|

市場調查報告書

商品編碼

1437958

UV LED:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)UV LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

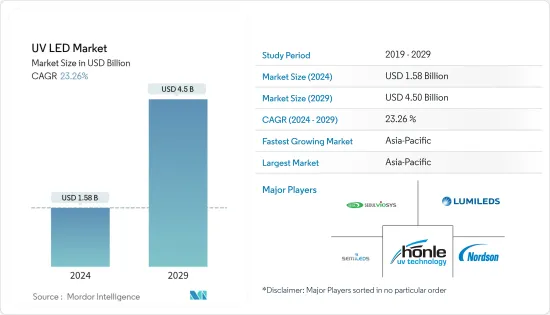

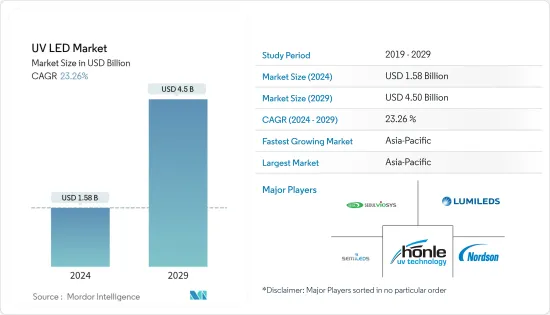

UV LED市場規模預計到2024年為15.8億美元,預計到2029年將達到45億美元,在預測期內(2024-2029年)複合年成長率為23.26%。

UV LED 照明的長壽命、高可靠性和小尺寸為系統設計人員提供了最大的設計自由度。波長在 180 至 280 nm 之間的輻射稱為 UV-C,這是有效用於去污、消毒和滅菌所需的範圍。

主要亮點

- UV LED 相對於 UV 燈的一個重要優點是其頻寬比 UV 燈窄。暴露於錯誤波長的風險大大降低。列印和醫療業務等應用在最初幾年受益最多。

- 由於市場合作夥伴關係和創新等不斷發展,列印解決方案市場的需求預計將顯著成長。 2021 年 1 月,RMGT 宣布與 GEW 建立 UV LED 合作夥伴關係。經過幾個月對所有主要 UV LED 製造商的評估,RMGT 選擇高性能 GEW 產品作為持續技術改進的最終新解決方案。

- UV LED照明為使用者提供了更節能、環保的解決方案。其維護量減少、尺寸緊湊且無需預熱,使其成為更具成本效益和方便的選擇。 UV-C LED 照明比傳統照明更具永續,可提供均勻分佈的熱量、即時預熱、集中光源和耐用的外殼。這種靈活且使用者友好的實施方式使其可以整合到各種系統中並提高消毒過程的效率。

- 而且,從電到UV-C的轉換效率已經低於汞燈。顯著降低的功耗使 UV LED 更加節能。 UV LED也可以即時打開和關閉,但水銀管在達到全功率之前有一個預熱期,使得能耗更難以控制。

- 由於新型冠狀病毒感染疾病(COVID-19)的爆發,由於其殺菌特性和表面消毒的快速使用,對UV LED市場的需求顯著增加。中國和美國等一些國家正在使用紫外線燈來清潔表面並防止人們被感染。根據 Photonics Media 通報,疫情增加了對紫外線 LED 空間消毒的需求。

紫外線 (UV) LED 市場趨勢

滅菌佔據主要市場佔有率

- UV LED 應用在滅菌應用中變得越來越豐富,因為它們已被證明是在世界各地提供安全飲用水的最便宜的方式。這增加了消費量並為玩家提供了金錢利益。

- 已開發國家和開發中國家對水純度的日益關注為消費者在住宅和商業領域採用 UV LED 帶來了巨大的成長機會。由於世界人口不斷成長以及純淨水的稀缺,許多UV LED製造商都將目光投向了尚未開發的水淨化應用市場。

