|

市場調查報告書

商品編碼

1437961

預防資料外洩:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Data Loss Prevention - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

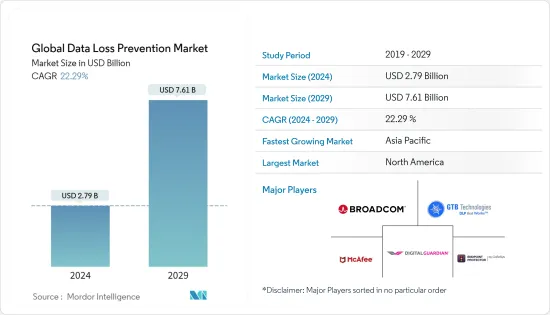

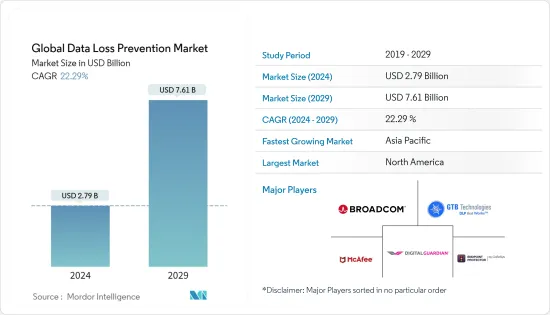

2024年全球預防資料外洩市場規模估計為27.9億美元,預計到2029年將達到76.1億美元,在預測期間(2024-2029年)以22.29%的複合年增長率增長。

世界各地的企業擴大採用更好的安全解決方案作為其數位轉型過程的一部分,從而推動市場成長。

主要亮點

- 快速增加的資料外洩案例以及 DLP 即服務、擴展到雲端的 DLP 功能以及高級威脅防護等其他因素促使全球範圍內對資料遺失防護解決方案的極大關注。隨著對數位資產需求的增加,結構化和非結構化資料的數量顯著增加,從而增加了以資料為中心的組織對資料資料保護服務的需求。十多年來,多家大型財富世界 500 強公司一直在 DLP 市場進行投資。該市場現已成為中型企業的重要安全策略。

- 您的資料保護策略需要預防資料外洩(DLP) 工具。 DLP 解決方案可進行客製化,以滿足各種需求,並支援 GDPR 和加州消費者隱私法案 (CCPA) 等新資料保護條例的合規工作。它們可協助組織搜尋、監控和控制進出企業網路的敏感資料。

- BYOD 需求的不斷成長引發了主要企業對資料安全的擔憂。根據 Forcepoint 的 2021 年 BYOD 安全報告,82% 的公司積極鼓勵員工攜帶自己的設備職場。 BYOD 與攜帶非託管設備職場的員工 (70%) 最為相關,此外還有承包(26%)、合作夥伴(21%)、客戶(18%) 和供應商(14%)。這也適用於其他群體,例如作為然而,資訊安全問題 (30%)、員工隱私問題 (15%) 和支援成本問題 (9%) 是採用 BYOD 的最大障礙。資料外洩或遺失是安全問題的首位 (62%)。根據同一份報告,使用者安裝有風險的應用程式或內容 (54%)、遺失或竊取設備 (53%) 以及非法存取公司資料或系統 (51%) 都是重大問題。

- 以可列印格式查看資料,即使存取權限僅限於敏感資料。文件共用和線上服務等涉及「傳輸中」資料的管道是主要課題之一,因為這些管道無法關閉,並且是資料交換的業務基礎。為了確保這些通道的最佳安全性,必須對流量進行嚴格過濾。實施的 DLP 系統必須始終平衡這些管道的安全性和互通性。

- 隨著冠狀病毒感染疾病(COVID-19)大流行的出現,隨著全球產生的資料總量加速成長,該市場預計將進一步成長。由於 COVID-19 封鎖和在家工作的趨勢,越來越多的人轉向行動裝置作為主要通訊設備,從而幫助組織保護其端點免受日益成長的網路威脅。

預防資料外洩(DLP) 市場趨勢

全球資料外洩和網路攻擊的增加推動市場

- 隨著多個行業的資料外洩案例不斷增加,數以百萬計的消費者資料記錄被洩露給駭客,新興經濟體的許多企業損失了數百萬美元,安全解決方案越來越受到關注。

- 隨著世界各地企業的發展,零日惡意軟體、特洛伊木馬和進階持續性威脅等新威脅正在使關鍵資料面臨風險。這一趨勢鼓勵組織部署 DLP 解決方案,以保護其網路內的端點和資料免受潛在攻擊。

