|

市場調查報告書

商品編碼

1438299

電動車動力總成 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Electric Vehicle Powertrain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

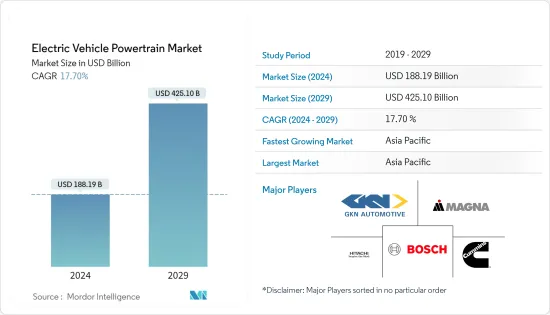

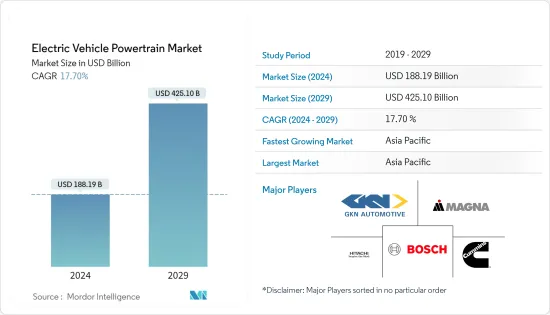

電動車動力總成市場規模預計到 2024 年為 1,881.9 億美元,預計到 2029 年將達到 4,251 億美元,在預測期內(2024-2029 年)CAGR為 17.70%。

主要亮點

- 由於全球封鎖和社交距離規範,COVID-19大流行對市場產生了負面影響,許多原始設備製造商的組裝線停止了研究和生產。這導致汽車銷售整體下滑,進而導致電動車動力總成市場下滑。然而,隨著全球範圍內對電動車的青睞不斷增加,預計該市場將在預測期內經濟復甦並顯著成長。

- 例如,2023年7月,IC Bus推出了下一代CE系列校車,這是其旗艦CE系列的重新設計和更新版本。全新CE系列的電動動力總成為駕駛員和乘客提供更安靜的乘坐體驗,以及三級可選的再生煞車,以實現更平穩的乘坐、電池效率和操作體驗。電動動力總成選項的峰值功率為 255 kW(342 hp),可支援交流電(AC)和直流快速充電(DCFC)。

- 從長遠來看,電動車市場預計將高速擴張,對汽車電動動力總成產生大量需求。世界各地的電動車取得了巨大的成長。主要汽車零件製造商一直在投資電動車軸驅動,以利用電動和混合動力汽車銷量的成長來增加其市場佔有率。公司一直在增加產能,特別是在中國、美國和歐洲地區等大型電動車市場。

- 豐田、本田、特斯拉、通用汽車和福特等主要汽車公司對電動車的大規模投資預計將在不久的將來推動電動馬達市場的發展。此外,電機製造商和汽車公司之間不斷發展的合作夥伴關係預計將擴大全球電動車動力總成市場。

- 例如,2023 年 7 月,麥克拉倫應用有限公司和 BOLD 宣布合作開發高性能電動動力系統。 McLaren Applied 與 BOLD 聯手,利用後者在設計和製造高性能、輕型電池組系統方面的專業知識。

- 預計電機市場在同步馬達永久磁鐵中使用的稀土金屬採購方面將面臨課題,因為這些電機中使用的金屬受到出口限制和供應風險。除了全球市場電動車開發活動不斷增加之外,石油和天然氣儲量的枯竭也是推動汽車製造商從IC動力總成轉向電動動力總成的主要因素之一。

電動車動力總成市場趨勢

電動車銷量的增加預計將推動市場

- 電動和混合動力汽車市場的不斷擴大是汽車動力總成市場的主要驅動力。全球電動車市場出現了巨大成長。

- 由於電池成本下降和技術進步(例如儲存容量增加),電動車的銷售量預計將上升,這促使消費者採用電動車。隨著全球氣溫以驚人的速度上升,世界各國政府和產業承諾減少溫室氣體排放。

