|

市場調查報告書

商品編碼

1437938

浮體式海上風電:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Floating Offshore Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

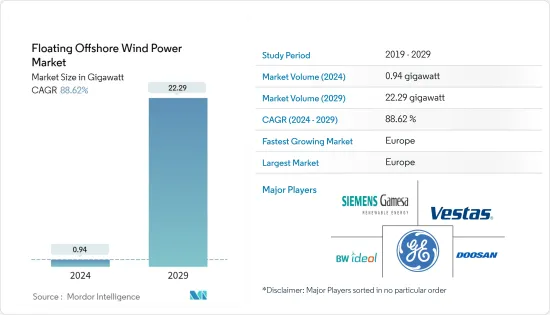

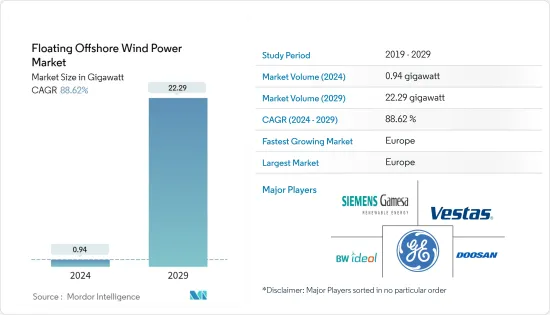

2024年浮體式海上風電市場規模預計為0.94吉瓦,預計到2029年將達到22.29吉瓦,在預測期(2024-2029年)複合年成長率為88.62%。

儘管 COVID-19感染疾病對 2020 年市場產生了負面影響,但已達到疫情前的水平。

主要亮點

- 從長遠來看,隨著越來越多的人希望利用離岸風力發電,浮體式海上風電市場可能會成長。此外,深化離岸風力發電計劃被視為一項創新技術,可以利用更深水域的強風來推動市場成長。

- 另一方面,天然氣和太陽能發電等清潔發電方式的使用正在增加。從太陽能或天然氣中獲取電力是更清潔的能源產出方式之一,因此隨著越來越多的人使用這些方法,對風能的需求可能會放緩。

- 海上風力發電在發展中國家和未開發市場也越來越受歡迎。這可能會在預測期內為浮體式海上風電市場創造成長機會。

- 歐洲地區佔市場最大佔有率,預計未來五年複合年成長率最高。這一成長得益於離岸風力發電投資的快速增加,以及挪威、英國和法國等該地區國家製定了支持風電的政策。

浮體式海上風力發電市場趨勢

過渡水域(30m至60m深)預計將成長

- 浮體式海上風力發電機(FOWT)技術在過渡水深(30-60 m)更加發達,因為更深的水深使計劃經濟性更加有利。駁船變體是最具商業性可行性的浮體式風力發電機設計。此型號適用於 30 m 以上高度作業,具有浮體式基礎中最淺的吃水深度。駁船式浮體式風力發電機的佔地面積為平方公尺,而其他設計則採用月池來減少波浪載荷帶來的應力。據GWEC稱,典型的6兆瓦浮體式駁風力發電機重量在2,000噸至8,000噸之間。然而,BW Ideol 憑藉其傾卸池浮體浮動下部結構技術,是唯一部署兆瓦級駁船型 FOWT 的公司。

- 由於水深較淺,與固定基地技術相比,FOWT技術從商業角度來看實用性較差。因此,在預測期內,駁船技術預計將佔整個 FOWT 市場的一小部分。美國環保署稱,截至2021年,全球運作中的駁船FOWT容量僅為5MW。據宣布,該駁船的 FOWT 容量佔全球未來計劃宣布的所有離岸風基礎技術的 2.1%。

- 大多數公司都在嘗試銷售可在深水中使用的 FOWT 設計。然而,一些半潛式技術也可以在瞬時深度使用。多種基於半潛式設計的商用 FOWT 型號即使在過渡深度也能發揮作用。其中一些模型最初用於實驗計劃,而其他模型則經過改編用於商業企業。

- EolMed計劃是法國第一個位於地中海的浮體式風電場。 2022年5月,TotalEnergies宣布計劃開始建設,預計2024年運作。該計劃位於水深62公尺處,由三個錨定在海底的10MW浮體式渦輪機組成。渦輪機採用帶有阻尼池的駁船設計。該計劃將由 Quadran Energies Marines、Ideol、土木工程公司 Bouygues Travaux Publix 和風力發電機製造商 Senvion 管理。

- 在過渡深度區域,固定式和浮體式風力發電機風力發電機都可以工作,但駁船設計在商業性最可行。

- 2010 年至 2021 年間,全球風力發電平均裝置成本從每度電 4,876 美元下降到 2,858 美元,下降了 41%。在 2011 年的高峰期,全球加權平均裝置成本為每千瓦 5,584 美元,是 2021 年價值的兩倍。在歐洲,2020年至2021年間,新委託的海上計劃的加權平均LCOE從0.092美元下降了29%。 /kWh 至 0.065 美元/kWh。計劃規模效益使總安裝成本與前一年同期比較減了25%,新計畫的加權平均容量係數從2021年的42%增加到48%。

