|

市場調查報告書

商品編碼

1438447

積層陶瓷電容(MLCC):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Multi-Layer Ceramic Capacitor (MLCC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

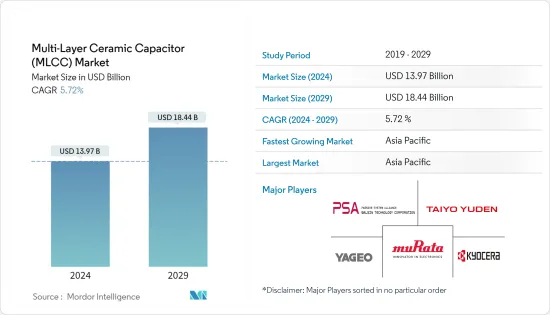

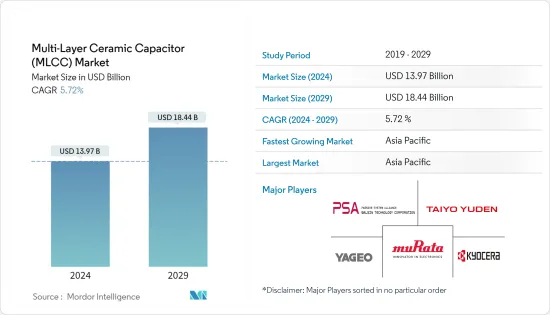

積層陶瓷電容(MLCC)市場規模預計2024年為139.7億美元,預計2029年將達到184.4億美元,預測期內(2024-2029年)年複合成長率為5.72%,預計還會成長。

主要亮點

- 隨著IT設備的進步,作為電子產業核心零件的積層陶瓷電容(MLCC)的需求正在顯著增加。迄今為止,電子產業一直是 MLCC 的最大用戶,並且預計將繼續佔據較大佔有率。快速數位化和物聯網、雲端和人工智慧等技術的出現將推動市場成長。

- 此外,5G的推出將成為這些新興技術的推動者,因此對運算電子產品的需求可能會激增。

- 此外,由於小型化的潛力,製造商正在嘗試將更多的組件和電路整合到有限的空間中。 MLCC 可能是新興運算技術成功的重要因素,因為沒有其他電容器能夠與 MLCC 的獨特特性相符。

- 半導體產業面臨的主要挑戰之一是由於美國之間持續的貿易戰而導致法規和相關關稅的不確定性。兩國政府對任一國家的進口產品徵收額外關稅。京瓷、三星電子和村田製作所等大公司都在離客戶較近的國家設有工廠。

- 全球在家工作政策的實施增加了對筆記型電腦、智慧型手機、個人電腦、印表機、智慧型穿戴裝置、醫療保健設備、網路攝影機、耳機等電子設備的需求,刺激了電子產業對MLCC的需求。我應用了它。此外,網路使用的增加加速了通訊業對 MLCC 的需求。考慮到這些因素,全球積層陶瓷電容(MLCC)市場的成長放緩,但在疫情期間仍不減。然而,COVID-19 後的市場預計將持續成長。

積層陶瓷電容(MLCC)市場趨勢

電子業佔最大市場佔有率佔有率

- 每家公司都開發了比傳統 2 端子積層陶瓷電容(MLCC) 具有更低等效串聯電阻 (ESL) 的 MLC 電容器,以更少的頻寬降低了高頻段的電阻。由於這一特性,MLCC 擴大應用於高階電子設備,尤其是智慧型手機,需要高密度和小型化以容納高速處理器。

- 根據GSMA預測,2025年,5G網路預計將覆蓋全球三分之一的人口。該組織預計,5G連線預計到年終年底將達到10億,到2025年將達到20億,佔所有行動連線的五分之一以上。 5G 的日益普及對智慧型手機等支援 5G 的設備產生了巨大的需求。

- 隨著普及5G 的智慧型手機變得越來越普遍,以及穿戴式終端等裝置變得更加多功能和小型化,對更小、更密集的電子電路的需求日益成長。

- 此外,物聯網的普及也是市場成長的重要因素。例如,根據愛立信的數據,2022年全球短程物聯網設備數量將約為102.9億個,預計2027年將成長至約251.5億個。此外,到2022年,廣域物聯網設備的數量預計將達到28億個,預計2027年將達到54億個。

