|

市場調查報告書

商品編碼

1439854

鋅化學品 - 市場佔有率分析,產業趨勢與統計,成長預測(2024-2029)Zinc Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

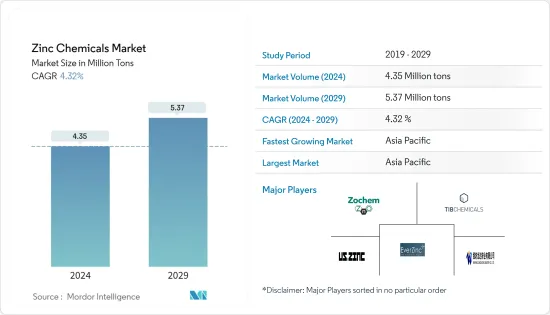

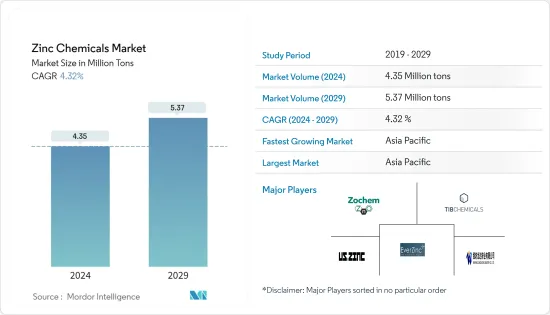

2024年鋅化學品市場規模預計為435萬噸,預計2029年將達到537萬噸,在預測期(2024-2029年)CAGR為4.32%。

COVID-19的爆發為建築、石化和其他行業帶來了一些短期和長期的影響,影響了全球鋅化學品市場。不過,目前市場已恢復到疫情前的水準。

主要亮點

- 短期內,汽車產業利用率的上升和橡膠輪胎產業需求的增加可能會推動鋅化學品市場的需求。

- 另一方面,與鋅基化學品相關的健康危害等因素預計將阻礙市場的成長。

- 用於診斷、成像和癌症治療的鋅奈米顆粒領域的新興研究和技術進步為未來幾年的鋅市場提供了巨大的機會。

鋅化學品市場趨勢

橡膠加工領域將主導市場

- 由於鍍鋅和製造輪胎大量消耗鋅化學品,橡膠加工領域成為主導領域。

- 鋅化學品廣泛用於製造汽車常用的輪胎和內胎;不斷成長的汽車工業預計將很快增加對鋅化學品的整體需求。

- 根據國際橡膠研究組織(IRSG)的資料,2021年全球天然橡膠產量正成長5.4%,從2020年的1,306.5萬噸增加至1,377萬噸。

- 2021年,全球橡膠需求量年增9.4%,超過疫情前水準,總量為2,957萬噸。輪胎和非輪胎產業被壓抑的需求,尤其是2021年上半年,推動了強勁反彈。

- 電動車的日益普及預計將帶動汽車輪胎的需求,推動汽車產業輪胎的消費,進而帶動鋅化工市場。

- 此外,較高的氧化鋅含量可以改善熱空氣/熱老化性能,而過低的氧化鋅濃度會導致燒焦問題。此外,它還可以減少輪胎的生熱和磨損,使其成為橡膠輪胎行業的重要組成部分。因此,隨著輪胎工業的發展,氧化鋅的消耗量也隨之增加。

- 中國、印度、日本、韓國、泰國等亞太國家為汽車主要生產國;因此,預計在預測期內該地區對鋅化學品市場的需求將會增加。

亞太地區將主導市場

- 由於鋅化學衍生物在橡膠加工、化學品加工和農業等各領域的廣泛應用,亞太地區將成為主導區域。

- 中國是化學加工中心,佔全球化學品產量的大部分。由於令人鼓舞的政府措施和龐大的消費者基礎,中國的化學製造業預計在預測期內將以穩定的速度成長。化學品產量的增加預計將在不久的將來為該國所研究市場的成長創造機會。

- 印度有 40 家輪胎製造商和約 6,000 家非輪胎製造商,生產密封件、傳送帶以及擠出成型橡膠型材,用於汽車、鐵路、國防、航空航太和其他應用。

- 此外,印度擁有超過 2,500 家裝飾塗料製造商和 800 家工業塗料製造商。對塗料的需求不斷成長促使各公司提高產量和產能。預計這將推動該國液體合成橡膠市場的需求,進一步推動未來幾年對鋅化學品的需求。

