|

市場調查報告書

商品編碼

1438374

工業感測器:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Industrial Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

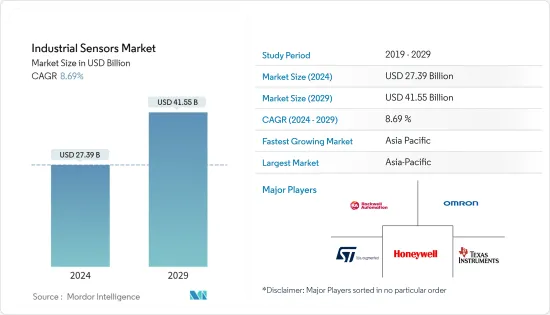

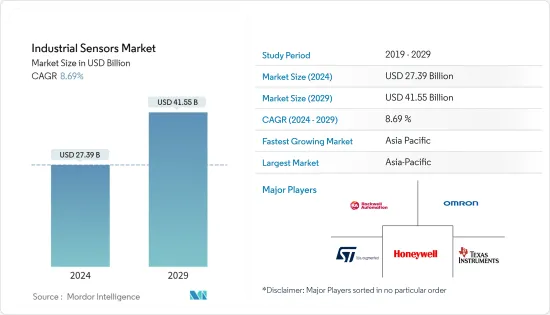

預計2024年工業感測器市場規模為273.9億美元,預計2029年將達到415.5億美元,在預測期內(2024-2029年)成長8.69%,年複合成長率為

現在,感測器的一致和可靠的性能使重工業業務中的資產能夠驅動關鍵的日常指標。製造商不斷監控其生產線上資產的運作。 IIoT 透過工業連接與適用於不同用例、角色和應用的 IIoT 平台整合了這些複雜行業中常見的傳統機械。

主要亮點

- 工業物聯網使各行業能夠重新思考經營模式,並從 IIoT 設備產生可操作的資訊和知識。資料共用生態系統已經開始打造新的收益來源和合作關係。

- 雷射感測器可測量任何表面上的 3D 運動和振動,使工業製造商能夠即時監控引擎、渦輪機和泵浦的健康狀況和性能。緊湊的非接觸式幾何形狀允許感測器在熱、濕和移動的表面上運行。

- 過去兩年,全球汽車產業經歷了景氣衰退,中國也出現了同樣的趨勢。該領域的感測器和感測器組件的數量有所增加。過去幾年,MEMS 壓力感測器在智慧汽車領域得到了廣泛採用。同樣,Asystom 最近推出了一系列具有增強自主性的多感測器 IIoT 設備。多感測器功能整合了新的板載連接節能電子設備,以執行現場分析並滿足各種工業設備的預測性維護需求。除了改進的性能外,這些創新產品還環保且 100% 可升級。

- 電感式接近感測器只能偵測金屬設備,而其他感測器則檢測其他材料。此外,電感式接近感測器的感應範圍取決於設計中使用的金屬形狀、尺寸和線圈尺寸的類型。因此,考慮了感應距離限制。關於感應式接近感測器的感測能力和僅在金屬物體上使用的這一因素阻礙了所研究市場的成長。

- 作為生產好的溫度感測器的關鍵一環,選擇優質的原料對於製造商來說至關重要。用於製造的金屬和合金包括鉑、銅、矽、鎢、鎳和合金,並進一步分為K型、M型、E型和J型。鉑金價格在 2020 年 5 月升至兩個月高點,從 3 月中旬的 17 年低點回升,但鉑族金屬市場仍因 COVID-19感染疾病而承壓。

工業感測器市場趨勢

影像感測器佔有率高

- 影像感測器將光作為輸入並將其轉換為電訊號。影像感測器獲取其接收到的光的參數(例如顏色和亮度),並將它們傳遞到處理電路以將其轉換為影像。

- 感測器形成 PN 接面,當受到入射光照射時,開始產生電子電洞對,導致電流流動。這配置了影像感測器內的像素,進而配置了影像。該感測器被廣泛採用,以提高工業設備的速度,同時降低功耗。

- 例如,東芝裝置及儲存裝置公司於2021年3月發布了TCD2726DG,這是一款用於執行高速掃描的A3多功能裝置的鏡頭縮小型CCD線性影像感測器。新感測器減少了定時發生器電路和 CCD 驅動器的引腳數量,以防止電磁干擾 (EMI) 增加,這是更快時脈速率的負面影響。這減少了客戶的EMI/時序調整工作以及外圍元件的數量,使系統開發變得更加容易。

