|

市場調查報告書

商品編碼

1438493

企業金鑰管理:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Enterprise Key Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

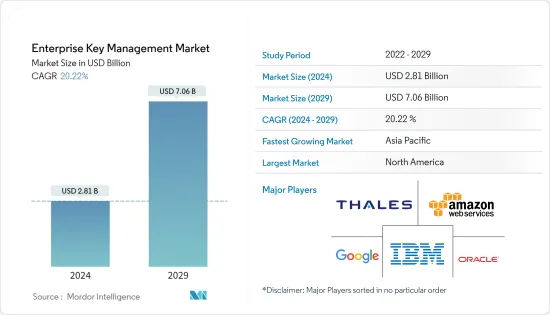

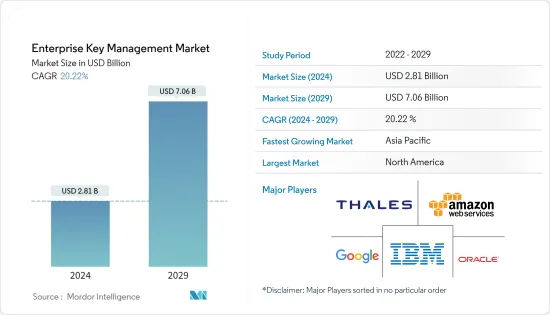

2024年企業金鑰管理市場規模估計為 28.1 億美元,預計到 2029 年將達到 70.6 億美元,在預測期間(2024-2029 年)以 20.22% 的複合年增長率增長。

資料外洩和身分盜竊的激增促使許多行業採用先進的企業安全解決方案。市場成長預計將由轉向數位環境以提供數位服務的組織以及需要保護的敏感資料量的增加所推動。

主要亮點

- 企業金鑰管理使用集中管理的解決方案來保護用於加密企業分散式 IT 環境中的敏感資料的加密金鑰。組織內資料的成長、隱私法的擴展、資料外洩和駭客攻擊的風險,以及保護哪些資料和成本的決策都會影響資料安全策略。資料保護需要具有強大架構和內建安全性的系統。當今的企業更頻繁地使用資料保護技術,這產生了重大影響,增加了複雜性並增加了成本。

- 隨著物聯網的引入,產生的資料總量將會增加,工業資料將轉化為工業巨量資料。由於物聯網解決方案提供的人工智慧、機器學習和即時資料處理的結合,物聯網設備的數量預計將顯著增加。預計到 2023 年,亞洲將引領物聯網設備新增數量超過目前估計的 35 億台。由於採用物聯網和雲端技術而促使的大量資料成長預計將推動市場發展。

- 世界各國政府已開始透過頒布 GDPR 和 CCPA 等法律來報復備受矚目的資料外洩事件。滿足這些要求表明您的組織充分意識到威脅並採取措施解決它。這些標準旨在確保最低程度的安全性。因此,關鍵資料遺失和合規性問題推動了對企業金鑰管理服務的需求。

- 缺乏熟練的專業人員可能會影響企業金鑰管理解決方案的實施。雲端基礎的解決方案正在迅速被企業採用,並提供許多好處。儘管如此,仍然存在安全和隱私問題,例如儲存資料的資料外洩、介面駭客攻擊、憑證保護和 DoS 攻擊。預計此類活動將阻礙市場成長。

- COVID-19感染疾病以及俄羅斯和烏克蘭之間的衝突正在影響世界各地人們的生活。所有其他企業和市場均陷入低迷。然而,在疫情之後,企業金鑰管理市場總體上取得了進展,規模、產品、模式和中心參與者和組織的興趣都在擴大,這些參與者和組織將受益於先前的市場經驗。

企業金鑰管理市場趨勢

由於採用物聯網和雲端技術,資料顯著增加

- 全球範圍內參與數位化趨勢的公司不斷湧入,大量資料被創建、儲存、處理和通訊。同時, IT基礎設施基礎設施變得越來越開放和互聯,使得資料更容易訪問,因此更容易被竊取。加密是組織可用於保護敏感資料(無論其位於何處)的基本工具之一。組織必須提高金鑰管理能力,以滿足不斷成長的資料安全要求。

