|

市場調查報告書

商品編碼

1437984

農業機器人:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Agricultural Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

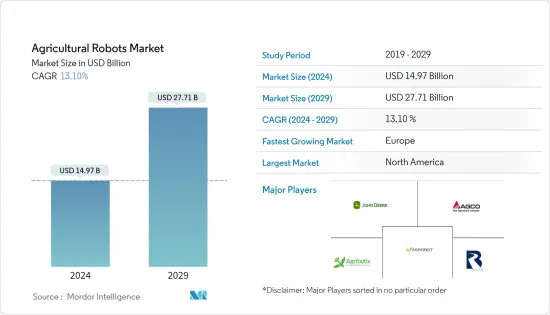

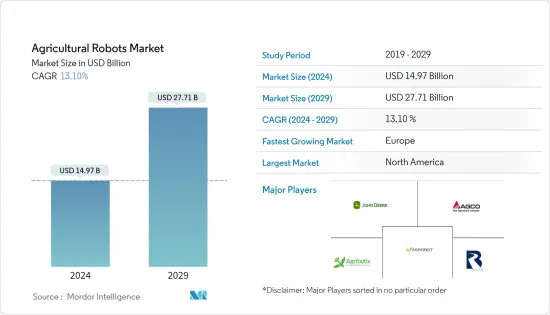

2024年農業機器人市場規模估計為149.7億美元,預計到2029年將達到277.1億美元,在預測期間(2024-2029年)以13.10%的複合年增長率增長。

主要亮點

- 農業機器人,也稱為農業機器人,是農業產業的最新革命之一。這些是自動化機器,用於提高產量品質和效率、提高整體生產力並最大限度地減少對體力勞動的依賴。隨著人口成長,全球糧食需求迅速增加。因此,農民現在正在轉向現代工具和設備,例如農業機器人,以提高整體生產力並創造更多收益。

- 此外,世界各國政府正在提供補貼並努力提高農民對自動化技術的認知。例如,歐盟在2021年推出了Robs4Crops等計劃,範圍從農業控制器、智慧農具到完全自主的農業系統。 Robs4Crops(新計劃)正在幫助農民填補正在改變農業形勢的勞動力短缺問題。這很可能會擴大農業機器人市場的範圍。

- 此外,一些老牌和新興農業公司正在投資研發工作,以引進創新的農業機器人。例如,愛科公司於 2021 年開始試行其 Precision Ag Line (PAL) 計劃。該工具旨在簡化在混合車隊營運中使用愛科解決方案的農業客戶的支援服務。

農業機器人市場趨勢

人手不足,人事費用增加

- 近年來,由於農業勞動力老化和農業興趣下降,農業勞動力不斷減少。隨著農業勞動力持續萎縮,農民感受到維持生產以滿足對生鮮食品不斷成長的需求的壓力。而且,勞動力的下降趨勢促使了勞動力工資的上漲。

- 此外,美國和英國等國家的農業依賴工人,其他已開發國家也有類似的趨勢。根據世界銀行的資料,過去十年來,全球農業就業人數下降了15%。勞動力短缺是一個全球性問題,農民老化進一步限制了體力勞動者的供給。因此,自動化農業系統可以幫助緩解農場勞動力短缺的壓力。農業科技可以為農場系統帶來新的效率並提高整體生產力。

- 因此,由於缺乏可用的工人,相關人員正在考慮如何實現農場現代化。例如,美國農業局聯合會 (AFBF) 報告稱,56% 的美國農場已開始使用農業技術,其中超過一半的農場將勞動力短缺作為原因。創新農業技術的使用包括無線感測器、機器人、預測模型和資料分析。因此,勞動力短缺和工資上漲正在推動市場成長。

北美市場佔據主導地位

- 北美佔據農業機器人市場的最大佔有率。由於勞動力短缺加劇、人事費用上升以及人均可支配收入高,該地區市場正受到先進技術日益採用的推動。政府加強鼓勵將機器人引入農業,例如無人機、無人駕駛曳引機和其他農業系統以實現智慧農業,是促進該地區成長的一些因素。為了提高農民的產量並降低成本,該市場的一些參與者正在大力投資開發具有成本效益和生產力的機器人。

- 例如,總部位於聖莫尼卡的 Future Acres 於 2021 年推出了首款機器人 Carrie,計劃解決葡萄採摘問題。 Carrie 使用人工智慧與人類合作運輸手工收割的作物。因此,緩解勞動力短缺的課題並在市場上推出適合農民需求的新產品正在推動北美地區農業機器人市場的成長。

農業機器人產業概況

農業機器人市場由活躍的參與者鞏固,他們在產品品質和促銷的基礎上進行競爭,並專注於戰略舉措以保持更大的市場佔有率。 公司正在大力投資開發具有成本效益的新產品。 該公司還與其他公司合作並收購其他公司,以增加其市場佔有率並加強其研發活動。 AGCO Corporation、Deere & Company、Agrobot 和 Agribotix LLC 等公司是農業機器人市場的一些主要參與者。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 依類型

- 無人機(無人機)

- 擠乳機器人

- 無人曳引機

- 自動收割系統

- 依用途

- 廣泛應用

- 現場測繪

- 播種和種植

- 施肥和灌溉

- 跨文化營運

- 採摘和收穫

- 酪農管理

- 擠乳

- 牧羊人與牲畜

- 航空資料採集

- 氣象追蹤與預報

- 庫存控制

- 廣泛應用

- 依報價

- 硬體

- 軟體

- 服務

- 依地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Agrobot

- Blue River Technology

- Harvest Automation

- AGCO Corporation

- Lely Industries

- Naio Technologies

- Precision Hawk

- Deere &Company

- AG Eagle LLC

- Agribotix LLC

- Trimble

- IBM

第7章市場機會與未來趨勢

The Agricultural Robots Market size is estimated at USD 14.97 billion in 2024, and is expected to reach USD 27.71 billion by 2029, growing at a CAGR of 13.10% during the forecast period (2024-2029).

