|

市場調查報告書

商品編碼

1439776

區域供暖 - 市場佔有率分析、行業趨勢與統計、成長預測(2024 - 2029)District Heating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

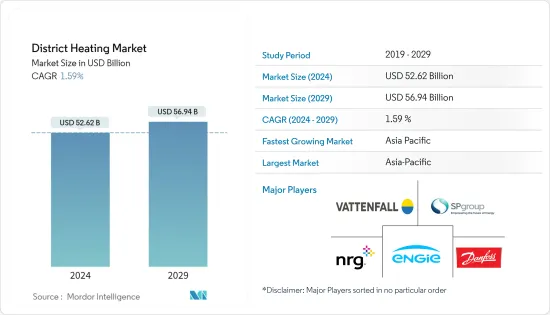

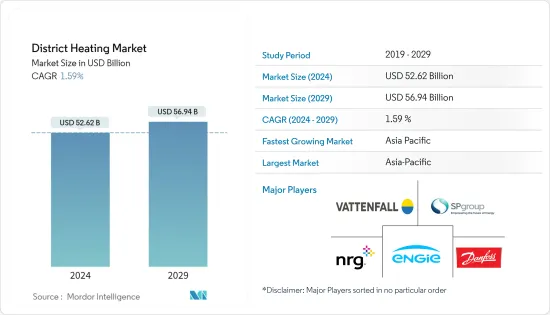

2024年區域供熱市場規模估計為526.2億美元,預計到2029年將達到569.4億美元,在預測期內(2024-2029年)CAGR為1.59%。

在全球經濟制定的積極氣候目標的支持下,區域能源是全球快速成長的產業。根據初步評估,這些區域供熱和冷凍公司已被認為可以透過替代控股結構產生更非凡的成長和價值潛力。透過在區域供熱中納入電動熱泵,可以將更高水準的再生能源用於供熱目的,從而實現能源系統之間的整合和平衡。隨著全球風力渦輪機容量的迅速成長,大型熱泵將在全球綠色能源持續發展和到2050年逐步淘汰化石燃料方面發揮有意義的作用。

主要亮點

- 區域供暖提供了一種透過高度絕緣的管道分配網路以熱水的形式向建築物(住宅和商業空間)提供熱能的方法。增加工業區域供熱使用的潛力是有限的,因為工業製程向區域供熱的轉換涉及不同類型的工業和製程的熱負荷。

- 然而,改用區域暖氣後,電力使用量可減少 11%,化石燃料使用量可減少 40%,各產業最終能源使用總量可節省 6%。

- 工業流程的轉變可能促使全球二氧化碳排放量每年減少 112,000 噸。然而,住宅和商業市場預計將佔據相當大的佔有率。

- 約 6,000 萬歐盟公民享有區域供暖服務,另有 1.4 億人居住在至少擁有一個區域供熱系統的城市。根據歐盟和國際能源總署的報告,DH 透過 6,000 個區域供熱和冷凍網路滿足歐盟約 11-12% 的供熱需求。

- 透過機器學習,其想法是根據客戶資料和營運資料以及天氣預報、國家假期、工作日等來預測熱負荷,以最佳化和規劃熱生產,從而降低熱損失並處理尖峰負荷。這種潛力也擴展到故障檢測中的智慧演算法,以識別洩漏、低效加熱系統或與單一組件相關的故障所導致的錯誤。

- 2019 年 10 月,Enermax Oy 開發了坦佩雷電力公司的智慧區域供熱服務,以平衡區域供熱尖峰輸出、最佳化建築物供暖並降低供熱成本。該部署可以減少 5-10% 的能源消耗。

- 為了應對 COVID-19 大流行,國際區域能源協會 (IDEA) 召集了一個工作小組,以幫助其成員和其他受影響的個人獲得必要的資源和資訊,以幫助應對這一史無前例的事件。然而,由於勞動力短缺和全國範圍內的封鎖,大多數區域供暖項目都被擱置。此外,Statkraft等歐洲公司優先考慮資源以保障工廠安全穩定的區域供熱運作。

區域供熱市場趨勢

住宅見證成長

- 區域供暖在全世界工業化國家普遍使用。與單獨的建築設備相比,它具有多種優勢,包括更高的安全性和可靠性、更低的排放以及更大的燃料靈活性,特別是在使用生質能或垃圾等替代燃料時。

- 區域供暖廣泛應用於單戶住宅、多戶住宅、高層建築和大型城鎮。需要區域供暖的主要家庭用途是空間供暖和熱水供暖。區域供熱市場在丹麥、冰島、德國、美國、其他歐盟國家和加拿大等一些寒冷氣候國家已經成熟。

- 然而,由再生能源供電的區域供熱網路可以顯著減少排放,並幫助政府實現其減排目標。各國政府制定了法定責任和激勵措施,例如贈款、補貼和能源稅,以提高再生能源在供熱中的比例。

- 此外,區域供熱以前主要由發電廠、垃圾發電設施和工業活動的副產品提供動力。然而,瑞典現在正在將更多的再生能源納入其中。由於競爭,這種本土化的電力已上升為全國家庭暖氣產業的佼佼者。

