|

市場調查報告書

商品編碼

1438445

電腦視覺:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Computer Vision - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

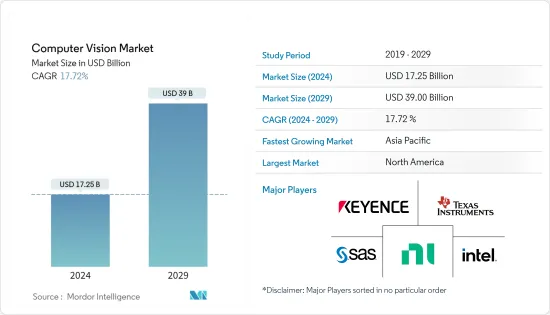

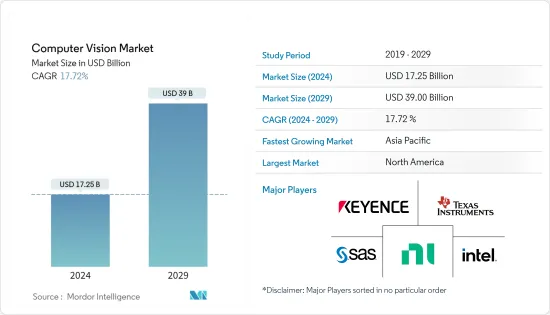

電腦視覺市場規模預計到 2024 年為 172.5 億美元,預計到 2029 年將達到 390 億美元,在預測期內(2024-2029 年)年複合成長率為 17.72%。

透過利用數位相機和視訊並應用深度機器學習演算法,電腦視覺成為預測性維護的關鍵組成部分,因為它可以找出系統內的任何缺陷。

主要亮點

- 電腦視覺技術中的人工智慧在各種用例中變得越來越受歡迎,包括消費級無人機以及自動和半自動車輛的電腦視覺解決方案。影像感測器、先進相機和深度學習技術的最新進展增加了電腦視覺系統在教育、醫療保健、機器人、消費性電器產品、零售、製造、安全和監控等許多領域的應用。

- 電腦視覺系統使用臉部辨識和生物識別辨識掃描來增強對寶貴資產的保護。智慧型手機安全是臉部辨識技術最常見的用途,因為電腦視覺系統可以區分人類視網膜和虹膜的不同圖案。

- 此外,臉部辨識的更複雜的應用包括使用主體的生理特徵來驗證身分的商業或家庭安全系統。銀行金庫房和調查等高安全性地點也需要進行指紋分析以進行存取控制。

- 例如,2022 年 8 月,總部位於杜拜的醫院和醫療機構人工智慧解決方案開發商 TachyHealth, Inc. 與為患者提供遠端醫療諮詢的公司 Medical Refill 合作。此次合作將為臨床團隊提供電腦視覺和人工智慧等技術解決方案。

- 此外,根據世界衛生組織的數據,每年有 125 萬人死於交通事故。此外,據世界衛生組織稱,到 2030 年,這一趨勢預計將超過心臟病,成為第七大死因。大多數交通事故都可能涉及弱勢道路使用者 (VRU),例如騎自行車的人和行人。因此,可以認為大部分的交通事故都是人為失誤造成。因此,推動電腦視覺市場發展的一項新技術就是無人駕駛汽車。

- 然而,電腦視覺系統整合的複雜性以及圍繞雲端基礎的影像處理日益增加的安全性問題是限制市場擴張的一些關鍵挑戰。此外,市場成長主要受到對高素質和經驗豐富的專業人員的高需求以及對用戶資料隱私和安全的擔憂的限制。

電腦視覺市場趨勢

製造業可望強勁成長

- 機器人和自動化最常用於製造業。隨著製造設施轉向全自動製造,對更智慧的系統來監控工業流程和結果的需求不斷增加。隨著物聯網改變製造業並使其更加自動化,機器視覺作為電腦視覺的一個分支,正在進一步幫助改善工業運作。