- 正在生產的許多物聯網產品都是穿戴式的或設計為消費者環境的延伸,因此面臨體積效率問題。因此,我們需要僅適用於 MLCC 外殼尺寸的超小型外殼尺寸零件。

- 此外,新興國家智慧型手機普及的提高以及物聯網和穿戴式裝置市場的擴大預計將抵消這些因素,同時為研究市場中的供應商創造機會。

亞太地區主導市場

- 從最終用戶的角度來看,中國長期以來一直是全球最大的汽車市場,並且正在成為汽車技術強國。該國對技術進步持開放態度,這可能對未來的汽車產業產生重大影響。此外,隨著工業4.0的到來,隨著「中國製造2025」等計畫的實施,中國的自動化和工業領域預計將出現大規模成長。

- 根據中國工業協會統計,2023年1月至5月,中國生產汽車1,068.7萬輛,銷售汽車1,061.7萬輛,較去年成長11.1%。自動駕駛、電動車、聯網汽車等新技術在中國正大力推廣。 MLCC 的需求預計將進一步成長。根據豐業銀行的數據,以銷售量計算,中國是最大的汽車市場,2022 年銷售量約 2,324 萬輛。

- 在印度,不斷成長的需求和旨在使該國成為汽車製造中心的支持性政府法規進一步推動了汽車產業的成長。例如,《印度汽車使命計畫2026》是印度政府和印度汽車產業共同計劃的,旨在製定汽車產業發展藍圖。

- 考慮到成長潛力並滿足不斷成長的需求,多家汽車製造商正在印度汽車工業的各個領域進行大量投資。 IBEF表示,印度汽車工業的目標是在2016年至2026年間將汽車出口量增加五倍。 2012會計年度印度汽車出口量為5,617,246輛。

- 日本的通訊業在過去幾十年中取得了顯著的發展。日本政府計劃投資數十億美元加速超高速通訊的發展。日本設備製造商NEC和富士通以及芬蘭設備製造商諾基亞宣布計劃對自己的行動通訊技術進行實驗測試,目標是在2030年實現6G服務的商業化。

積層陶瓷電容(MLCC) 產業概覽

積層陶瓷電容(MLCC) 市場競爭溫和,有幾家知名廠商。擁有較大市場佔有率的企業正專注於擴大海外基本客群。我們也進行策略合作,以擴大市場佔有率並提高盈利。

2023年5月,三星馬達宣布將為汽車開發卓越的驅動力輔助系統(ADAS)和獨立驅動,尺寸為1206英吋(3.21.6毫米)、電容為22F、X7S(-55至125)/額定電壓16V。我們已經領先產了適用於(AD)的積層陶瓷電容(MLCC)CL31Y226MOK6PJ。

2023年4月,作為獲客策略的一部分,宇陽參加了EIMS深圳國際電子智慧製造展。本公司展出了七個重要產品系列:超小型008004/01005封裝MLCC、高潛力系列0201-2.2 Hoshi F/4.7 Hoshi F、0402-4.7 Hoshi F/10 Hoshi F、0603-22 Hoshi F/47此外Hoshi F、0805-47 Hoshi F/100 Hoshi F、1206-47 Hoshi F/100 Hoshi F、1210-100 Hoshi F/220 Hoshi F MLCC,針對汽車能源安全的汽車級MLCC產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 擴大在電子產業的應用

- 汽車領域的裝置採用率增加

- 市場挑戰

- 監管和關稅變化

第6章市場區隔

- 按類型

- 通用電容器

- 數組類型

- 系列結構

- 巨型上限

- 其他類型

- 額定電壓範圍

- 低電壓範圍

- 中壓範圍

- 高電壓範圍

- 依媒體類型

- X7R

- X5R

- C0G

- Y5V

- 其他電介質類型

- 按最終用戶產業

- 電子產品

- 車

- 工業的

- 通訊

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 亞太地區

- 中國

- 印度

- 日本

- 拉丁美洲

- 巴西

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 供應商市場佔有率分析

- 公司簡介

- Murata Manufacturing Co. Ltd

- Taiyo Yuden Co. Ltd

- Kyocera Corporation

- Yageo Corporation

- Walsin Technology Corporation

- Samsung Electro-mechanics Co. Ltd

- Eyang Holdings Group Co. Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Kemet Corporation

- Spectrum Control INC.