- 由於農化產業的不斷發展和經濟的成長,中國和印度對鋅化學品的需求預計將增加。化肥的低成本和易於取得是市場成長的關鍵因素。硫酸鋅用作化肥中的肥料添加劑,刺激了鋅化學品的市場規模。

- 日本擁有世界上最大的橡膠工業之一,是輪胎生產的主要中心之一。根據日本汽車輪胎製造商協會統計,2021年橡膠消耗量約101萬噸。在兩種橡膠類型(包括天然橡膠和合成橡膠)中,2021年合成橡膠約佔402,597噸。

- 此外,就橡膠材料消耗總量而言,中國排名全球第三,僅次於中國和美國。日本最大的輪胎生產商,如 Tosoh Corporation、Zeon Corp.、Toyo Tire & Rubber,日益增加產能,預計這將為橡膠加工行業的鋅化學品在預測期內提供一個令人興奮的市場舞台。

- 因此,所有這些市場趨勢預計將在預測期內推動該地區鋅化學品市場的需求。

鋅化學品產業概況

全球鋅化學品市場較為分散,沒有一家公司佔據重要佔有率。市場上一些主要的公司包括 US Zinc、Zochem Inc、EverZinc、TIB Chemicals AG 和濰坊龍達鋅業等。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 促進要素

- 汽車業利用率上升

- 橡膠輪胎產業的需求不斷增加

- 限制

- 與鋅化學物質相關的健康危害

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場區隔(按數量分類的市場規模)

- 類型

- 氧化鋅

- 硫酸鋅

- 碳酸鋅

- 氯化鋅

- 其他類型

- 最終用戶產業

- 農業

- 化學品和石化產品

- 陶瓷製品

- 製藥

- 油漆和塗料

- 橡膠加工

- 其他最終用戶產業

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 領先企業採取的策略

- 公司簡介

- American Chemet Corporation

- Changsha Lantian Chemical Co. Ltd.

- EverZinc

- Flaurea Chemicals

- Global Chemical Co. Ltd

- Hakusui Tech

- Intermediate Chemicals Company

- L. Bruggemann GmbH & Co. KG

- Nexa

- Old Bridge Chemicals Inc.

- Pan-Continental Chemical Co. Ltd

- Rech Chemical Co. Ltd

- Rubamin

- Seyang Zinc Technology(Huai An)Co. Ltd

- Silox India Pvt. Ltd

- TIB Chemicals AG

- US Zinc.

- Weifang Longda Zinc Industry Co., Ltd.

- Zochem LLC

第7章 市場機會與未來趨勢

- 奈米鋅粒子在醫療產業的應用研發

- 在電子和半導體行業中的應用不斷成長

The Zinc Chemicals Market size is estimated at 4.35 Million tons in 2024, and is expected to reach 5.37 Million tons by 2029, growing at a CAGR of 4.32% during the forecast period (2024-2029).

The outbreak of COVID-19 brought several short-term and long-term consequences in the construction, petrochemical, and other industries, which affected the zinc chemicals market across the world. However, presently the market has returned to the pre-pandemic level.

Key Highlights

- Over the short term, the rising utilization in the automotive industry and increasing demand from the rubber tire industry are likely to drive the demand for the zinc chemicals market.

- On the flipside, factors such as health hazards related to zinc-based chemicals are expected to hinder the growth of the market.

- The emerging research and technological advancement in the field of zinc nanoparticles employed for diagnosis, imaging, as well as treatment of cancer offer great opportunities for the zinc market over the upcoming years.

Zinc Chemicals Market Trends

Rubber Processing Segment to Dominate the Market

- The rubber processing segment is the dominating segment owing to the large-scale consumption of zinc chemicals in galvanization and manufacturing tires.

- Zinc chemicals are widely used in manufacturing tires and tubes commonly used in automobiles; the growing automobile industry is expected to augment the overall demand for zinc chemicals shortly.

- According to the International Rubber Study Group (IRSG), global natural rubber production increased positively by 5.4% in 2021, reaching 13.770 million tons from 13.065 million tons produced in 2020.

- In 2021, the global demand for rubber increased by 9.4% (year over year), surpassing pre-pandemic levels with a total of 29.57 million tons. Pent-up demand from the tire and non-tire sectors, particularly in the first half of 2021, contributed to the strong rebound.

- The growing popularity of electric vehicles is expected to drive the demand for automotive tires, thereby propelling the consumption of tires in the automotive industry, which in turn goes to the zinc chemical market.