- 各種規模的組織對雲端服務的需求和採用不斷增加,以及各個最終用戶行業對雲端服務的需求不斷增加,以最大限度地提高營運安全性,這肯定會增加企業金鑰管理的市場價值。混合雲端和資料中心基礎設施已成為許多企業的新常態。根據 Thales 最近的全球威脅報告,全球 84% 的組織使用多個 IaaS 供應商,34% 使用 50 多個 SaaS 應用程式。同樣,根據 CloudTech 的報告,84% 的組織使用混合雲端平台。此外,隨著 BYOD 和物聯網的日益普及,許多端點設備都連接到企業網路。

- 雲端基礎的部署的增加和資料外洩的增加,加上保護敏感資料的法規和合規性的不斷增加,預計將推動企業金鑰管理市場的成長。網路用戶的增加和數位服務的快速採用促使組織收集的敏感資料量呈指數級成長。進一步推測這將促進加密解決方案的採用。

- 對雲端基礎的服務和硬體安全模組的投資不斷增加,以促進企業金鑰管理和資料保護,預計將進一步推動市場成長。然而,與缺乏熟練勞動力、更換現有IT基礎設施的成本以及使用企業金鑰管理解決方案的複雜性相關的問題可能會限制市場成長。

預計北美市場佔有率最高

- 由於IBM、甲骨文和惠普等全球知名企業管理市場主要企業的存在推動了採用率,預計北美將在整個預測期內保持最全面的市場佔有率。該地區的優勢在於其發達的IT基礎設施基礎設施以及雲端服務的日益普及。

- 由於中小企業的擴張和成長,不斷上升的網路威脅和安全問題促使各國採用企業金鑰管理解決方案。政府支持IT基礎設施基礎設施發展的政策也拉動了企業金鑰管理的需求。

- 網路威脅推動了區域對企業金鑰管理解決方案的需求。預計美國和加拿大將在該地區保持重要的市場佔有率。根據身分盜竊資源中心的資料,2021 年光是美國就發生了約 18.62 億起資料外洩事件。

- 數位服務普及的提高和IT基礎設施的快速擴張預計將在未來幾年進一步推動市場擴張。此外,BFSI 行業預計將在未來推動該市場方面發揮重要作用。這項優勢也可以歸功於發達的IT基礎設施和雲端服務的日益普及。此外,區域和國際參與者之間不斷增加的併購活動預計將在一定程度上支持該地區的市場成長。

企業金鑰管理產業概況

企業金鑰管理市場是一個高度分散的市場。然而,雲端服務供應商中的主導者包括金雅拓(Thales)、微軟、Google、AWS等。這些公司利用策略合作舉措來提高其產品、市場佔有率和盈利。

- 2022 年 11 月,Zoom 宣佈對其企業級安全性和可靠性平臺進行重要更新,以提供必要的隱私和安全功能,以便輕鬆連接並保持井井有條,以滿足小型企業和大型企業的需求。

- 2022 年 7 月,Axis Bank 與 Amazon Web Services (AWS) 合作,提供 AWS 金鑰管理服務、加密作業 (KMS) 的完全託管服務、AWS CloudHSM、雲端基礎的硬體安全模組 (HSM) 和 AWS Identity。管理(IAM)、AWS 加密SDK 和用戶端加密庫可提高資料安全性、合規性和客戶經驗。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 市場促進因素

- 最佳化安全的整體擁有成本,同時最大限度地提高營運效率和安全性

- 引人注目的資料遺失和合規性問題

- 由於採用物聯網和雲端技術,資料顯著增加

- 市場限制因素

- 缺乏意識和熟練的勞動力

- 評估 COVID-19 對市場的影響

第5章市場區隔

- 部署類型

- 雲

- 本地

- 公司規模

- 中小企業

- 主要企業

- 目的

- 磁碟加密

- 文件和資料夾加密

- 資料庫加密

- 通訊加密

- 雲端加密

- 最終用戶產業

- BFSI

- 衛生保健

- 政府和國防,

- 資訊科技和電信

- 零售

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Amazon Web Services Inc.

