demand over the projection period, reaching 377 million tons by 2031.

- Hence, owing to the growing food packaging sector, the demand for PVDC-coated films is expected to increase over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for PVDC-coated films during the forecast period. Due to the high demand from countries like China, India, and Japan, the market for PVDC-coated films is growing.

- The packaging industry in China is expected to register tremendous growth with a growth rate of nearly 6.8%, reaching CNY 2 trillion (USD 290 billion) by 2025, as per the report of the Chinese government. China has one of the largest food industries in the world.

- The country is expected to witness consistent growth during the forecast period due to the rise of customized and flexible packaging in the food segment, like microwave, snack, and frozen foods, along with increasing exports. This has increased the demand for innovative packaging, which in turn will boost the PVDC-coated films market during the forecasted period.

- According to the Packaging Industry Association of India (PIAI), the country's packaging sector is the fifth largest sector of India's economy. The association has predicted that the packaging sector will reach USD 204.81 billion by 2025. This will likely boost the demand for PVDC-coated films during the forecasted period.

- Japan is currently the world's 3rd-largest and one of the fastest-growing e-commerce markets globally. As per the government of Japan, revenue in the e-commerce market in Japan is expected to generate USD 232.20 billion by 2023 and is further expected to register a 11.23% annual rate between 2023 and 2027, resulting in a market volume of USD 355.40 billion by 2027. The increasing penetration of e-commerce in the country is anticipated to enhance the demand for PVDC-coated films during the forecasted period.

- The factors above, coupled with government support, may contribute to the increasing demand for PVDC-coated films during the forecast period.

PVDC Coated Films Industry Overview

The polyvinylidene chloride (PVDC) coated films market is fragmented in nature. Some of the major players in the market include Innovia Films, KUREHA CORPORATION, UNITIKA LTD, Vibac Group S.p.a., and Perlen Packaging, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Processed Food Industry

- 4.1.2 Usage Of PVDC Coated Films In Fresh Meat Packaging

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Film Substrate Type

- 5.1.1 Bi-axially Oriented Polypropylene (BOPP)

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Other Film Substrate Types

- 5.2 Application

- 5.2.1 Food Packaging

- 5.2.2 Pharmaceutical Blister Packaging

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACG

- 6.4.2 Cosmo Films

- 6.4.3 Innovia Films

- 6.4.4 Jindal Poly Films Limited

- 6.4.5 Kaveri Metallising & Coating Ind. Private Limited

- 6.4.6 Perlen Packaging

- 6.4.7 POLINAS

- 6.4.8 UNITIKA LTD

- 6.4.9 Vibac Group S.p.a.

- 6.4.10 Glenroy Inc.

- 6.4.11 KUREHA CORPORATION

- 6.4.12 Asahi Kasei Corporation

- 6.4.13 Huawei Pharma Foil Packaging

- 6.4.14 Klockner Pentaplast

- 6.4.15 Liveo Research

- 6.4.16 Polyplex

- 6.4.17 Qingdao Kingchuan Packaging

- 6.4.18 RMCL

- 6.4.19 Solvay

- 6.4.20 Tekni-Plex Inc.

- 6.4.21 Tipack Group

- 6.4.22 Transparent Paper Ltd.

- 6.4.23 Valtec Italia SRL

- 6.4.24 Bilcare Limited

- 6.4.25 Caprihans India Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research on Recycling PVDC