- 組織內擴大採用 BYOD 趨勢,增加了不同筆記型電腦、桌上型電腦和智慧型手機的湧入,導致其他端點變得容易受到攻擊。僅靠安全措施不足以阻止這些威脅。預計全球行動裝置採用率的大幅增加將在預測期內創造大量機會。根據思科年度網際網路報告,到 2023 年,連網設備數量將達到約 293 億台。由於5G的普及,智慧製造和智慧工業預計將擴大市場。

- 勒索軟體威脅行為者以世界各地的軟體供應鏈企業為目標,以危害或勒索客戶。透過專注於軟體供應鏈,勒索軟體攻擊者可以透過初始入侵來存取多個受害者並擴大其攻擊範圍。近年來,技術的進步導致通訊業網路攻擊的增加。因此,電信業者選擇資料保全服務來確保其網路上所有作業系統的安全變得越來越重要。

- 端點數量正在經歷兩位數的成長。這主要是由於工業4.0、機器對機器通訊和智慧城市的出現,自動化的採用迅速增加。保護資料和設備漏洞並部署工具來識別攻擊並最大程度地減少損害至關重要。因此,自動化技術的日益採用預計將在預測期內推動市場成長。

預計北美將佔據最大市場佔有率

- 美國的資料遺失案例正在增加。根據身分盜竊資源中心(ITRC)的數據,近年來美國的平均違規次數略有增加,從 2017 年的 1,506 起違規行為增加到 2021 年的 1,826 起違規行為。

- 2021年,日本資料外洩事件數量增加,影響約2.9393億人。各行業不斷增加的資料外洩預計將成為預測期內推動預防資料外洩解決方案需求的主要因素。

- 隨著美國醫療保健產業繼續向電子記錄過渡,資料外洩不斷發生,需要預防資料外洩解決方案。

- 作為一種成長策略,公司在產品發布上花費了大量精力,以此作為最大化市場佔有率的有利可圖的方式。例如,2022 年 10 月,美國網路安全與合規公司 Proofpoint Inc. 在 2022 年 Microsoft Ignite 大會上宣布了其威脅防護平台的一系列創新。這使組織能夠防禦當今最先進和最普遍的威脅,包括:供應鏈攻擊和商業電子郵件外洩 (BEC)。這些增強功能使企業能夠更好地洞察電子郵件詐騙偵測、第三方和供應商違規保護、機器學習 (ML) 和行為分析。所有這一切都可以透過新的易於部署的內聯 API 模型實現。

- 2022 年 3 月,魁北克省總理兼衛生部長宣布對魁北克省衛生系統進行改革,包括衛生和社會服務資訊的管理。政府已提出第19號法案。它旨在實現衛生網路現代化和分散化,並建立新的管理系統,使衛生和社會服務資訊更加安全和無縫流動。

預防資料外洩(DLP) 產業概述

預防資料外洩市場中競爭公司之間的敵意強度很高,預計在預測期內將進一步加劇。大公司在研發和整合活動方面對市場具有強大的影響力。相反,該市場的特徵可能是市場滲透率高且分散程度不斷提高。

- 2022 年 4 月 - 麥克菲公司在美國推出個人資料清理,這是該公司在其旗艦產品邁克菲全面保護中添加的最新隱私功能。個人資料清理為消費者提供可見性、指導和持續監控,透過從網路上最危險的資料仲介網站中刪除資料來保護自己免受身分竊盜、駭客和垃圾郵件發送者的侵害。

- 2022 年 4 月 - Broadcom Inc. 宣佈為 IBM 全新 z16 提供「第一天」支持,為組織提供更多機會,讓他們從該公司先進的人工智慧、安全和混合雲端解決方案中獲得更多價值。 Broadcom 的尖端技術解決方案、服務和創新的「超越代碼」軟體為客戶提供了在日益具有課題性的商業環境中取得成功所需的競爭優勢。

- 2021 年 3 月 - Proofpoint 完成對資料遺失保護託管服務創新者 InteliSecure Inc. 的收購。透過此次收購, Proofpoint透過增強客戶在不同環境中保護關鍵資料的能力,強化了其雲端基礎、以人性化的安全平台。 Proofpoint 以 6,250 萬美元現金收購了 InteliSecure。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 全球資料外洩和網路攻擊的增加推動市場

- 法規和合規性(GDPR、CCPA、PCI DSS 等)

- 資料的重要性和脆弱性日益增加

- 市場限制因素

- 缺乏實施完整解決方案的意識

- 與進入許可權、加密、可擴展性和整合相關的部署課題

第6章市場區隔

- 依配置

- 本地

- 雲端基礎

- 依解決方案

- 網路DLP

- 端點DLP

- 基於資料中心/儲存的 DLP

- 依最終用戶產業

- 資訊科技/通訊

- BFSI

- 政府

- 衛生保健

- 製造業

- 零售和物流

- 其他最終用戶產業

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Broadcom Inc.(Symantec)

- Mcafee LLC

- GTB Technologies Inc.