- 此外,工業設備各領域對數位轉型的需求不斷增加。這加速了相機在各種應用中的採用,增加了對具有更高成像性能的(互補型金屬氧化物半導體)CMOS 影像感測器的需求。

- 市場上的供應商也將影像感測器和 3D 相機結合起來,以提供更好的產品。例如,SICK Ranger 3-3D 相機使用 CMOS 影像感測器 M30 來建立具有減少的片上資料的3D 配置檔案。

亞太地區將經歷最高的成長

- 亞太地區在市場中佔據主要佔有率,由於技術進步和快速工業化,預計在預測期內將出現最高成長。

- 工業 4.0 打破了製程和製造業中自動化和控制功能的傳統界限。在日本社會5.0、中國製造2025等全球舉措和架構的框架下,我們正在賦能更廣泛的功能和產業。

- 在韓國,隨著政府對市場的支持,企業正在迅速轉型以採用工業 4.0 元素,加速向智慧和自動化工廠的轉型。韓國的汽車工業是世界上最大的汽車工業之一,在過去的幾十年中已經從一個由政府控制的小型行業發展成為由大型跨國公司控制的行業。該國是起亞汽車、現代汽車和雷諾等大公司的所在地,預計汽車需求將穩定成長。

- 食品飲料、發電等產業是中國感測器的重要用戶群。核能發電和火力發電行業包括多種高溫製程、零件和設備,包括鍋爐、熔爐、渦輪機、過熱蒸氣和水管道。因此,越來越需要高效的溫度感測器來最佳化製程。

- 日本的幾家公司正在致力於產品創新。例如,2021年10月,羅姆半導體宣布推出新型BM1390GLV(-Z)緊湊型高精度氣壓感知器IC。這款新設備具有 IPX8 防水等級,非常適合家用電器、工業設備和小型物聯網設備。該公司開發了一種新型緊湊型壓力感測器,以應對壓力感測器在各種應用中日益普及的趨勢。

- 此外,電子產業的崛起、人口的快速成長以及汽車產業的成長也刺激了該地區工業感測器市場。

- 工業機器人可以部署在越來越多的行業中執行各種任務。這導致亞太機器人感測器市場工業領域的自動化程度提高。製造公司正在廣泛部署自動化技術來簡化業務流程。

工業感測器產業概況

由於成熟的行業參與者的存在,工業感測器市場適度分散。這些公司利用並整合先進技術來提供服務不同最終用戶產業的多樣化產品。

- 2021 年 5 月 - Viezo 宣布推出 Sonora 無線自主感測器系列測試版。這些感測器環保且經濟高效,廣泛應用於鐵路營運商、工業公司、鐵路製造商和工業機械製造商。

- 2021 年 9 月,Hiber BV 宣布與殼牌達成協議,在全球提供完整性監控解決方案。該協議允許所有空殼公司和子公司在全球範圍內使用 HiberHilo 產品。該解決方案還使殼牌能夠獲得更多有關良好性能的資料,並更有效地監控油井完整性問題,從而提高偏遠和海上油井的安全性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 技術簡介

第5章市場動態

- 市場促進因素

- 由於物聯網的廣泛採用,對感測元件的需求增加

- 越來越重視預測性維護和遠端監控的使用

- 市場限制因素

- 成本和營運問題

第6章市場區隔:按感測器類型

- 流動

- 壓力

- 接近性(區域)

- 液位測量

- 溫度

- 影像

- 光電

- 其他感測類型

第7章市場區隔:依最終用戶產業

- 化學和石化

- 採礦和金屬

- 電力

- 食品和飲料

- 生命科學

- 航太和軍事

- 水和污水

- 其他最終用戶產業

第8章市場區隔:按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

第9章 競爭形勢

- 公司簡介

- Texas Instruments Incorporated

- TE Connectivity Inc.

- Omega Engineering Inc.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Siemens AG

- STMicroelectronics Inc.