- 根據(IUVA)(國際紫外線協會)的說法,有效對抗水和空氣中細菌的紫外線頻譜範圍在200nm至300nm之間。這對應於 UV-B 範圍(通常是 UV-C),有時被稱為殺菌紫外線。在這個範圍內,紫外線可以穿透微生物的細胞並破壞其DNA,消除其繁殖和致病的能力。

- 幾十年來,紫外線殺菌照射一直被認為是去污和消毒行業的重要製程之一。此過程使用100至280 nm之間的短波長UV-C光來殺死微生物,但去污的有效波長範圍為250至260 nm。

- UV LED 被認為是全球提供安全飲用水最便宜的方式,因此其在消毒應用中的使用顯著增加。該產品可能會為企業帶來經濟利益並增加消費。

- 滅菌領域的巨額投資進一步促進了市場成長。全球醫療保健先驅 GERMITEC 將於 2022 年 5 月將用於超音波探頭的高水準 UV-C 消毒系統商業化,從根本上簡化醫護人員的業務時間、安全性和責任,並宣布完成一輪 1,100 萬歐元資金籌措。

亞太地區將經歷顯著成長

- 預計亞太地區在預測期內將出現顯著的市場成長。日本和中國的幾家供應商正在大力投資擴大 UV LED 的應用。

- 在中國營運的知名油墨製造商(如東洋油墨、DIC株式會社以及在華營運的日本化學公司)都使用紫外線油墨,因為其環保且固化速度快。他強調,市場對紫外線油墨的需求例如,UV LED 用於葡萄酒和菸草等最終用戶行業的材料(鋁箔、紙張、塑膠等)的包裝印刷。

- 中國中央政府預計,2025年,中國汽車產量將達到3,500萬輛。隨著汽車產量的增加,由於紫外線在塗裝等方面的應用,預計對紫外線 LED 的需求也會增加。另一方面,UV LED 的使用壽命更長。壽命延長10倍以上,壽命超過10000小時。這意味著 UV LED 淨化可以整夜運行,以淨化更持久的病原體。

- 日本被認為是龐大的技術進步中心,擁有活躍的新型高效紫外線固化黏劑研發基地。最近,新型紫外光固化黏劑產品已在該國的電氣、包裝和汽車產業得到應用。

- 除了擴張努力之外,幾家日本供應商還在大力投資擴大 UV LED 的應用,例如消毒和殺菌。

- 在韓國,UV固化樹脂的消費水準較低,在生產階段仍然引人注目。這家韓國 LED 供應商預計很快就會推出一系列新的 UV-C LED 產品。由於 UV-C LED 在技術上難以製造,因此預計它們將為亞太地區的市場成長做出重大貢獻。

紫外線 (UV) LED 產業概覽

UV LED 市場本質上是競爭激烈的。市場高度分散。該市場的一些主要參與者包括 Lumileds Holding BV、Signify Holding、Nordson Corporation、GEW (EC) Limited、Seoul Viosys 和工業 Corporation。

- 2022 年 3 月 - Signify 與 Perfect Plants 合作開發植物生長燈。兩個新的氣候單元配備了可調光的飛利浦 GreenPower LED 頂燈和用於生長照明的緊湊型飛利浦 GrowWise 控制系統,提供了一個可在所有生長階段有效且高效地使用的照明系統。該公司正在爭奪荷蘭合法種植大麻的許可證,並最近投資了研究和生產設施。 Signify 提供靈活的 GreenPower LED 系統和專業知識。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- COVID-19 對 UV LED 市場的影響

第5章市場動態

- 市場促進因素

- 環保UV LED組合物

- 紫外線固化市場的採用率增加

- 更高的適應性和更低的總擁有成本

- 市場限制因素

- 增加UV LED晶片產量

第6章市場區隔

- 依技術

- UV-A

- UV-B

- UV-C

- 依用途

- 光學感測器和儀器

- 仿冒品檢測

- 消毒

- 紫外線固化

- 醫療光療

- 其他用途

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 智利

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Lumileds Holding BV

- Koninklijke Philips NV

- Nordson Corporation

- Honle UV America Inc.