- 大多數過渡性 FOWT計劃可能會在歐洲進行,特別是在英國、斯堪地那維亞和法國,這些國家的大型計劃正處於規劃階段。在預測期內,該區隔市場的大部分發展可能會發生在這些地區。

歐洲主導市場成長

- 歐洲佔全球離岸風力發電電場的最大佔有率。根據歐盟統計,歐洲佔全球離岸風力發電電場的四分之一。這個國家(主要是北海國家)很可能主導離岸風力發電市場。

- 全球約85%的離岸風力發電電場位於歐洲水域。歐洲地區,特別是北海地區各國政府,制定了在其領海安裝離岸風力發電的雄心勃勃的目標。

- 預計到 2022 年,歐洲將安裝 112 兆瓦的浮體式海上風電,其中英國、法國、挪威、愛爾蘭和西班牙是該地區最大的市場。

- 2022 年 8 月,Cerulean Winds 與 PING Petroleum UK 簽署了一項主要由離岸風電供電的海上石油和天然氣設施協議。根據協議,Cerulean Winds 及其層級工業合作夥伴集團將交付大型浮體式海上石油和天然氣設施。風力發電機透過電纜連接到 Ping Petroleum 的浮體式生產和儲存船。該計劃預計將於 2025 年運作。津貼使該計劃能夠透過浮體式海上風電示範計劃交付給 Cerulean Winds。

- 2022年2月,挪威宣布計畫首次競標離岸風力發電。此次競標定於今年下半年進行,競標將尋求開發至少 1.5 吉瓦的離岸風力發電容量,為該國供電,隨後競標將提供更多電力出口到歐洲。經濟。

- 在預測期內,這些趨勢將使歐洲成為浮體式海上風電場業務的最佳開展業務地點。

浮體式海上風電產業概況

浮體式海上風電市場較為分散。市場主要企業包括(排名不分先後)通用電氣公司、斗山能源、西門子歌美颯可再生能源、BW Ideaol SA、維斯塔斯風力系統公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查範圍

- 市場定義

- 調查先決條件

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年浮體式海上風電潛在設置容量預測(兆瓦)

- 主要計劃資訊

- 現有主要計劃

- 即將進行的計劃

- 最新趨勢和發展

- 政府政策法規

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 依水深(僅限定性分析)

- 淺水(水深小於30m)

- 漸進深度(30 m 至 60 m 深度)

- 深海(深度超過60m)

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭形勢

- 合併、收購、合作和合資企業

- 主要企業採取的策略

- 公司簡介

- Vestas Wind Systems AS

- General Electric Company

- Siemens Gamesa Renewable Energy SA

- BW Ideol AS

- Equinor ASA

- Marubeni Corporation

- Macquarie Group Limited

- Doosan Enerbility Co. Ltd.

第7章市場機會與未來趨勢

The Floating Offshore Wind Power Market size is estimated at 0.94 gigawatt in 2024, and is expected to reach 22.29 gigawatt by 2029, growing at a CAGR of 88.62% during the forecast period (2024-2029).

Though the COVID-19 pandemic negatively impacted the market in 2020, it reached pre-pandemic levels.

Key Highlights

- Long-term, the floating offshore wind power market is likely to grow because more people want to use offshore wind power. Also, increasing the water depth of offshore wind power projects is seen as a game-changing technology that can take advantage of the strong winds in deeper waters and help the market grow.

- On the other hand, more and more gas and solar power, which are both clean ways to make electricity, are being used. Since getting power from solar and gas is one of the cleaner ways to make energy, more people using these methods is likely to slow the demand for wind power.

- Also, offshore wind energy is becoming more popular in developing and untapped markets. This is likely to create growth opportunities for the floating offshore wind power market during the forecast period.

- The European region has the biggest share of the market and is also expected to register the highest CAGR over the next five years. This growth is due to the fast rise in offshore wind power investments and the fact that countries in this area, like Norway, the UK, and France, have policies that support wind power.

Floating Offshore Wind Market Trends

The Transitional Water (30 m to 60 m Depth) Segment is Expected to Grow

- Due to the greater water depth and favorable project economics, floating offshore wind turbine (FOWT) technology is more developed in transitional water depths (30-60 m). The barge variant is the most commercially viable floating wind turbine design at shallow depths. This model is appropriate for activities higher than 30 m and has the shallowest draft of any floating foundation. Barge-style floating wind turbines have a square footprint, while other designs incorporate a moonpool to lessen stresses brought on by wave-induced loads. A typical 6-megawatt floating barge wind turbine weighs between 2000 and 8000 tons, according to GWEC. However, BW Ideol, with its Damping Pool Barge Floating Substructure Technology, is the only company that has deployed barge-type FOWT at the MW scale.

