|

市場調查報告書

商品編碼

1437916

固態硬碟 (SSD):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Solid State Drive (SSD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

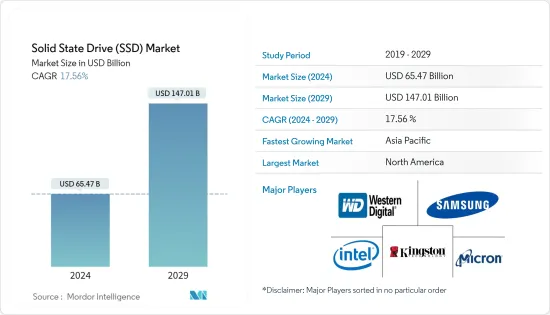

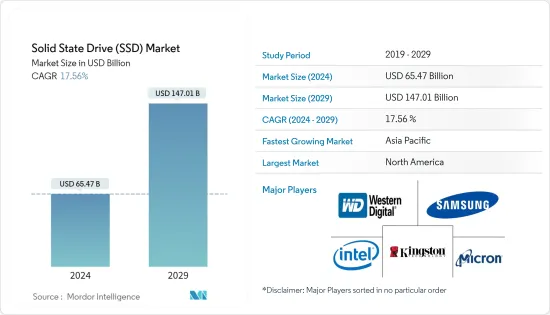

固態硬碟(SSD)市場規模預計到2024年為654.7億美元,預計到2029年將達到1,470.1億美元,在預測期內(2024-2029年)複合年成長率為17.56%。

過去幾年,資料儲存的需求顯著增加,預計在預測期內將維持成長趨勢。由於對資料儲存選項的需求不斷增加,預計在預測期內,SSD 的需求將會增加。

隨著雲端平台的不斷增多,從傳統的企業私有雲端、新型公共雲端到個人雲端的使用,SSD的需求正在快速成長。常用的 SSD 介麵包括串列 ATA (SATA)、PCI Express (PCIe) 和串列連接 SCSI (SAS)。高速和快速資料存取等增強功能將加速 PCIe SSD 在雲端運算中的採用。

數位化程度的提高和生活方式的改變是電器產品消費增加的主要驅動力。此外,COVID-19感染疾病迫使消費者數位化。因此,SSD 在消費性科技解決方案中的使用正在迅速增加。隨著物聯網、VR/AR、5G、線上技術和機器學習等技術的發展變得更加普遍,這種需求預計將普及。

此外,對儲存的需求不斷成長促使公司投資製造先進的解決方案。例如,三星電子於 2022 年 5 月確認就下一代儲存軟體創新建立全面合作夥伴關係。該合作夥伴關係將專注於為現有和新興內存和存儲技術創建和測試開放原始碼應用程式,包括 NVMe SSD、計算存儲(智慧 SSD、HBM-PIM、智慧 SSD)、CXL 內存和結構。

在 COVID-19感染疾病之後,人們將更加關注自動化技術,以支援固態硬碟 (SSD) 世界的擴展。此外,由於在家工作的影響,資料量增加,資料中心對固態硬碟的需求也隨之增加。這些 SSD 可協助資料中心供應商向大型雲端和工作站提供快速、強大的輸入輸出操作。

固態硬碟 (SSD) 市場趨勢

企業部門需求的成長推動市場成長

- 企業級 SSD 在斷電期間保護 DRAM 中儲存的資料、更高的效能、更強的糾錯碼 (ECC)、一致且持久的服務品質以及更長的保固期方面領先於客戶端 SSD。

- 早期的企業級 SSD 使用 SLC(單層單元) NAND快閃記憶體。它每個單元儲存 1 位,並提供最高水準的耐用性和性能,每個單元的典型生命週期為 100,000 次寫入。此外,基於 NAND 的快閃記憶體儲存解決方案因其長期耐用性、低成本、快速儲存和低遺失率而受到組織的大量需求,從而增加了世界各地企業對 SSD 解決方案的需求。

- SSD在資料中心的使用增加是由於多種因素造成的,包括比傳統HDD記憶體更高的效率、對儲存容量的需求不斷增加以及企業SSD耐用性和效率的突破等。資料中心需求的增加預計將推動 SSD 的需求。 SSD 受到企業的青睞,因為它們可以減少無序擴張,需要更少的能源,並且對環境的影響也更小。

- NAND快閃記憶體技術的改進使企業 SSD 製造商能夠使用耐用性較差的NAND快閃記憶體選項,例如多級單元 (MLC)、三級單元 (TLC) 和 3D NAND。非耐久格式的NAND快閃記憶體的優勢包括低成本和高容量,推動市場成長。

