|

市場調查報告書

商品編碼

1438287

矽光電:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Silicon Photonics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

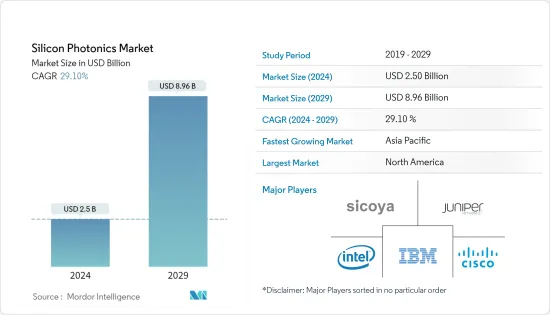

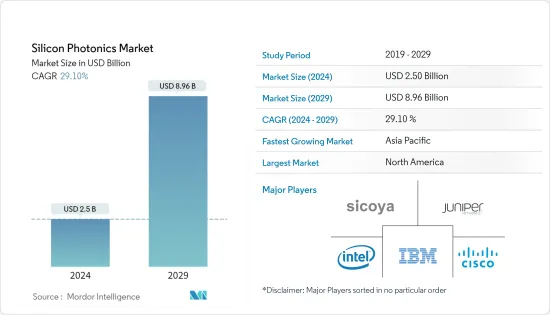

矽光電市場規模預計到2024年為25億美元,到2029年預計將達到89.6億美元,在預測期內(2024-2029年)年複合成長率為29.10%。

主要亮點

- 矽光電是一個新興的光電領域,與高速傳輸系統中使用的半導體中使用的導體相比,具有明顯的優勢。該技術預計將傳輸速度提高至100 Gbps,IBM、Intel、Kothura等公司正利用該技術取得突破。此外,該技術將徹底改變半導體產業,實現高速資料傳輸和處理。

- 在過去的幾十年裡,光纖通訊對於地面系統變得越來越重要。遠距光纖通訊顯著提高了遠距資料傳輸速度。隨著這些系統不斷突破通道容量的極限,新的、更複雜的技術正在被創建,以滿足世界各地巨量資料傳輸的需求。矽光電就是這些技術之一。使用成熟的矽製造技術實現的光學元件在提供低成本、高產量比率、小外形尺寸和低功率光子積體電路(PIC)方面顯示出巨大的潛力。

- 隨著雲端服務的普及,資料中心的需求近年來迅速成長。根據《2021 年雲端基礎設施報告》,57% 的受訪者表示,他們一半以上的基礎設施位於雲端,64% 的受訪者預計未來五年將完全是公共雲端。這些趨勢可能會推動這段時期研究的市場。

- 2022 年 1 月,Qpisemi 宣布推出一款基於矽光電的 AI 處理器,為 AI 2.0 以及生物資訊、藥物發現、AI 建模、最佳化、元宇宙和製造等各種其他應用提供動力。 AI 2.0 處理器使用光學處理器而不是電子處理器來執行神經網路運算。對資料中心來說,代號AI20PXX的AI 2.0處理器可以比GPU快100倍。

- 在矽光電應用中,熱和各種雜訊源可能會干擾光纖通訊,將光推入通常會被濾除的頻率。在更改這些過濾器之前,資料可能會遺失或不完整,並且在流資料的情況下,重建可能會很複雜。然而,預測物理過程何時以及如何改變光線並不總是那麼容易,這使得校正變得更加困難。

- 在生產和供應方面,全球半導體短缺加上COVID-19大流行影響了包括光電在內的大多數產業。 AIM Photonics 表示,全球半導體短缺嚴重阻礙了整合光電的創新。

矽光電市場趨勢

資料中心預計將佔據最大的市場佔有率

- 對矽光電的需求,特別是用於高頻寬光收發器的矽光子學的需求持續成長,以支援高效能運算(HPC)應用的激增和日益大型的資料中心。

- 到 2021 年,企業和消費者流量的增加可能會增加資料中心的數量,從而在預測期內為矽光電市場提供巨大的空間。

- 在企業內部,運算和協作是資料中心工作負載和運算需求的主要促進因素。根據 Data Center World 全球會議的數據,三年內(到 2021 年)每個組織的平均資料中心數量將從目前的 8.1 個增加到約 10.3 個。這種擴散共同要求提高性能,消除互連瓶頸,並為矽光電的使用提供範圍。

- 除了資料流量的顯著增加之外,支援萬物互聯(IoE)的基礎設施也強調了人與物之間即時回應的需求。資料處理和資料流量管理將越來越需要支援雲端運算、認知運算和巨量資料分析的能力,從而為市場供應商提供及時響應所需的速度和能力,而這樣做是有壓力的。

- 矽奈米光電技術擴大應用於光纖通訊系統。由於大規模資料中心和5G技術的需求,矽光收發器市場預計在未來幾年將顯著成長。基於高速矽光電技術的技術可實現更小的外形尺寸、更高的頻寬和更高的功率效率。

