|

市場調查報告書

商品編碼

1437911

中密度纖維板(MDF):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Medium Density Fiberboard (MDF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

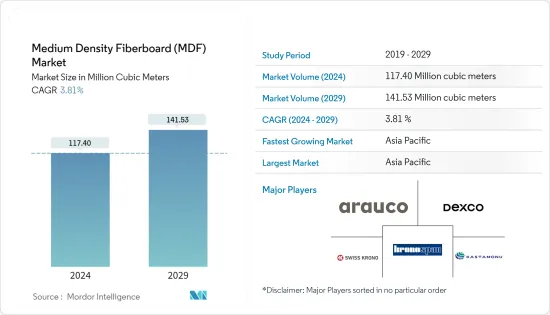

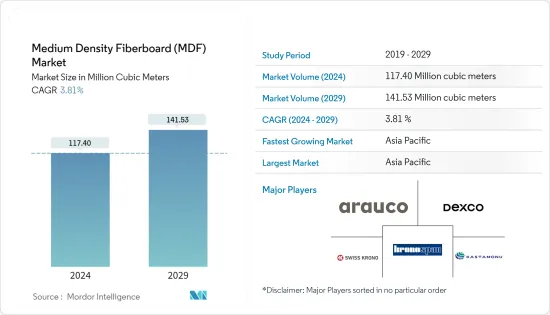

中密度纖維板(MDF)市場規模預計到2024年為1.174億立方米,預計到2029年將達到1.4153億立方米,在預測期內(2024-2029年)複合年成長率為3.81%。

COVID-19 對 2020 年市場產生了負面影響。據美國總承包商(AGC)稱,由於COVID-19的影響,美國的計劃已被推遲或暫停。大約 16% 的美國計劃可能會遇到材料、設備或零件短缺的情況。 11%的計劃將短缺工藝工人,包括分包商,18%的計劃將短缺政府僱員,8%的計劃將因工人可能被感染而暫停計劃。

主要亮點

- 短期來看,家具中密度纖維板需求的增加、原料的容易取得以及住宅領域的擴張是推動所研究市場成長的關鍵因素。

- 然而,嚴格的政府法規和替代產品的存在是預計在預測期內抑制所涉及行業成長的主要因素。

- 儘管如此,特種中密度纖維板生產在歐洲的日益突出以及中密度纖維板在裝飾產品中的使用越來越多,可能很快就會為全球市場創造利潤豐厚的成長機會。

- 在亞太地區,在櫥櫃、地板材料、家具、包裝材料和其他應用等最終用途領域的中密度纖維板的推動下,中密度纖維板(MDF)市場預計在評估期間將健康成長。

中密度纖維板市場趨勢

住宅領域對家具的需求增加

- 中密度纖維板 (MDF) 是大批量生產的家具行業的主要材料,也是現成家具製造商的首選材料。對品牌家具、現成家具、低維護家具的需求日益增加,家具應用對中纖板的需求也增加。

- 人口成長、從家鄉遷移到服務業群聚以及核心家庭的趨勢是推動世界各地住宅建設的一些因素。此外,土地人口比的下降以及高層住宅和城鎮建設的增加趨勢正在推動中密度纖維板在全球住宅建築領域的應用。

- 中密度纖維板(MDF)是一種重組人造板產品。它是通過將硬木或軟木殘留物分解成木纖維(通常在心臟去顫器中)將其與蠟或樹脂粘合劑結合併施加高溫和壓力形成面板而製成的。

- 全球家具市場佔國內家居家具的65%,其次是辦公家具佔15%,飯店及其他產品分別佔15%和5%。

- 根據美國人口普查局的數據,在美國,2021 年 11 月家具和家居用品商店銷售額預計將達到約 133.1 億美元,高於上個月的 124.4 億美元。近年來,受國內COVID-19感染疾病影響,該國有市場陷入低迷。然而,2022年該國有市場穩定復甦。

- 印度是世界第五大家俱生產國和第四大消費國。根據國家投資促進和便利化局的數據,2021 會計年度印度租賃家具和電器市場的總價值達到 3,350 億盧比(45.3088 億美元)。

- 此外,截至 2021 年 9 月,印度未來七年的住宅投資預計將達到約 1.3 兆美元。可以建造 6000 萬套新住宅。這將對住宅建設起到很大的促進作用。預計這將為中密度纖維板(MDF)市場的成長提供各種機會。

- 德國是歐洲最大的家具市場。根據德國家具工業協會 (VDM) 的數據,2020 年家具業的營業額達 172 億歐元(196.4 億美元)。此外,根據 VDM 的數據,德國家具出口與前一年同期比較%。 2021 年前 9 個月達到 62 億歐元(73.4 億美元)。

- 此外,辦公空間的轉變需要更實用、更靈活的家用家具。無論是符合人體工學的椅子、辦公桌還是學習桌,在家工作都集中在家居裝飾上,而家具領域正在興起,促使 MDF 市場在預測期內出現成長。

- 根據Bureau van Dijk統計,義大利住宅家具製造業Promethea 2020年產值約94.79億歐元(108.2241億美元),2021年產值約97.4億歐元(108.2241億美元)。115.2388萬美元)。

