|

市場調查報告書

商品編碼

1436010

葡萄酒包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Wine Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

2024年葡萄酒包裝市場規模預計為35.4億美元,預計到2029年將達到42.1億美元,在預測期內(2024-2029年)複合年成長率為3.54%成長。

一些流行的新興趨勢預計將成為葡萄酒包裝的常規趨勢,包括旋斷式軟木塞、瓶子包裝、更薄的生態玻璃、雷射切割標籤、蝕刻玻璃和收縮包裝套。

主要亮點

- 由於 COVID-19感染疾病,美國葡萄酒包裝市場預計將成長。葡萄酒包裝製造商也面臨許多預計在短期內持續存在的課題。封鎖的影響包括製造過程中使用的原料的缺乏、供應鏈中斷、價格波動、可能導致交付問題的勞動力短缺以及最終產品。例如,

- 該地區葡萄酒包裝的受歡迎程度很大程度上取決於消費者的年齡和目的。例如,在音樂節、社交聚會和體育比賽等活動中,罐裝、袋裝和小型襯袋紙盒越來越受到消費者的歡迎。

- 襯袋紙盒(BIB) 等包裝比玻璃瓶輕。它永遠不會破裂,並且可以隨時密封。此外,它還具有物流成本低、運輸方便、用於行銷目的的大印刷面積、理想的堆疊能力(對於製造商)和節省空間等優勢。也為大宗買家節省了採購和運輸成本。它比玻璃瓶裝葡萄酒(對於最終消費者而言)便宜 40%,而且還有回收和回收再利用的選擇。

- 葡萄酒包裝市場的製造商不斷創新和開發新的包裝產品,以提高市場競爭力。

- Amcor 推出了 Easypeel,它是一種一體式鋁製膠囊,旨在沿著乾淨的生產線打開酒瓶。與其他依賴拉片的技術不同,EASYPEEL 允許消費者和專業人士使用傳統的開瓶器。

美國葡萄酒包裝市場趨勢

玻璃作為包裝材料在酒類包裝市場中佔據最大的收益佔有率。

- 玻璃包裝是最主流的酒類包裝形式。玻璃的特性與葡萄酒的特性非常匹配,但與塑膠或金屬不相容。根據飲料資訊集團2020年7月發布的報告,2019年美國佐餐酒消費量達到約31,072萬箱9公升。

- 2020年1月,美國葡萄酒市場最大的國內玻璃瓶製造商Glass-North America Ardagh集團宣布了六款新的精緻玻璃酒瓶設計。

- 美國之間持續的貿易戰可能會影響該國的玻璃包裝市場。美國葡萄酒產業使用的玻璃瓶50%以上從中國進口。此外,對來自中國的進口產品徵收關稅的增加預計將增加改進玻璃製造基礎設施的需求,並增加未來幾年產品的整體成本。

- 釀酒師變得越來越創新,創造新的概念和設計,以透過包裝吸引顧客。

襯袋紙盒是成長最快的葡萄酒包裝市場

- 襯袋紙盒(BIB) 葡萄酒包裝由美國化學工程師 William R. Scholl 於 1995 年首次推出。 BIB 包裝的保存期限較短,因為它在打開後可以保存葡萄酒長達 8 週,而玻璃瓶只能保存 2-3 天。

- BIB包裝方攜帶帶,可適應現場交付。例如,包裝具有防碎設計,可用於體育場館、音樂會、遊樂園等。此外,盒子的製造是密封的,以確保葡萄酒長時間保持新鮮。

- BIB型包裝主要由袋、紙板、蓋子三部分組成。瓶蓋和瓶蓋最好由塑膠製成,但市場上的供應商正在投資環保瓶蓋,例如生物基瓶蓋。例如,利樂國際公司已訂購由可再生甘蔗衍生的 HDPE(高密度聚苯乙烯)製成的生物基蓋子,用於封袋。

- 據 Smurfit Kappa 稱,在 COVID-19感染疾病期間,英國和法國的消費者對此類包裝的需求激增,吸引了該地區約 370 萬消費者。據說美國也出現了類似的趨勢。這增加了美國供應商出口包裝的需求。

美國葡萄酒包裝產業概況

主要公司包括 Ball Corporation、AMCOR PLC、Ardagh Group、Siligan Holding Inc.、Owens-Illinois Inc. 等。市場適度分散,沒有主導的企業,競爭激烈。因此,市場集中度適中。

2021 年 1 月 - 為了服務美國市場,Alder Group SA 擴大了其位於奧克拉荷馬州的工廠的葡萄酒瓶生產,包括為 Lombauer Vineyards 生產的酒瓶。 此次擴建將縮短供應鏈,降低複雜性,並確保向客戶穩定供應高品質的玻璃瓶。

2020 年 6 月-利樂拉伐子公司利樂與屢獲殊榮的英國新興企業Garçons Wines 合作,打造一款使用消費後回收(PCR) PET 塑膠製成的新產品,宣布將生產其標誌性產品,更永續的扁平酒瓶,並將其提供給普通消費者。美國市場。