- 市場相關人員增加產品開發以滿足資料中心不斷成長的需求預計將有助於該領域的成長。 2022年8月,群聯電子發布了企業導向的X1 Controller固態硬碟(SSD)平台。 X1 SSD 系統是與 Seagate Technology Holdings PLC 合作構思的,並使用 Phison 技術構建,以滿足對更快、更智慧的全球資料中心基礎設施日益成長的需求。 X1 SSD 可配置平台能夠以更少的能源實現更關鍵的運算。憑藉著消除瓶頸並提高服務品質的經濟高效技術,X1 與功耗相當的現有市場競爭對手相比,資料讀取速度提高了 30% 以上。

北美預計將佔據很大佔有率

- 由於雲端、物聯網、巨量資料和高階雲端運算等先進技術的日益採用,北美預計將成為一個重要的市場。此類技術的普及正在增加儲存需求並推動該地區的市場成長。

- 該地區包括世界上最大的已開發經濟體美國和加拿大。一家著名的北美公司為各種企業提供尖端的 SSD 作為創新記憶體選項。為了獲得競爭優勢並提高企業效率,美國企業正在增加IT基礎設施的支出,並且擴大尋求提高資料傳輸速度和增加SSD等儲存解決方案以實現高水準的效率,需求不斷增加。

- 該地區擁有強大的供應商立足點,為市場成長做出了貢獻。其中包括英特爾公司、美光科技公司、西部數據公司等。此外,區域製造商也專注於創新和產品差異化,以提高產品普及、增加收益並推動該地區對其產品的需求。

- 例如,2022 年 6 月,美光推出了適用於關鍵基礎設施的 5400 SATA SSD 高階記憶體系統。該公司利用 5400 SSD 將 176 層 NAND 創新帶入資料中心 SATA SSD。美光 5400 SSD 是第 11 代資料中心 SATA SSD。

- 美國和加拿大5G技術的發展預計將對市場成長做出重大貢獻。 CTIA表示,5G的快速擴張將為美國5G產業奠定基礎,帶來2,750億美元的投資、300萬個新就業機會和5,000億美元的經濟成長。

固態硬碟 (SSD) 產業概覽

由於英特爾、美光科技、三星電子、金士頓科技公司和西部數據公司等主要供應商的存在,固態硬碟 (SSD) 市場競爭非常激烈。市場上的現有供應商正在大力投資新產品和創新產品的研發。

2022 年 10 月 - CFD Gaming 發佈 PCIe Gen5 NVMe 2.0 M.2 SSD,讀取速度高達 10 GB/s,寫入速度高達 9.5 GB/s。該SSD基於群聯電子的PS5026-E26構建,並採用美光的3D TLC NAND快閃記憶體體創新。

2022 年 10 月 - WD 推出具有雙 Thunderbolt/USB 連接埠的高速 SanDisk Pro SSD。 Western Digital 最新的超高速 SSD 是該公司 San Disk Pro 產品線的一部分。 PRO-G40 SSD 透過單一介面結合了 Thunderbolt 3 (40Gbps) 和 USB 3.2 Gen 2 (10Gbps)。

2022 年 10 月 - Solidigm 推出 P44 Pro SSD,這是一款適用於最嚴苛應用的高效能使用者 SSD。 P44 Pro 具有閃電般的性能和出色的能效。

2022 年 8 月-三星發布 990 Pro 系列 SSD。這些是 NVMe M.2 2280 SSD,具有出色的性能,「專為遊戲和藝術應用而設計」。 PCIe 4.0介面用於最新的三星990 Pro系列SSD。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

- 由於多家大型組織持續囤積庫存,供應鏈中斷將在中短期內影響企業級 SSD 領域

- 目前與企業級相比報酬率較低的客戶端SSD價格將小幅上漲

- 遊戲機等新興應用需求穩定

- 繪製 COVID-19 疾病對 2021 年和 2022 年整體產業績效的影響

- 市場動態

- 市場促進因素

- 資料中心應用的採用率提高

- 高階雲端領域的高需求

- 在主要產業中 SSD 比 HDD 更有效用

- 市場課題

- 對 SSD 成本和整體壽命的擔憂

- 市場促進因素

- 市場機會

第5章 固態硬碟(SSD)市場分析

- SSD價格分析

- SSD市場的演進(與HDD比較)

- 出貨貨量分析

- SSD儲存容量和外形尺寸及其演變分析

第6章市場區隔

- 依 SSD 介面(概述、趨勢、預測、市場前景)

- SATA

- SAS

- PCIE

- 依應用(概述、趨勢、預測、市場前景)

- 公司

- 客戶

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 台灣

- 韓國

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭形勢分析

- 供應商市場佔有率分析

- 主要SSD廠商(企業及客戶)差異化主要因素及策略分析

第8章 競爭形勢

- 公司簡介

- Intel Corporation

- Samsung Group

- Micron Technology Inc.