- 2020 年,全球插電式汽車銷量達到 2,986,659 輛,而全球電動車總銷量為 2,123,872 輛。純電動車銷量預計將在2022 年達到730 萬輛,高於2021 年的約460 萬輛。純電動車銷量飆升的原因有很多,包括消費者對更永續交通的興趣增加以及政府制定遏制直接交通排放的法規。 2021 年,這些銷量比 2020 年成長了一倍多,2022 年則創下全電動銷售新紀錄。這清楚地表明了市場上電動車成長的上升趨勢以及預計電動動力總成市場的市場機會的增加。

- 交通運輸部門一直是主要關注領域之一,因為交通運輸和旅行在排放量中所佔佔有率僅次於發電。由於歐洲和亞太地區對產業和消費者的補貼和免稅等有利的監管環境,全球電動車的生產和銷售一直在快速成長。

- 中國和印度等主要汽車市場的政府已承諾到 2030 年僅允許電動車上路。主要汽車製造商也增加了對電動車開發的投資,以滿足預計的電動車需求成長。未來十年。

- 例如,2023 年 7 月,馬來西亞沃爾沃卡車推出了該地區首款全電動重型原動機。 VolvoFH Electric、FM Electric 和FMX Electric 車型由電動動力總成提供動力,該動力總成配備兩個或三個電機,根據應用可產生高達490 kW 的功率和2,400 Nm 的扭矩,電池容量範圍為180 kWh 至540 kWh,由兩個馬達組成。六個電池組,在組合總重 (GCW) 為 44 噸的情況下,一次充滿電後的行駛里程可達 300 公里。

中國可望成為最大電動車市場

- 近年來,電動車市場健康發展。成熟的亞洲市場對電動四輪車的採用將持續強勁。從絕對值來看,中國將成為最大的電動車市場。依照目前的軌跡,中國的採用率將達到 60%,到 2030 年,中國將佔新電動車銷量的 40% 以上。銷量的激增歸因於各個組織和政府為控制排放而實施的監管規範水平並推廣零排放車輛。

- 在許多方面,亞洲國家都處於氣候變遷的最前線。亞洲擁有 100 個污染最嚴重的城市中的 93 個,以及十大氣候脆弱國家中的 6 個。隨著許多國家持續發展和城市化,該地區面臨相對較高的能源需求。光是中國的能源消耗量就超過歐洲總能源消耗量的三倍多,這使得該國實現淨零能源消耗的努力變得更加複雜。

- 這迫使汽車製造商增加電動車的研發支出,最終使他們能夠在未來銷售電動車。這項策略對人們產生了強烈影響,因為購買模式從傳統內燃機汽車轉向電動車發生了相當大的變化。這種差異並沒有減少內燃機汽車的銷量,反而為當前和未來的電動車創造了一個充滿希望的市場。

- 亞洲品牌在該地區汽車消費支出中佔據相當大的比例,而電動車領域也出現了類似的趨勢。中國品牌已在E4W市場確立了強勢地位。中國比亞迪2021年市佔率成長了5%,五菱廣受歡迎、價格實惠的宏光Mini EV上市一年內銷售超過40萬輛。 2017 年至 2021 年間,最暢銷的 20 個電動車品牌中有 13 個是亞洲生產的。

- 亞太地區各國政府啟動了各種計劃,鼓勵買家選擇電動車而不是傳統汽車。印度、中國、韓國等國家對願意購買電動車的人有許多激勵措施。

- 例如,2022年5月,北京市政府發布了《2022年北京市交通綜合治理行動計畫》。根據《行動計畫》,北京市將推廣低碳能源交通方式,加速公車、計程車等電動車由汽油轉向電力的轉變。

- 因此,上述因素正在推動亞太地區電動車動力總成市場的成長。

電動車動力總成產業概況

羅伯特·博世有限公司、採埃孚股份公司、康明斯公司、德納公司、吉凱恩公司和麥格納國際等少數幾家公司在電動車動力總成市場佔據主導地位。參與者正在建立合作夥伴關係、收購、推出新產品並進行投資,以在競爭中保持領先。

例如,2023年6月,中山大洋汽車宣布計畫在重慶市渝北區建造「大洋汽車新能源汽車動力總成系統及零件(重慶)研發製造基地」。該計畫擬在重慶創新經濟轄區設立專案公司,總投資約10億元人民幣(1.399億美元),土地面積約73,333平方公尺。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 電動車銷量的增加預計將推動市場

- 市場限制

- 基礎設施缺乏可能會阻礙市場的成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 成分

- 傳染

- 馬達

- 電池

- 推進類型

- 純電動車

- 插電式混合動力汽車

- 車輛

- 搭乘用車

- 商用車

- 地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 挪威

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 公司簡介

- GKN PLC (Melrose Industries PLC)

- Magna International Inc.

