|

市場調查報告書

商品編碼

1438457

智慧型手機:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smartphones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

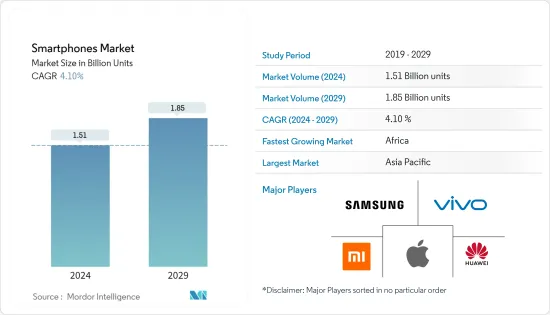

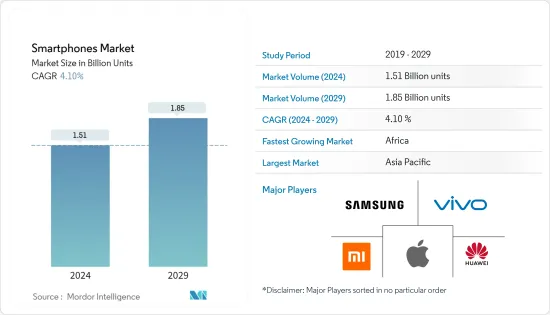

預計2024年智慧型手機市場規模將達到15.1億部,預計2029年將達到18.5億部,預測期內(2024-2029年)年複合成長率為4.10%。

可支配收入的增加、通訊基礎設施的開拓、廉價手機的出現以及產品推出的增加等因素正在促進亞洲國家智慧型手機市場的成長。

主要亮點

- 智慧型手機產業穩步發展,市場規模和機型數量不斷擴大。全球整體,到 2021 年,全球 40% 的人口將擁有智慧型手機。據愛立信稱,全球智慧型手機用戶數量超過60億,預計未來幾年這數字還將增加數億。中國、印度和美國是智慧型手機用戶數量最多的國家。

- 消費者科技協會(CTA)進行的《消費者科技銷售與預測》研究也聚焦於新科技趨勢,5G行動電話銷售額達到613.7億美元,預計2021年將達到533.8億美元。我們預測成長15%促銷。同時,預計 2021 年 5G 智慧型手機將佔所有智慧型手機的 62%,2022 年將升至 72%。

- 市場主要企業建立策略夥伴關係,以改善服務交付並保持競爭力。 2022 年 10 月,三星電子宣布與Google達成擴大協議,以提高智慧家庭的互通性。未來幾個月,三星 Galaxy行動電話和平板電腦用戶將能夠快速將支援 Matter 的產品添加到 SmartThings 和 Google Home 生態系統中。

- 消費者對 5G 設備的興趣與日俱增。因此,晶片製造商正在鼓勵製造商將5G晶片涵蓋新的智慧型手機產品陣容中。

- 市場上的主要供應商也致力於開拓和擴展他們的網路。例如,2022年5月,中國電信與華為聯合發表會上宣布了一項創新的5G-Advanced技術Super TimeFreq Folding。中國電信核算劉桂清、5G建設工作小組核算張鑫、華為營運商BG總裁丁耘、無線解決方案副總裁甘斌分別發表主題演講,支持這一進一步改進,並討論了該技術及其實驗室篩檢的細節。

- COVID-19 大流行嚴重擾亂了智慧型手機市場的供需平衡。中國是大多數此類設備和零件的全球製造地,由於全國範圍內的封鎖,智慧型手機製造業受到了出貨延遲和下一代產品開發減弱的負面影響。我們也看到供應商、工人和物流網路被切斷。此外,由於大流行,消費者減少了奢侈品支出並專注於必需品,消費者對智慧型手機的需求,特別是高階市場的需求下降。

- 由於產品成本下降、手機設計和功能的改進、全球行動電子郵件和瀏覽服務的擴展、4G和5G網路技術的出現、行動通訊業者之間的競爭加劇以及營運方式的變化,智慧型手機目前變得越來越受歡迎。由於標準化和升級等多種因素,它正在經歷快速成長。

- 智慧型手機在新冠疫情期間發揮了非常重要的作用,即使在疫情消退之後,這種作用仍將持續,幾乎所有的政府服務、醫療、教育、金融服務等都已實現線上化,智慧型手機成為更便捷、更實惠的閘道器存取這些服務。

智慧型手機市場趨勢

Android作業系統預計將大幅成長

- 根據 StatCounter 2022 年 1 月發布的報告,Android 仍然是全球最受歡迎的行動作業系統,市場佔有率接近 70%,而 iOS 的市佔率約為 25%。

