|

市場調查報告書

商品編碼

1438480

資料中心交換器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Center Switch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

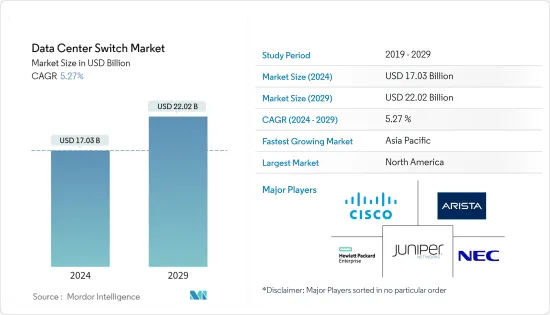

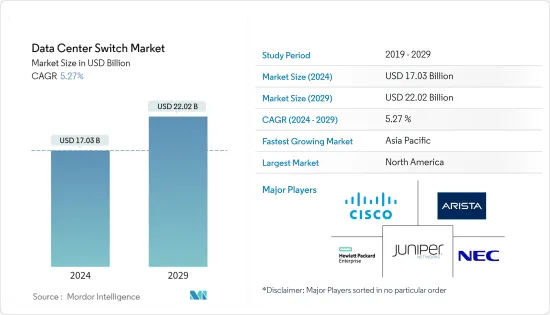

資料中心交換器市場規模預計到 2024 年為 170.3 億美元,預計到 2029 年將達到 220.2 億美元,預測期內(2024-2029 年)年複合成長率為 5.27%。

主要亮點

- 雲端運算、資料在地化以及 5G 和物聯網等新興技術的採用正在推動全球資料中心投資的增加。各種規模的企業不斷變化的需求、數百萬個連結設備的持續創建以及網際網路上每天產生的資料量正在迅速提高資料中心的普及度。

- 要充分發揮人工智慧技術的潛力,需要額外的電腦處理和決策流程。根據效能、容量和成本方面的不同,人工智慧處理和資料儲存位置的範圍可以從雲端到本地資料中心再到網路外圍。預計邊緣運算將從連網型設備、創新產業和聯網汽車中受益匪淺,並對所考慮的市場產生重大影響。

- 核心交換器隨著流量管理的擴展看到了新的成長潛力。當 COVID-19 爆發迫使人們留在家裡時,許多人轉向 Netflix 等 OTT 服務來娛樂,而不是外食或看電影。在新冠肺炎 (COVID-19) 疫情的前三個月,Netflix 亞太地區新增訂閱用戶達 360 萬。為了處理大量傳入流量,同時保持串流媒體服務的質量,Netflix 決定取消最大頻寬流並減少通過 Tor 的流量。

- COVID-19 的爆發擾亂了資料中心建設供應鏈。與封鎖相關的計劃完工延遲和收益減少,尤其是餐旅服務業和娛樂等受災最嚴重的產業,影響了建設活動和資料中心的使用。

- 隨著雲端基礎的業務流程的快速採用,公司在資料管理解決方案上投入了大量資金,以處理這些系統產生的大量資料。隨著多重雲端運算的成長,基於虛擬網路的伺服器正在取代傳統的本地實體伺服器,這正在推動資料中心世界的擴展,並增加對資料中心交換設備的需求。

- 然而,資料中心最重要的成本之一仍然是電力。根據國際能源總署的數據,資料中心消耗了全球1%的電力。我們計劃在未來五年內使用它。大部分能源消耗用於運作伺服器,從而產生熱量和冷卻。同樣,冷卻過程會消耗大量能量。

資料中心交換器市場趨勢

核心交換器市佔率第一

- 核心交換器的優先順序應高於其他兩台交換器。亞馬遜和微軟等市場佔有率較大的公司正在建造更多的資料中心。隨著資料中心的擴展,對核心交換器的需求將呈指數級成長。

- 必須以低且可預測的延遲有效、可靠地處理不斷成長的流量。然而,頻寬是三層資料中心架構中的一個限制,因為vPC(虛擬連接埠通道)只能提供兩個活動的平行上行鏈路。三層設計的另一個問題是伺服器之間的延遲會根據所使用的流量路徑而變化。例如,思科推出了一種新的資料中心設計,稱為基於 Clos 網路的脊葉架構,以解決這些限制。該設計已被證明可以提供高頻寬、低延遲、無阻塞的伺服器到伺服器連線。

