|

市場調查報告書

商品編碼

1439766

包裝印刷:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Packaging Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

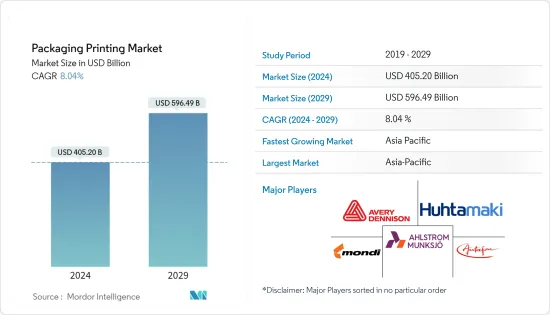

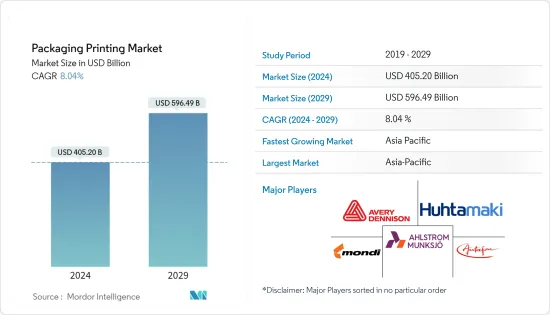

預計2024年包裝印刷市場規模為4,052億美元,預計2029年將達到5964.9億美元,在預測期內(2024-2029年)年複合成長率為8.04%。

技術進步,加上激烈的競爭以及品牌認知度驅動的對獨特包裝的需求,預計將推動市場成長。特別是,食品、食品和飲料和化妝品等最終用戶產業對創新包裝的需求不斷成長,預計將導致市場擴張。

主要亮點

- 數位印刷技術的快速崛起促進了印刷標籤市場的成長,這使得標籤印刷市場更加複雜,並增加了數位印刷標籤的採用。彈性、多功能性和高圖形標準是主要的成長要素。彈性凸版印刷方法可以在金屬薄膜、塑膠、賽珞玢、紙張和紙板表面進行印刷。

- 此外,人工智慧、機器學習、物聯網、資料分析等的進步使得所提供的服務變得更加個人化。數位印刷的融合使得大量訂單的印刷個人化具有優勢。然而,成本因素仍然是一個主要障礙。

- RFID(無線射頻辨識)使用無線電波無線識別各種「標記」物體和人。 RFID 技術在市場研究中發揮著重要作用,因為它提高了列印技術的有效性。支援 RFID 的印表機有各種尺寸和容量,並且可以配置 RFID 印表機軟體,以滿足廣泛的安全和其他業務需求。

- 包裝印刷產業的發展、美學需求、產品差異化和技術進步是數位印刷包裝市場的促進因素。安裝生產和印刷設備需要大量初始投資。設立工廠和購買印刷機需要較高的投資。對經濟且永續的創新印刷技術的需求不斷成長。

- 在 COVID-19 期間,包裝行業很少出現封鎖,因為與其他行業相比,包裝、食品和飲料以及醫療行業被認為是至關重要的。此外,人們對主食和藥品的巨大需求是由於恐慌性搶購造成的。多種供應鏈限制對包裝印刷市場的成長產生了複雜的影響。

包裝印刷市場趨勢

食品和飲料行業預計將佔據很大的市場佔有率

- 由於全球新興企業的增加、食品和非食品類別的多樣化以及大流行期間食品和飲料需求的增加,包裝行業在過去幾年中經歷了重大轉型。

- 由於飲食習慣的改變,消費者對包裝產品的需求不斷增加,食品包裝印刷的需求不斷增加,而不斷變化的生活方式可能對市場產生至關重要的影響。由於高阻隔性、保存期限和消費者安全,人均可支配收入的增加和人口成長預計將促進產品需求。食品包裝上的印刷用於消費者資訊和行銷目的。印刷用於各種包裝材料。塑膠、紙張、紙板和軟木可直接印刷。

- 隨著食品內容被印在產品上,買家對食品的認知度不斷提高,對產品透明度的需求不斷增加,從而增加了食品領域對包裝印刷的需求。人們對經過最少加工或未經加工、不含防腐劑且保存期限較長的天然、優質食品的需求不斷成長。包裝食品有多種用途,包括屏障、預防污染、方便性和份量控制。永續包裝透過安全考慮來減少食品廢棄物和損失,預防食品源性疾病和化學污染,並維持食品品質。

- 消費者的購買行為在包裝食品市場的成長中扮演重要角色。近年來,消費者開始轉向簡便食品。快節奏、忙碌的生活方式、準備用餐的時間限制、電子商務的成長以及可支配收入的增加正在推動包裝食品的銷售。對便利性的日益偏好預計將推動受訪市場的需求。