- Knowles Corporation

- Worth Elektronik Group

第8章投資分析

第9章市場的未來

The Multi-Layer Ceramic Capacitor Market size is estimated at USD 13.97 billion in 2024, and is expected to reach USD 18.44 billion by 2029, growing at a CAGR of 5.72% during the forecast period (2024-2029).

Key Highlights

- The demand for Multi-Layer Ceramic Capacitor (MLCC), a core component of the electronic industry, is increasing significantly with the advancement of IT devices. The electronics industry has been the largest user of MLCCs in the past and is expected to hold a significant share in the future. The rapid digitalization and emergence of technologies like IoT, cloud, and AI will drive the growth of the market.

- Furthermore, the launch of 5G will act as an enabler for these emerging technologies, due to which there will be a massive surge in demand for computing electronics.

- Moreover, with the possibility of miniaturization, the manufacturers are trying to integrate more components and circuits within the limited space available to them. Other capacitors have not matched the unique characteristics of MLCC, due to which MLCC is going to be the prominent factor in the success of the emerging new computing technology.

- One of the main challenges the semiconductor industry faces is the uncertainty in regulations and associated tariffs due to the ongoing trade war between the United States and China. Both governments have imposed additional tariffs on imported goods from either country. All the major players like Kyocera, Samsung Electromechanical, and Murata have their plants in countries to be closer to their customers.

- The increase in demand for electronics such as laptops, smartphones, computers, printers, smart wearables, healthcare devices, webcams, and headphones due to the implementation of work-from-home policies globally fueled the demand for MLCCs in the electronics industry. In addition, the rise in internet usage accelerated the need for MLCCs in the telecommunications industry. Considering these factors, the growth of the global multi-layer ceramic capacitor (MLCC) market did not decline but slowed down during the pandemic. However, the market is expected to grow consistently in the post-COVID-19 period.

Multi-Layer Ceramic Capacitor (MLCC) Market Trends

Electronics Industry to Hold the Largest Market Share

- Companies are developing MLC capacitors with lower equivalent series resistance (ESL) than a conventional 2-terminal multilayer ceramic capacitor to reduce the impedance in a high-frequency band with fewer components. This characteristic resulted in the increasing adoption of MLCC in high-end electronics, especially smartphones and other devices, where high density with compactness is required for mounted high-speed processors.

- According to GSMA, 5G networks are expected to cover one-third of the world's population by 2025. As per the organization's estimates, the number of 5G connections was expected to surpass 1 billion by the end of 2022 and 2 billion by 2025, making up over a fifth of mobile connections. The rise in the implementation of 5G is creating a huge demand for 5G-enabled devices, such as smartphones.

- With smartphones supporting 5G becoming more widespread and devices like wearable devices becoming increasingly multifunctional and compact, the need for smaller, higher-density electronic circuitry is increasing.

- Furthermore, the proliferation of IoT is another key factor contributing to market growth. For instance, Ericsson said there were around 10.29 billion short-range IoT devices globally in 2022, predicted to grow to around 25.15 billion devices by 2027. Besides, wide-area IoT devices are estimated at 2.8 billion in 2022 and are anticipated to reach 5.4 billion devices by 2027.

- Many IoT products being produced have volumetric efficiency issues as they are wearable or designed to be extensions of the consumer's environment. Therefore, they require ultra-small case size parts only available in the MLCC case sizes.

- Moreover, the increasing penetration of smartphones in emerging countries and the growing market for IoT and wearable devices are expected to offset these factors while creating an opportunity for the vendors in the market studied.

Asia-Pacific to Dominate the Market

- In terms of end-users, China has been the world's largest automotive market for years and is becoming a powerhouse for automotive technology. The country may substantially impact the automotive industry in the future since it is open to technological progress. Furthermore, with the arrival of Industry 4.0, China is expected to see massive growth in the automation and industry sector, owing to schemes like "Made in China 2025".