亞太地區在區域供熱市場中佔有重要佔有率

- 推動中國市場成長的主要原因是可支配收入的增加、對二氧化碳排放的擔憂增加以及暖氣和冷氣系統的高使用率。此外,經合組織預計,到 2060 年,印度和中國的人均 GDP 可能會成長七倍。

- 亞太地區各國政府也正在與當地企業合作開發國內市場。例如,北京集中供熱集團是中國一家主要的供熱公司。該公司為北京市中央政府和軍隊、中國大使館、重要企業和組織以及一般民眾提供暖氣解決方案。在其他省份也擁有大量項目。

- 現代區域供暖系統對於東南亞國家尤其重要,這些國家的空氣污染造成長期經濟損失和數十萬人過早死亡。東南亞製冷的未來調查了 2040 年能源消耗、尖峰電力需求和二氧化碳排放的預期成長。

- 印度和澳洲是該地區最大的兩個市場。由於對區域供熱和製冷解決方案的投資增加以及政府推廣這些解決方案的活動增多,區域市場正在不斷成長。

- 為了應對能源危機和氣候變化,韓國政府制定了推廣零能耗建築的國家計劃,並近年來制定了多項針對新建和現有建築的能源效率政策來實現這些計劃。

區域供熱產業概況

區域供熱市場競爭適中,擁有許多全球和區域參與者。這些公司正在努力擴大其全球消費者基礎。為了在預測期內獲得競爭優勢,他們還優先考慮開發創新解決方案、策略合作以及其他有機和無機成長策略的研發支出。

2023 年5 月,Vattenfall AB 和可口可樂宣佈在瑞典合作,並製定了雄心勃勃的氣候目標,到2040 年在整個價值鏈上實現淨零排放。兩家公司啟動了一個擁有三個充電站的試點項目,以滿足電力需求電力運輸。

2023 年3 月,NRG Energy Inc 完成了對Vivint Smart Home, Inc. 的收購,加速了NRG 以消費者為中心的成長策略,並為消費者提供簡單、互聯的體驗,以智慧地為家庭供電、保護和管理。 NRG 處於能源和家庭服務的交叉點,擁有獨特的端到端智慧家庭生態系統,並以卓越的客戶體驗為基礎。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19 對市場的影響

- 政府關於區域供暖轉型的措施和計劃

- 區域供暖的主要趨勢和創新

第 5 章:市場動態

- 市場促進因素

- 對節能和經濟高效的供暖系統的需求增加

- 都市化和工業化不斷發展

- 市場限制

- 基礎設施成本高

第 6 章:市場區隔

- 依植物類型

- 鍋爐

- 熱電聯產 (CHP)

- 依熱源分類

- 煤炭

- 天然氣

- 再生能源

- 石油和石油產品

- 依應用

- 住宅

- 商業和工業

- 依地理

- 北美洲

- 歐洲

- 亞太

- 世界其他地區

第 7 章:競爭格局

- 公司簡介

- Vattenfall AB

- SP Group

- Danfoss Group

- Engie

- NRG Energy Inc.

- Statkraft AS

- Logstor AS

- Shinryo Corporation

- Vital Energi Ltd

- Gteborg Energi

- Alfa Laval AB

- Ramboll Group AS

- Keppel Corporation Limited

- FVB Energy

第 8 章:投資分析

第 9 章:未來的機會

The District Heating Market size is estimated at USD 52.62 billion in 2024, and is expected to reach USD 56.94 billion by 2029, growing at a CAGR of 1.59% during the forecast period (2024-2029).

District energy is a quick-growing industry globally, supported by the aggressive climate objectives set by the global economies. Based on initial assessments, these district heating and cooling companies have been recognized as operations that could produce more extraordinary growth and value potential with an alternative holding structure. By including electrically powered heat pumps in the district heating supply, higher renewable energy levels can be used for thermal purposes, generating integration and balance between energy systems. With a burgeoning global wind turbine capacity, big heat pumps will play a meaningful role in the sustained global green energy development and phasing out fossil fuels by 2050.

Key Highlights

- District heating provides a method of delivering thermal energy to buildings (homes and commercial space) in the form of hot water through a distribution network of highly insulated pipelines. The potential for increased use of industrial district heating is limited because conversions of industrial processes to district heating involve varying heat loads amongst types of industries and processes.

- However, the conversion to district heating serves an 11% reduction in the use of electricity and a 40% reduction in the use of fossil fuels, with a total energy end-use saving of 6% among industries.

- Converting the industrial processes has led to a potential reduction of global carbon dioxide emissions by 112,000 tons per year. However, the residential and commercial markets are expected to hold a significant share.

- Approximately 60 million EU citizens are served by district heating, and an additional 140 million people live in cities with at least one district heating system. According to reports by the EU and the IEA, DH meets around 11-12% of the EU's heat demand via 6,000 district heating and cooling networks.

- With machine learning, the idea is to predict heat loads from customer data and operational data, along with weather forecasts, national holidays, weekdays, etc., to optimize and plan heat production, thereby lowering heat loss and handling peak loads. The potential is extended to intelligent algorithms in fault detection to identify leakages, inefficient heating systems, or errors from failure related to single components.