- 在消費者方面,視訊/媒體串流是最大的貢獻者。考慮到潛在的資料中心流量,Google、Facebook和微軟等主要企業都計劃在地理上增加其資料中心的容量。因此,與傳統電子產品相比,遠距資料傳輸的需求可能會增加預測期內對 SiP 的需求。

亞太地區將經歷最快的成長

- 由於經濟成長和全球電子市場佔有率較高,中國的矽光電市場預計將在亞太國家中呈現顯著的成長速度。中國是重要的電子產品生產國和消費國之一。該地區的製造業正在快速成長,各種製造和通訊技術的不斷引入預計將推動市場成長。

- 「中國製造2025」計畫等中國政府計畫正在促進工廠自動化和技術的研發活動和投資。 「中國製造」旨在擴大自動化設備的國內生產,因為大多數自動化設備都是從其他國家進口的。

- 日本在矽光電市場佔有很大佔有率,並且對合作變得更加開放。大公司希望保持其領先地位,並正在尋找投資來推動其成長。市場規模、新的開放程度以及充滿活力的產業必將有利於日本的創新企業,從而推動日本市場的成長。

- 韓國是對市場有重大貢獻的國家之一。人口的成長、矽光電產品開發投資的增加、國內外廠商對開發最新矽光電產品的日益關注,以及增加區域資料傳輸速度的研發活動也促進了市場的成長。我們正在促進成長。

- 其他考慮的亞太地區國家包括印度、新加坡和台灣。隨著AI、5G、物聯網、虛擬實境以及這些新技術的商業應用的快速發展,資料處理和資訊互動的需求不斷增加,這導致該地區資料中心的建設將加速。 ,帶動產業爆發式成長。根據 Cloud Scene 的數據,資料中心的主要市場包括中國、日本、澳洲、印度和新加坡。

矽光電產業概況

競爭程度由影響市場的各種因素決定,例如強而有力的競爭策略和公司的集中度。這個市場由在其產品上進行了大量投資的歷史悠久的參與者組成。新參與者正在進入市場並需要大量投資。公司可以透過強而有力的競爭策略來維持自身的發展。因此,在所研究的市場中,競爭企業之間的敵意正逐漸增加。

- 2022 年 2 月 - 英特爾公司收購 Tower Semiconductors,使其能夠透過全球多元化的產品系列滿足不斷成長的半導體需求。此次收購將使該公司能夠向全球客戶群提供晶圓代工廠服務。

- 2021 年 9 月 - NeoPhotonics Corporation 是矽光電和基於先進混合光子積體電路的雷射、模組和用於頻寬高速通訊網路的子系統的開發商,宣布推出新的可調高功率FMCW(調變連續頻率)。雷射模組和高功率半導體光放大器(SOA)晶片支援頻寬密集高速通訊網路。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 使用基於矽光電的收發器降低功耗

- 資料中心之間對高速連線和進階資料傳輸能力的需求不斷成長

- 市場限制因素

- 熱效應風險

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 目的

- 資料中心

- 電訊

- 其他用途

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Sicoya GMBH

- Intel Corporation

- Cisco Systems Inc.

- NeoPhotonics Corporation

- IBM Corporation

- Juniper Networks Inc.

- Global Foundries

- Broadcom Limited

第7章 投資分析

第8章市場機會及未來趨勢

The Silicon Photonics Market size is estimated at USD 2.5 billion in 2024, and is expected to reach USD 8.96 billion by 2029, growing at a CAGR of 29.10% during the forecast period (2024-2029).

Key Highlights

- Silicon photonics is a developing branch of photonics offering a clear advantage over electric conductors used in semiconductors used in high-speed transmission systems. This technology is expected to push the transmission speeds up to 100 Gbps, with companies such as IBM, Intel, and Kothura achieving breakthroughs using the technology. Besides, this technology revolutionizes the semiconductor industry, enabling high-speed data transfer and processing.

- Optical communications have grown critical for terrestrial systems for the past several decades. Vast-haul fiber communications have seen significant gains in data speeds over long distances. New and more complicated technologies have been created to keep up with the need for worldwide big data transfer, as these systems continue to push the channel capacity boundaries. Silicon photonics is one of these technologies. Photonic components implemented utilizing established silicon fabrication techniques have shown considerable possibilities in providing low-cost, high-yield, tiny form-factor, and low-power photonic integrated circuits (PICs).

- Due to the widespread use of cloud services, the demand for data centers has surged in recent years. According to the Cloud Infrastructure Report 2021, 57% of respondents said more than half of their infrastructure is in the cloud, and 64% expect to be entirely in the public cloud in the next five years. These trends may drive the market studied over the period.

- In January 2022, Qpisemi unveiled AI processors based on silicon photonics to power AI 2.0 and various other applications, such as bioinformatics, drug discovery, AI modeling, optimization, metaverse, and manufacturing. Optical processors, rather than electrons, are used in AI 2.0 processors to perform neural-network calculations. For data centers, AI 2.0 processors, codenamed AI20PXX, may be 100 times quicker than GPUs.

- In silicon photonics applications, heat and various noise sources can disturb optical communications, pushing light into frequencies that are usually filtered out. Data may be lost or incomplete until those filters are modified, and reconstruction may be complex in the case of streaming data. However, forecasting when and how physical processes alter light is not always easy, making the modifications more challenging.