- According to the China Association of Automobile Manufacturers, in January-May 2023, production and sales of automotive cars in China amounted to 10.687 million units and 10.617 million units, increasing by 11.1% yearly. New technologies, such as autonomous driving, electric vehicles, and connected cars, are being driven very strongly in China. The demand for MLCCs is expected to grow further. According to Scotiabank, China was the largest automobile market based on sales, with around 23.24 million units in 2022.

- In India, increasing demand, along with the supportive government regulations to make the country an automotive manufacturing hub, is further driving the growth of the automotive sector. For instance, India's Automotive Mission Plan 2026 is a mutual initiative by the Government Of India and the Indian automotive industry to lay down the roadmap for the evolution of the industry.

- Considering the growth potential and to keep up with the growing demand, several automakers have invested heavily in various segments of the Indian automotive industry. According to IBEF, the Indian automotive industry is targeting to increase the export of vehicles by five times during 2016-26. In FY22, total automobiles exported from India stood at 5,617,246.

- The telecommunication industry in Japan has witnessed remarkable evolution in the past few decades. The Japanese government plans to invest billions of dollars in promoting the development of ultra-high-speed communication. Japanese equipment manufacturers NEC and Fujitsu and Finnish equipment manufacturer Nokia announced plans to conduct experimental trials of unique mobile communications technologies for the targeted commercial launch of 6G services by 2030.

Multi-Layer Ceramic Capacitor (MLCC) Industry Overview

The multi-layer ceramic capacitor market is moderately competitive and consists of some influential players. The players with significant shares in the market are concentrating on expanding their customer bases across foreign countries. They are taking strategic collaborative actions to improve their market presence and enhance their profitability.

In May 2023, Samsung Electro-Mechanics advanced and heavily produced a multi-layer ceramic capacitor CL31Y226MOK6PJ that may be applied withinside the superior driving force help system (ADAS) and self-sustaining driving (AD) of an automobile with a capacitance of 22μF at 1206-inch (3.21.6mm) size/ X7S (-fifty-five to 125)/ rated 16V.

In April 2023, Eyang attended EIMS Shenzhen International Electronic Intelligent Manufacturing Exhibition as part of the customer acquisition strategy. The company showcased its seven important collections of products: ultra-micro 008004/01005 packaged MLCCs, high-potential collection of 0201-2.2μF/4.7μF, 0402-4.7μF/10μF, 0603-22μF/47μF, 0805-47μF/100μF, 1206-47μF/100μF, and 1210-100μF/220μF MLCCs, in addition to automotive-grade MLCC product for car energy safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing applications in the Electronics Industry

- 5.1.2 Increased Unit Adoption in the Automotive Sector

- 5.2 Market Challenges

- 5.2.1 Changing Regulations and Tariffs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 General Capacitor

- 6.1.2 Array

- 6.1.3 Serial Construction

- 6.1.4 Mega Cap

- 6.1.5 Other Types

- 6.2 By Rated Voltage Range

- 6.2.1 Low Range

- 6.2.2 Mid-range

- 6.2.3 High Range

- 6.3 By Dielectric Type

- 6.3.1 X7R

- 6.3.2 X5R

- 6.3.3 C0G

- 6.3.4 Y5V

- 6.3.5 Other Dielectric Types

- 6.4 By End-user Industry

- 6.4.1 Electronics

- 6.4.2 Automotive

- 6.4.3 Industrial

- 6.4.4 Telecommunication

- 6.4.5 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 United Kingdom

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share Analysis

- 7.2 Company Profiles

- 7.2.1 Murata Manufacturing Co. Ltd

- 7.2.2 Taiyo Yuden Co. Ltd

- 7.2.3 Kyocera Corporation

- 7.2.4 Yageo Corporation

- 7.2.5 Walsin Technology Corporation

- 7.2.6 Samsung Electro-mechanics Co. Ltd

- 7.2.7 Eyang Holdings Group Co. Ltd

- 7.2.8 TDK Corporation

- 7.2.9 Vishay Intertechnology Inc.

- 7.2.10 Kemet Corporation

- 7.2.11 Spectrum Control INC.

- 7.2.12 Knowles Corporation

- 7.2.13 Worth Elektronik Group