- Unbound Tech Ltd(Dyadic Security)

- Thales Group(Gemalto NV)

- Google Inc.(Alphabet)

- IBM Corporation

- Oracle Corporation

- Hewlett Packard Enterprise

- Quantum Corporation

- Winmagic Inc.

- Microsoft Corporation

- Townsend Data Security LLC

第7章 投資分析

第8章市場機會及未來趨勢

The Enterprise Key Management Market size is estimated at USD 2.81 billion in 2024, and is expected to reach USD 7.06 billion by 2029, growing at a CAGR of 20.22% during the forecast period (2024-2029).

Many sectors have adopted advanced corporate security solutions due to the surge in data breaches and the theft of private information. Market growth is expected to be driven by the shift in organizations to a digital environment to offer digital services and the increasing volume of sensitive data to be protected.

Key Highlights

- Enterprise key management uses a centralized management solution to safeguard the cryptographic keys used to encrypt sensitive data throughout a distributed IT environment inside a business. The expansion of data within an organization, expanding privacy laws, the danger of data breaches and hacking, and decisions about which data to safeguard and at what expense all impact data security strategies. Data protection requires a system with a solid architecture and built-in security. Today's businesses use data protection techniques more frequently, which has substantial repercussions, added complexity, and expense.

- The adoption of IoT increases the total volume of the generated data transforming the industrial data into industrial Big Data. With the combination of AI, machine learning, and real-time data processes delivered by IoT solutions, the number of IoT devices is set to grow substantially. Asia is expected to lead the way in adding more IoT devices than the current estimate of 3.5 billion by 2023. The massive data growth due to the adoption of IoT and cloud technologies is anticipated to drive the market.

- Governments worldwide are starting to retaliate against high-profile data breaches by enacting laws like the GDPR and CCPA. Meeting these requirements demonstrates that the organization is fully aware of the threat and has taken action to address it. These standards are there to assure a minimum level of security. Thus, the necessity for enterprise key management services is driven by the loss of essential data and compliance problems.

- A lack of skilled professionals may impact the adoption of enterprise key management solutions. Cloud-based solutions are rapidly adopted by enterprises that provide numerous benefits. Still, it has security and privacy issues such as data breaches, hacked interfaces, credential protection, DoS attacks, etc., of stored data. Such activities are expected to hinder the growth of the market.

- The COVID-19 pandemic and the Russia-Ukraine conflict have affected people's lives worldwide. Every other business and market is in a downturn. However, post-pandemic, the enterprise key management market is advancing overall with expanding size, offers, patterns, and interests by central participants and organizations that would benefit from previous market experiences.

Enterprise Key Management Market Trends

Massive Growth of Data Due to the Adoption of IoT and Cloud Technologies

- With a constant influx of enterprises joining the digitization trend globally, vast amounts of data are being created, stored, processed, and communicated. At the same time, IT infrastructure is increasingly open and connected, making data more accessible and thus vulnerable to theft. Cryptography is one of the fundamental tools that organizations can use to protect sensitive data wherever it resides. Organizations must improve their crucial management capabilities to address increasing data security requirements.

- With the rising demand and adoption of cloud services by different sizes of organizations coupled with a rise in demand for cloud services by various end-user verticals to maximize operational security, the enterprise key management market value is bound to rocket up. Hybrid cloud and data center infrastructures are the new norms for many businesses. According to the Thales recent Global Threat Report, 84% of organizations globally use more than one IaaS vendor, and 34% use over 50 SaaS applications. Similarly, with the report from CloudTech, 84% of organizations use hybrid cloud platforms. In addition, many endpoint devices are connecting to corporate networks, with increasing adoption of BYOD and the internet of things.