Key Highlights

- Agricultural robots, also known as agribots, are one of the latest revolutions in the agriculture industry. They are autonomous machines employed to improve the quality and efficiency of yield, increase overall productivity, and minimize reliance on manual labor. With the growing population, the demand for food is rising at a rapid pace globally. Thus, farmers are now shifting toward modern tools and equipment, such as agricultural robots, to boost their total productivity and generate more revenue.

- Furthermore, governments across the world are offering subsidies and undertaking initiatives to propagate awareness about automated technologies among farmers. For instance, in 2021, the European Union launched projects, such as Robs4Crops, from farming controllers and smart implements to fully autonomous farming systems. Robs4Crops (a new project) is helping farmers fill the labor shortage, which is shaking up the farming landscape. This is likely to enhance the scope of the agricultural robots market.

- Moreover, several established and start-up agricultural companies are investing in research and development activities to introduce an innovative range of agricultural robots. For instance, in 2021, AGCO Corporation launched the pilot of its Precision Ag Line (PAL) program, a tool designed to streamline support services for farming customers using AGCO solutions with mixed-fleet operations.

Agricultural Robots Market Trends

Labor Shortage and Increasing Costs of Labor

- The agriculture labor force has decreased in recent years due to the reduced interest in farming, combined with the aging farmer population. As the population of farm laborers continues to decline, farmers are feeling pressure to keep up with production for the growing demand for fresh produce. Moreover, the downward trend of labor is translating into higher labor wages.

- Furthermore, the agricultural industry in the United States and the United Kingdom, among other countries, depend on laborers, and a similar trend is seen across other developed countries as well. Agricultural employment has declined by 15% in the last decade around the globe, according to World Bank data. The labor shortage has become a global problem, with an aging farmer population that further limits the supply of manual labor. Thus, automated farming systems can help to reduce the pressures of the farm labor shortage. Agtech can bring new efficiencies to farm systems and drive overall productivity.

- Consequently, with a shortage of available workers, stakeholders are looking at how to modernize the farms. For instance, the American Farm Bureau Federation (AFBF) reported that 56% of US farms have begun using agritech, with more than half stating labor shortage as the reason. The use of innovative agrotechnology includes wireless sensors, robotics, predictive forecasting model, and data analytics. Thus, increasing labor shortages and wages are driving the growth of the market.

North America Dominates the Market

- North America accounted for the largest share of the agricultural robots market. The market in the region is driven by the higher adoption of advanced technology due to increasing labor shortage, high labor costs in the region, and high per-capita disposable income. Increasing government encouragement for the deployment of robots in agriculture, such as unmanned aerial vehicles, driverless tractors, and other agriculture systems to provide smart farming, are some of the factors contributing to the region's growth. To increase the yields and reduce the costs of farmers, some of the players in this market are heavily investing in developing cost-efficient and highly productive robots.

- For instance, in 2021, Future Acres, based in Santa Monica, launched its first robot, Carry, with plans to tackle grape picking. Carry relies on AI to transport hand-picked crops, working alongside humans. Hence, reducing the challenges of labor shortages and introducing new products into the market suiting the farmer's needs are driving the growth of the agricultural robots market in the North American region.

Agricultural Robots Industry Overview

The agricultural robot market is consolidated with active players competing on the basis of product quality and promotion and focusing on their strategic moves to hold larger market shares. Companies are investing heavily to develop new and cost-efficient products. They are also collaborating with and acquiring other companies to increase their market shares and strengthen R&D activities. The companies like AGCO Corporation, Deere & Company, Agrobot, and Agribotix LLC are some of the major players in the agricultural robots market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Unmanned Aerial Vehicles (Drones)

- 5.1.2 Milking Robots

- 5.1.3 Driverless Tractors

- 5.1.4 Automated Harvesting Systems

- 5.2 By Application

- 5.2.1 Broad Acre Applications

- 5.2.1.1 Field Mapping

- 5.2.1.2 Seeding and Planting

- 5.2.1.3 Fertilizing and Irrigation

- 5.2.1.4 Intercultural Operations

- 5.2.1.5 Picking and Harvesting

- 5.2.2 Dairy Farm Management

- 5.2.2.1 Milking

- 5.2.2.2 Shepherding and Herding

- 5.2.3 Aerial Data Collection

- 5.2.4 Weather Tracking and Forecasting

- 5.2.5 Inventory Management

- 5.2.1 Broad Acre Applications

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Agrobot

- 6.3.2 Blue River Technology

- 6.3.3 Harvest Automation

- 6.3.4 AGCO Corporation

- 6.3.5 Lely Industries

- 6.3.6 Naio Technologies

- 6.3.7 Precision Hawk

- 6.3.8 Deere & Company

- 6.3.9 AG Eagle LLC

- 6.3.10 Agribotix LLC

- 6.3.11 Trimble

- 6.3.12 IBM