- 總體而言,在整個預測期內,住宅和商業市場的成長預計將推動中密度纖維板在家具中的使用。

亞太地區主導市場

- 亞太地區在全球市場中佔據主導地位,佔60%以上的佔有率。中國、印度和日本建設活動的增加增加了該地區對中密度纖維板的需求。

- 中國佔全球市場佔有率近40%。中國中密度纖維板(MDF)消費量的快速成長主要得益於經濟成長支撐下的住宅和商業建築業的發達。

- 根據工業與資訊化部統計,2022年1月至4月中國主要家具製造商利潤總額達100.6億元人民幣(15億美元),較去年同期成長2.9%。

- 在中國,中密度纖維板消費可能會保持強勁,因為中國計劃在未來五年內投資1.43萬億美元用於大型建築專案,直到2025年。 根據國家發展和改革委員會(NDRC)的數據,上海的計劃包括在未來三年內投資387億美元,而廣州市已經簽署了16個新的基礎設施專案,投資額為80.9億美元。

- 在印度,經濟適用住宅的供應量預計到 2024 年將增加 70% 左右。印度政府的「2022 年全民住宅」政策也改變了該產業的遊戲規則。該計劃旨在2022年為都市區貧困階級建造超過2000萬套經濟適用住宅。

- 隨著2025年大阪世博會的舉辦,日本的建設產業可望進一步發展。此外,虎之門麻布台地區再開發案、八重洲再開發案以及61樓、390m高的辦公大樓計畫分別於2023年及2027年完工。

- 此外,2020年印尼家具出口額為19.1億美元,佔該國具出口總額的1.23%以上,年成長率為7.7%,使得中密度纖維板在預測期內更受歡迎。一個巨大的市場。

- 這些因素可能會增加該地區中密度纖維板市場的需求。

中密度纖維板產業概況

中密度纖維板(MDF)市場本質上高度分散。主要企業包括(排名不分先後)Kronoplus Limited、ARAUCO、SWISS KRONO Group、Kastamonu Entegre、Dexco 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 家具中密度纖維板的需求增加

- 原料容易取得

- 擴大住宅領域

- 抑制因素

- 嚴格的政府法規

- 產品替代品的存在

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 價格走勢分析

第5章市場區隔

- 目的

- 櫥櫃

- 地板材料

- 家具

- 線條、門和木製品

- 包裝系統

- 其他用途

- 最終使用者部門

- 住宅

- 商業的

- 制度性的

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- ARAUCO

- DAIKEN CORPORATION

- Dexco

- EGGER Group

- Eucatex

- Masisa

- Fantoni Spa

- Kastamonu Entegre

- Korosten MDF Manufacture

- Kronoplus Limited

- Nelson Pine Industries Limited

- Roseburg

- Sonae Arauco

- SWISS KRONO

- West Fraser

- Weyerhaeuser Company

第7章市場機會與未來趨勢

- 特殊中密度纖維板生產在歐洲的聲譽日益提高

- 增加中密度纖維板在裝飾物品中的使用

The Medium Density Fiberboard Market size is estimated at 117.40 Million cubic meters in 2024, and is expected to reach 141.53 Million cubic meters by 2029, growing at a CAGR of 3.81% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. According to the Associated General Contractors of America (AGC), COVID-19 impact has delayed or disrupted projects in the United States. Around 16% of the projects in the United States are likely to experience a shortage of materials, equipment, or parts; 11% of the projects will see a shortage of craft workers, including subcontractors, 18% of the projects will witness a lack of government workers, and 8% of the projects will be disrupted by an infected worker, who may have a potential to infect a worksite.

Key Highlights

- Over the short term, an increase in the demand for MDF for furniture, easy availability of raw materials, and expansion of the residential sectors are major factors driving the growth of the market studied.

- However, stringent government regulations and the presence of product substitutes are the key factors anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the growing prominence of the production of specialty MDF in Europe and the rising use of MDF in decorative articles is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is estimated to witness healthy growth over the assessment period in the medium-density fiberboard (MDF) market due to the medium-density fiberboard in end-use application segments, such as cabinet, flooring, furniture, packaging, and other applications.

Medium Density Fiberboard Market Trends

Increase Demand for Furniture in Residential Sector.

- Medium-density fiberboard (MDF) is the staple of the mass-manufacturing furniture industry and the preferred choice of ready-made furniture manufacturers. The demand for branded, ready-made, and low-maintenance furniture is increasing daily, propelling the demand for MDF in furniture applications.

- Growth in population, migration from hometowns to service sector clusters, and nuclear family trend are some of the factors that have been driving residential construction across the world. Besides, decreasing land-to-population ratio and the growing trend of constructing high-rise residential buildings and townships have been driving the application of MDF in the residential construction segment globally.

- Medium-density fiberboard (MDF) is a reconstituted wood-based panel product. It is made by breaking down hardwood or softwood residuals into wood fibers, often in a defibrillator, combining it with wax and a resin binder, and forming panels by applying high temperature and pressure.

- The global furniture market comprises 65% of domestic home furniture, followed by office furniture comprising 15%, and hotels and others include 15% and 5%, respectively.

