|

市場調查報告書

商品編碼

1437494

摩托車燃油噴射系統:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)2 Wheeler Fuel Injection System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

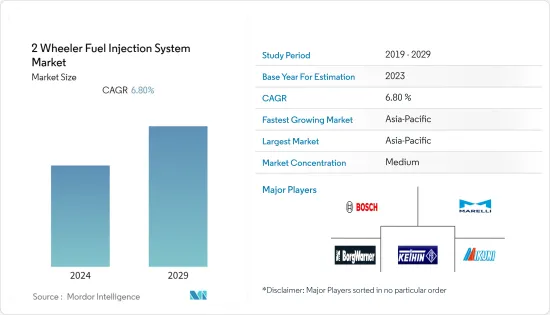

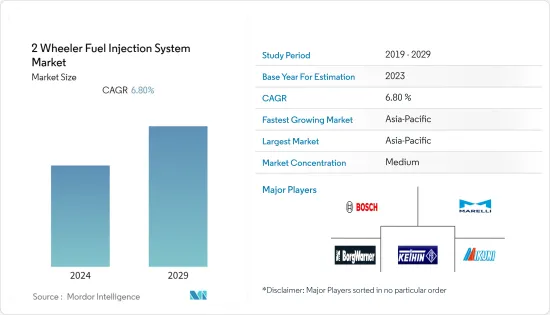

以 Equal-6.80 計算的兩輪車燃油噴射系統市場規模預計將從 2024 年的 119.4 億美元成長到 2029 年的 165.9 億美元,預測期內(2024-2029 年)複合年成長率為 6.80%。到美元。

從中期來看,由於政府對兩輪車排放的嚴格規則和法規以及汽車化油器桿的低效率,對更清潔、更有效率的車輛的需求不斷增加,預計將推動市場的發展。

由於存在許多未鋪砌的道路以及不同國家不同家庭的私人購買者的承受能力相對較低,促使購買者選擇兩輪車輛,例如摩托車、輕型機踏車和Scooter。上述因素的綜合作用將在未來幾年在全球創造對摩托車燃油噴射系統的巨大需求。

線控 (RbW) 技術的快速採用可使用致動器、感測器和電控系統來節流電線並調節引擎內的燃料和空氣供應,以實現高效率和高性能。此前,RbW 僅在工廠出貨在高階自行車上。然而,它現在已被引入中階自行車,例如 KTM Duke 390。

隨著摩托車製造商開發出具有更好燃油噴射系統的更小型引擎,引擎尺寸正在不斷縮小。小型化使引擎運轉到更高的負載,從而提高引擎效率。輕型引擎有助於提高燃油效率。電動二輪車在全球範圍內的日益普及可能會阻礙燃油噴射系統市場的成長。

摩托車燃油噴射系統市場趨勢

摩托車佔據市場主導地位

由於都市化加快、可支配收入增加以及對負擔得起且有效的交通的需求等因素,摩托車的銷量大幅成長。本田、Yamaha、川崎等日本摩托車製造商主導市場。

同時,收入的增加、政府的舉措和基礎設施的擴大是人們將注意力從升級舊摩托車轉向購買入門級小客車的一些主要原因。這表明該國對汽車市場的依賴程度正在增加,同時逐漸轉向更昂貴的更大引擎的兩輪(運動)汽車和電動車市場。

汽車產業的快速技術進步迫使(並在某種程度上迫使)製造商依賴未來新的汽車技術,並在核心設計和產品研發方面投入大量資金。雖然大多數擁有可行創新資源的製造商都在削減開支,但有些製造商在車輛的核心設計上遇到了困難,以滿足市場需求,與市場上的其他參與者進行創新和製定策略,往往依賴私人合作夥伴關係。

這一新的夥伴關係和協作浪潮將幫助市場參與者進行技術和關鍵資訊的受控共用,從而為整個市場在滿足買家需求方面帶來巨大利益。結果,汽車製造商之間的製造聯盟在撒哈拉以南地區激增,該地區汽車行業的技術進步相對緩慢。例如,

2022 年 7 月,TVS Motor Company 宣布推出高階車型 TVS RONIN,這是業界首款「現代復古」自行車。 TVS RONIN 從頭開始設計,是受當今新時代騎手啟發的生活方式宣言。

2022 年 5 月,TVS 汽車公司宣佈在肯亞推出限量版 TVS HLX 125 Gold 和 TVS HLX 150 Gold 車型。據該公司稱,發布這兩款名人限量型號是為了紀念TVS HLX系列全球銷量突破200萬台。

全球範圍內的上述發展可能表明預測期內市場將顯著成長。

亞太地區預計將成為成長最快的地區

亞太地區在市場上佔據主導地位,預計該地區在預測期內將呈現最高成長率。

在亞太地區,印度摩托車市場自2016年以來一直是全球最大的摩托車市場,Hero、TV、本田等主要製造商紛紛進入該市場。隨著女性進入勞動市場以及對舒適和便利的需求增加,對高度便利的Scooter的需求持續增加。