- 本已蓬勃發展的電子商務產業在疫情期間銷售額激增。疫情期間,許多雜貨店已轉向線上業務並促進非接觸式購物。根據 UNCTAD 的數據,2020 年線上零售業的銷售額從 16% 成長至 19%。

- 根據專門從事線上食品訂購和宅配的荷蘭線上平台Just Eat Takeaway.com 的數據顯示,2021 年Just Eat Takeaway.com 收到約10.9 億份訂單和5.88 億份訂單,與前一年相比大幅成長,帶動包裝印刷市場向前發展。

亞太地區可望成為快速成長的市場

- 亞太地區的包裝印刷市場廣泛普及,印刷技術多樣,應用廣泛。中國、印度、日本和韓國等國家與食品和飲料飲料、消費性電子產品等相關的各個行業正在為該地區的包裝解決方案創造巨大的需求。

- 亞太地區對包裝印刷的需求預計將隨著包裝產業的成長而增加。核心家庭的增加、新包裝材料、客戶舒適度需求的增加以及人口老化正在推動包裝行業的發展。預計推動消費者成長的另一個因素是對包裝飲料的需求不斷成長。對瓶裝水、酒精飲料、碳酸飲料和罐裝果汁不斷成長的需求正在增加瓶裝飲料的購買和消費。

- 包裝印刷廣泛應用於食品和飲料、藥品、家居及化妝品、電子設備、汽車業。例如,由於在食品和飲料和食品和飲料包裝上印刷數位資料以傳達產品有效期限、內容物和營養價值的趨勢不斷增加,包裝印刷在食品和飲料行業中普遍使用。

- 包裝印刷應用的需求不斷成長可能會推動預測期內的市場成長。此外,永續印刷需求的成長、軟包裝需求的增加、成本效益和包裝廢棄物的減少等因素正在推動包裝印刷市場的發展。醫療保健產業的成長和便利包裝的普及是包裝印刷市場的主要促進因素。

- 在亞太地區,包裝印刷市場主要受到個人消費增加和對永續產品需求不斷成長的推動。加工食品消費的增加正在推動市場成長。包裝印刷的新興技術也正在推動要素市場發展。製藥業的成長和對方便包裝的需求不斷增加是該市場的主要成長要素。

包裝印刷業概況

由於 Mondi PLC、Ahlstrom-Munksjo Oyj、Autajon CS、Huhtamaki 軟包裝 (Huhtamaki Oyj) 和 Avery Dennison Corporation主要企業的存在,包裝印刷市場競爭對手之間的競爭非常激烈。我們不斷創新產品的能力使我們比競爭對手更具競爭優勢。透過策略合作夥伴關係、研發和併購,每家公司都能夠在市場上佔據更大的佔有率。

- 2022 年 5 月 - 艾利丹尼森圖形解決方案宣布與 Siser North America 合作,進軍 DIY/工匠領域。 Siser 是傳熱乙烯基市場的領導者,也是個人化和改裝專家,已涉足消費品工藝品市場 40 多年。

- 2022 年 5 月 - Mondi 在芬蘭庫奧皮奧工廠投資 1.25 億歐元。這項重大資本投資計劃將提高產能、增強競爭力、提高安全性並改善當地環境,符合 Mondi 的 MAP2030永續性目標。對庫奧皮奧工廠的投資認可了 Mondi 的永續產品系列及其對當地經濟的重要性。庫奧皮奧工廠生產 ProVantage Powerfrude,這是一種高性能、高品質瓦楞紙板級半化學瓦楞紙,用作新鮮水果和蔬菜托盤和盒子的組成部分。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間存在敵對關係

- 市場促進因素

- RFID和數位印刷的使用需求

- 對數位印刷和永續包裝印刷的需求不斷成長

- 市場限制因素

- 高資金投入

- 包裝印刷規定

第5章市場區隔

- 透過印刷技術

- 平張膠印

- 凹版印刷

- 彈性凸版印刷

- 數位印刷

- 網版印刷

- 按墨水類型

- 溶劑型油墨

- UV固化油墨

- 水性油墨

- 按包裝類型

- 標籤

- 塑膠

- 玻璃

- 金屬

- 紙板

- 按用途

- 化妝品/家庭護理

- 食品和飲料

- 藥品

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- Mondi PLC

- Ahlstrom-Munksjo Oyj

- Autajon CS

- Huhtamaki Flexible Packaging(Huhtamaki Oyj)

- Avery Dennison Corporation

- CCL Industries Inc.