- Crore Switch 提供全面的設備選擇,以滿足各種資料中心的要求。該公司的交換器使客戶能夠為架頂式 (ToR)、主幹和葉子架構創建有效且可擴展的網路基礎設施。此外,它還為特定用例提供專門的控制,例如用於高效能運算 (HPC) 的 SAN 和叢集。

- 雲端運算技術在北美的應用越來越廣泛。例如,Facebook公司的Metaplatforms去年宣布計畫投資8億美元在美國愛達荷州建造一個大型園區,以擴大其資料中心市場佔有率。

- 隨著資料中心能力的擴展,許多IT設備的複雜性和互連性預計將得到改善,而對交換器和路由器等資料中心網路元件的需求將成為超大規模基礎設施的關鍵組成部分。超大規模IT基礎設施供應商使用高效能核心交換器進行高速資料傳輸將推動資料中心交換器市場的成長。

預計北美地區將出現顯著成長

- 房地產專家世邦魏理仕(CBRE)的數據顯示,美國七大市場的資料中心租賃量比往年增加了31%,比去年因疫情略有下降的情況增加了50%。北維吉尼亞是一個主要市場,佔全國新增資料中心容量的 60% 以上。

- 主機代管資料中心的大部分需求來自雲端服務供應商和社群媒體公司。該市場也受到區塊鏈技術、5G基礎設施、虛擬實境社群和自動駕駛汽車技術等新技術引入的推動。

- 亞特蘭大最近成為資料中心開發的另一個重要市場,供應商針對企業部門推出了新計劃。 QTS 資料 Centers 今年稍早提交了一份在亞特蘭大開發 110 萬平方英尺資料中心的提案。根據「計劃 Granite」設計,QTS計劃在約36英畝的土地上創建230萬平方英尺的混合用途空間,包括資料中心空間以及商業、零售和住宅用地。這些進步增加了這些領域對資料中心交換設備的需求。

- 超融合透過將儲存、處理和網路合併到單一系統中來降低資料中心的複雜性並提高擴充性。這開始引起北美地區公司的注意。融合式基礎架構平台的使用不斷增加正在推動資料中心市場的發展。

- Patrinely Group 及其融資合作夥伴 USAA Real Estate 去年向北維吉尼亞市場推出了新的資料中心開發平台 Corscale。該公司的第一個計劃是威廉王子縣的 Gainesville Crossing,這是一個 300 兆瓦的綜合體,擁有五個專為超大規模客戶設計的資料中心。

- 近年來,200GbE 和 400GbE 交換器連接埠也已在該地區廣泛採用。例如,惠普企業(HPE)去年和今年推出了專為現代資料中心設計的32埠200GbE SN3700M交換器。當配備基於 50G PAM-4 的 Spectrum-2 ASIC 時,此交換器具有突破性的 8.33Bpps封包處理速度和高達 12.8Tb/s 的雙向交換容量。

資料中心交換器產業概況

資料中心交換器市場競爭激烈,主要參與者眾多。但目前在市場佔有率上佔據主導地位的主導企業寥寥無幾。公司遵循多種策略,包括擴張、併購、合資、合作、夥伴關係等。這些市場參與者正在加強他們在行業中的地位。報告中解讀的主要市場參與者包括思科、Jupiter Networks、Dell EMC、Arista Networks、中興通訊、惠普企業、Mellanox、華為、Extreme Networks等。

2022年3月,華為推出兩款新的CloudEngine高可用性多播(HAM)資料中心交換器CloudEngine 8850-HAM和CloudEngine 6860-HAM。這些交換器非常適合證券、保險和高階製造業,並有望幫助企業建立廣闊的生產和交易系統。

2023年4月,鈀登科技推出超高容量400G交換機,提供新一代資料中心網路架構。為滿足下一代資料中心和雲端運算環境的需求,將基礎網路架構提升到新的水平,鈀登科技宣布推出超高容量400G交換器DCS520。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

- 技術簡介

- 頻寬

- 科技(乙太網路、光纖通道、InfiniBand)

第5章市場動態

- 市場促進因素

- 對雲端和邊緣運算服務的需求不斷成長

- 有關資料中心在地化的政府法規

- 市場限制因素

- 資料中心營運成本高

第6章市場區隔

- 開關類型

- 核心交換機

- 配電開關

- 存取交換機

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭形勢

- 公司簡介

- Cisco Systems, Inc.