- 此外,許多應用開發使用 Android 作業系統來開發遊戲/娛樂應用程式、社交媒體應用程式、行動公共事業應用程式和生活應用程式,因為 C++、Kotlin 和 Java 等語言需要開發人員了解。我喜歡它。此外,Google 還提供各種開發工具,例如 Android Jetpack、Firebase 和 Android SDK,幫助開發人員建立直覺的介面。

- 此外,該平台允許用戶免費下載應用程式。然而,該應用程式旨在提供應用程式內收費和應用程式內課程訂閱,並且在 Google Play 商店上收益比在 Apple Store 上多。例如,根據 Airnow PLC 的數據,2021 年 4 月 Coinmaster 透過 Google Play 商店產生的收益約為 6,102 萬美元。其次是《GarenaFree Fire-World》系列和《PUBG Mobile-Karakin》,它們在 2021 年 4 月的收益3,856 萬美元和 3,776 萬美元。

- 能源管理和智慧家庭產品等整合物聯網應用對高速資料連接的需求不斷成長,預計將推動 5G 智慧型手機的採用。

- 2022年2月,OPPO發表了支援5G的Find X5系列,提升了智慧型手機影像處理和奢華設計的標準。 Find X5 系列配備了業界領先的功能,並提供簡潔、現代的精緻和未來風格,帶來至關重要的成像體驗。它包括一個專用的影像神經處理單元,可以解決智慧型手機影片中最困難的挑戰:夜間錄製。

亞太地區預計將佔據主要市場佔有率

- 亞太地區是智慧型手機的重要市場之一,主要得益於其高度發展的通訊業和龐大的基本客群。此外,該地區對行動網路的投資也在增加。印度、日本、澳洲、新加坡和韓國等國家擴大投資開拓國內通訊市場,預計這也將推動該地區的市場發展。

- 印度、印尼等新興經濟體對入門價格分佈智慧型手機的需求不斷增加,隨著地方政府推動數位化和行動經濟,智慧型手機正在向農村地區滲透,預計這將是一個因素。例如,「數位印度計劃」是印度政府的旗艦計劃,其主要目標是將印度轉變為數位賦能的社會。

- 此外,印度推出了 PLI 計劃,對 2019 年至 2020 年期間生產的行動電話銷量增加提供 6-4% 的獎勵,為期五年。高階跨國行動電話製造商,即生產價格超過 200 美元的行動電話的製造商,去年銷售了價值 490 萬美元的商品,必須申請獎勵。政府的此類舉措預計將提振該國的智慧型手機市場。

- 智慧型手機市場的主要供應商正致力於豐富其產品陣容並在該全部區域推出新產品。例如,2022年9月,蘋果宣布推出iPhone 14 Pro和iPhone 14 Pro Max。它具有常亮顯示器、iPhone 首款 48MP 攝影機、碰撞偵測、透過衛星進行緊急求救以及透過 Dynamic Island 接收通知和活動的創新方式。

- 城市人口的成長、消費者對行動裝置使用意識的提高、AR 技術的快速整合以及Over-The-Top平台訂閱量的成長預計將在未來幾年推動市場擴張。

- 在中國當地,由於智慧型手機的普及和4G的普及,行動網際網路的使用量迅速增加,支持了國家在數位社會價值鏈中的移動。超過9.9億人使用行動網路服務,預計到2025年這數字將增加2億。

智慧型手機產業概況

智慧型手機市場競爭激烈,由三星、華為、蘋果和小米等老牌企業主導。這些公司中的大多數不斷推出新型號,但技術變化較小,例如電池電量、相機配置、處理器等。

2022 年10 月,三星電子將透過其網路解決方案支援NTT East 專用5G 網路的發展,包括雲端原生5G 宏核心和無線存取網路(RAN),並將支援NTT East 跨多個領域的專用5G 網路的發展。該公司已成功為全球企業提供了新的、多樣化的用例。

2022年10月,華為發布了下一階段5G天線演進的最新天線解決方案,包括Maxwell平台和X2天線系列。新技術增強了天線整合和設定能力,使通訊業者能夠更快地部署 5G。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 智慧型手機產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 5G 設備、服務和技術的出現

- 新興市場的需求不斷增加

- 市場限制因素

- 需求停滯

- 市場機會

- 市場技術形勢

- 智慧型手機設備的生命週期分析

- 相關人員的生命週期

- 分析相關人員在整個設備生命週期中的關鍵痛點

- 智慧型手機設備的生命週期分析

- 技術藍圖分析

第6章市場區隔

- 按作業系統

- android

- iOS

- 按地區

- 北美洲

- 歐洲

- 中國

- 亞太地區(不包括中國)

- 拉丁美洲

- GCC

- 非洲

第7章 競爭形勢

- 公司簡介

- Samsung Electronics Co. Ltd

- Huawei Technologies Co. Ltd

- Apple Inc.