- Seoul Viosys Co. Ltd

- Nichia Corporation

- Semileds Corporation

- EPIGAP Optronic GmbH

- CRYSTAL IS Inc.(Asahi Kasei Corporation)

- Heraeus Holding GmbH

- FUJIFILM Business Innovation Corporation

第8章投資分析

第9章市場的未來

The UV LED Market size is estimated at USD 1.58 billion in 2024, and is expected to reach USD 4.5 billion by 2029, growing at a CAGR of 23.26% during the forecast period (2024-2029).

UV LED lighting offers longer lifetimes, greater reliability, and smaller sizes, enabling system designers maximum design freedom. Radiations with wavelengths from 180 to 280 nm are referred to as UV-C, and this is the range needed to be used effectively in decontamination, disinfection, and sterilization.

Key Highlights

- The critical advantage UV LEDs have over UV lamps is that they have a narrow band compared to UV lamps. The risk of exposure to the wrong wavelength gets reduced significantly. The applications, such as printing and medical operations, benefitted the most during the initial years.

- The printing solution market is expected to witness a considerable increase in demand, owing to constant developments such as partnerships and innovations in the market. In January 2021, RMGT announced a UV LED partnership with GEW. RMGT adopted the high-performance GEW product as its definitive new solution in the ongoing technology improvement after months of evaluating all significant UV LED manufacturers.

- UV LED lighting provides the user with a much more energy-efficient and environmentally friendly solution. With reduced maintenance, small compact sizing, and no preheating requirement, it is a more cost-effective and convenient option. UV-C LED lighting is more sustainable than traditional, providing evenly dispersed heat, instantaneous preheating, a concentrated light source, and durable housing. With such a flexible, user-friendly implementation, they can be integrated into various systems and improve the efficiency of the disinfection process.

- Additionally, the electrical-to-UV-C conversion efficiency is already lower than that of mercury lamps. They consume substantially low power, making UV LEDs more energy efficient. UV LEDs can also be turned on and off instantly, whereas mercury tubes have a warm-up period before they reach full power, which means their energy consumption is less controllable.

- With the COVID-19 outbreak, the ultraviolet LED market is witnessing significant growth in demand due to the rapid usage of germ-killing properties and disinfecting surfaces. Several countries, such as China and the United States, use ultraviolet lamps to clean surfaces and prevent people from getting infected. According to Photonics Media, the pandemic has increased the demand for ultraviolet LEDs that disinfect spaces.

Ultravoilet (UV) LED Market Trends

Sterilization to Hold Significant Market Share

- The scope for a UV LED is becoming abundant in sterilization applications, as it is being proved to be the cheapest way to provide safe drinking water across the globe. This also offers monetary benefits to the players with increasing consumption.

- The growing concern for water purity in developed and developing nations presents a substantial growth opportunity for ultraviolet LEDs to be adopted by consumers in both residential and commercial sectors. The rise in the world population and the scarcity of pure water have attracted many UV LED manufacturers toward the untapped water purification application market.

- According to (IUVA) (International Ultraviolet Association), the portion of the ultraviolet spectrum that effectively works against germs in the water and air ranges between 200nm-300nm. This corresponds to the UV-B range, often to UV-C, and is sometimes termed germicidal ultraviolet light. Within such a range, ultraviolet light can penetrate the cells of microorganisms and disrupt the DNA, eliminating the ability to multiply and cause diseases.

- UV germicidal irradiation has been considered one of the essential processes in the decontamination and disinfectant industry for decades. This process utilizes short-wavelength UV-C light to kill the microbes from 100 to 280 nm, but the effective wavelength range for decontamination is between 250-260 nm.

- UV LED is increasing significantly for sterilization applications, as it is considered of the cheapest ways to provide safe drinking water globally. The products would offer monetary advantages to companies and increase consumption.

