|

市場調查報告書

商品編碼

1437909

複合絕緣板:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Composite Insulated Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

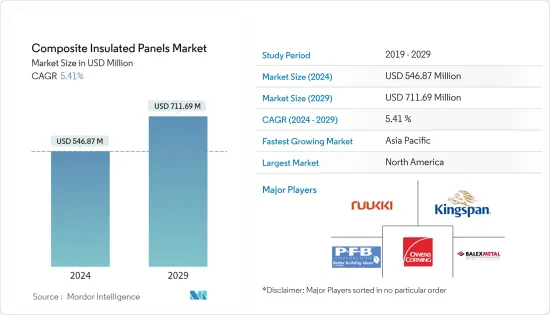

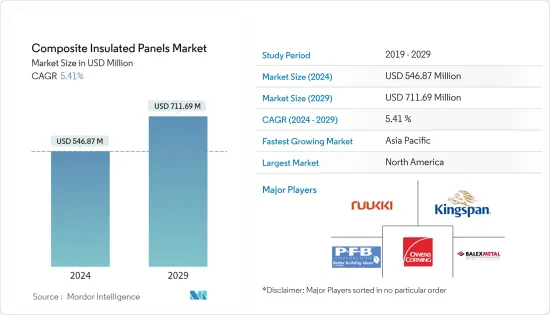

2024年複合絕緣板市場規模估計為5.4687億美元,預計到2029年將達到7.1169億美元,在預測期間(2024-2029年)以5.41%的複合年增長率增長。

冠狀病毒感染疾病(COVID-19)大流行對市場產生了負面影響。這是因為製造設施和工廠因封鎖和限制措施而關閉。供應鏈和運輸中斷造成了進一步的市場瓶頸。然而,隨著所研究市場的需求復甦,該產業在 2021 年出現復甦。

主要亮點

- 從短期來看,建築業需求的增加和冷藏應用的增加是推動所研究市場成長的一些因素。

- 另一方面,模組化建築技術等建築技術的進步可能會阻礙市場成長。

- 然而,智慧城市建設的成長預計將在預測期內提供許多機會。

- 雖然北美在消費方面主導市場,但預計亞太地區在預測期內將呈現最高的複合年成長率。

複合絕緣板的市場趨勢

建築牆體需求增加

- 外牆是建築的主體部分。另外,外牆對於建築的節能也扮演著非常重要的角色。因此,牆面節能技術非常重要。

- 複合板可以更好地應用於工程實踐,滿足節能建築和住宅產業化的發展要求。節能技術主要應用於傳統單層牆體、內保溫複合牆體、外保溫複合牆體、夾心絕緣板牆體四種類型的牆體。

- 建設產業需求的增加是推動複合絕緣板市場的關鍵因素之一。世界各地正在進行的主要建築計劃包括德克薩斯州耗資 10 億美元的 Magnolia 綜合體計劃,計劃於 2025 年第一季竣工。東京南小岩六丁目區一類城市再開發計劃是日本的類似計劃,計畫於 2026 年完工。因此,預計在此類建設計劃中,建築物的牆體將採用複合絕緣板。

- 此外,亞太複合絕緣板市場預計在預測期內將顯著成長,其中中國由於不斷擴大的建設和快速的工業發展而引領市場。由於該地區建築施工和維修活動的增加,預計複合絕緣板的消耗量將激增。例如,亞太地區正在進行的建築計劃包括耗資 31.7 億美元的日本東京濱松町芝浦 1 丁目重建計劃,計劃於 2030 年竣工。另一個類似的計劃是武漢復星外灘中心T1計劃,該項目在中國武漢建設復星外灘中心T1。因此,建築施工計劃的增加預計將推動該地區複合絕緣板市場的成長。

- 此外,由於政府的支持和舉措,印度的住宅產業正在崛起,需求進一步增加。據印度品牌股權基金會(IBEF)稱,住房與城市發展部(MoHUA)已在2022-2023年預算中撥出98億日元用於建造住宅,並設立基金以完成停滯的計劃,並撥款5000萬美元。因此,國內住宅建築數量的增加預計將增加建築牆體的需求,進一步增加複合絕緣板市場的需求。

- 所有上述因素預計將增加建築牆體應用對複合絕緣板的需求。

北美市場佔據主導地位

- 由於商業房地產行業的改善以及聯邦和州對公共建築和公共設施投資的增加,北美建築業一直在穩步成長。北美主要建築計劃包括耗資25億美元的酵母綜合開發計劃;該計劃旨在為德克薩斯州提供更好的住宅和辦公設施,預計將於2040年竣工。因此,建設產業投資的增加預計將為複合絕緣板提供上升空間。