- Xiaomi Corporation

- BBK Electronics Corporation(Vivo, Realme, Oppo, and OnePlus)

- Lenovo Group Limited

- HTC Corporation

- HMD Global Oy

- Sony Corporation

- ZTE Corporation

- Google LLC

第8章供應商市場佔有率

第9章 競爭基準化分析分析

第10章投資分析

第11章投資分析市場的未來

The Smartphones Market size is estimated at 1.51 Billion units in 2024, and is expected to reach 1.85 Billion units by 2029, growing at a CAGR of 4.10% during the forecast period (2024-2029).

Factors such as increasing disposable income, the development of telecom infrastructure, the emergence of budget-centric smartphones, and an increasing number of product launches contribute to the smartphone market growth in Asian countries.

Key Highlights

- The smartphone industry has been steadily developing and growing in market size and models. Globally, 40% of the world's population owned a smartphone by 2021. According to Ericsson, the number of smartphone subscriptions worldwide surpasses six billion and is expected to grow by several hundred million in the next few years. China, India, and United States are the countries with the highest number of smartphone users.

- The Consumer Technology Sales and Forecast study conducted by the Consumer Technology Association (CTA) also looked at new technology trends, projecting that 5G cellphones would generate USD 61.37 billion in revenue, up by 15% from USD 53.38 billion in 2021. Meanwhile, 5G smartphones are expected to account for 62% of all smartphone units in 2021, rising to 72% in 2022.

- The key players in the market are involved in strategic partnerships to improve their service offerings and remain competitive. In October 2022, Samsung Electronics announced an expanded agreement with Google to advance smart home interoperability. Users of Samsung Galaxy phones and tablets will be able to quickly add Matter-compatible products to both the SmartThings and Google Home ecosystems in the coming months.

- Consumer interest in 5G devices is growing. Thus, chipmakers are pushing manufacturers to include 5G chips in their new smartphone lineup.

- Key vendors in the market are also focusing on network development and expansion. For instance, in May 2022, Super TimeFreq Folding, a new innovative 5G-Advanced technology, was launched during a joint press conference by China Telecom and Huawei. The technology underpinning this further improvement, as well as the specifics of its lab testing, were discussed during keynote addresses delivered by China Telecom's Deputy General Manager Liu Guiqing and 5G Construction Working Group's General Manager Zhang Xin, as well as Huawei's Carrier BG's President Ryan Ding and Wireless Solution's Vice President Gan Bin.

- The COVID-19 pandemic severely disrupted the smartphone market's balance between supply and demand. Since China is the global manufacturing center for most of these devices and components, and with the nationwide lockdown, the smartphone manufacturing sector has been adversely hit by delayed shipments and weakened development of next-generation products. The country also witnessed being choked off by suppliers, workers, and logistics networks. Moreover, consumer demand for smartphones, especially in the premium segment, declined due to customers' tendency to cut down on luxury spending and focus on essentials due to the pandemic.

- Smartphones are currently experiencing rapid growth as a result of a variety of factors such as lower product costs, improved handset design and functionality, the expansion of global mobile email and browsing services, the emergence of 4G and 5G network technologies, rising competition among mobile carriers, and the standardization and upgrading of operating systems.

- Smartphones played an incredibly important role amid the widespread corona pandemic, and this continued even after the pandemic was over, as almost all government services, health, education, financial services, and so on went online, with smartphones serving as a more accessible and more affordable gateway to access these services.

Smartphone Market Trends

Android Operating System is Expected to Grow Significantly

- According to a StatCounter report released on January 2022, Android remained the world's most popular mobile operating system, with a market share of close to 70%, while iOS accounted for roughly 25% of the market.

- Furthermore, many application developers prefer Android OS to develop gaming/entertainment applications, social media applications, mobile utility applications, and lifestyle applications, as it requires the developers to know languages such as C++, Kotlin, and Java, among others. Moreover, Google also offers various development tools, such as Android Jetpack, Firebase, and AndroidSDK, to assist developers in building a user-intuitive interface.

- Additionally, the platform allows users to download applications free of cost. However, the applications are designed to offer in-app purchases and in-app course subscriptions that have generated more revenue in Google Play Stores than in Apple Stores. For instance, according to Airnow PLC, the revenue generated by coin master in April 2021 was approximately USD 61.02 million through Google Play Stores. This was followed by the GarenaFree Fire- World series and PUBG Mobile-Karakin, which generated a revenue of USD 38.56 million and 37.76 million in April 2021.