- Hitachi Automotive Systems Ltd

- Bosch Limited

- Cummins Inc.

- AVL List GmbH

- Mitsubishi Electric Corp

- BorgWarner Inc.

第 7 章:市場機會與未來趨勢

The Electric Vehicle Powertrain Market size is estimated at USD 188.19 billion in 2024, and is expected to reach USD 425.10 billion by 2029, growing at a CAGR of 17.70% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had a negative impact on the market due to the global lockdown and social distancing norms, which halted the research and production from the assembly lines of many OEMs. This led to the downfall of automobile sales as a whole and, consequently, the electric vehicle powertrain market. However, with the rising inclination towards electric vehicles worldwide, the market is expected to revive economically and grow significantly during the forecast period.

- For instance, in July 2023, IC Bus introduced the next-generation CE Series school bus, a redesigned and updated version of its flagship CE Series. The all-new CE Series' electric powertrain provides a quieter ride for drivers and passengers, as well as three levels of selectable regenerative braking for a smoother ride, battery efficiency, and operating experience. The electric powertrain option has a peak power of 255 kW (342 hp) and is ready for alternating current (AC) and direct current fast charging (DCFC).

- Over the long term, the market for electric vehicles is expected to expand at a high rate, creating a high demand for automotive electric powertrains. There has been tremendous growth in electric vehicles all over the world. Major automotive component manufacturers have been investing in electric axle drives to capitalize on the increasing sales of electric and hybrid vehicles to increase their market share. Companies have been increasing production capacity, particularly in large electric vehicle markets, such as China, the United States, and the European region.

- Massive investments in electric vehicles by major automotive companies, such as Toyota, Honda, Tesla, General Motors, and Ford, are expected to drive the electric motor market in the near future. Additionally, the evolving partnerships between motor manufacturers and automotive companies are expected to expand the electric vehicle powertrain market globally.

- For instance, in July 2023, McLaren Applied Ltd. and BOLD announced a collaboration to create high-performance electric powertrains. McLaren Applied has joined forces with BOLD to capitalize on the latter's expertise in designing and manufacturing high-performance, lightweight battery pack systems.

- The electric motor market is expected to face challenges in procuring rare earth metals used in permanent magnets for synchronous motors, as the metals used in these motors are subject to export restrictions and supply risks. Apart from the growing activities in developing electric vehicles in the global market, depleting oil and gas reserves is also one of the major factors driving the automakers to shift from IC powertrain to electric powertrain.

EV Powertrain Market Trends

Increasing Sales of Electric Vehicles are Expected to Drive the Market

- The expanding market for electric and hybrid vehicles is a major driver for the automotive powertrain market. There has been tremendous growth in the electric vehicle market all over the world.

- The sales of electric vehicles are expected to rise, owing to a fall in the costs of batteries and technological improvements, like increased storage capacity, which has led to consumer adoption. As global temperatures are rising at an alarming rate, governments and industries worldwide have pledged to reduce greenhouse gas emissions.

- Global plug-in vehicle sales reached 2,986,659 units in 2020, as opposed to a lower 2,123,872 units of total electric vehicles sold worldwide. Battery-electric vehicle sales reached an estimated 7.3 million in 2022, up from around 4.6 million in 2021. BEV sales have soared due to a number of factors, including an increased consumer interest in more sustainable transport and governmental regulations to curb direct transport emissions. In 2021, these sales more than doubled compared to 2020, and 2022 marks a new record in all-electric sales volume. This clearly shows the rising trend of electric vehicle growth in the market and the projected increase in market opportunities for the electric powertrain market.

- The transportation sector has been one of the major focus areas, as transportation and mobility account for the second-largest share in emissions after electricity generation. The production and sales of electric vehicles globally have been growing rapidly, owing to a favorable regulatory environment, such as subsidies and tax exemptions for the industry and consumers in the European and Asia-Pacific regions.

- Governments of major automotive markets, such as China and India, have pledged to allow only electric vehicles on their roads by 2030. Major automakers have also increased their investments in the development of electric vehicles to cater to the anticipated growth in demand for such cars in the coming decade.

