|

市場調查報告書

商品編碼

1438454

行動邊緣運算:市場佔有率分析、產業趨勢與成長預測(2024-2029)Mobile Edge Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

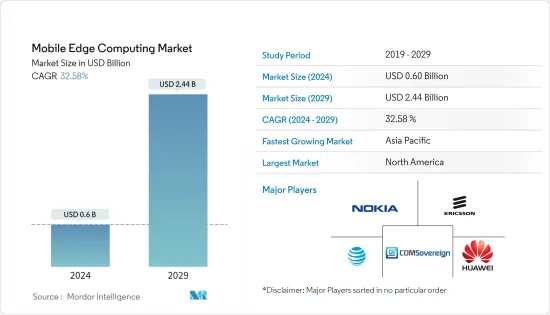

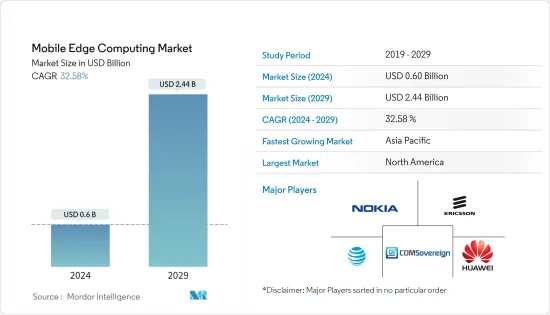

行動邊緣運算市場規模預計到 2024 年將達到 6 億美元,預計到 2029 年將達到 24.4 億美元,在預測期內(2024-2029 年)年複合成長率為 32.58%。

多接取邊緣運算(MEC)通常稱為行動邊緣運算,是邊緣運算的一種型態,它將雲端運算引入網路邊緣以增加功能。 MEC 是歐洲通訊標準協會 (ETSI) 一項計劃的成果,最初旨在在行動網路中部署邊緣節點,但後來也擴展到固定(或最終整合)網路。 MEC 支援在網路上的基地台、中心辦公室和其他聚合站點進行操作,雲端處理不同。

主要亮點

- 隨著無線訂閱數量的快速增加,對數位媒體服務的需求也在增加。為了滿足這種不斷成長的需求,行動無線網路正在突飛猛進。各行業的公司開始透過部署各種技術創新,包括感測器、其他資料生成和收集設備以及分析工具,將性能和生產力提高到新的水平。傳統上,資料管理和分析是在雲端或資料中心完成的。然而,隨著智慧製造和舉措城市等網路相關技術和措施的日益普及,情況似乎正在改變。

- 此外,隨著目前 4G 網路達到極限,5G 將需要對線上流量進行更智慧的管理,而行動邊緣運算將發揮重要作用。除了管理資料負載之外,MEC 預計還將顯著減少 5G 網路延遲。

- 在通訊業,行動邊緣運算、MEC 和多存取邊緣運算,為靠近最終用戶的網路應用程式提供執行資源(運算和儲存)。這通常在內部或外圍完成的通訊業者網路。邊緣解決方案提供低延遲、高頻寬、設備處理、資料分流以及可靠的運算和儲存等關鍵優勢。

- 與其他網路技術/架構一樣,MEC缺乏安全框架,容易受到各種威脅和硬體威脅。 MEC 網路上可能會出現各種各樣的威脅和危險。然而,阻礙市場成長的最常見攻擊範圍縮小到通訊協定受損、資訊和日誌被篡改、策略執行失敗、中間人攻擊和資料遺失。

- COVID-19 的爆發極大地促進了 5G 的普及。例如,GSMA 行動智庫的一項消費者調查發現,大多數歐洲市場受訪者對升級到 5G 的興趣有限。然而,在疫情期間,視訊會議和內容流對高速網路的需求增加,對更高頻寬和無延遲資料傳輸的需求推動了5G的採用。

行動邊緣運算(MEC) 市場趨勢

擴大5G和工業IoT服務在終端用戶產業的應用

- 以物聯網 (IoT)機芯為動力的工業 4.0 呈現出在世界任何地方互連各種技術平台並與世界任何地方的製造設備連接的能力。工業 4.0 正在改變行業,從舊有系統到智慧組件和機器,促進數位工廠,開發互聯工廠和企業生態系統,MEC 平台找到了令人興奮的部署機會。

- 工業自動化中的物聯網預計將從 5G 服務中受益最多。支持該細分市場的功能目前由 3GPP 定義,並受到工業 4.0 計劃和 5G-ACIA 等行業協會的影響。這將是一個針對本地區域使用案例和專用網路部署的 5G 特定部分。