- Western Digital Corporation

- Kingston Technology Corporation

- Seagate Technology LLC

- SK Hynix Inc.

- ADATA Technology Co. Ltd

- Transcend Information Inc.

- Teclast Electronics Co. Limited

第9章投資分析

第10章市場的未來

The Solid State Drive Market size is estimated at USD 65.47 billion in 2024, and is expected to reach USD 147.01 billion by 2029, growing at a CAGR of 17.56% during the forecast period (2024-2029).

The data storage demand has been on a massive rise over the past few years, and it is expected to witness an increasing trend over the forecast period. Increasing demand for data storage options is expected to drive the demand for SSD demand over the forecast period.

The demand for SSD has been rapidly increasing, along with the growing number of cloud platforms, from the traditional corporate private and new public clouds to personal cloud usage. The commonly used SSD interfaces include Serial ATA (SATA), PCI Express (PCIe), and Serial Attached SCSI (SAS). Enhanced features, such as high speed and quick data access, boost the adoption of PCIe SSDs for cloud computing.

Increasing digitalization and shifting lifestyles are the primary factors of the rise in consumer electronics consumption. The COVID-19 pandemic also compelled consumers to go digital for various reasons, including home-schooling and remote employment and has expedited digitalization in various industries. As a result, the use of SSDs in consumer technology solutions is rapidly rising. This need is projected to continue as technological developments, including IoT, VR/AR, 5G, online technologies, and machine learning, become more prevalent.

Furthermore, the rise in storage demand has led companies to invest in manufacturing advanced solutions. For instance, in May 2022, Samsung Electronics confirmed a comprehensive collaboration on next-generation storage software innovations. The collaboration will concentrate on creating and testing open-source applications for existing and new memory and storing technologies, such as NVMe SSDs, computational storage (Smart SSDs, HBM-PIM, Smart SSDs), CXL memory, and fabrics.

Post-COVID-19 pandemic, the effort towards automated technologies will rise, supporting the global expansion of solid-state drives. Furthermore, growing data volume as a result of the work-from-home situation increased demands for solid-state discs in data centers. These SSDs will assist data center providers in providing high-speed and robust intake output operation for massive clouds and workstations.

Solid State Drive Market Trends

Rising Demand from Enterprise Segment to Augment the Market Growth

- Enterprise SSDs lead over a client SSD due to the protection of DRAM-stored data in the event of a power loss, higher performance, stronger error correction code (ECC), consistent and persistent quality of service, and a lengthier warranty.

- The earliest SSDs for enterprises used SLC (single-level cell) NAND flash, which stores one bit per cell and offers the highest level of endurance and performance, with a typical lifecycle of 100,000 writes per cell. Furthermore, NAND-based flash storage solutions are in great demand from organizations due to their long durability, low cost, and quicker storage with a low mistake rate, which drives the need for SSD solutions in enterprises worldwide.

- The growing use of SSD in data centers is due to various factors, including higher efficiency relative to conventional HDD memory, rising demand for storing capacity, and breakthroughs in corporate SSD durability and efficiency. Increasing demand for data centers is expected to propel SSDs demand. SSDs are preferred by businesses since they enable less sprawl, require less energy, and result in a reduced environmental imprint.

- The improvements to NAND flash technology-enabled enterprise SSD manufacturers to use lower-endurance NAND flash options, such as a multi-level cell (MLC), triple-level cell (TLC), and 3D NAND. The advantages of the lower-endurance forms of NAND flash include lower cost and higher capacity, which have increased market growth.

- Increasing product development by market players to meet the rising demand for data centers is expected to contribute to segment growth. In August 2022, Phison Electronics Corp. introduced its X1 controller solid-stated state drive (SSD) platform for enterprise use. The X1 SSD system was conceived in collaboration with Seagate Technology Holdings PLC and built using Phison technology to suit the rising demands of faster and more intelligent worldwide data-center infrastructures. The X1 SSD configurable platform allows for more significant computation using less energy. Due to a cost-effective technology that removes bottlenecks and enhances service quality, the X1 delivers more than a 30% boost in data readings than established market rivals for the equivalent power utilized.

North America Region Expected to Hold Significant Share

- North America is expected to be a prominent market due to the growing adoption of advanced technologies, such as Cloud, IoT, Big Data, and High-end cloud computing. The increasing need for storage, owing to the high adoption of such technologies, drives the market's growth in the region.