- Also, higher loadings of zinc oxide can improve hot air/heat aging properties, and too low a concentration of zinc oxide can lead to scorching problems. Furthermore, it reduces heat buildup and wears in tires, thus, making it an important segment in the rubber tire industry. Thus, with the growth in the tire industry, the consumption of zinc oxide is also increasing concurrently.

- Asia-Pacific countries like China, India, Japan, South Korea, and Thailand are the primary producer of automobiles; hence the requirement for the zinc chemical market is projected to increase from this region in the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region stands to be the dominating region owing to the vast and extensive application of zinc chemical derivatives in various applicationa including rubber processing, chemicalsprocessing, and agriculture among others.

- China is a hub for chemical processing, accounting for most chemicals produced worldwide. Owing to the encouraging government initiatives and a vast consumer base, the chemical manufacturing sector in China is expected to increase at a consistent rate during the forecast period. The increasing production of chemicals is expected to create an opportunity for the growth of the studied market in the country in the near future.

- In India, there are 40 tire manufacturers and around 6,000 non-tire manufacturers producing seals, conveyor belts, and extruded and moulded rubber profiles to be used in automotive, railway, defence, aerospace and other applications.

- Furthermore, India is home to over 2,500 decorative coatings and 800 industrial coatings manufacturers. This increasing demand for coatings has prompted the companies to increase their production and production capacities. This is expected to drive the demand for the liquid synthetic rubber market in the country, which further will boost the demand for zinc chemicals in coming years.

- In China & India demand for the zinc chemical expected to increase due to the growing agrochemical industry & economic growth. Low cost and easy availability of chemical fertilizers act as key factors for the growth of the market. Zinc sulfate is used as a fertilizer additive in chemical fertilizers, thereby stimulating the zinc chemicals' market size.

- Japan possesses one of the world's largest rubber industries as it is one of the major hub of tire production. According to the Japan Automobile Tyre Manufacturers Association, the consumption of rubber recorded about 1.01 million tons of rubber in 2021. Among both the rubber types (including natural and synthetic rubber), the synthetic rubber accounted about 402,597 tons in 2021.

- Furthermore, the country is ranked third globally, only behind China and the United States, in terms of the total amount of rubber material consumed. The largest producers of tires in Japan, like Tosoh Corporation, Zeon Corp., and Toyo Tire & Rubber Co. Ltd, are undergoing capacity additions, which is expected to present an exciting market arena for zinc chemicals from the rubber processing industry over the forecast period.

- Hence, all such market trends are expected to drive the demand for zinc chemical market in the region during the forecast period.

Zinc Chemicals Industry Overview

The global zinc chemical market is fragmented, with no player capturing a significant share. Some of the key companies in the market include U.S. Zinc, Zochem Inc, EverZinc, TIB Chemicals AG, and Weifang Longda Zinc Industry Co. Ltd., amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Utilization in Automotive Industry

- 4.1.2 Increasing Demand from the Rubber Tires Industry

- 4.2 Restraints

- 4.2.1 Health Hazard Related to Zinc Chemical

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Type

- 5.1.1 Zinc Oxide

- 5.1.2 Zinc Sulfate

- 5.1.3 Zinc Carbonate

- 5.1.4 Zinc Chloride

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Chemicals and Petrochemicals

- 5.2.3 Ceramic

- 5.2.4 Pharmaceutical

- 5.2.5 Paints and Coatings

- 5.2.6 Rubber Processing

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Chemet Corporation

- 6.4.2 Changsha Lantian Chemical Co. Ltd.

- 6.4.3 EverZinc

- 6.4.4 Flaurea Chemicals

- 6.4.5 Global Chemical Co. Ltd

- 6.4.6 Hakusui Tech

- 6.4.7 Intermediate Chemicals Company

- 6.4.8 L. Bruggemann GmbH & Co. KG

- 6.4.9 Nexa

- 6.4.10 Old Bridge Chemicals Inc.

- 6.4.11 Pan-Continental Chemical Co. Ltd

- 6.4.12 Rech Chemical Co. Ltd

- 6.4.13 Rubamin

- 6.4.14 Seyang Zinc Technology (Huai An) Co. Ltd

- 6.4.15 Silox India Pvt. Ltd

- 6.4.16 TIB Chemicals AG

- 6.4.17 U.S. Zinc.

- 6.4.18 Weifang Longda Zinc Industry Co., Ltd.

- 6.4.19 Zochem LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 R&D in Application of Zinc Nanoparticle in Medical Industry

- 7.2 Growing Use in Electronics and Semiconductor Industry