- 在醫療保健產業,物聯網使提供者能夠透過連網型醫療解決方案遠端監控患者健康狀況,並擴展對即時資料收集以及即時監控和分析的存取。在醫療保健領域,5G服務的部署正在增加。例如,三星醫療中心和韓國最大的電信業者KT Corporation 宣佈建立合作夥伴關係,共同開發智慧患者照護、利用 5G 進行創新醫療實踐,並提高醫院營運效率。

- 能源和公共產業公司在積極改善 5G 相關的業務案例、服務和合作夥伴關係方面處於領先地位。 Infosys 表示,56% 的能源和公用事業公司已經定義了 5G 用例,20% 已經與生態系統合作夥伴建立了 5G 服務組合。該公司進一步預測,智慧城市將產生1,000億美元的公共產業收益。由於電力分銷商控制著城市或社區各個部分的電線杆和電線,因此他們可以利用該資產為社區、執法部門和企業提供智慧監控和智慧照明解決方案。

北美預計將佔據很大佔有率

- 北美有三大雲端服務供應商:Amazon Web Services、Microsoft Azure 和 Google Cloud。此外,該地區是Verizon Communications Inc.和AT&T Inc.等主要行動邊緣運算市場供應商的所在地,這對該地區的行動邊緣運算市場產生了積極影響。該地區也被認為是所有主要技術創新的中心,包括 5G、自動駕駛、物聯網、區塊鏈、遊戲和人工智慧。

- 美國和加拿大等國家以較早採用新技術而聞名。當今大多數新技術都是資料密集型的。隨著大量資料的創建、處理和傳輸,當今由資料中心和雲端組成的基礎設施正在接近最大容量。目前,隨著大量新資料的產生和使用,這些基礎設施不太可能滿足客戶的需求。在涉及的所有參數中,延遲可能是對您的業務最重要的因素。

- 大多數企業都依賴即時資料存取和處理,因此低延遲可能會中斷整個流程。邊緣運算正在幫助基礎設施開發人員解決這個問題。隨著新技術的成熟,邊緣運算預計將產生重大影響。

- 此外,行動邊緣運算使各行業的消費者和企業能夠近乎即時地利用資料中心的力量,為從家庭娛樂和遊戲到醫療保健和農業等各個領域的變革性技術提供動力。這為高速運算帶來了更多可能性,低延遲行動網路。

- 該地區的各種最終用戶熱衷於與邊緣行動邊緣運算。例如,2022 年 1 月,沃達豐宣布與 Proximie 建立合作關係。 Proximie 是一個醫療技術平台,可將世界各地的手術室數位化,並透過共用世界上最好的臨床實踐來拯救生命。透過將 5G、物聯網和邊緣運算等技術與 Proximie 世界一流的互聯連網型護理軟體相結合,醫療保健專業人員可以在世界各地的手術室中進行虛擬「擦洗」、「記錄」和「互動」。加速和改善勞動力發展,並有效地大規模提供高品質的外科護理。

行動邊緣運算(MEC) 產業概覽

MEC 市場由多家全球和地區公司組成,它們試圖在競爭相當激烈的市場空間中吸引註意力。然而,該市場由擁有巨大市場佔有率的大型供應商主導,競相在各個區域市場佔有一席之地並成為先行者。總體而言,供應商之間的競爭非常激烈,並且在預測期內預計仍將如此。

2022 年 9 月,諾基亞宣佈為其本地關鍵任務工業邊緣 (MXIE) 運算解決方案推出新的平台功能和應用程式。 MXIE 也開發了針對特定產業的藍圖,以簡化工業公司的數位轉型。

2022 年 9 月,Verizon 與美國軍方合作,在珍珠港-希卡姆聯合基地 (JBPHH) 的飛機維修機庫內建造專用 5G 網路。這種設計使軍事領導人能夠輕鬆利用 Verizon 5G 的高速度、寬頻寬和低延遲。

2022 年 8 月,AT&T 與 WNBA 合作,透過升級的 AT&T 5G 遊戲視圖,為 WNBA 球迷提供客製化內容並與比賽互動的方式。球迷可以在現場比賽期間查看比賽和球員統計數據、觀看可自訂的剪輯以及使用擴增實境境存取即時 3D 統計數據。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈分析

- COVID-19 對行動邊緣運算市場的影響

第5章市場動態

- 市場促進因素

- 特定延遲應用程式的普及和成長

- 擴大5G和工業IoT服務在終端用戶產業的應用

- 市場限制因素

- 缺乏通用的安全框架

第6章市場區隔

- 按成分

- 硬體

- 軟體

- 按最終用戶

- 金融/銀行

- 零售

- 醫療保健/生命科學

- 產業

- 能源/公共產業

- 通訊業

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Comsovereign Holding Corp

- AT&T Inc.