- The increasing demand for high-speed data connectivity for integrated IoT (Internet of Things) applications, such as energy management and smart home products, is anticipated to propel the adoption of 5G smartphones.

- In February 2022, OPPO unveiled its Find X5 Series with 5G support, which raises the bar for smartphone imaging and luxurious design. Find X5 Series brims with industry-leading features and offers a futuristic style that achieves clean, modern sophistication and significant imaging experiences. These include a dedicated image neural processing unit, which addresses the most challenging barrier of smartphone video capture of nighttime recording.

Asia-Pacific is Expected to Hold a Significant Market Share

- The Asia-Pacific region is one of the significant markets for smartphones, primarily owing to the highly developing telecom sector and large customer base. Furthermore, the region is increasingly investing in the mobile network. Countries such as India, Japan, Australia, Singapore, and South Korea, are increasingly investing in developing the domestic telecom market, which is also expected to drive the market in the region.

- The demand for smartphones at the entry-level price points is expected to be driven by the increasing demand from the developing countries in the region, such as India and Indonesia, where smartphones are increasingly penetrating into the rural areas as local governments are pushing for digital and mobile economy. For instance, the Digital India program is a flagship program of the Government of India primarily aimed at transforming the country into a digitally empowered society.

- Moreover, India had also launched the PLI Scheme, which offered a 6-4% incentive for five years on incremental sales of manufactured handsets over 2019-2020. High-end multinational cell phone makers, or those producing handsets worth over USD 200, had to sell goods worth USD 4.9 million in the last financial year claim the incentives. Such initiatives by the government are expected to boost the smartphone market in the country.

- The key vendors in the smartphone market are focusing on improving their product offerings and introducing new products across this region. For instance, in September 2022, Apple announced the release of the iPhone 14 Pro and iPhone 14 Pro Max. It featured the Always-On display, the first-ever 48 MP camera on an iPhone, Crash Detection, Emergency SOS via satellite, and an innovative new way to receive notifications and activities with the Dynamic Island.

- The rise in the urban population, increased consumer awareness regarding mobile device usage, the surging integration of AR technology, and expanding over-the-top (OTT) platform subscriptions are expected to drive the market's expansion in the coming years.

- In mainland China, rising smartphone adoption and the availability of 4G have resulted in a surge in mobile internet usage that supports the country's movement up the digital-society value chain. More than 990 million people use mobile internet services, which is expected to increase by 200 million by 2025.

Smartphone Industry Overview

The smartphones market is a highly competitive market, dominated by established players such as Samsung, Huawei, Apple, and Xiaomi, among others. Most of these players keep launching new models with small technology changes such as battery power, camera configuration, and processor.

In October 2022, Samsung Electronics stated that it successfully supported NTT East's private 5G network growth with its network solutions, including the cloud-native 5G Macro Core and Radio Access Network (RAN), enabling new and diverse use cases for corporations across multiple industries in Japan.

In October 2022, Huawei announced the launch of the latest antenna solutions for the next phase of 5G antenna evolution, including the Maxwell platform and the X2 antenna series. The new technologies enhance antenna integration and setup capabilities, allowing carriers to deploy 5G more quickly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Smartphones Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Launch of 5G Devices, Services, and Technologies

- 5.1.2 Increasing Demand in the Emerging Markets

- 5.2 Market Restraints

- 5.2.1 Stagnating Demand

- 5.3 Market Opportunities

- 5.4 Technology Landscape of the Market

- 5.4.1 Smartphone Device Lifecycle Analysis

- 5.4.1.1 Lifecycle Through Stakeholders

- 5.4.1.2 Key Pain-point Analysis of Stakeholders Throughout the Device Lifecycle

- 5.4.1 Smartphone Device Lifecycle Analysis

- 5.5 Technology Roadmap Analysis

6 MARKET SEGMENTATION

- 6.1 By Operating Segment

- 6.1.1 Android

- 6.1.2 iOS

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 China

- 6.2.4 Asia-Pacific (Excluding China)

- 6.2.5 Latin America

- 6.2.6 GCC

- 6.2.7 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Huawei Technologies Co. Ltd

- 7.1.3 Apple Inc.

- 7.1.4 Xiaomi Corporation

- 7.1.5 BBK Electronics Corporation (Vivo, Realme, Oppo, and OnePlus)

- 7.1.6 Lenovo Group Limited

- 7.1.7 HTC Corporation

- 7.1.8 HMD Global Oy

- 7.1.9 Sony Corporation

- 7.1.10 ZTE Corporation

- 7.1.11 Google LLC