- According to the US Census Bureau, in the United States, In November 2021, furniture and home furnishing store sales were estimated to reach approximately USD 13.31 billion, up from the month before, when the sales stood at USD 12.44 billion. In recent years, the country witnessed a slump in the furniture market owing to the impact of the COVID-19 outbreak in the country. However, the country has registered a steady recovery in the furniture market in 2022.

- India is the fifth-largest producer and fourth-largest consumer of furniture in the world. According to National Investment Promotion and Facilitation Agency, the total rental furniture and appliances market in India reached INR 335,000 million (USD 4,530.88 million) during FY21.

- Furthermore, as of September 2021, India will likely witness an investment of around USD 1.3 trillion in housing over the next seven years. It is likely to witness the construction of 60 million new homes. This will provide a significant boost to housing construction. This is expected to offer various opportunities for the Medium-Density Fiberboard (MDF) market growth.

- Germany is the largest market for furniture in the European region. According to the Association of the German Furniture Industry (VDM), the turnover for the furniture industry was valued at EUR 17.2 billion (USD 19.64 billion) in 2020. Furthermore, according to VDM, German furniture exports increased 17 percent year-on-year and reached EUR 6.2 billion (USD 7.34 billion) in the first nine months of 2021.

- Moreover, shifting away from office workspaces has resulted in demand for more functional and flexible home furniture. Whether it is an ergonomic chair, office desk, or study table, work from home is focusing on home decor, increasing the furniture segment, thus resulting in an increase in the MDF market in the forecast period.

- According to Bureau van Dijk; Prometeia, the production of the manufacturing industry of house furniture in Italy was worth about EUR 9,479 million (USD 10,822.41 million) in 2020 and reached EUR 9,740 million (USD 11,523.88 million) in 2021.

- Overall, the residential and commercial market growth is expected to drive the use of MDF in furniture through the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market, holding a share of more than 60%. The increasing construction activities in China, India, and Japan are boosting the demand for MDF in the region.

- China accounted for almost more than 40% of the global share. The rapid growth in consumption of medium-density fiberboard (MDF) in China has been majorly driven by the ample developments in the residential and commercial construction sectors, which are being supported by the growing economy.

- During the January-April period of 2022, total profits of major Chinese furniture-making enterprises stood at CNY 10.06 billion (USD 1.5 billion), up 2.9 percent year-on-year, according to the Ministry of Industry and Information Technology.

- The consumption of MDF is likely to witness positive strides in China, as the country is investing USD 1.43 trillion in the next five years till 2025 in major construction projects. According to National Development and Reform Commission (NDRC), the Shanghai plan includes the investment of USD 38.7 billion in the next three years, whereas Guangzhou has signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In India, the rate of availability of affordable housing is expected to rise by around 70% in 2024. The Indian government's 'Housing for All by 2022' is also a major game-changer for the industry. This initiative aims to build more than 20 million affordable homes for the urban poor by 2022.

- Japanese construction industry is expected to be blooming as the country will host the World Expo in 2025 in Osaka, Japan. Furthermore, Toranomon Azabudai District Redevelopment project, Yaesu redevelopment project and a 61-storey, 390 m tall office tower due for completion in 2023 and 2027 respectively.

- Furthermore, the furniture market in Indonesia accounts for over 1.23% of the country's total exports as the furniture export in 2020 stood at USD 1.91 billion, registering a growth of 7.7% per annum, thus it will provide huge market for MDF in forecast period.

- Such factors, in turn, are likely to boost the demand in the MDF market in the region.

Medium Density Fiberboard Industry Overview

The medium-density fiberboard (MDF) market is highly fragmented in nature. The major players include Kronoplus Limited, ARAUCO, SWISS KRONO Group, Kastamonu Entegre, and Dexco, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in the Demand for MDF for Furniture

- 4.1.2 Easy Availability of Raw Materials

- 4.1.3 Expansion of the Residential Sector

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Presence of Product Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trend Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Cabinet

- 5.1.2 Flooring

- 5.1.3 Furniture

- 5.1.4 Molding, Door, and Millwork

- 5.1.5 Packaging System

- 5.1.6 Other Applications

- 5.2 End-user Sector

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Institutional

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Vietnam

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARAUCO

- 6.4.2 DAIKEN CORPORATION

- 6.4.3 Dexco

- 6.4.4 EGGER Group

- 6.4.5 Eucatex

- 6.4.6 Masisa

- 6.4.7 Fantoni Spa

- 6.4.8 Kastamonu Entegre

- 6.4.9 Korosten MDF Manufacture

- 6.4.10 Kronoplus Limited

- 6.4.11 Nelson Pine Industries Limited

- 6.4.12 Roseburg

- 6.4.13 Sonae Arauco

- 6.4.14 SWISS KRONO

- 6.4.15 West Fraser

- 6.4.16 Weyerhaeuser Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Prominence for the Production of Specialty MDF in Europe

- 7.2 Rising use of MDF in Decorative Articles

![纖維板市場:趨勢、機遇、競爭分析 [2023-2028]](/sample/img/cover/42/1289754.png)