- 由於國內建設活動的增加,美國主導了北美複合隔熱板市場。

- 根據美國人口普查局的數據,2022年美國私人建築價值為1.43兆美元,較2021年的1.28兆美元增加10.47%。 2022年住宅支出為8,991億美元,較2021年成長13.3%,非住宅支出為5,301億美元,較2021年下降9.1%。在美國,該國建設產業對複合絕緣板市場的需求預計將回升。

- 此外,2022年5月,美國政府宣布將撥款超過1,100億美元,實施4,300個機場港口現代化、道路橋樑重組等具體計劃。這些計劃預計將使 50 個州的約 3,200 個社區受益。因此,國內建築業的擴張預計將創造一個複合絕緣板市場,建築牆體領域的需求也將上升。

- 此外,根據美國人口普查局的數據,2022年新建設總額約為1.79兆美元,較2021年的1.63兆美元增加10.20%,預計將繼續逐年成長。這將進一步增加複合絕緣板在各種建築和施工應用中的消耗。

- 此外,加拿大的建築業是北美第二大。預計到 2024 年它將以合理的速度改善和成長。例如,根據加拿大房屋抵押貸款公司的數據,截至 2022 年 12 月,加拿大約有 334,100 套住宅單元在建,因此該國建設活動的增加正在推動複合隔熱板市場的需求上升。

- 隨著建設產業的成長,所研究市場的需求預計將顯著增加。

複合絕緣板產業概況

複合絕緣板市場本質上是分散的。該市場的主要企業(排名不分先後)包括 Kingspan Group、Rautarukki Corporation、Balex-Metal、PFB Corporation、Owens Corning 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建設產業需求增加

- 冷庫應用程式增加

- 其他司機

- 抑制因素

- 模組化建築技術等建築技術的進步

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 產品

- 發泡聚苯乙烯(EPS)板

- 硬質聚氨酯 (PUR) 和硬質聚異氰酸酯(PIR) 面板

- 玻璃絨板

- 其他產品(擠出發泡聚苯乙烯泡沫)

- 目的

- 建築牆

- 建築屋頂

- 冷藏

- 皮膚材質

- 連續纖維增強熱塑性塑膠 (CFRT)

- 玻璃纖維增強面板(FRP)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Alubel

- ArcelorMittal

- Balex-Metal

- DANA Group of Companies

- ITALPANNELLI SRL

- Jiangsu Jingxue Insulation Technology Co. Ltd

- Kingspan Group

- Metecno

- Owens Corning

- PFB Corporation

- Rautaruukki Corporation

- Tata Steel

- Zamil Steel Pre-Engineered Buildings Company Limited

第7章市場機會與未來趨勢

第8章 智慧城市建設發展

第9章 其他機會

The Composite Insulated Panels Market size is estimated at USD 546.87 million in 2024, and is expected to reach USD 711.69 million by 2029, growing at a CAGR of 5.41% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand from the construction sector and increasing cold storage applications are some of the factors driving the growth of the market studied.

- On the flip side, advancements in building technologies such as modular construction techniques are likely to hinder the growth of the market.

- However, growing smart city constructions are anticipated to provide numerous opportunities over the forecast period.

- North America dominated the market in terms of consumption, however, Asia-Pacific is expected to have the highest CAGR during the forecast period.

Composite Insulated Panels Market Trends

Increasing Demand from the Building Wall

- The outer walls are the major part of a building. Additionally, the external walls play a very important role in energy-saving buildings. Therefore, the wall's energy-saving technology is of much significance.

- Composite panels can be better applied to the engineering practice, in order to meet the development requirements of energy-saving buildings and housing industrialization. The energy-saving technologies are applied on mainly four kinds of walls, namely, traditional single wall, internal thermal insulation composition wall, external thermal insulation composite wall, and sandwich insulation panel wall.

- The increasing demand from the construction industry is one of the key factors driving the market for composite insulated panels market. Some of the large ongoing building construction projects across the world include the Magnolia Mixed-Use Complex project worth USD 1 billion in Texas, which is expected to be completed in Q1 2025. The Minamikoiwa 6-Chome District Type One Urban Redevelopment project in Tokyo, Japan is another such project, which is expected to complete in 2026. Thus, such construction projects are estimated to use composite insulated panels for walls of the building.