- Huawei Technologies Co. Ltd.

- Verizon Communication Ltd

- SGH, Inc.(penguin Solutions)

- ADLINK Technology Inc.

- Vodafone Group PLC

- Adva Optical Networking SE

第8章投資分析

第9章 市場機會及未來趨勢

The Mobile Edge Computing Market size is estimated at USD 0.6 billion in 2024, and is expected to reach USD 2.44 billion by 2029, growing at a CAGR of 32.58% during the forecast period (2024-2029).

Multi-access edge computing (MEC), popularly known as mobile edge computing, is a form of edge computing that brings cloud computing to the network's edge to increase its functionality. MEC is a result of the European Telecommunications Standards Institute (ETSI) program that was first intended to place edge nodes on mobile networks but has since expanded to include the fixed (or eventually integrated) network. MEC permits operations in base stations, central offices, and other aggregation sites on the network, as opposed to traditional cloud computing, which takes place on distant servers, far from the user and device.

Key Highlights

- The demand for digital media services is increasing as the number of wireless subscriptions grows exponentially. Mobile wireless networks have advanced tremendously to meet this growing need. Enterprises across industries are beginning to drive new levels of performance and productivity by deploying different technological innovations, like sensors and other data-producing and collecting devices, along with analysis tools. Traditionally, data management and analysis are performed in the cloud or data centers. However, the scenario seems to be changing with the increasing penetration of network-related technologies and initiatives, such as smart manufacturing and smart cities.

- Furthermore, with the current 4G networks reaching their maximum limit, 5G will have to manage online traffic far more intelligently, in which mobile edge computing will play a major role. In addition to managing the data load, MEC is expected to significantly reduce the latency in 5G networks.

- In the telecom industry, edge computing, also known as mobile edge computing, MEC, or multi-access edge computing, offers execution resources (compute and storage) for applications with networking close to end users, often within or at the boundary of operator networks. Edge solutions offer key advantages: low latency, high bandwidth, device processing, data offloading, and reliable computing and storage.

- As with any network technology/ architecture, MEC is prone to various threats and hardware that lay in wait owing to its lack of security framework. A wide variety of threats and hazards could potentially occur in the MEC network. However, the most common attacks that hinder the market's growth can be narrowed down to compromised protocols, falsified information and logs, loss of policy enforcement, man-in-the-middle, and data loss.

- The COVID-19 pandemic boosted 5G penetration significantly. For instance, GSMA Intelligence's consumer survey found that most market respondents in Europe had limited interest in upgrading to 5G. However, amid the pandemic, the increasing demand for high-speed networks for video conferencing and content streaming, the requirement for higher bandwidth, and zero-latency data transfer, boosted the adoption of 5G.

Mobile Edge Computing (MEC) Market Trends

Rising Application of 5G and Industrial IoT Services Among End-user Industries

- Industry 4.0, powered by the Internet of Things (IoT) movement, involves interconnecting various technological platforms and presents the ability to interface with manufacturing equipment located anywhere in the world, from anywhere in the world. With Industry 4.0 transforming industries, from legacy systems to smart components and machines to facilitating digital factories and developing an ecosystem of connected plants and enterprises, MEC platforms find exciting opportunities for deployment.

- IoT in industrial automation is expected to derive maximum benefit from 5G services. The functionality to support this segment is currently being defined in 3GPP, influenced by Industry 4.0 initiatives and industry bodies, such as 5G-ACIA. It will be a 5G-specific segment for local area use cases and private network deployments.

- In the healthcare industry, IoT enables providers to monitor patient health remotely through connected medical solutions, along with real-time data collection and extended access to real-time monitoring and analysis. The healthcare sector is witnessing an increase in the deployment of 5G services. For instance, Samsung Medical Center and Korea's largest telecommunications company, KT Corporation, announced that they have partnered to develop smart patient care, 5G-powered innovative medical practices, and improve hospital operational efficiency.

