|

市場調查報告書

商品編碼

1439783

地板黏劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Floor Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

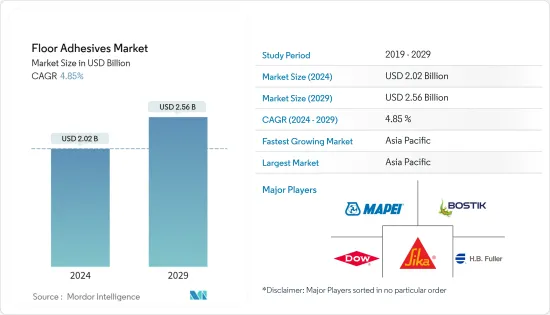

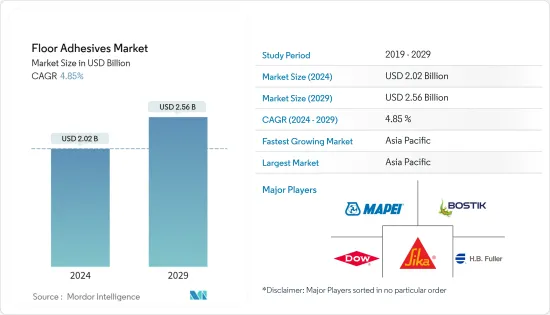

地板黏劑市場規模預計到2024年為20.2億美元,預計到2029年將達到25.6億美元,在預測期內(2024-2029年)成長4.85%,年複合成長率為

主要亮點

- 全球建設產業的快速成長以及地板黏劑的多功能性、安全性和塗布性預計將推動市場成長。

- 另一方面,揮發性有機化合物排放對健康的有害影響可能會阻礙市場成長。

- 對生物基地板黏劑不斷成長的需求可能會帶來機會。

- 亞太地區主導全球市場,最大的消費國是中國、印度和日本。

地板黏劑市場趨勢

住宅終端用戶產業需求增加

- 磁磚和石材黏劑是住宅最終用戶領域最常用的黏劑類型。此外,住宅市場是所研究市場中規模最大且成長最快的部分。

- 中產階級人口的成長和可支配收入的增加促進了中產階級住宅領域的擴張,從而增加了地板黏劑的使用量。

- 根據世界銀行的數據,全球建築業價值從2020年的22.36兆美元增加到2021年的27.18美元。

- 在中國和印度不斷擴大的住宅建築市場的推動下,亞太地區預計將出現最高的成長。預計到2030年,這兩個地區的中產階級將佔全球中產階級的43.3%以上。印度政府已將住宅消費稅從 12% 降至 5%。這種退稅可以擴大中產階級住宅建設的市場。

- 此外,2021 年 10 月,聖保羅州住宅協會 (Secovi-SP) 記錄巴西聖保羅住宅銷售量為 5,555 套。由於住宅消費支出的增加,這一數字可能會進一步增加。此外,巴西單戶住宅的成長趨勢可能會在未來支持住宅建設產業。

- 由於聯邦住宅援助計劃大幅削減以及引發嚴重衰退的疫情影響,墨西哥的住宅和庫存水準已降至十年來的最低水準。 2021 年,Programa de Vivienda Social(公共住宅計畫)預算增加了 179%,達到 2 億美元,以支持建設支出。此外,可用的融資便利性和有利的房屋抵押貸款便利預計將有利於該國的住宅建設。

- 廉租住宅市場穩定成長,主要得益於政府為都市區貧困階級提供經濟適用住宅的努力。

- 與其他住宅相比,低成本住宅建設中使用的地板黏劑用量相對較低。世界各國為來自其他國家的難民提供庇護。因此,政府為難民提供臨時或永久的廉價住宅。

亞太地區主導市場

- 亞太地區主導全球地板黏劑市場佔有率。隨著中國、印度和東南亞國協等國家建設活動的增加,該地區地板黏劑的消費量不斷增加。

- 儘管中國政府努力重新平衡經濟,轉向更以服務為導向的型態,但大規模的建設計畫。

- 根據中國國家統計局的報告,中國建築市場規模將從2020年的23.27兆元(3.34兆美元)增加到2021年的25.92兆元(3.72兆美元)。

- 該國擁有全球最大的建築市場,佔全球建築投資總額的20%。預計到 2030 年,中國將在建築方面花費近 13 兆美元。中國持續推動都市化進程,目標是2030年都市化率達70%。

- 由於政府加大對基礎設施計劃的關注,預計住宅和商業領域的需求將迅速復甦,預計 2022 會計年度建築業將成長 10.7%。因此,由於該國建設活動的增加,預計對地板黏劑的需求將會增加。

- 印度政府實施的各種政策,例如智慧城市計劃和到 2022 年普及住宅,預計將為放緩的建設產業提供所需的刺激。此外,最近的房地產法、商品及服務稅和房地產投資信託基金等政策改革預計將在未來幾年減少核准延遲並加強建築業。

- 統計局資料顯示,由於國際需求強勁,2021年韓國承包商贏得的建築訂單成長了兩位數。根據韓國統計廳統計,2021年國內外本土建築企業接到的建築訂單金額為2,459億美元,比2020年增加了31兆韓元。

地板黏劑行業概況

全球地板黏劑市場已部分整合。主要參與者包括西卡股份公司、MAPEI SpA、阿科瑪集團 (Bostik SA)、HB Fuller Company 和陶氏化學。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 全球建設產業快速成長

- 地板黏劑的多功能性、安全性和易用性

- 抑制因素

- VOC排放對健康的有害影響

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 樹脂型

- 環氧樹脂

- 聚氨酯

- 丙烯酸纖維

- 乙烯基塑膠

- 其他樹脂類型

- 科技

- 水性的

- 溶劑型

- 其他技術

- 目的

- 磁磚和石材

- 地毯

- 木頭

- 層壓板

- 彈性地板材料

- 其他用途

- 最終用戶產業

- 住宅

- 商業的

- 產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- 3M

- Arkema Group(Bostik SA)

- Ashland

- Dow

- Forbo Holding AG

- HB Fuller Company

- Henkel AG &Co. KGaA

- Jowat SE

- LATICRETE International Inc.