- In October 2019, the smart district heating service of Tampere Power Utility was developed by Enermax Oy to balance peak district heating outputs, optimize heating in buildings, and reduce heating costs. The deployment could cut down energy consumption by 5-10%.

- In response to the COVID-19 pandemic, the International District Energy Association (IDEA) convened a Working Group to help its members and other affected individuals get the essential resources and information required to help navigate this unprecedented event. However, most district heating projects are on hold due to the scarcity of workforce and countrywide lockdowns. Moreover, European companies like Statkraft prioritize resources to safeguard the plants' safe and stable district heating operation.

District Heating Market Trends

Residential to Witness the Growth

- District heating is commonly used in industrialized nations worldwide. It has several advantages over individual building equipment, including improved safety and dependability, lower emissions, and greater fuel flexibility, particularly when utilizing alternative fuels such as biomass or garbage.

- District heating is widely utilized in single-family houses, multi-family dwellings, high-rise buildings, and mega townships. The primary home uses that require district heating are space and water heating. District heating markets are well-established in several cold-climate nations, such as Denmark, Iceland, Germany, the United States, other EU countries, and Canada.

- However, the District heating networks powered by renewable energy sources may significantly reduce emissions and help governments meet their emission reduction objectives. Various governments have established statutory responsibilities and incentives, such as grants, subsidies, and energy taxes, to boost the percentage of renewables in heat generation.

- Moreover, District heating was previously primarily powered by byproducts of power plants, waste-to-energy facilities, and industrial activities. However, Sweden is now incorporating more renewable energy sources into the mix. Due to competition, this localized kind of electricity has risen to the national top home-heating industry.

Asia-Pacific Holds a Significant Share in the District Heating Market

- The primary reasons driving the market's growth in China are rising disposable income, increased worries about CO2 emissions, and high usage of heating and cooling systems. Moreover, OECD states that projections for India and China's per capita GDP might climb sevenfold by 2060.

- Governments in the Asia-Pacific region are also collaborating with local businesses to develop the home market. For example, the Beijing District Heating Group is a major heating firm in China. The firm provided heating solutions to the central Beijing government and army, Chinese embassies, significant corporations and organizations, and the general people. It also has a large number of projects in other provinces.

- Modern district heating systems are especially important for Southeast Asian countries, where air pollution causes long-term economic expenses and hundreds of thousands of premature fatalities. The Future of Cooling in Southeast Asia investigates the anticipated growth in energy consumption, peak power demand, and CO2 emissions by 2040.

- India and Australia are two of the region's biggest marketplaces. The regional market is rising due to increased investment in district heating and cooling solutions and increased government activities to promote these solutions.

- To respond to energy crises and climate change, the South Korean government established a national plan to promote zero energy buildings, and several energy efficiency policies for new and existing buildings in recent years have been developed to achieve these plans.

District Heating Industry Overview

The district heating market is moderately competitive and has many global and regional players. These companies are working hard to broaden their consumer base globally. To gain a competitive advantage during the predicted term, they also prioritize R&D expenditure in developing innovative solutions, strategic collaborations, and other organic and inorganic growth tactics.

In May 2023, Vattenfall AB and Coca-Cola announced the collaboration in Sweden and have set ambitious climate targets for net zero emissions across their entire value chains by 2040. The companies have initiated a pilot project with three charging stations to meet the need for powering electric transport.

In March 2023, NRG Energy Inc completed its acquisition of Vivint Smart Home, Inc. by accelerating NRG's consumer-focused growth strategy and offering consumers simple, connected experiences to power, protect, and manage their homes intelligently. NRG is at the intersection of energy and home services, with a unique end-to-end smart home ecosystem underpinned by our exceptional customer experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Government Initiatives and Programs on District Heating Transition

- 4.6 Key Trends and Innovations in District Heating

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Augmented Demand for Energy-efficient and Cost-effective Heating Systems

- 5.1.2 Rising Urbanization and Industrialization

- 5.2 Market Restraints

- 5.2.1 High Infrastructure Cost

6 MARKET SEGMENTATION

- 6.1 By Plant Type

- 6.1.1 Boiler

- 6.1.2 Combined Heat and Power (CHP)

- 6.2 By Heat Source

- 6.2.1 Coal

- 6.2.2 Natural Gas

- 6.2.3 Renewables

- 6.2.4 Oil and Petroleum Products

- 6.3 By Application

- 6.3.1 Residential

- 6.3.2 Commercial and Industrial

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vattenfall AB

- 7.1.2 SP Group

- 7.1.3 Danfoss Group

- 7.1.4 Engie

- 7.1.5 NRG Energy Inc.

- 7.1.6 Statkraft AS

- 7.1.7 Logstor AS

- 7.1.8 Shinryo Corporation

- 7.1.9 Vital Energi Ltd

- 7.1.10 Gteborg Energi

- 7.1.11 Alfa Laval AB

- 7.1.12 Ramboll Group AS

- 7.1.13 Keppel Corporation Limited

- 7.1.14 FVB Energy