- Energy and utility companies are driving the pack in actively improving business cases, services, and partnerships around 5G. According to Infosys, 56% of the energy and utility companies are defining use cases for 5G, and 20% have already established their 5G service portfolios along with the ecosystem partners. The company further anticipates that smart cities will create USD 100 billion in utility revenue. As electricity distributors manage poles and wires to all parts of the cities and neighborhoods, they could leverage their assets to offer smart surveillance solutions or smart lighting solutions to communities, law enforcement agencies, and enterprises.

North America is Expected to Hold Major Share

- North America is home to three major cloud service providers: Amazon Web Services, Microsoft Azure, and Google Cloud. In addition, the region is home to major mobile edge computing market vendors such as Verizon Communications Inc., AT&T Inc., etc., which positively impacts the mobile edge computing market in the region. This region is also considered to be the hub for all major technological innovations, such as 5G, autonomous driving, IoT, blockchain, gaming, and AI, among others.

- Countries like the United States and Canada are known to be early adopters of new technologies. Most new technologies at present are data intensive. They create, process, and transfer large amounts of data, due to which the current infrastructure, consisting of data centers and the cloud, is inching toward its maximum capacity. With the amount of new data generated and used presently, these infrastructures would not be able to support their customers' needs. Of all the parameters involved, latency is going to be the most crucial factor for business.

- Since most companies rely on real-time data access and processing, low latency can disrupt their entire process. This is where edge computing has helped infrastructure developers address the issue. With new technologies maturing, edge computing is expected to have a significant impact.

- Further, mobile edge computing allows consumers and businesses from various sectors to capitalize on the power of a data center in near real-time, unlocking the further potential for fast, low-latency mobile networks to empower transformative technologies for everything from home entertainment and gaming to healthcare and agriculture.

- Various end-users in the region are indulging in partnerships with edge computing providers to develop innovative platforms coupled with advanced technologies such as 5G, IoT, and mobile edge computing. For instance, in January 2022, Vodafone announced a partnership with Proximie, the health technology platform that digitizes operating rooms worldwide to save lives by sharing the world's best clinical practices. Combining technologies such as 5G, IoT, and Edge Computing with Proximie's world-class connected surgical care software, healthcare experts will be able to virtually' scrub in,' record, and interact with operating rooms across the world to help accelerate and improve workforce training and more efficient delivery of high-quality surgical care, at scale.

Mobile Edge Computing (MEC) Industry Overview

The MEC market comprises several global and regional players vying for attention in a fairly contested market space. However, the market is dominated by major vendors that cover a significant share of the market and compete to gain a foothold and become pioneers in different regional markets. Overall, the competitive rivalry among the vendors is expected to be high and remain the same during the forecast period.

In September 2022, Nokia introduced new platform capabilities and applications for its on-premise Mission Critical Industrial Edge (MXIE) compute solution that would enable to host of applications from different ecosystems to advance enterprise digital transformation. It also developed vertical-specific blueprints that guide industrial enterprises to simplify their digital transformation.

In September 2022, Verizon partnered with US Armed Forces to construct a private 5G network inside an aircraft maintenance hangar on Joint Base Pearl Harbor Hickam (JBPHH). With this design, it would be easy for military leaders to leverage the high-speed, high-bandwidth, and low latency of Verizon 5G.

In August 2022, AT&T partnered with WNBA, offering WNBA fans a way to customize content and interact with the game with the upgraded AT&T 5G game view. Fans can view game and player stats during live games, watch customizable clips, and access real-time 3D stats using augmented reality.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Impact of COVID-19 on the Mobile Edge Computing Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Widespread Adoption and Growth of Latency-specific Applications

- 5.1.2 Rising Application of 5G & Industrial IoT Services Among End-user Industries

- 5.2 Market Restraints

- 5.2.1 Lack of a Common Security Framework

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By End-user

- 6.2.1 Financial and Banking Industry

- 6.2.2 Retail

- 6.2.3 Healthcare and Life Sciences

- 6.2.4 Industrial

- 6.2.5 Energy and Utilities

- 6.2.6 Telecommunications

- 6.2.7 Other End-users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Comsovereign Holding Corp

- 7.1.4 AT&T Inc.

- 7.1.5 Huawei Technologies Co. Ltd.

- 7.1.6 Verizon Communication Ltd

- 7.1.7 SGH, Inc. (penguin Solutions )

- 7.1.8 ADLINK Technology Inc.

- 7.1.9 Vodafone Group PLC

- 7.1.10 Adva Optical Networking SE