- For instance, in July 2023, Volvo Trucks Malaysia introduced the region's first fully electric Heavy Duty Prime Mover. The Volvo FH Electric, FM Electric, and FMX Electric models are powered by an electric powertrain with two or three motors producing up to 490 kW and 2,400 Nm of torque depending on the application, and battery capacity ranging from 180 kWh to 540 kWh from two to six battery packs, claiming up to 300 km of travel range on a single full charge at 44 tons gross combination weight (GCW).

China is Expected to Become the Largest Market for Electric Vehicles

- The electric vehicle market witnessed healthy growth in recent years. The adoption of electric four-wheelers in mature Asian markets will continue to be strong. In absolute terms, China will become the largest EV market. On its current trajectory, China's adoption rate will reach 60%, and the country will account for more than 40% of total new EV sales by 2030. This spike in sales is attributable to the regulatory norms imposed by various organizations and governments to control emission levels and propagate zero-emission vehicles.

- In many ways, Asian countries are at the forefront of climate change. Asia is home to 93 of the top 100 most polluted cities and six of the top ten climate-vulnerable countries. The region faces relatively high energy demand as many countries continue to grow and urbanize. China alone consumes more than three times the total energy used in Europe, complicating the country's efforts to achieve net zero energy consumption.

- It forced the automakers to increase their expenditure on the R&D of electric vehicles, eventually allowing them to market electric cars in the future. This strategy strongly impacted people, as there was a considerable change in the purchase pattern from conventional IC engine vehicles to electric vehicles. The difference did not decrease the sales of IC engine vehicles but created a promising market for electric cars in the present and future.

- Asian brands account for a sizable portion of consumer automotive spending in the region, and similar trends are emerging in EVs. Chinese brands have established strong positions in the E4W market. China's BYD increased its market share by 5% in 2021, and Wuling's popular and affordable Hongguang Mini EV sold more than 400,000 units within a year of its debut. Between 2017 and 2021, Asia produced 13 of the top 20 selling EV brands.

- Governments across Asia-Pacific have initiated various schemes, encouraging buyers to choose electric vehicles over conventional ones. Countries like India, China, Korea, etc., have multiple incentives for people willing to buy electric cars.

- For instance, in May 2022, the Beijing government released the "Action Plan for Comprehensive Traffic Management in Beijing in 2022". According to the action plan, Beijing will popularise low-carbon energy modes of transportation, accelerating the transition from gasoline to electricity on vehicles such as buses, taxis, and other EVs.

- Therefore, the factors mentioned above are contributing to the growth of the electric vehicle powertrain market in the Asia-Pacific region.

EV Powertrain Industry Overview

Few players, such as Robert Bosch GmbH, ZF Friedrichshafen AG, Cummins Inc., Dana Incorporated, GKN PLC, and Magna International, dominate the electric vehicle powertrain market. The players are making partnerships, acquisitions, launching new products, and investing to be ahead of the competition.

For instance, in June 2023, Zhongshan Broad-ocean Motor Co., Ltd. announced plans to build the "Broad-ocean Motor New Energy Vehicle Powertrain System and Parts (Chongqing) R&D and Manufacturing Site" in Chongqing's Yubei District. The project is planned to have a project company established in an area under the jurisdiction of the Chongqing Innovation Economy with a total investment of about CNY 1 billion (USD 139.9 Million) and a land area of about 73,333 square meters.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Sales of Electric Vehicles are Expected to Drive the Market

- 4.2 Market Restraints

- 4.2.1 Lack of Infrastructure May Hamper the growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Transmission

- 5.1.2 Motors

- 5.1.3 Battery

- 5.2 Propoulsion Type

- 5.2.1 Battery Electric Vehicle

- 5.2.2 Plug-In Hybrid Electric Vehicle

- 5.3 Vehicle

- 5.3.1 Passenger Car

- 5.3.2 Commercial Vehicle

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Norway

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 GKN PLC (Melrose Industries PLC)

- 6.2.2 Magna International Inc.

- 6.2.3 Hitachi Automotive Systems Ltd

- 6.2.4 Bosch Limited

- 6.2.5 Cummins Inc.

- 6.2.6 AVL List GmbH

- 6.2.7 Mitsubishi Electric Corp

- 6.2.8 BorgWarner Inc.