- Clondalkin Group Holdings BV

- Constantia Flexibles Group GmbH

- Amcor PLC

- Smurfit Kappa Group PLC

- DS Smith PLC

- Georgia-Pacific LLC

- International Paper Company

- Sealed Air Corporation

- WestRock Company

- Stora Enso Oyj

- Sonoco Products Company

- Mayr-Melnhof Karton AG

- Trustpack UAB

- Duncan Printing Group

第7章 投資分析

第8章市場的未來

The Packaging Printing Market size is estimated at USD 405.20 billion in 2024, and is expected to reach USD 596.49 billion by 2029, growing at a CAGR of 8.04% during the forecast period (2024-2029).

The technological advancements, coupled with demand for creative packaging, driven by intense competition and brand awareness, are expected to aid the growth of the market. The growing demand for innovative packaging from end-user segments, such as food, beverage, and cosmetics, among others, is expected to lead to the expansion of the market studied.

Key Highlights

- The growth of the print label market is augmented by the rapid rise of digital print technology that has made the label printing market more sophisticated and increased the adoption of digital print labels. Their flexibility and versatility, along with the high graphics standards, are the major growth features. It is possible to print on metallic films, plastics, cellophane, paper, and corrugated surfaces using the flexographic method.

- Moreover, advancements such as AI, machine learning, IoT, and data analytics, have personalized offerings to a great extent. The convergence in digital printing enables superiority in terms of print personalization for large-volume orders. However, the cost factor remains a big hurdle.

- RFID (Radio Frequency Identification) uses radio waves to identify various "tagged" objects or people wirelessly. RFID technology plays a vital role in the market study because it enhances the effectiveness of printing technology. RFID-enabled printers come in various sizes and capacities and can be configured using RFID printer software to meet a wide range of security and other business needs.

- Development in the packaging printing industry, demand for aesthetics, product differentiation, and technological advancements are some digitally printed packaging market drivers. A significant initial investment is required to install production and printing equipment. Setting up a factory or purchasing a printing press requires higher investments. There is a growing demand for economical, sustainable, and innovative printing technologies.

- During COVID-19, as compared to other industries, fewer lockdowns were observed in the packaging industry as the packaging, food, beverage, and medical industries were considered essential. Furthermore, the huge demand for staples and medicines was due to panic-driven buying. Several supply chain constraints resulted in a mixed COVID-19 impact on the packaging printing market growth.

Packaging Printing Market Trends

Food and Beverage Sector is Expected to Hold Significant Market Share

- The packing industry has undergone an immense transformation over the last couple of years, owing to the increase in the number of start-ups worldwide, the introduction of diversified categories of food and non-food products, and increased demand for food and beverage during the pandemic.

- The demand for printing in food packaging is increasing owing to rising consumer demand for packaged products due to the shift in eating habits, and evolving lifestyles may have an imperative impact on the market. A rise in per capita disposable income and a growing population are expected to aid in the product demand owing to high barrier properties, shelf life, and consumer safety. Printing on food packaging materials is used for consumer information and marketing purposes. Printings are used with many different packaging materials. Plastics, paper, board, and cork may be directly printed.

- As the food contents are printed on the product helps in the awareness regarding the food item; the demand for product transparency increased among the buyers, which has led to high demand for packaging printing in the food sector. There is a growing demand for natural and highquality foods, which are minimally processed or unprocessed, do not contain preservatives, and offer a longer shelf-life. Packaged food is used for various purposes, such as barrier and contamination protection, convenience, and portion control. Sustainable packaging addresses food waste and loss reduction by safety issues by preventing food-borne diseases and chemical contamination and preserving food quality.

- A consumer's buying behavior plays a vital role in the growth of packaged food market. For a couple of years, consumers have been tilted toward convenient food. A fast-paced, hectic lifestyle, time constraints for meal preparations, developing e-commerce, and rising disposable income have boosted packaged food sales. An increasing preference for convenience is expected to bolster the demand in the market studied.

- The e-commerce sector, which was already booming, saw a sudden increase in sales during the pandemic. During the pandemic, many grocers shifted their business online to promote no-contact shopping. According to UNCTAD, the online retail sector grew its sales from 16% to 19% in 2020.

- According to Just Eat Takeaway.com, a Dutch online platform specializing in online food ordering and home delivery, in 2021, Just Eat Takeaway.com received approximately 1.09 billion orders, a significant increase compared to the previous year when the company counted 588 million, which propelled the packaging printing market.

Asia-Pacific is Expected to be the Fastest-growing Market

- The packaging printing market is widespread in the Asia-Pacific region concerning multiple printing technologies and applications in various industries. Various industries related to food and beverage, consumer electronics, etc., in countries like China, India, Japan, and South Korea have resulted in significant demand for packaging solutions in the region.