- The region includes the world's two largest economically developed countries, the United States and Canada. Prominent North American companies provide various businesses with cutting-edge SSDs as innovative memory options. To gain a competitive edge and enhance corporate efficiency, firms in the United States are increasing expenditures in IT infrastructures which have boosted the demand for storage solutions, including SSD, to increase the speed of data transmission and achieve high levels of efficiency.

- The region has a strong foothold of vendors, contributing to the market's growth. Some of them include Intel Corporation, Micron Technology Inc., and Western Digital Corporation, among others. Additionally, the regional manufacturers are focusing on innovation and product differentiation to increase the penetration of products, increase revenues, and quicken the demand for the product in the region.

- For instance, in June 2022, Micron introduced the 5400 SATA SSD Advanced Memory System for Critical Infrastructure. The company offers 176-layer NAND innovation to its data center SATA SSD using the 5400 SSD. Micron's 5400 SSD is the 11th generation data centre SATA SSD.

- The development of 5G technology in the United States and Canada is expected to contribute significantly to market growth. According to the CTIA, this rapid expansion of 5G will provide the groundwork for a 5G industry in the United States, generating USD 275 billion in investments, 3 million new employment, and USD 500 billion in economic growth.

Solid State Drive Industry Overview

The solid-state drive (SSD) market is competitive due to the presence of major vendors, such as Intel, Micron Technology, Samsung Electronics, Kingston Technology Corporation, and Western Digital Corporation. The existing vendors in the market are investing heavily in the R&D of new and innovative products.

October 2022 - CFD Gaming released a PCIe Gen5 NVMe 2.0 M.2 SSD with reading speeds of up to 10 GB/s and write speeds of up to 9.5 GB/s. The SSDs are built on PHISON ELECTRONICS' "PS5026-E26" and utilize Micron's 3D TLC NAND flash innovation.

October 2022 - WD Introduced the Fast SanDisk Pro SSD, which has a twin Thunderbolt/USB port. Western Digital's latest super-fast SSD is one of the company's San Disk Pro line of goods. The PRO-G40 SSD combines Thunderbolt 3 (40Gbps) with USB 3.2 Gen 2 (10Gbps) through a single interface.

October 2022 - Solidigm launched the P44 Pro SSD, a high-performance user SSD for most demanding applications. The P44 Pro has lightning-fast performance and great power efficiency.

August 2022 - Samsung released the 990 Pro Series SSDs. These are NVMe M.2 2280 SSDs with great performance "designed for gaming and artistic applications." The PCIe 4.0 interface is used by the latest Samsung 990 Pro Series SSDs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the impact of COVID-19 on the Industry

- 4.4.1 Supply chain disruptions to impact the enterprise SSD segment in the short & medium-term as several large-scale organizations continue to stockpile their inventory

- 4.4.2 Marginal rise in prices of Client SSD's which currently offer smaller profit margins as compared to the enteprise segments

- 4.4.3 Stable demand from emerging applications, such as gaming consoles

- 4.4.4 Mapping of the effect of COVID-19 on the overall industry performance for 2021 and 2022

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 Growing Adoption in Data Center Applications

- 4.5.1.2 High Demand from the High-end Cloud Segment

- 4.5.1.3 Greater Utility of SSD over HDD in Key Verticals

- 4.5.2 Market Challenges

- 4.5.2.1 Concerns over Cost and Total Lifespan of SSD's

- 4.5.1 Market Drivers

- 4.6 Market Opportunities

5 SSD MARKET ANALYSIS

- 5.1 SSD Pricing Analysis

- 5.2 Evolution of SSD Market (in comparison to the HDD)

- 5.3 Unit Shipment Analysis

- 5.4 Analysis of the Storage capacity & Form Factor of SSD and their evolution

6 MARKET SEGMENTATION

- 6.1 By SSD Interface (Overview, Trends, Forecasts & Market Outlook)

- 6.1.1 SATA

- 6.1.2 SAS

- 6.1.3 PCIE

- 6.2 By Application (Overview, Trends, Forecasts & Market Outlook)

- 6.2.1 Enterprise

- 6.2.2 Client

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Taiwan

- 6.3.3.3 South Korea

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE ANALYSIS

- 7.1 Vendor Market Share Analysis

- 7.2 Analysis of the Key Differentiators and Strategies of Major SSD Manufacturers (Enterprise and Client)

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 Intel Corporation

- 8.1.2 Samsung Group

- 8.1.3 Micron Technology Inc.

- 8.1.4 Western Digital Corporation

- 8.1.5 Kingston Technology Corporation

- 8.1.6 Seagate Technology LLC

- 8.1.7 SK Hynix Inc.

- 8.1.8 ADATA Technology Co. Ltd

- 8.1.9 Transcend Information Inc.

- 8.1.10 Teclast Electronics Co. Limited