- ams AG

- NXP Semiconductors NV

- First Sensor AG

- Bosch Sensortec GmbH

- Sick AG

- ABB Limited

- Omron Corporation

第10章限位開關分析

- 目前的市場情景(2020年至2027年的趨勢和預測)

- 市場動態

第11章投資分析

第12章市場機會與未來趨勢

The Industrial Sensors Market size is estimated at USD 27.39 billion in 2024, and is expected to reach USD 41.55 billion by 2029, growing at a CAGR of 8.69% during the forecast period (2024-2029).

The consistent and reliable performance of sensors has led the assets in heavy-industrial operations to drive critical daily metrics. Manufacturers are constantly monitoring the uptime of assets along their production lines. IIoT integrates legacy machinery commonplace within these complex industries via industrial connectivity with IIoT platforms for different use cases, roles, and applications.

Key Highlights

- The Industrial Internet of Things enabled industries to rethink business models, generating actionable information and knowledge from IIoT devices. A data-sharing ecosystem started to have built new revenue streams and partnerships.

- The laser sensors measured 3D motion and vibrations of any surface to enable industrial manufacturers to monitor the real-time health and performance of engines, turbines, and pumps. Their compact and contactless form enables the sensors to work on hot, wet, and moving surfaces.

- Although the global automotive sector witnessed a recession in the past two years, the trend was also reflected in China. The number of sensor and sensor components increased in the sector. MEMS pressure sensors have witnessed significant adoption in the smart automotive sector over the past few years. For the same, Asystom recently launched a range of multi-sensor IIoT devices featuring increased autonomy. The multi-sensor capability has addressed the predictive maintenance needs of a wide array of industrial equipment, integrating new onboard, connected, energy-saving electronics performing in situ analysis. These innovative products, apart from increased performance, are eco-responsible and 100% upgradeable.

- The inductive proximity sensors could detect only metallic devices, whereas other sensors detect any other materials. In addition, the sensing range of an inductive proximity sensor depends on the type of metal's shape, size, and coil size used in the design. Due to this, it accounted for distance limitations for sensing. This factor regarding the sensing capability and usage of inductive proximity sensors only on metallic objects is hindering the growth of the studied market.

- As an important part of producing a superior temperature sensor, the high-quality raw materials choice is vital for the producer. Metals and alloys used while manufacturing includes platinum, copper, silicon, tungsten, nickel, and alloys, which are further categorized into type-K, type-M, type-E, and type-J. Platinum prices rose to a two-month high in May 2020, recovering from a 17-year low in mid-March, but the platinum-group metals markets are projected to remain under pressure because of the COVID-19 pandemic.

Industrial Sensors Market Trends

Image Sensors to Hold Significant Share

- Image sensors take light as an input and convert it to an electrical signal. The image sensor takes the parameters of the light it receives, such as color and brightness, and passes it through the processing circuitry to be turned into an image.

- The sensor constitutes a PN junction, and when it is struck by incident light, it begins to produce electron-hole pairs and thus conducts current. This makes up the pixels within the image sensors, which further make up the images. The sensors are being widely adopted for enhancing industrial equipment in terms of speed while consuming little power.

- For instance, in March 2021, Toshiba Electronic Devices & Storage Corporation released the "TCD2726DG," a lens reduction type CCD linear image sensor for A3 multifunction printers that perform high-speed scanning. The new sensor contains a timing generator circuit and a smaller CCD driver pin count to prevent increased electromagnetic interference (EMI), which is a negative side effect of a faster clock rate. Customers' EMI and timing adjustment work, as well as the number of peripheral parts, are reduced, making system development easier.

- Also, the need for digital transformation continues to grow in different fields of industrial equipment. This has accelerated the adoption of cameras for a variety of applications, driving the demand for (complementary metal-oxide-semiconductor) CMOS image sensors with higher imaging performance.

- The vendors in the market are also combining image sensors and 3D cameras for a better offering. For instance, SICKs Ranger 3 - 3D camera uses CMOS image sensor M30 to create a 3D profile with reduced on-chip data.

Asia-Pacific to Witness the Highest Growth

- Asia-Pacific is expected to hold a significant share in the market and witness the highest growth over the forecast period, owing to the increasing technological advancements and rapid industrialization.

- Industry 4.0 is breaking the traditional borders of automation and control functions in the process and manufacturing industry. It is enabling a wider domain of functions and industries under global initiatives and architectural frameworks, like Society 5.0 in Japan and Made-in-China 2025 in China.