- The demand for packaging printing is expected to rise in the Asia-Pacific region alongside the packaging industry. The packaging industry is propelled by the growing increase of nuclear families, new packaging material, increasing customer comfort needs, and population aging. Another factor anticipated to drive consumer growth is the rising demand for packaged drinks. The growing demand for bottled water, alcoholic beverages, carbonated soft drinks, and canned juices has increased the purchase and consumption of bottled beverages.

- Packaging printing has broadly used in the food and beverage, pharmaceutical, household and cosmetic, electronic, and automobile industries. For example, packaging printing is commonly used in the food and beverage industry, owing to the growing trend of digital data printing on food packages to convey the product's shelf-life, content, and nutritional value.

- The rising demand for packaging printing applications would fuel market growth over the forecast period. Moreover, factors such as growth in demand for sustainable printing, growing demand for flexible packaging, cost-effectiveness, and decreased packaging waste, drive the packaging printing market. The growing healthcare sector and the popularity of convenient packaging are the main drivers of the packaging printing market.

- In the Asia-Pacific region, the packaging printing market is primarily driven by increasing consumer spending and rising demand for sustainable products. An increase in processed food consumption is driving the market's growth. Emerging technologies for packaging printing can also be seen as a driving factor for the development of the market. The growing pharmaceutical industry and the increasing demand for convenient packaging are major growth factors for this market.

Packaging Printing Industry Overview

The competitive rivalry in the packaging printing market is high, owing to the presence of some key players, such as Mondi PLC, Ahlstrom-Munksjo Oyj, Autajon CS, Huhtamaki Flexible Packaging (Huhtamaki Oyj), and Avery Dennison Corporation, among others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over others. Through strategic partnerships, R&D, and mergers and acquisitions, the players have been able to gain a greater footprint in the market.

- May 2022 - Avery Dennison Graphics Solutions stated that it would join forces with Siser North America to penetrate the DIY/crafter sector. Siser, a market leader in heat-transfer vinyl and a specialist in personalization and modification, has been in the consumer craft market for more than 40 years.

- May 2022 - Mondi invested EUR 125 million in the Kuopio mill in Finland. Following Mondi's MAP2030 sustainability objectives, the major capex project will boost production capacity, strengthen competitiveness, improve safety, and help the local environment. Mondi's investment in the Kuopio mill recognizes its importance to Mondi's sustainable product portfolio and the local economy. Kuopio mill manufactures semi-chemical fluting - ProVantage Powerflute, a high-performance, high-quality containerboard grade used as an integral component of fresh fruit and vegetable trays and boxes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Demand for the Use of RFIDs and Digital Printing

- 4.4.2 Growing Demand for Digital and Sustainable Packaging Printing

- 4.5 Market Restraints

- 4.5.1 High Capital Investments

- 4.5.2 Packaging and Printing Regulations

5 MARKET SEGMENTATION

- 5.1 By Printing Technology

- 5.1.1 Offset Lithography

- 5.1.2 Rotogravure

- 5.1.3 Flexography

- 5.1.4 Digital Printing

- 5.1.5 Screen Printing

- 5.2 By Ink Type

- 5.2.1 Solvent-based Ink

- 5.2.2 UV-curable Ink

- 5.2.3 Aqueous Ink

- 5.3 By Packaging Type

- 5.3.1 Label

- 5.3.2 Plastic

- 5.3.3 Glass

- 5.3.4 Metal

- 5.3.5 Paper and Paperboard

- 5.4 By Application

- 5.4.1 Cosmetic and Homecare

- 5.4.2 Food and Beverage

- 5.4.3 Pharmaceutical

- 5.4.4 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mondi PLC

- 6.1.2 Ahlstrom-Munksjo Oyj

- 6.1.3 Autajon CS

- 6.1.4 Huhtamaki Flexible Packaging (Huhtamaki Oyj)

- 6.1.5 Avery Dennison Corporation

- 6.1.6 CCL Industries Inc.

- 6.1.7 Clondalkin Group Holdings BV

- 6.1.8 Constantia Flexibles Group GmbH

- 6.1.9 Amcor PLC

- 6.1.10 Smurfit Kappa Group PLC

- 6.1.11 DS Smith PLC

- 6.1.12 Georgia-Pacific LLC

- 6.1.13 International Paper Company

- 6.1.14 Sealed Air Corporation

- 6.1.15 WestRock Company

- 6.1.16 Stora Enso Oyj

- 6.1.17 Sonoco Products Company

- 6.1.18 Mayr-Melnhof Karton AG

- 6.1.19 Trustpack UAB

- 6.1.20 Duncan Printing Group