- 此外,製造商可以使用電腦視覺對鑽機、管道、設施和現場進行遠端現場檢查進行預測性維護。利用電腦視覺密切監控包裝和產品質量,並減少缺陷產品的數量。

- 例如,雲端運算平台公司 Amazon Web Services, Inc. 最近推出了 Amazon Lookout,這是一種用於在製造過程中檢查產品的視覺服務。 Amazon Lookout 旨在透過消除建置、最佳化、培訓、監控和部署電腦視覺模型的障礙,使電腦視覺模型更容易被許多製造工廠使用。我們也支援將電腦視覺實施到客戶設施內的作業系統。

- 此外,借助電腦視覺和深度學習演算法,我們可以自動檢查生產線上的每個產品。例如,人工智慧主導的視訊追蹤和視訊分析提供商 Drishti Technologies, Inc. 將於 2022 年 1 月使用電腦視覺和深度學習對生產單位的現場視訊記錄進行自動分析。本質上,該公司在生產線上安裝鏡頭來錄製影片,然後使用運動識別、異常檢測和物體檢測進行分析。

- 預測性維護領域預計將在預測期內擴大。預測性維護將機器學習演算法與物聯網 (IoT) 設備結合,以監控機器和相關組件上的資料。因此,該地區的市場預計也將受到數位技術和與其行業更相關的預測性維護偏好的日益採用的推動。

亞太地區將經歷顯著成長

- 世界上一些成長最快的經濟體,例如中國和印度,都位於亞太地區。中國在消費品和其他電子產品的製造方面處於世界領先地位。由於電腦視覺在製造業有廣泛的應用,「中國製造2025」目標是推動該產業市場成長的關鍵因素之一。

- 中國專家開發了一種機器學習驅動的系統來解釋電腦斷層掃描和患者臨床資料。當研究人員將該系統的性能與中國專家的性能進行比較時,他們有了意想不到的發現。此整合模型成功識別出超過 70% 的電腦斷層掃描被醫療專業人員認為正常的患者感染疾病了COVID-19。上述研究也發現,深度學習和電腦視覺技術可以幫助識別人眼看不見的複雜模式。

- 此外,由於政府加大力度,印度的醫療保健產業正在迅速擴張。政府已採取一系列措施促進印度成為醫療旅遊中心。因此,對最先進的診斷設施進行大量資本投資的潛力增加,從而增加了電腦視覺技術的普及和需求。

- 此外,透過提供各種網路架構,高效能硬體組件簡化了視覺系統安裝並支援各種不同的應用。例如,2022 年 8 月,電腦視覺技術供應商 VisualCortex Pty Ltd 與公共安防監控供應商 i-PRO 合作,從頭到尾輕鬆部署企業範圍的視訊分析系統,讓安裝成為可能。

電腦視覺產業概況

電腦視覺技術市場的參與者之間的競爭逐漸加劇。臉部辨識、手勢姿態分析和增強安全性等技術的最新進展正在徹底改變製造業、醫療保健等各個行業。因此,各種各樣的公司正在進入這個市場。一些主要參與者包括英特爾公司、國家儀器公司、基恩士公司、德州儀器公司和 SAS 研究所。其中一些進展是:

2022 年 8 月,Vedanta Limited 與 Detect Technologies 合作,這是一個基於工業人工智慧的組織,致力於創造最尖端科技。此次合作旨在部署 Detect Technologies 基於人工智慧的辦公室軟體 T-pulse。 T-pulse 軟體的 COVID-19 合規模組可幫助 Vedanta Limited 確保工作空間符合所有必要的要求並保持最高的衛生標準。 T-computer Pulse 的視覺技術也改進了數位安全監控系統。

2022年3月,AI電腦視覺平台Cogniac與美國科技公司思科系統公司(Cisco Meraki)近期建立了合作關係。此次合作將實現 Cogniac 的電腦視覺功能與思科系統公司的 MV 智慧相機和雲端基礎的平台的整合。兩個組織都利用照片和影片資料創建機器學習模型,無需新的基礎設施或人工智慧專業知識即可追蹤操作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與阻礙因素簡介

- 市場促進因素

- 對品質檢測和自動化的需求不斷成長

- 對視覺引導機器人系統的需求不斷成長

- 市場限制因素

- 整合電腦視覺系統的複雜性

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 按成分

- 硬體

- 軟體

- 按最終用戶產業

- 生命科學

- 製造業

- 國防和安全

- 車

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Intel Corporation

- National Instruments Corporation

- SAS Institute

- Keyence Corporation

- Texas Instruments Incorporated

- Microsoft Corporation.