- Arista Networks, Inc.

- Juniper Networks, Inc.

- Hewlett Packard Enterprise Development LP

- NEC Corporation

- Huawei Technologies Co., Ltd.

- H3C Holding Limited

- Lenovo Group Limited

- Extreme Networks Inc.

- Dell EMC

- Mellanox Technologies.

- Fortinet, Inc.

- ZTE Corporation

- Quanta Cloud Technology(QCT)

- D-Link Corporation

- Silicom Ltd. Connectivity Solutions

第8章投資分析

第9章 未來市場展望

The Data Center Switch Market size is estimated at USD 17.03 billion in 2024, and is expected to reach USD 22.02 billion by 2029, growing at a CAGR of 5.27% during the forecast period (2024-2029).

Key Highlights

- Global data center investments are rising because of adopting cloud computing, data localization, and emerging technologies like 5G and IoT. Data centers are fast gaining popularity because of the shifting needs of businesses of all sizes, the ongoing creation of millions of linked devices, and the daily volume of data generated via the Internet.

- Additional computer processing and decision-making processes are needed to exploit AI technology's potential fully. Depending on aspects like performance, capacity, and cost, the location of AI processing and data storage may range from the cloud to on-premises data centers to the network's periphery. Edge computing, projected to tremendously benefit from connected devices, innovative industries, and connected cars, would significantly impact the market under examination.

- Core switches are experiencing new growth potential because of expanding traffic management. When the COVID-19 outbreak forced people to stay home, many turned to OTT services like Netflix for entertainment instead of going out to eat or to the movies. In the first three months of COVID-19, Netflix Asia-Pacific added 3.6 million new subscribers. Netflix decided to delete the highest bandwidth streams and cut traffic by tor to handle the high volume of incoming traffic while retaining the streaming service's quality.

- The COVID-19 outbreak messed up the supply chain for building the data center. Lockdown-related delays in project completion and a decline in revenue from particularly hard-hit industries, like hospitality and entertainment, impacted construction activity and data center entry locations.

- Due to the rapid adoption of cloud-based business processes, businesses have made significant investments in data management solutions to handle the massive volume of data produced by these systems. Virtual network-based servers are replacing conventional on-premises physical servers due to the growth of multi-cloud computing, which drives the global expansion of data centers and increases the demand for data center switching equipment.

- However, one of the most significant expenses for data centers is still electricity. According to the International Energy Agency, data centers consume 1% of all electricity worldwide. They will use it in the next five years. Most of this energy consumption is required to run the servers, which generate heating and cooling. Again, a lot of energy is used in the cooling process.

Data Center Switch Market Trends

Core Switches Holding the Largest Market Share

- Core switches must be given more priority than the other two switches. Companies with larger market shares, such as Amazon and Microsoft, are building additional data centers. The need for core switches will rise dramatically since data centers are expanding.

- The growing traffic must be handled effectively and reliably, with low and predictable latency. However, because vPC (virtual-port-channel) can only supply two active parallel uplinks, bandwidth becomes a constraint in a three-tier data center architecture. Another issue with a three-tier design is that server-to-server latency changes depending on the traffic path used. For Instance, Cisco introduced a new data center design known as the Clos network-based spine-and-leaf architecture to address these restrictions. This design has been demonstrated to provide a high-bandwidth, low-latency, nonblocking server-to-server connection.

- Crore Switches offer a comprehensive selection of devices to satisfy different data center requirements. Switches from their range allow clients to create effective and scalable network infrastructures for top-of-rack (ToR), spine, and leaf architectures. Additionally, offer specialized controls for particular use cases, including SANs or clusters for high-performance computing (HPC).

- In North America, cloud computing technology is becoming more widely used. For instance, Facebook Inc.'s Meta Platforms Inc. announced plans to increase its data center market share by investing USD 800 million in large-scale campuses in Idaho, United States, last year.

- The complexity and interconnectedness of many IT devices are expected to be improved by expanding data center capabilities, and the demand for data center networking components like switches and routers will be a crucial part of hyper-scale infrastructures. The use of high-performance core switches for quick data transfer by hyper-scale IT infrastructure providers will drive the growth of the data center switch market.