- Cososys

- Digital Guardian Inc.

- Forcepoint LLC

- Securetrust(Vikingcloud)

- Trend Micro

- Check Point Software Technologies Ltd

- Proofpoint Inc.

- Spirion LLC

第8章投資分析

第9章市場的未來

The Global Data Loss Prevention Market size is estimated at USD 2.79 billion in 2024, and is expected to reach USD 7.61 billion by 2029, growing at a CAGR of 22.29% during the forecast period (2024-2029).

Enterprises worldwide are increasingly adopting better security solutions as part of their digital transformation process, thereby augmenting the market's growth.

Key Highlights

- The rapidly increasing instances of data breaches and other factors, such as DLP-as-a-service, DLP functionalities extending into the cloud, and advanced threat protection, have significantly increased the focus on data loss protection solutions worldwide. As the demand for digital assets increased, there was a massive growth in the amount of structured and unstructured data, driving the need for data protection services with a strategic focus on data-centric organizations. Multiple large enterprises in the Fortune Global 500 list have invested in the DLP market for over a decade. Currently, the market is emerging as a critical security strategy within reach of mid-sized enterprises.

- Data loss prevention (DLP) tools are necessary for data protection strategies. DLP solutions can be tailored to various needs and support compliance efforts with the new data protection regulations, such as GDPR or the California Consumer Privacy Act (CCPA). They are helping organizations find, monitor, and control sensitive data travelling in and out of the company's network.

- The increasing demand for BYOD is raising the concern among key enterprises regarding data security. According to the BYOD Security Report 2021 by Forcepoint, 82% of all businesses actively encourage employees to bring their own devices to work. BYOD is most associated with employees bringing unmanaged devices to work (70%), but it also applies to other groups such as contractors (26%), partners (21%), customers (18%), and suppliers (14%). However, information security issues (30%), employee privacy concerns (15%), and support cost concerns (9%) are the biggest impediments to BYOD adoption. Data leakage or loss is at the top of the list of security concerns (62%). Users installing hazardous apps or content (54%), lost or stolen devices (53%), and illegal access to the company data and systems are all significant worries (51%), according to the same report.

- Data can still be viewed in a printable format even when access permission is restricted to confidential data. As these channels cannot be closed and are the foundation of business in terms of data interchange, channels like file sharing and online services related to data "in transit" have been one of the main challenges. Traffic must be heavily filtered to guarantee optimal security in these channels. The DLP system that would be implemented should constantly work to balance security and interconnectivity in these channels.

- With the emergence of the COVID-19 pandemic, the market is anticipated to grow further as the total volume of data being generated worldwide is rising much faster. As a result of the COVID-19 lockdowns and work-from-home trends, an unprecedented number of people are now making use of mobile devices as their primary communication devices, thereby creating more endpoints for the organization to secure from the rising cyber threats.

Data Loss Prevention (DLP) Market Trends

Rising Data Breaches and Cyber Attacks Worldwide to Drive the Market

- The increasing instances of data breaches across multiple industries have leaked millions of consumer data records to hackers and led to the loss of millions of dollars for numerous companies, thus increasing the focus on security solutions across emerging economies.

- As businesses worldwide grow, new threats such as zero-day malware, trojans, and advanced persistent threats have exposed critical data to risk. This trend has encouraged organizations to deploy DLP solutions to safeguard their data within endpoints and networks against potential attacks.

- The increasing adoption of BYOD trends in organizations has increased the influx of different laptops, desktops, and smartphones, thus creating other endpoints vulnerable to attacks. Security measures on their own are not enough to stop these threats. The massive growth in the adoption of mobile devices across the world is expected to create significant opportunities during the forecast period. According to the Cisco Annual Internet Report, there may be approximately 29.3 billion networked devices by 2023. Smart manufacturing and the smart industry are expected to augment the market with the increased adoption of 5G.

- Ransomware threat actors target software supply chain businesses worldwide, compromising and extorting their clients. By focusing on software supply chains, ransomware threat actors can expand the scope of their assaults by gaining access to several victims through a single initial penetration. In recent years, technological advancements have increased cyberattacks in the telecom industry. Hence, it is becoming increasingly crucial for telecom companies to choose data security services to ensure that all operating systems on their network are secure.