- The considerable investments in the sterilization sector further contribute to the market growth. GERMITEC, a global healthcare pioneer, in May 2022, commercialized and created high-level UV-C disinfection systems for ultrasound probes that essentially simplified health providers' time tasks, safety, and responsibilities and announced the completion of a EURO 11 Million fundraising round.

Asia-Pacific to Witness Significant Growth

- The Asia-Pacific is expected to witness significant market growth over the forecast period. Several vendors based in Japan and China are making considerable investments in the expanding applications of UV LEDs.

- The prominent ink manufacturers operating in China (like Toyo Ink Co. Ltd, DIC Corporation, and Japanese chemical companies operating in China) highlighted the increasing demand for ultraviolet inks, owing to the environmental advantages and the faster curing rates. For instance, the application of ultraviolet LEDs are materials (such as aluminum foil, paper, and plastic) package printing in end-user industries, such as wine and cigarette)

- The Chinese central government expects China's automobile production to reach 35 Million units by 2025. With the increasing growth in automobile production, the need for ultraviolet LED is expected to increase owing to ultraviolet applications in painting, etc. On the contrary, ultraviolet LEDs last more than ten times longer, with lifespans of over 10,000 hours. This means UV LED decontamination can be run overnight to decontaminate more persistent pathogens.

- Japan is considered a vast hub for technological advancements and hosts an active research and development base for efficient and newer UV-curable adhesives. Recently, novel UV-curable adhesive products are finding applications in the country's electrical, packaging, and automotive sectors.

- Several vendors based out of Japan are making considerable investments in the expanding applications of ultraviolet LEDs, like sterilization and disinfection, in addition to the expansion activities.

- South Korea has comparatively low consumption levels of UV-curable resins, which is still prominent in the production phase. LED vendors based out of South Korea are expected to launch new series of UV-C LED products shortly. UV-C LEDs, which are challenging to manufacture technologically, are expected to significantly contribute to the market's growth in the Asia-Pacific region.

Ultravoilet (UV) LED Industry Overview

The UV LED Market is competitive in nature. The market is highly fragmented. Some of the significant players in the market are Lumileds Holding B.V, Signify Holding, Nordson Corporation, GEW (EC) Limited, Seoul Viosys Co. Ltd, and Nichia Corporation.

- March 2022 - Signify collaborated with Perfect Plants on grow lights. Two new climate cells are equipped with dimmable Philips GreenPower LED toplighting compact to grow lights and the Philips GrowWise Control System, providing a light system that can be used effectively and efficiently in every growth phase. The company is competing for a Dutch license for the legal cultivation of cannabis and recently invested in facilities for research and production. Signify supplies flexible GreenPower LED systems and specialist knowledge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the UV LED Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Eco-friendly Composition of UV LED

- 5.1.2 Rising Adoption of the UV Curing Market

- 5.1.3 Increasing Adaptability Fueled by Low Total Cost of Ownership

- 5.2 Market Restraints

- 5.2.1 Increasing Manufacturing of UV LED Chips

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 UV-A

- 6.1.2 UV-B

- 6.1.3 UV-C

- 6.2 By Application

- 6.2.1 Optical Sensors and Instrumentation

- 6.2.2 Counterfeit Detection

- 6.2.3 Sterilization

- 6.2.4 UV Curing

- 6.2.5 Medical Light Therapy

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Chile

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 South Africa

- 6.3.5.3 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lumileds Holding BV

- 7.1.2 Koninklijke Philips NV

- 7.1.3 Nordson Corporation

- 7.1.4 Honle UV America Inc.

- 7.1.5 Seoul Viosys Co. Ltd

- 7.1.6 Nichia Corporation

- 7.1.7 Semileds Corporation

- 7.1.8 EPIGAP Optronic GmbH

- 7.1.9 CRYSTAL IS Inc. (Asahi Kasei Corporation)

- 7.1.10 Heraeus Holding GmbH

- 7.1.11 FUJIFILM Business Innovation Corporation