- Migration to smart or automated factories has accelerated in South Korea as companies are rapidly transforming to implement Industry 4.0 elements as the government is being conducive to the market. South Korea's automotive industry is one of the largest worldwide, growing from a small government-controlled sector to one controlled by large multinational enterprises over the past few decades. The country is home to major players like Kia, Hyundai, and Renault, and it is expected to witness steady growth in the demand for automobiles.

- In China, industries like food and beverage and electric power generation form a significant user base for sensors. The nuclear and thermal power generation industries have several high-temperature processes, parts, and equipment, like boilers, furnaces, turbines, super-heated steam, and water pipelines. Hence, there is a rising need for efficient temperature sensors to optimize the process.

- Multiple companies based in Japan have been engaging in product innovations. For instance, in October 2021, ROHM Semiconductor announced the launch of a new BM1390GLV (-Z) compact, high accuracy barometric pressure sensor IC. The new device features a waterproof rating of IPX8 and is ideal for home appliances, industrial equipment, and compact IoT devices. The company developed the new compact pressure sensor in response to the growing popularity of pressure sensors across various applications.

- Furthermore, the rising electronics industry, burgeoning population, and the growing automobile industry are also responsible for fueling the industrial sensors market in the region.

- Industrial robots can be deployed for a range of tasks in a growing number of industries. This led to the rising automation in the industrial sector in the Asia-Pacific robot sensor market. Manufacturing companies are widely implementing automation technologies to simplify operational processes.

Industrial Sensors Industry Overview

The industrial sensors market is moderately fragmented due to the presence of established industry players. These players are leveraging and incorporating advanced technologies to offer diversified products catering to varied end-user industries.

- May 2021- Viezo announced the launch of the Beta Version of its Sonora wireless autonomous sensors series. These sensors are eco-friendly and cost-efficient and find their applications in railway operators, industrial companies, train manufacturers, and industrial machinery manufacturers.

- September 2021, Hiber BV announced an agreement with Shell to provide well-integrity monitoring solutions globally. The agreement enables all Shell entities and subsidiaries to use the HiberHilo product globally. The solution also enables Shell to get more data on their good performance and monitor well integrity issues more effectively, thereby improving the safety of remote and offshore wells.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of IoT Leading to Demand for Sensing Components

- 5.1.2 Growing Emphasis on the Use of Predictive Maintenance and Remote Monitoring

- 5.2 Market Restraints

- 5.2.1 Cost and Operational Concerns

6 MARKET SEGMENTATION - BY SENSOR TYPE

- 6.1 Flow

- 6.2 Pressure

- 6.3 Proximity (Area)

- 6.4 Level Measurement

- 6.5 Temperature

- 6.6 Image

- 6.7 Photoelectric

- 6.8 Other Sensing Types

7 MARKET SEGMENTATION - BY END-USER VERTICAL

- 7.1 Chemical and Petrochemicals

- 7.2 Mining and Metal

- 7.3 Power

- 7.4 Food and Beverage

- 7.5 Life Sciences

- 7.6 Aerospace and Military

- 7.7 Water and Wastewater

- 7.8 Other End-user Verticals

8 MARKET SEGMENTATION - BY GEOGRAPHY

- 8.1 North America

- 8.1.1 United States

- 8.1.2 Canada

- 8.2 Europe

- 8.2.1 Germany

- 8.2.2 United Kingdom

- 8.2.3 France

- 8.2.4 Rest of Europe

- 8.3 Asia-Pacific

- 8.3.1 China

- 8.3.2 Japan

- 8.3.3 South Korea

- 8.3.4 Rest of Asia-Pacific

- 8.4 Latin America

- 8.5 Middle East & Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Texas Instruments Incorporated

- 9.1.2 TE Connectivity Inc.

- 9.1.3 Omega Engineering Inc.

- 9.1.4 Honeywell International Inc.

- 9.1.5 Rockwell Automation Inc.

- 9.1.6 Siemens AG

- 9.1.7 STMicroelectronics Inc.

- 9.1.8 ams AG

- 9.1.9 NXP Semiconductors NV

- 9.1.10 First Sensor AG

- 9.1.11 Bosch Sensortec GmbH

- 9.1.12 Sick AG

- 9.1.13 ABB Limited

- 9.1.14 Omron Corporation

10 ANALYSIS OF LIMIT SWITCHES

- 10.1 Current Market Scenario (Trends and Estimates from 2020-2027)

- 10.2 Market Dynamics