- Since the water depth is shallower, FOWT technology is less practical from a business point of view than fixed-base technology. So, during the period of the projection, barge technology is expected to make up a small part of the FOWT market as a whole.The US EPA claims that only 5 MW of barge FOWT capacity was operating globally as of 2021. Just 1932 MW of FOWT capacity on barges, or 2.1% of all announced offshore wind substructure technologies for future projects around the world, were announced.

- Most companies attempt to market FOWT designs that can be used in deeper waters. However, some semi-submersible technologies can also be used at transitional water depths. They can function at transitional depths due to several commercial FOWT models that are built on the semi-submersible design. A few of these models were initially used in experimental projects, while others were modified for use in ventures for profit.

- The EolMed project is France's first floating pilot wind farm in the Mediterranean Sea. In May 2022, TotalEnergies announced the start of the project's construction, which is expected to be operational by 2024. The project will consist of three 10 MW floating turbines on the bathymetry of the 62-meter depth and anchored to the seabed. The turbines will use a barge design with a damping pool. Quadran Energies Marines, Ideol, Bouygues Travaux Publics, a company that specializes in civil engineering, and Senvion, a manufacturer of wind turbines, will run the project.

- In the area of transitional depth, both fixed and floating wind turbines can work, but the barge design is the most commercially viable.

- Between 2010 and 2021, the global average installed cost of wind energy decreased by 41%, from USD 4,876 per kW to USD 2,858/kW. At its peak in 2011, the global weighted average installed cost was USD 5,584 per kW, which was twice its value in 2021. In Europe, the weighted average LCOE of newly commissioned offshore projects decreased by 29% between 2020 and 2021, from USD 0.092/kWh to USD 0.065/kWh. Driven by project economies of scale, there was a 25% reduction in total installed costs year-on-year and an increase in new projects' weighted average capacity factor from 42% to 48% in 2021.

- Most of the FOWT projects in transitional depths are likely to be in Europe, especially in the United Kingdom, Scandinavia, and France, where large projects are in the planning stages. During the forecast period, most of the deployments in this market segment are likely to happen in these regions.

Europe to Dominate the Market Growth

- Europe holds the largest share of offshore wind energy installations globally. According to the European Union, Europe represents a quarter of global offshore wind installations. The country (primarily North Sea countries) is likely to be at the helm of the offshore wind market.

- Around 85% of offshore wind installations are globally in European waters. The governments of the European region, particularly in the North Sea area, have set an ambitious target for installing offshore wind farms in their territorial waters.

- Europe was expected to have 112 MW of floating offshore wind power capacity installed by 2022, with the UK, France, Norway, Ireland, and Spain being the region's biggest markets.

- In August 2022, an agreement was made between Cerulean Winds and Ping Petroleum UK about offshore oil and gas facilities that would be mostly powered by offshore wind.Under the agreement, Cerulean Winds and its group of Tier 1 industrial partners will provide a large floating offshore wind turbine that will be connected by a cable to Ping Petroleum's floating production and storage vessel.The project is expected to go online by 2025. A grant enabled the project to go to Cerulean Winds through the Floating Offshore Wind Demonstration Program.

- In February 2022, Norway announced plans for its first auction for offshore wind. The tender, scheduled for the second half of this year, would first look for bids to develop at least 1.5 GW of offshore wind capacity to supply the country, with subsequent tenders designed to provide an economic boost by providing more electricity for export to Europe.

- During the forecast period, these trends should make Europe a great place to do business for people who are in the business of floating offshore wind farms.

Floating Offshore Wind Industry Overview

The floating offshore wind power market is moderately fragmented. Some major players in the market (in no particular order) include General Electric Company, Doosan Energy, Siemens Gamesa Renewable Energy, BW Ideaol SA, and Vestas Wind Systems AS, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Floating Offshore Wind Power Potential Installed Capacity Forecast in MW, till 2028

- 4.3 Key Projects Information

- 4.3.1 Major Existing Projects

- 4.3.2 Upcoming Projects

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraint

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Water Depth (Qualitative Analysis Only)

- 5.1.1 Shallow Water (less than 30 m depth)

- 5.1.2 Transitional Water (30 m to 60 m depth)

- 5.1.3 Deep Water (higher than 60 m depth)

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems AS

- 6.3.2 General Electric Company

- 6.3.3 Siemens Gamesa Renewable Energy SA

- 6.3.4 BW Ideol AS

- 6.3.5 Equinor ASA

- 6.3.6 Marubeni Corporation

- 6.3.7 Macquarie Group Limited

- 6.3.8 Doosan Enerbility Co. Ltd.