- On the production supply front, the global semiconductor shortage coincided with the COVID-19 pandemic and affected the majority of industries, including photonics. As per AIM Photonics, the global semiconductor shortage has hampered innovation in integrated photonics to a great extent.

Silicon Photonics Market Trends

Data Centers are Expected to Hold the Maximum Market Share

- The demand for silicon photonics, particularly used in high-bandwidth optical transceivers, continues to gain impetus to support proliferating high-performance computing (HPC) applications and ever-larger data centers.

- The rise in the number of data centers through 2021 due to the increased traffic from the enterprises and the consumers may provide a huge scope for the silicon photonics market during the forecast period.

- Within the enterprise, computing and collaboration are the main contributors to data center workload and computation demand. According to the Data Center World Global Conference, the average number of data centers will be approximately 10.3 per organization in three years (by 2021), which is up from the current 8.1 per organization. This surge calls for improved performance, on the whole, removing the interconnect bottlenecks and providing scope for the use of silicon photonics.

- In addition to the massive growth in data traffic, the infrastructure supporting the Internet of Everything (IoE) emphasizes the need for real-time responsiveness between people and objects. Increasingly, data processing and data traffic management require the ability to support cloud computing, cognitive computing, and big data analysis, pressurizing the market vendors to offer the necessary speed and capacity to deliver a timely response.

- Silicon nanophotonics technology is being increasingly applied to optical communication systems. The silicon optical transceiver market is expected to grow manifold in the next few years, driven by demand from large data centers and 5G technology. High-speed silicon photonics-based technologies are enabling smaller form factors with higher bandwidth and improved power efficiency.

- On the consumer side, video/media streaming is the most significant contributor. In the light of the potential data center traffic, key businesses like Google, Facebook, and Microsoft, are planning to ramp up their data center volumes across geographies. Therefore, the need for long-distance data transfer compared to traditional electronics may increase the demand for SiP during the forecast period.

Asia-Pacific to Witness the Fastest Growth

- China's silicon photonics market is expected to exhibit a significant growth rate among Asia-Pacific countries, owing to its growing economy and high global electronics market share. China is one of the prominent electronics producers and consumers. The manufacturing industry is rapidly growing in the region and is witnessing the continuous deployment of various manufacturing and telecommunications technologies, which is expected to drive the market's growth.

- The Chinese government's programs, such as the Made in China 2025 plan, are promoting R&D activities in factory automation and technologies and investments in them. As most automation equipment are imported from other countries, the 'Made in China' initiative aims to expand its domestic production of automation equipment.

- Japan holds a significant share in the silicon photonics market and is becoming more open to collaborations. Big corporations want to stay on top and look for investments to fuel growth. The market size, emerging openness, and dynamic industry can surely benefit innovative companies in Japan, thereby driving the market's growth in Japan.

- South Korea is one of the major contributors to the market. Growing population, increasing investments in the development of silicon photonic products, the rising focus of international and domestic players on the development of modern silicon photonic products, and increasing R&D activities to increase the region's data transmission rate are also fueling the market's growth.

- The countries considered under the rest of Asia-Pacific include India, Singapore, and Taiwan. With the rapid development of AI, 5G, the internet of things, virtual reality, and the commercial application of these new technologies, the demand for data processing and information interaction is growing, which would speed up the construction of data centers in the region and lead to the explosive growth of the industry. According to Cloud Scene, some of the top markets in data centers include China, Japan, Australia, India, and Singapore.

Silicon Photonics Industry Overview

The degree of competition depends on various factors affecting the market, such as powerful competitive strategies and firm concentration ratio. The market comprises long-standing established players who have made significant investments in the product. The new players are entering the market and require high investments. The companies can sustain through powerful competitive strategies. Therefore, the competitive rivalry is moderately growing in the market studied.

- February 2022 - Intel Corporation acquired Tower Semiconductors to enable a globally diversified product portfolio to meet the growing demand for semiconductors. This acquisition also enables the company to provide foundry services to a global customer base.

- September 2021 - NeoPhotonics Corporation, a developer of silicon photonics and advanced hybrid photonic integrated circuit-based lasers, modules, and subsystems for bandwidth-intensive, high-speed communications networks, announced a new, tunable high-power FMCW (frequency-modulated continuous wave) laser module and high-power semiconductor optical amplifier (SOA) chips for bandwidth-intensive, high-speed communication networks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers

- 4.2.2 Growing Need for High Speed Connectivity and High Data Transfer Capabilities Across Data Centers

- 4.3 Market Restraints

- 4.3.1 Risk of Thermal Effect

- 4.4 Industry Value Chain Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Data Center

- 5.1.2 Telecommunications

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Sicoya GMBH

- 6.1.2 Intel Corporation

- 6.1.3 Cisco Systems Inc.

- 6.1.4 NeoPhotonics Corporation

- 6.1.5 IBM Corporation

- 6.1.6 Juniper Networks Inc.

- 6.1.7 Global Foundries

- 6.1.8 Broadcom Limited