- The increasing adoption of cloud-based deployment and a growing number of data breaches, coupled with the rising regulatory and compliance enforcements to protect sensitive data, are presumed to bolster the growth of the enterprise key management market. A rise in internet users and the rapid adoption of digital services has led to an exponential increase in the volume of sensitive data collected by organizations. This is further presumed to accelerate the adoption of encryption solutions.

- The growing investments in cloud-based services and hardware security modules to promote enterprise key management and data protection are supposed to expedite market growth further. However, issues concerning to shortage of skilled workforce, replacement costs of the existing IT infrastructure, and complexity of using enterprise key management solutions may limit the growth of the market.

North American is Expected to Have Highest Market Share

- North America is anticipated to maintain the most comprehensive market share over the forecast period, owing to the presence of globally notable enterprise key management market players, such as IBM, Oracle, and Hewlett Packard, which promote the adoption. This region also dominates because of a well-developed IT infrastructure coupled with the rising adoption of cloud services.

- Rising cyber threats and security concerns have further led to the adoption of enterprise key management solutions across countries, owing to the expansion and growth of small and medium-sized enterprises. Supportive government policies to develop the IT infrastructure are also promoting the demand for enterprise key management.

- Cyber threats trigger the local demand for enterprise key management solutions. The United States and Canada are expected to maintain significant market shares in this region. In 2021, nearly 1862 million data breaches were encountered in the United States alone, according to the data from Identity Theft Resource Center.

- The growing penetration rate of digital services and rapidly expanding IT infrastructure are expected to drive market expansion in the future years further. In addition, the BFSI sector will likely play an essential role in driving this market in the future. The dominance can also be attributed to well-developed IT infrastructure and the rising adoption of cloud services. In addition, rising merger and acquisition activities among regional and international players are supposed to further support the growth of the market in this region to a certain extent.

Enterprise Key Management Industry Overview

The enterprise key management market is a highly fragmented market. However, it is dominated by players, including Gemalto(Thales), among other cloud service providers, Microsoft, Google, and AWS. These companies are leveraging strategic collaborative initiatives to enhance their offerings, market share, and profitability.

- In November 2022, Zoom announced critical updates to the Enterprise-grade security and Reliability platform for easy connection and staying organized to fit the needs of small businesses or large enterprises, with the features of privacy and security needed.

- In July 2022, Axis bank partnered with Amazon Web Services (AWS) to use the AWS key management service, a fully managed service for cryptographic operations (KMS), AWS CloudHSM, a cloud-based hardware security module (HSM), AWS Identity and Access Management (IAM), AWS Encryption SDK, and a client-side encryption library to improve data security, compliance, and customer experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Optimizing Overall Ownership Cost for Security while Maximizing Operational Efficiency and Security

- 4.3.2 Loss of High Profile Data and Compliance Issues

- 4.3.3 Massive Growth of Data Due to the Adoption of IoT and Cloud Technologies

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness and Skilled Workforce

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-Premises

- 5.2 Size of Enterprise

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 Application

- 5.3.1 Disk Encryption

- 5.3.2 File and Folder Encryption

- 5.3.3 Database Encryption

- 5.3.4 Communication Encryption

- 5.3.5 Cloud Encryption

- 5.4 End-user Verticals

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 Government and Defense,

- 5.4.4 IT and Telecom

- 5.4.5 Retail

- 5.4.6 Other End-user Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 Unbound Tech Ltd (Dyadic Security)

- 6.1.3 Thales Group (Gemalto NV)

- 6.1.4 Google Inc. (Alphabet)

- 6.1.5 IBM Corporation

- 6.1.6 Oracle Corporation

- 6.1.7 Hewlett Packard Enterprise

- 6.1.8 Quantum Corporation

- 6.1.9 Winmagic Inc.

- 6.1.10 Microsoft Corporation

- 6.1.11 Townsend Data Security LLC