- Moreover, Asia-Pacific composite insulated panels market is anticipated to grow significantly during the forecast period with China leading the market owing to expanding construction and rapid industrial development. The growing building construction and renovation activities in the region are expected to surge the consumption of composite insulated panels. For instance, some of the ongoing building construction projects in the Asia-Pacific include the Hamamatsucho Shibaura 1 Chome Redevelopment project worth USD 3.17 billion, which is expected to be completed in 2030, in Tokyo, Japan. Another such project is the Wuhan Fosun Bund Center T1 project, which involves the construction of the Fosun Bund Center T1 in Wuhan, China. Therefore, increasing building construction projects are expected to drive the growth of composite insulated panels market in the region.

- Furthermore, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects. Therefore, increasing in the number of house constructions in the country is expected to create an upside demand for building walls, further boosting the demand for composite insulated panels market.

- All the aforementioned factors are expected to drive the demand of composite insulated panels from building walls application.

North-America to Dominate the Market

- The construction industry in North America is growing steadily, due to the improving commercial real estate sector and increased federal and state investment in public construction and institutional buildings. Some of North America's major building construction projects include the East River Mixed-Use Development project worth USD 2.5 billion. The project aims to provide better residential and office facilities in Texas, which is expected to be completed in 2040. Therefore, increasing investments from the building and construction industry is expected to create an upside for composite insulated panels.

- The United States dominated the North American composite insulated panels market, owing to the increasing construction activities in the country.

- According to the US Census Bureau, the value of private construction in the United States in 2022 was USD 1.43 trillion, which shows an increase of 10.47% compared to 2021, which amounted to USD 1.28 trillion. Residential construction spending in 2022 amounted to USD 899.1 billion, which showed an increase of 13.3% compared to 2021, while non-residential construction spending amounted to USD 530.1 billion, which showed a decrease of 9.1% compared to 2021. Therefore, increasing private construction in the United States is expected to create an upside demand for composite insulated panels market from the country's construction industry.

- Additionally, in May 2022, the the United States government announced to the allocation of over USD 110 billion for carrying out 4.3 thousand specific projects for modernizing airports and ports and rebuilding roads and bridges. These projects are expected to benefit around 3.2 thousand communities across the 50 states. Therefore, the expansion of constructing industry in the country is expected to create an upside demand composite insulated panels market from the building walls segment.

- Moreover, according to the US Census Bureau, the total new construction put in place was valued at about USD 1.79 trillion during year 2022, registering a growth rate of 10.20% compared to the USD 1.63 trillion in 2021 and is expected to rise through the years to come, which will further enhance the consumption of composite insulated panels from various building and construction applications.

- Furthermore, the Canadian construction industry is the second-largest in North America; it is expected to improve and grow at a decent pace, till 2024. For instance, according to Canada Mortgage and Housing Corporation, the number of dwelling units that were under construction in Canada in December of 2022 was approximately 334.1 thousand units, which showed an increase of 12.8% compared to 2021. Therefore, increasing construction activities in the country is expected to create an upside demand for composite insulated panels market.

- With the construction industry's growth, the demand for market studied is expected to increase significantly.

Composite Insulated Panels Industry Overview

The Composite Insulated Panels Market is fragmented in nature. The major players in this market (not in a particular order) include Kingspan Group, Rautaruukki Corporation, Balex-Metal, PFB Corporation, and Owens Corning, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Sector

- 4.1.2 Increasing Cold Storage Applications

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Advancements in Building Technologies, such as Modular Construction Techniques

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product

- 5.1.1 Expanded Polystyrene (EPS) Panel

- 5.1.2 Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

- 5.1.3 Glass Wool Panel

- 5.1.4 Other Products (Extruded Polystyrene Foam)

- 5.2 Application

- 5.2.1 Building Wall

- 5.2.2 Building Roof

- 5.2.3 Cold Storage

- 5.3 Skin Material

- 5.3.1 Continuous Fiber Reinforced Thermoplastics (CFRT)

- 5.3.2 Fiberglass Reinforced Panel (FRP)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alubel

- 6.4.2 ArcelorMittal

- 6.4.3 Balex-Metal

- 6.4.4 DANA Group of Companies

- 6.4.5 ITALPANNELLI SRL

- 6.4.6 Jiangsu Jingxue Insulation Technology Co. Ltd

- 6.4.7 Kingspan Group

- 6.4.8 Metecno

- 6.4.9 Owens Corning

- 6.4.10 PFB Corporation

- 6.4.11 Rautaruukki Corporation

- 6.4.12 Tata Steel

- 6.4.13 Zamil Steel Pre-Engineered Buildings Company Limited