- MAPEI SpA

- Pidilite Industries Limited

- Sika AG

- Tesa SE

第7章市場機會與未來趨勢

- 對生物基地板黏劑的需求增加

簡介目錄

Product Code: 68260

The Floor Adhesives Market size is estimated at USD 2.02 billion in 2024, and is expected to reach USD 2.56 billion by 2029, growing at a CAGR of 4.85% during the forecast period (2024-2029).

Key Highlights

- The rapidly growing global construction industry and the versatility, safety, and ease of application of floor adhesives, are likely to drive market growth.

- On the flip side, hazardous health effects due to VOC emissions may hinder the market's growth.

- Increasing demand for bio-based floor adhesives will likely act as an opportunity.

- Asia-Pacific dominates the global market, with the largest consumption coming from China, India, and Japan.

Floor Adhesives Market Trends

Increasing Demand from Residential End-user Industry Segment

- Tile and stone adhesives are the most commonly used adhesive type in the residential end-user segment. Additionally, the residential segment is the largest and fastest-growing segment in the market studied.

- The rising middle-class population, coupled with the increasing disposable incomes, has facilitated an expansion in the middle-class housing segment, thereby increasing the use of flooring adhesives.

- According to the World Bank, the value of the global construction industry has increased from USD 22.36 trillion in 2020 to USD 27.18 in 2021.

- The highest growth is expected to be registered in the Asia-Pacific region, owing to China and India's expanding housing construction markets. These two regions are expected to represent over 43.3% of the global middle class by 2030. The Government of India reduced the GST taxes for housing from 12% to 5%. This tax redemption may increase the construction market for middle-class housing.

- Furthermore, in October 2021, Sao Paulo State Housing Union (Secovi-SP) recorded 5,555 new residential units sold in Sao Paulo, Brazil. The number is likely to rise, owing to the increase in consumer spending on residential housing units. Moreover, the growing trend for single-family housing in Brazil is likely support the residential construction industry in the upcoming period.

- Mexico's housing starts and inventory levels reached a 10-year low due to a sharp cut in the federal housing subsidy program and the pandemic that triggered a severe recession. The Programa de Vivienda Social, or social housing program, had a budget increase of 179% to USD 200 million in 2021, thus, supporting construction spending. Moreover, accessible loan facilities and favorable mortgage schemes are expected to benefit residential construction in the country.

- The low-cost housing segment is rising steadily, primarily due to government initiatives to provide affordable housing to the poor in urban and rural regions.

- The consumption of flooring adhesives in constructing low-cost houses is comparatively less than other types of houses. Various countries across the world are providing shelter to refugees from other countries. Hence, governments offer temporary or permanent low-cost housing to refugees.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global floor adhesives market share. With growing construction activities in countries such as China, India, and ASEAN Countries, the consumption of floor adhesives is increasing in the region.

- The Chinese government has rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities, over the next ten years, despite efforts to rebalance its economy to a more service-oriented form.

- The National Bureau of Statistics of China reports that the market for construction works in China increased from CNY 23.27 trillion (USD 3.34 trillion) in 2020 to CNY 25.92 trillion (USD 3.72 trillion) in 2021.

- The country has the largest construction market in the world, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings by 2030. China is promoting and undergoing a process of continuous urbanization, with a target rate of 70% for 2030.

- Because of the government's increased attention to infrastructure projects and the predicted rapid rebound in demand for both residential and commercial segments, the construction sector was expected to grow by 10.7% in FY22. Hence, the growing construction activities in the country are expected to increase the demand for floor adhesives.

- Various policies implemented by the Indian government, such as Smart City projects, Housing for All by 2022, etc., are expected to bring the needed impetus to the slowing construction industry. Moreover, recent policy reforms, such as the Real Estate Act, GST, and REITs, are expected to reduce approval delays and strengthen the construction sector over the next few years.

- According to statistical office data, construction orders won by South Korean builders in 2021 increased by double digits due to robust international demand. According to Statistics Korea, construction orders collected by local builders both at home and overseas totaled USD 245.9 billion in 2021, up by 31 trillion won from 2020.

Floor Adhesives Industry Overview

The global floor adhesives market is partially consolidated. The major players include Sika AG, MAPEI S.p.A, Arkema Group (Bostik SA), HB Fuller Company, and Dow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Growing Global Construction Industry

- 4.1.2 Versatility, Safety, and Ease of Application of Floor Adhesives

- 4.2 Restraints

- 4.2.1 Hazardous Health Effects Due to VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Vinyl

- 5.1.5 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Tile & Stone

- 5.3.2 Carpet

- 5.3.3 Wood

- 5.3.4 Laminate

- 5.3.5 Resilent Flooring

- 5.3.6 Other Applications

- 5.4 End-user Industry

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group (Bostik SA)

- 6.4.3 Ashland

- 6.4.4 Dow

- 6.4.5 Forbo Holding AG

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Jowat SE

- 6.4.9 LATICRETE International Inc.

- 6.4.10 MAPEI SpA

- 6.4.11 Pidilite Industries Limited

- 6.4.12 Sika AG

- 6.4.13 Tesa SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Floor Adhesives

02-2729-4219

+886-2-2729-4219