|

市場調查報告書

商品編碼

1439851

氯鹼:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Chlor-alkali - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

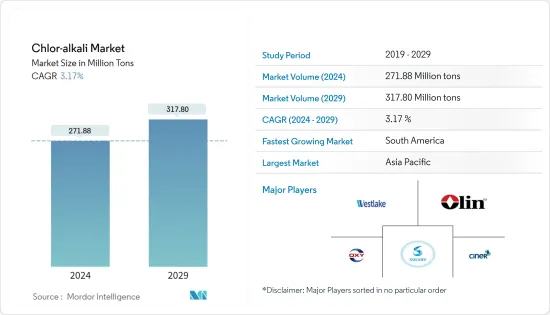

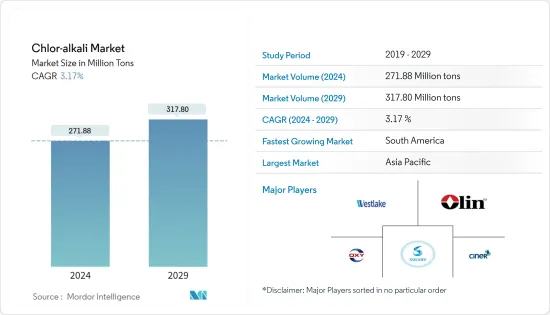

預計2024年氯鹼市場規模為27,188萬噸,預計2029年將達31,780萬噸,在預測期內(2024-2029年)年複合成長率為3.17%。

COVID-19 對 2020 年氯鹼需求產生了負面影響。然而,氧化鋁、纖維、紙張和紙漿應用化學品的需求不斷增加正在推動氯鹼的消費。

主要亮點

- 推動短期市場成長的主要因素是對苛性鈉及其衍生物的高需求。此外,苛性鈉也用於製造造紙和紙漿、肥皂和清潔劑、紡織品以及許多有機和無機化學品的合成等行業的產品。

- 水處理和鋰離子電池等新應用對氯鹼的需求不斷增加,預計將為該產業提供新的成長機會。

- 由於氯鹼產品及其衍生物的大規模生產和消費,亞太地區預計將成為最大的市場。

- 另一方面,環境影響和嚴格的環境法規可能會阻礙產業成長。

氯鹼市場趨勢

氯部門預計將推動市場成長

- 氯存在於自然界中,但不是以元素(氣體)形式(如 Cl2)。透過使電流通過鹽溶液(溶解在水中的食鹽)來產生氯和苛性鈉/氫氧化鈉。這個過程稱為氯鹼。

- 此製程產生的氯氣和氫氧化鈉廣泛用於化學工業。生產氯氣需要三種原料:鹽、水和電。結果是三種產品:氯、苛性鈉和氫氣。

- 氯有許多工業用途,包括生產漂白紙製品等散裝材料、PVC 等塑膠以及四氯甲烷、氯仿和二氯甲烷等溶劑。它也用於生產染料、紡織品、藥物、防腐劑、殺蟲劑和油漆。

- 此外,氯在醫療機構中的臨床用途包括對飲用水進行過氯化以防止退伍軍人菌菌定植、對血液透析機中心使用的配水系統進行氯化、清洗環境表面和洗滌衣物。這些包括局部用於消毒、去污血液溢出、器械消毒、醫療廢棄物處置前的淨化處理以及牙科治療。

- 各個最終用戶產業的氯產量和消耗量不斷增加。 2022年6月歐洲氯產量為682,760噸。此外,PVC 是歐洲地區最大的氯消耗者之一。

- 此外,由於大流行,預計未來幾年水處理中對氯的需求將過度成長。

中國可望主導亞太地區

- 由於各行業對氯鹼化學品的需求不斷增加,中國在亞太地區氯鹼市場佔據主導地位。

- 中國紡織業的產量和出口量排名世界第一。 2021年,中國佔全球紡織品出口的比重超過41%,其次是歐盟和印度。由於「十三五」規劃加大投資和政府支持,中國紡織業也蓬勃發展。由於低電費、交通補貼和原棉價格下降,中國紡織業的投資正在增加。