- There has been double-digit growth in the number of endpoints, primarily due to the rapidly increasing adoption of automation due to Industry 4.0, machine-to-machine communication, and the emergence of smart cities. The need to protect the vulnerability of data and devices and deploy tools to recognize attacks and minimize the damage is critically important. Therefore, the increasing adoption of automation technology is expected to drive the market's growth during the forecast period.

North America is Expected to Account for the Largest Market Share

- The United States is witnessing an increased number of data breaches. According to the Identity Theft Resource Center (ITRC), the average number of violations in the United States has increased marginally over the past few years, from 1,506 breaches in 2017 to 1,826 violations in 2021.

- In 2021, the country's increasing number of data breaches impacted around 293.93 million individuals. These increasing data breaches in various industries are expected to be the primary factor driving the demand for data loss prevention solutions during the forecast period.

- The US healthcare industry also witnesses many data breaches as the industry is moving to an electronic record base, thus requiring data loss prevention solutions.

- As a growth strategy, companies heavily indulge in product launches as lucrative ways to maximize their market shares. For instance, in October 2022, Proofpoint Inc., a US-based cybersecurity and compliance company, declared an array of innovations across its Threat Protection Platform at the 2022 Microsoft Ignite Conference, allowing organizations to defend against today's most advanced and pervasive threats, including supply chain assaults and business email compromise (BEC). The enhancements provide companies with outstanding insight into email fraud detection, defense against third-party and supplier compromise, machine learning (ML), and behavioral analytics, all made available through a new, easy-to-deploy inline API model.

- In March 2022, Quebec's Premier and Health Minister announced the reformation of Quebec's health system, including the management of health and social services information. The government introduced Bill 19, which aims to set up a new management system that modernizes and decentralizes the health network to enable a safer and more seamless flow of health and social services information.

Data Loss Prevention (DLP) Industry Overview

The intensity of competitive rivalry in the data loss prevention market is high and is expected to increase during the forecast period. Major companies strongly influence the market in terms of R&D and consolidation activities. Conversely, the market can be characterized by high market penetration and increasing fragmentation levels.

- April 2022 - McAfee Corp. launched Personal Data Cleanup in the United States, the company's newest privacy feature addition to its flagship product, McAfee Total Protection. Personal Data Cleanup provides consumers with visibility, guidance, and continuous monitoring to protect themselves from identity thieves, hackers, and spammers by removing their data from some of the web's riskiest data broker sites.

- April 2022 - Broadcom Inc. announced "Day One" support for IBM's new z16, expanding opportunities for organizations to gain more value from the company's advanced AI, security, and hybrid cloud solutions. Broadcom's leading technology solutions, services, and innovative "beyond code" software give clients the competitive advantage required to succeed in an increasingly challenging business environment.

- March 2021 - Proofpoint completed its acquisition of InteliSecure Inc., an innovator in data loss protection managed services. With this acquisition, Proofpoint strengthened its cloud-based people-centric security platform by enhancing customers' ability to protect critical data in diverse environments. Proofpoint acquired InteliSecure for USD 62.5 million in cash.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment Of Covid-19 Impact On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Data Breaches and Cyber Attacks Worldwide to Drive the Market

- 5.1.2 Regulations and Compliances (GDPR, CCPA, PCI DSS, Etc.)

- 5.1.3 Increasing Data Criticality and Vulnerability

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness About Complete Solution Adoption

- 5.2.2 Deployment Challenges Related to Access Rights, Encryption, Scalability, and Integration

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Solution

- 6.2.1 Network DLP

- 6.2.2 Endpoint DLP

- 6.2.3 Datacenter/Storage-based DLP

- 6.3 By End-user Industry

- 6.3.1 IT and Telecommunication

- 6.3.2 BFSI

- 6.3.3 Government

- 6.3.4 Healthcare

- 6.3.5 Manufacturing

- 6.3.6 Retail and Logistics

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc. (Symantec)

- 7.1.2 Mcafee LLC

- 7.1.3 GTB Technologies Inc.

- 7.1.4 Cososys

- 7.1.5 Digital Guardian Inc.

- 7.1.6 Forcepoint LLC

- 7.1.7 Securetrust (Vikingcloud)

- 7.1.8 Trend Micro

- 7.1.9 Check Point Software Technologies Ltd

- 7.1.10 Proofpoint Inc.

- 7.1.11 Spirion LLC