此外,由於對高性能和巡洋艦摩托車的需求不斷增加,中型和大型摩托車的高價位市場也在擴大。全國中小企業的快速擴張很可能為汽車零件製造商創造機會。

在預測期內,全部區域兩輪車最後一英里交付的快速擴張可能會顯著成長。兩輪車在交通擁擠和狹窄的道路和小巷中比四輪車更容易操縱,這在擁擠的都市區是一個很大的優勢。此外,它可以輕鬆客製化以滿足特定的業務需求,例如添加宅配箱或貨架來運輸貨物或更換座位以適應乘客。

從長遠來看,企業可以透過使用兩輪車來節省燃料成本,兩輪車通常比四輪車消耗更少的燃料。兩輪車有時比四輪車行駛得更快。這對於需要快速交付貨物或快速提供運輸服務的企業尤其重要。

另一方面,在預測期內,兩輪車租賃和共享服務的擴張可能會顯示市場的顯著成長。

摩托車燃油噴射系統產業概況

Marelli Holdings、Mikuni Corporation、Denso Corporation 和 Robert Bosch GmbH 等主要公司主導著摩托車燃油噴射系統市場。多家兩輪車製造商已在全球推出新車型,預計市場在預測期內將大幅成長。例如,2023年6月,Adishwar Auto Ride India Pvt. Ltd.宣布將於明年將其Keeway品牌下的兩款新復古騎行自行車SR 250和SR 125本地化。兩種型號均配備電子燃油噴射系統。

Yamaha Motor Co, Ltd.於 2023 年 1 月在非洲地區推出了YamahaYZ65。 YZ65 由液冷 65cc二行程引擎提供動力,可提供卓越的動力和性能。

2022年3月,Aprila推出了燃油噴射二行程引擎,該引擎在燃燒室上方裝有燃油噴射器和壓縮空氣噴射設備。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 全球摩托車銷售成長

- 市場限制因素

- 電動二輪車越來越受歡迎

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(依金額分類的市場規模 - 美元)

- 依類型

- 直接燃油噴射系統

- 端口燃油噴射系統

- 依車型

- Scooter

- 摩托車

- 依位移

- 200cc以下

- 200~500cc

- 500~1000cc

- 1000cc以上

- 依銷售管道

- OEM

- 售後市場

- 依地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Robert Bosch GmbH

- Marelli Holdings Co., Ltd.

- Denso Corporation

- Mikuni Corporation

- Hitachi Astemo, Ltd.

- DUCATI Energia Spa

- Walbro LLC

- EDELBROCK, LLC.

- SEDEMAC Mechatronics Pvt Ltd.

- UCAL Systems Inc.

第7章市場機會與未來趨勢

The 2 Wheeler Fuel Injection System Market size in terms of Equal-6.80 is expected to grow from USD 11.94 billion in 2024 to USD 16.59 billion by 2029, at a CAGR of 6.80% during the forecast period (2024-2029).

Over the medium term, owing to the stringent government rules and regulations regarding two-wheeler emissions, increasing demand for cleaner and more efficient vehicles, and inefficiency of car carburetor stems are likely to drive the market.

The high number of unpaved roads and the relatively low individual buyer affordability that is observed across different households of various countries leads the buyer to opt for a two-wheeler, including a motorcycle, a moped, and a scooter. Combining the above factors creates a significant demand for two-wheeler fuel injection systems across the globe in the coming years.

The rapid adoption of Ride-by-wire (RbW) technology, as it uses actuators, sensors, and the Electronic Control Unit to throttle wire to regulate fuel and air supply in the engine, thus providing high efficiency and performance. Earlier, RbW was factory-installed only in high-end bikes. However, now it is introduced in mid-segment bikes, such as the KTM Duke 390.

Engine downsizing is on the rise as two-wheeler makers are developing smaller engines with better fuel injection systems. Downsizing shifts the engine operation to high loads where high engine efficiency exists. The lightweight engine helps to enhance fuel efficiency. The rising popularity of electric two-wheelers across the globe is likely to hinder the growth of the fuel injection system market.

2 Wheeler Fuel Injection System Market Trends

Motorcycles Dominating the Market

Motorcycles have grown significantly as a result of factors like rising urbanization, rising disposable incomes, and the need for affordable and effective transportation. Japanese motorcycle manufacturers like Honda, Yamaha, Suzuki, and Kawasaki dominate the market.

On the other hand, rising incomes, government initiatives, and the expansion of infrastructure are some of the primary reasons why people are shifting their focus away from upgrading their older motorcycles and toward purchasing entry-level passenger cars. It demonstrates that the nation is increasing its reliance on the automobile market while gradually shifting to more expensive motorcycle markets featuring larger engines (sports vehicles) and electric vehicles.