- Omron Corporation

- Sony Corporation

- Cadence Design Systems, Inc.

- Synopsys, Inc.

第7章市場機會與未來趨勢

- 投資分析

The Computer Vision Market size is estimated at USD 17.25 billion in 2024, and is expected to reach USD 39 billion by 2029, growing at a CAGR of 17.72% during the forecast period (2024-2029).

With the help of digital cameras or videos and applying deep machine learning algorithms, computer vision accurately identifies any defect in the system, thus, making it one of the critical components in predictive maintenance.

Key Highlights

- AI in computer vision technology is becoming increasingly popular in various use cases, including computer vision solutions in consumer drones and autonomous & semi-autonomous cars. Due to recent advancements in image sensors, sophisticated cameras, and deep learning techniques, the application of computer vision systems has increased in many sectors, including education, healthcare, robotics, consumer electronics, retail, manufacturing, and security & surveillance.

- Computer vision systems use facial recognition and biometric scanning to increase the protection of valuable assets. Due to computer vision systems' ability to distinguish various patterns in human retinas and irises, smartphone security is the most common application for facial recognition technology.

- Additionally, more sophisticated applications of facial recognition include commercial or home security systems that confirm identity using the physiological characteristics of the subject. High-security locations like bank vaults and research labs are also subject to fingerprint analysis for access control.

- For instance, in August 2022, TachyHealth, Inc., a Dubai-based developer of artificial intelligence solutions for hospitals and medical facilities, partnered with Medical Refill, a company that offers patients remote medical consultations. The alliance intends to give the clinical team access to technological solutions, including computer vision and artificial intelligence.

- Additionally, according to the WHO, 1.25 million individuals pass away each year as a result of traffic accidents. Furthermore, according to the WHO, by 2030, this trend will overtake heart disease as the seventh biggest cause of death. The majority of traffic collisions can be linked to Vulnerable Road Users (VRUs), such as cyclists and pedestrians. Thus, it may be inferred that human mistake is to blame for the majority of traffic accidents. Consequently, a new technology that is pushing the market for computer vision is driverless vehicles.

- However, the complexity of integrating computer vision systems and the growing security issues surrounding cloud-based image processing are some of the key challenges that are limiting the market's expansion. Additionally, the market's growth is primarily being constrained by the high demand for highly qualified and experienced professionals, as well as worries about the privacy and security of user data.

Computer Vision Market Trends

Manufacturing Sector is Expected to Register a Significant Growth

- Robotics and automation are being used most heavily in the manufacturing sector. There is an increasing need for more intelligent systems to monitor industrial processes and outcomes as manufacturing facilities move toward completely automated manufacturing. Machine vision, a branch of computer vision, is further assisting in improving industrial operations as the IoT is transforming the manufacturing sector and making them more autonomous.

- Additionally, manufacturers can use computer vision to provide predictive maintenance for remote site inspections of rigs, pipelines, facilities, and fields. With the aid of computer vision, packaging and product quality are closely monitored, and the number of defective products is also decreased.

- For instance, cloud computing platform company Amazon Web Services, Inc. recently introduced Amazon Lookout, a vision service for checking products while they are being manufactured. Amazon Lookout aims to make computer vision models more accessible to many manufacturing facilities by removing barriers to building, optimizing computer vision models, training, monitoring, and deploying. It would also support its customers' deployment of computer vision into its operating systems inside of their facilities.

- Additionally, every product in the production line can have its inspection automated thanks to computer vision and deep learning algorithms. For instance, in January 2022, Drishti Technologies, Inc., an AI-driven video traceability and video analytics provider, will automate the analysis of floor video recordings from production units using computer vision and deep learning. In essence, the company has installed cameras on manufacturing lines to record videos, which are afterwards analysed using action recognition, anomaly detection, and object detection.