- 此外,根據國家統計局數據,2022年10月,我國服飾布料產量約31.8億公尺。

- 此外,透過「一帶一路」計劃,中國獲得了大量的國內外投資,主要集中在增加紡織服裝產能和出口。因此,氯鹼市場的需求不斷增加。

- 中國是化學加工中心,佔全球化學品生產的大部分。該國的成長佔全球化學品市場成長的一半。中國的化學品市場每年以4-5%的速度成長,而世界其他地區的成長率約為3%。

- 總體而言,預計氯鹼市場在預測期內將健康成長。

氯鹼產業概況

整個氯鹼市場部分分散。市場的主要企業包括(排名不分先後)奧林公司、西方石油公司、索爾維、西納資源公司和西湖化學公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對苛性鈉及其衍生物的需求量大

- 最終用戶群和現有生產設施不斷成長的需求

- 抑制因素

- 環境影響和嚴格的環境法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 進出口趨勢

第5章市場區隔

- 產品

- 苛性鈉

- 氯

- 堿灰

- 製造過程

- 膜細胞

- 隔膜細胞

- 其他製造程序

- 目的

- 紙漿/紙

- 有機化學

- 無機化學品

- 肥皂/清潔劑

- 氧化鋁

- 纖維

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- ANWIL SA(PKN ORLEN SA)

- BorsodChem(Wanhua Chemical Group Co. Ltd)

- Ciner Resources Corporation

- Covestro AG

- Dow

- Ercros SA

- Formosa Plastics Corporation

- Genesis Energy LP

- Hanwha Solutions/Chemical Corporation

- INOVYN(INEOS)

- Kemira

- Kem One

- MicroBio Ireland Limited

- NIRMA

- Nouryon

- Occidental Petroleum Corporation

- Olin Corporation

- PCC Rokita SA(PCC SE)

- Shandong Haihua Group Co. Ltd

- Spolchemie

- Tata Chemicals Limited

- Tosoh Corporation

- Vinnolit GmbH & Co. KG(Westlake Chemical Corporation)

- Vynova Group

第7章 市場機會及未來趨勢

- 新興市場對氯鹼的需求不斷擴大

The Chlor-alkali Market size is estimated at 271.88 Million tons in 2024, and is expected to reach 317.80 Million tons by 2029, growing at a CAGR of 3.17% during the forecast period (2024-2029).

COVID-19 negatively affected the demand for chlor-alkali in 2020. However, the rise in demand for chemicals in alumina, textile, and paper and pulp applications has propelled the consumption of chlor-alkali.

Key Highlights

- The major factor driving the market's growth in the short term is the high demand for caustic soda and its derivatives. Furthermore, caustic soda is used to manufacture products in industries like paper and pulp, soap and detergents, textiles, and the synthesis of many organic and inorganic chemicals.

- Rising demand for chlor-alkali in emerging applications such as water treatment and lithium-ion batteries is expected to offer new growth opportunities to the industry.

- The Asia-Pacific region is expected to be the largest market due to the large-scale production and consumption of chlor-alkali products and their derivatives.

- On the flip side, the environmental impact and stringent environmental regulations are likely to hinder industry growth.

Chlor Alkali Market Trends

The Chlorine Segment is Expected to Drive the Market Growth

- Chlorine occurs naturally but not in its elemental (gas) form (as Cl2). Chlorine and caustic soda/sodium hydroxide are produced by passing an electrical current through brine (common salt dissolved in water). This process is called chlor-alkali.

- The chlorine and sodium hydroxide produced in this process is widely used in the chemical industry. The three raw materials used in chlorine production are salt, water, and electricity. The result is three products, chlorine, caustic soda, and hydrogen.

- Chlorine has many industrial uses, including making bulk materials like bleached paper products, plastics such as PVC, and solvents like tetrachloromethane, chloroform, and dichloromethane. It is also used to make dyes, textiles, medicines, antiseptics, insecticides, and paints.