The rapid technological advancements in the automobile industry have driven (in a way, forced) the manufacturers to resort to new and upcoming vehicle tech and invest significantly into the research and development of the core design and products. While most of the manufacturers with viable resources for innovation cut, some of the manufacturers tend to stumble at the core design of the vehicles to meet market needs and resort to innovations and strategic partnerships with other players in the market.

This new wave of partnership and collaboration helps the players in the market to execute a controlled sharing of technologies and key information, leading to the overall immense benefit for the market to cater to the demand from the buyers. Consequently, the sub-Saharan region, with its relatively slow technological advancement in the automotive industry, witnessed a surge in the manufacturer partnerships between the automotive manufacturers. For instance,

In July 2022, July 2022: TVS Motor Company announced a premium model with the launch of the industry's first 'modern-retro' motorcycle - the TVS RONIN. Designed ground up, the TVS RONIN is a lifestyle statement that takes inspiration from the modern, new-age rider.

In May 2022, TVS Motor Company announced the introduction of limited edition TVS HLX 125 Gold and TVS HLX 150 Gold models in Kenya. According to the company, the two celebrity limited edition models were released to commemorate global sales of over two million units of the TVS HLX series.

The development mentioned above across the globe is likely to witness major growth for the market during the forecast period.

Asia-Pacific is Expected to be the Fastest Growing Region

Asia-Pacific dominates the market, and the region is expected to witness the fastest growth rate during the forecast period.

In Asia-Pacific, the Indian motorcycle market has been the largest in the world since 2016, with the presence of major manufacturers such as Hero, TVs, and Honda. With the social advancement of women and the growing demand for comfort and convenience, the demand for scooters has been continually increasing as they are convenient.

Additionally, the premium price market segment for mid and large-sized motorcycles is also expanding, owing to a growing demand for high-performance and cruiser bikes. The rapid expansion of small and medium-scale industries across the country is likely to create an opportunity for vehicle parts manufacturers.

The Rapid expansion of last-mile delivery through two-wheelers across the region is likely to witness major growth during the forecast period. Two-wheelers are easier to maneuver through traffic and narrow streets and alleys than four-wheeled vehicles, making them a significant advantage in congested urban areas. Additionally, they can be easily customized to meet specific business requirements, such as by adding delivery boxes or racks to transport goods or by modifying the seating to accommodate passengers.

Businesses can save money over time on fuel costs by using two-wheeled vehicles, which typically use less fuel than four-wheeled vehicles. Two-wheeled vehicles can sometimes move faster than four-wheeled vehicles. This is especially important for businesses that need to deliver goods quickly or provide transportation services quickly.

The expansion of two-wheeler rental and sharing services, on the other hand, is likely to witness major growth for the market during the forecast period.

2 Wheeler Fuel Injection System Industry Overview

Major players, such as Marelli Holdings Co. Ltd., Mikuni Corporation, Denso Corporation, Robert Bosch GmbH, and others, dominate the 2-wheeler fuel injection system market. Several two-wheeler manufacturers are introducing new models across the globe, which in turn is anticipated to witness major growth for the market during the forecast period. For instance, in June 2023, Adishwar Auto Ride India Pvt. Ltd. announced the localization of the two Neo-Retro rides motorcycles from the Keeway brand, i.e., SR 250 and SR 125, in the coming year. Both models are equipped with an electronic fuel injection system.

In January 2023, Yamaha Motor launched the Yamaha YZ65 in the African region. The YZ65 is powered by a liquid-cooled 65cc two-stroke engine that delivers impressive power and performance.

In March 2022, Aprilla introduced a fuel-injected two-stroke that incorporates a fuel injector above the combustion chamber, as well as a provision for injecting compressed air.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Two-Wheeler Sales Across the Globe

- 4.2 Market Restraints

- 4.2.1 Rising Popularity of Electric Two-wheelers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 Direct Fuel Injection System

- 5.1.2 Port Fuel Injection System

- 5.2 By Vehicle Type

- 5.2.1 Scooters

- 5.2.2 Motorcycles

- 5.3 By Engine Displacement

- 5.3.1 Less than 200 cc

- 5.3.2 200 to 500 cc

- 5.3.3 500 to 1000 cc

- 5.3.4 Greater than 1000 cc

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturers (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Marelli Holdings Co., Ltd.

- 6.2.3 Denso Corporation

- 6.2.4 Mikuni Corporation

- 6.2.5 Hitachi Astemo, Ltd.

- 6.2.6 DUCATI Energia Spa

- 6.2.7 Walbro LLC

- 6.2.8 EDELBROCK, LLC.

- 6.2.9 SEDEMAC Mechatronics Pvt Ltd.

- 6.2.10 UCAL Systems Inc.