- Over the projected period, it is anticipated that the predictive maintenance segment will expand. To monitor the data of the machinery and associated components, predictive maintenance blends machine learning algorithms with IoT (Internet of Things) devices. Thus, it is anticipated that the region's market would also be driven by the increased adoption of digital technology and the preference for predictive maintenance that is more relevant to their industry.

Asia-Pacific to Witness the Significant Growth

- One of the economies with the fastest growth rates in the world, including China and India, is found in the Asia-Pacific area. China is the global leader in manufacturing items like consumer goods or other electronic goods. Since computer vision has numerous applications in the manufacturing sector, the "Made in China 2025" aim is one of the key factors promoting market growth in the area.

- Chinese experts developed an ML-driven system to interpret CT scans and patient clinical data. The researchers made an unexpected finding when they compared the system's performance to that of a Chinese expert. The combined model successfully identified COVID-19 infection in over 70% of patients with CT scans judged to be normal by medical professionals. The survey above also discovered that deep learning and computer vision technologies help recognize complex patterns that are invisible to the human eye.

- Additionally, India's healthcare industry is expanding rapidly due to increased government initiatives. To promote India's emergence as a center of medical tourism, the government has put in place a number of measures. As a result, it increases the potential for substantial capital investments in cutting-edge diagnostic facilities, boosting the uptake and demand for computer vision technologies.

- Additionally, by providing a variety of networking architectures, high-performance hardware components have simplified the installation of vision systems and serve a wide range of diverse applications. For instance, in August 2022, the provider of computer vision technology VisualCortex Pty Ltd, joined forces with the supplier of security surveillance for public safety, i-PRO, to make it easier to install enterprise-wide video analytics systems from beginning to finish in the Asia-Pacific area.

Computer Vision Industry Overview

In the computer vision technology market, the competition among the players is moderately increasing. Recent advancements in technologies such as facial recognition, gesture analysis, and enhanced security are revolutionizing different industries such as manufacturing, healthcare, etc. Therefore, different companies are entering the market. Some key players are Intel Corporation, National Instruments Corporation, Keyence Corporation, Texas Instruments Incorporated, and SAS Institute. Some of the developments are:

In August 2022, Vedanta Limited teamed with Detect Technologies, an organization based on industrial artificial intelligence that creates cutting-edge technology. The alliance aims to roll out T-pulse, Detect Technologies' AI-based office software. The COVID-19 compliance module of the T-pulse software will assist Vedanta Limited in ensuring that its workspaces meet all necessary requirements and uphold the highest sanitization standards. T-computer Pulse's vision technology would also improve the digital safety monitoring system.

In March 2022, the AI computer vision platform Cogniac and the American technology company Cisco Systems Inc. (Cisco Meraki) recently established a cooperation. The cooperation would enable the integration of Cogniac's computer vision capabilities with MV smart cameras from Cisco Systems Inc. and cloud-based platforms. Both organizations would create machine learning models that make use of picture and video data to track the actions without the requirement for new infrastructure or AI expertise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Need for Quality Inspection and Automation

- 4.3.2 Growing Demand for Vision-Guided Robotic Systems

- 4.4 Market Restraints

- 4.4.1 Complexity in Integrating Computer Vision Systems

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Components

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 By End-user Industry

- 5.2.1 Life science

- 5.2.2 Manufacturing

- 5.2.3 Defense & Security

- 5.2.4 Automotive

- 5.2.5 Other End User Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Intel Corporation

- 6.1.2 National Instruments Corporation

- 6.1.3 SAS Institute

- 6.1.4 Keyence Corporation

- 6.1.5 Texas Instruments Incorporated

- 6.1.6 Microsoft Corporation.

- 6.1.7 Omron Corporation

- 6.1.8 Sony Corporation

- 6.1.9 Cadence Design Systems, Inc.

- 6.1.10 Synopsys, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 INVESTMENT ANALYSIS