- Additionally, clinical uses of chlorine in healthcare facilities include hyper chlorination of potable water to prevent Legionella colonization, chlorination of water distribution systems used in hemodialysis centers, cleaning of environmental surfaces, disinfection of laundry, local use to decontaminate blood spills, disinfection of equipment, decontamination of medical waste before disposal, and dental therapy.

- The production and consumption of chlorine is increasing constantly in its various end-user industries. In June 2022, European chlorine production stood at 682,760 tonnes. Additionally, PVC is one of the largest consumers of chlorine in the European region.

- Moreover, owing to the pandemic, the demand for chlorine in water treatment is expected to grow excessively in the forthcoming years.

China is Expected to Dominate the Asia-Pacific Region

- China dominates the chlor-alkali market in the Asia-Pacific due to the growing demand for chlor-alkali chemicals from different industries.

- The Chinese textile industry is the largest in the world in production and exports. In 2021, China accounted for over 41% of the world's textile exports, followed by the European Union and India. The textile industry in China is also booming with increasing investments and government support from the 13th Five-Year Plan. Investment in the country's textile industry has been increasing due to cheaper electricity rates, transportation subsidies, and lower raw cotton prices.

- Additionally, according to the National Burau of Statistics, in October 2022, around 3.18 billion meters of clothing fabric were produced in China.

- In addition, through the Belt & Road initiative, the country saw an in-flow of huge investments, both domestic and foreign, mainly focusing on increasing production capacity and exports of textiles and apparel. This, in turn, increases the demand in the chlor-alkali market.

- China is a hub for chemical processing, accounting for a major chunk of the chemicals produced globally. The growth in the country accounts for half of the growth of the global chemical market. The chemical market in China is growing at 4-5% annually compared to the ~3% growth in the rest of the world.

- Overall, the market for chlor-alkali is projected to witness healthy growth in the country over the forecast period.

Chlor Alkali Industry Overview

The overall chlor-alkali market is partially fragmented. Some major players in the market include Olin Corporation, Occidental Petroleum Corporation, Solvay, Ciner Resources Corporation, and Westlake Chemical Corporation, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand for Caustic Soda and Its Derivatives

- 4.1.2 Growing Demand from End-user Segments and Existing Production Facilities

- 4.2 Restraints

- 4.2.1 Environmental Impact and Stringent Environmental Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import and Export Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product

- 5.1.1 Caustic Soda

- 5.1.2 Chlorine

- 5.1.3 Soda Ash

- 5.2 Production Process

- 5.2.1 Membrane Cell

- 5.2.2 Diaphragm Cell

- 5.2.3 Other Production Processes

- 5.3 Application

- 5.3.1 Pulp and Paper

- 5.3.2 Organic Chemical

- 5.3.3 Inorganic Chemical

- 5.3.4 Soap and Detergent

- 5.3.5 Alumina

- 5.3.6 Textile

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ANWIL SA (PKN ORLEN SA)

- 6.4.2 BorsodChem (Wanhua Chemical Group Co. Ltd)

- 6.4.3 Ciner Resources Corporation

- 6.4.4 Covestro AG

- 6.4.5 Dow

- 6.4.6 Ercros SA

- 6.4.7 Formosa Plastics Corporation

- 6.4.8 Genesis Energy LP

- 6.4.9 Hanwha Solutions/Chemical Corporation

- 6.4.10 INOVYN (INEOS)

- 6.4.11 Kemira

- 6.4.12 Kem One

- 6.4.13 MicroBio Ireland Limited

- 6.4.14 NIRMA

- 6.4.15 Nouryon

- 6.4.16 Occidental Petroleum Corporation

- 6.4.17 Olin Corporation

- 6.4.18 PCC Rokita SA (PCC SE)

- 6.4.19 Shandong Haihua Group Co. Ltd

- 6.4.20 Spolchemie

- 6.4.21 Tata Chemicals Limited

- 6.4.22 Tosoh Corporation

- 6.4.23 Vinnolit GmbH & Co. KG (Westlake Chemical Corporation)

- 6.4.24 Vynova Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Chlor-alkali from the Emerging Markets