North America Expected to Register Significant Growth

- According to real estate expert CBRE, data center leasing in the top seven US markets was 31% greater than in the previous several years and 50% higher than the last year, which had slightly decreased owing to the pandemic. Northern Virginia was the leading market, with over 60% of the country's new data center capacity.

- Cloud service providers and social media firms account for most of the demand for colocation data centers. The market is also driven by adopting new technologies, including blockchain technology, 5G infrastructure, virtual reality communities, and autonomous car technology.

- With new projects from providers aiming at the enterprise sector, Atlanta has recently become another important market for data center development. To develop a 1.1 million square foot data center in Atlanta, QTS Data Centers submitted proposals the year before the current year. According to the designs in "Project Granite," QTS would create 2.3 million square feet of mixed-use space on around 36 acres of land, including data center space and commercial, retail, and residential land uses. These advances increase the need for data center switching devices in these areas.

- By fusing storage, processing, and networking into a single system, hyper-convergence reduces the complexity of data centers and improves scalability, which has begun to gain the attention of businesses in the North American region. An increase in the usage of a hyper-converged infrastructure platform is driving the market for data centers.

- The Patrinely Group and its financing partner, USAA Real Estate, introduced Corscale, a new data center development platform, to the Northern Virginia market last year. The company's first project is Gainesville Crossing, a 300-megawatt complex in Prince William County with five data centers designed for hyper-scale clients.

- In recent years, the region has also widely adopted the 200GbE and 400GbE switch ports. Hewlett Packard Enterprise (HPE), for instance, in the previous and current year, introduced the 32-port 200GbE SN3700M switch, which is designed specifically for the modern data center. The switch has a groundbreaking 8.33Bpps packet processing rate and a bidirectional switching capacity of up to 12.8Tb/s when powered by the 50G PAM-4-based Spectrum-2 ASIC.

Data Center Switch Industry Overview

The Data Centre Switch market is highly competitive and has several major players. However, few significant companies currently dominate the market regarding market share. The companies follow several strategies, including expansions, mergers & acquisitions, joint ventures, collaborations, partnerships, and others; these market players have strengthened their position in the business. The major market players interpreted in the report include Cisco, Jupiter Networks, Dell EMC, Arista Networks, ZTE, Hewlett Packard Enterprise, Mellanox, Huawei, Extreme Networks, etc.

In March 2022, Two brand-new CloudEngine high availability multicast (HAM) data center switches, the CloudEngine 8850-HAM and CloudEngine 6860-HAM, were launched by Huawei. These switches were excellent for the securities, insurance, and high-end manufacturing industries and were expected to help businesses create expansive production and transaction systems.

In April 2023, the Ultra High-Capacity 400G Switch was launched by Edgecore to provide the next-generation data center network architectures. To satisfy the demands of the next-generation data center and cloud computing environments and to bring a new level of basic network architecture, Edgecore announced the launch of the DCS520, an ultra-high capacity 400G switch.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Technology Snapshot

- 4.4.1 Bandwidth

- 4.4.2 Technology (Ethernet, Fiber Channel, and InfiniBand)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Augmented Demand for Cloud & Edge Computing Services

- 5.1.2 Government Regulations Regarding Localization of Data Centers

- 5.2 Market Restraints

- 5.2.1 High Data Center Operational Cost

6 MARKET SEGMENTATION

- 6.1 Switch Type

- 6.1.1 Core Switches

- 6.1.2 Distribution Switches

- 6.1.3 Access Switches

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 Unites States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems, Inc.

- 7.1.2 Arista Networks, Inc.

- 7.1.3 Juniper Networks, Inc.

- 7.1.4 Hewlett Packard Enterprise Development LP

- 7.1.5 NEC Corporation

- 7.1.6 Huawei Technologies Co., Ltd.

- 7.1.7 H3C Holding Limited

- 7.1.8 Lenovo Group Limited

- 7.1.9 Extreme Networks Inc.

- 7.1.10 Dell EMC

- 7.1.11 Mellanox Technologies.

- 7.1.12 Fortinet, Inc.

- 7.1.13 ZTE Corporation

- 7.1.14 Quanta Cloud Technology (QCT)

- 7.1.15 D-Link Corporation

- 7.1.16 Silicom Ltd. Connectivity Solutions

![資料中心交換器市場:趨勢、機會與競爭分析 [2023-2028]](/sample/img/cover/42/1341998.png)