2020 年 2 月 - AMCOR PLC 與屢獲殊榮的英國初創公司 Garcon Wines 合作,在美國市場推出該公司獨特且更具可持續性的扁平酒瓶。 Amcor Wines 和 Garcon Wines 還在美國生產由消費後回收 (PCR) PET 塑膠製成的扁平酒瓶。 PET瓶不易破碎,適用於海灘和游泳池,設計僅受想像力限制。 還有環境效益。 這些瓶子重量輕,可無限回收,並且比玻璃瓶或鋁罐的碳足跡更低。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究成果

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 市場促進因素

- 非玻璃瓶替代品的出現

- 包裝創新

- 市場課題

- 材料相關法規的動態性質

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 消費者議價能力

- 替代產品的威脅

- 競爭公司之間敵對的強度

- 葡萄酒包裝的重大創新

第5章 COVID-19疾病對葡萄酒包裝產業的影響

第6章市場區隔

- 材料

- 塑膠

- 紙

- 玻璃

- 其他材料

- 產品類別

- 玻璃瓶

- 寶特瓶

- 襯袋紙盒

- 關閉

- 其他產品類型

第7章 競爭訊息

- Ball Corporation

- AMCOR PLC

- Scholle IPN Corporation

- CCL Industries Inc.

- Owens Illinois Inc.

- Saverglass SAS

- Plastipak Holding Inc.

- Tetra Laval International SA

- Ardagh Group

- Encore Glass

- Silgan Holding Inc.

第8章 市場未來展望

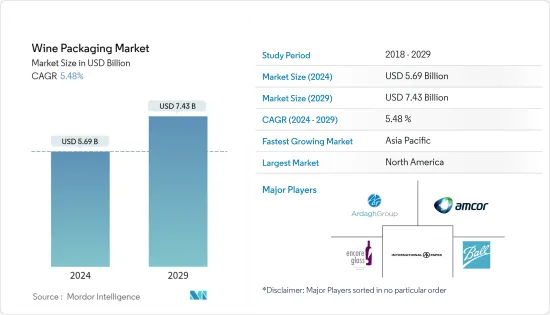

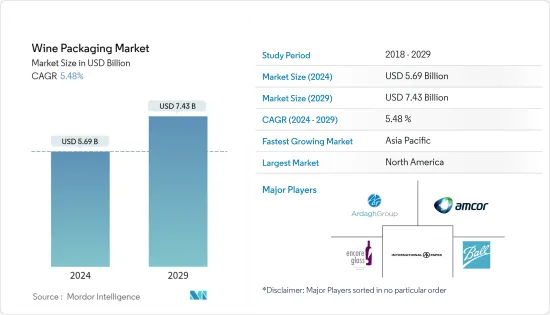

The Wine Packaging Market size is estimated at USD 5.69 billion in 2024, and is expected to reach USD 7.43 billion by 2029, growing at a CAGR of 5.48% during the forecast period (2024-2029).

Some popular emerging trends expected to become regular in wine packaging are twist-off corks, bottle wraps, thinner eco-glass, laser-cut labels, etched glass, and shrink-wrap sleeves.

Key Highlights

- The growing wine demand and evolving consumer behavior towards packaging aid the opportunities in wine packaging. Due to the increased competitiveness in wine markets, companies are now focusing on acquiring information about their customers' requests to cater to changing customer demand. Additionally, according to the International Organisation of Vine and Wine (OIV), in 2021, the United was the most significant wine consumer in the world, with 33.1 million hectoliters, followed by France, Italy, and Germany, with 25.2, 24.2, and 19.8 million hectoliters respectively.

- Additionally, with the rise of Italian wine production as the standard, new business opportunities are being created in this rapidly growing market. Also, Modern B2B Marketplace platform helps buyers and sellers identify new product sourcing opportunities with the best production experts from the top wine vineyards in Italy. This allows wine manufacturers to their online presence and marketing products, thus boosting their sales.

- Also, while purchasing wine, consumers look for aspects such as a retail shelf, packaging, labeling, etc. This packaging protects and preserves the wine from within and is also used as a marketing tool. Wine packaging is a way to influence the customer's perception and, ultimately, acceptance of the product. With wine, the package appears to have a more significant influence over the consumer than other extrinsic cues such as brand name, price, etc.

- Moreover, manufacturers are increasingly using innovative materials such as metal, cork, and rubber to make wine bottles stronger, recyclable, and resealable. Wine packaging manufacturers focus on reducing their environmental footprint and formulating highly eco-friendly and sustainable solutions for packaging.

- However, despite its strength, cardboard can be dented, crushed, or damaged under some conditions. Also, they are not waterproof and cannot withstand weather conditions like snow or rain, and they prove ineffective while keeping the product inside the box free from water and snow molecules.

- Covid-19 impacted many organizations and enterprises outside the medical and emergency sectors, creating a ripple effect across the globe. Many industries, like wine packaging, were sterilized by the introduction of social distancing and lockdown on a global scale. The impacts of pandemic affected wine purchases. As per the study by Wittwer and Anderson, there was a reduction in the value of domestic consumption of wine by 14% due to the insurgence of the covid-19 virus in Western Europe. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Wine Packaging Market Trends

Growing Consumption of Premium Wines

- Alcoholic beverages dominate the glass bottles segment in the United States. A high percentage of distilled spirits and wines are packaged using glass containers, while in the beer segment, the rate of glass containers decreased significantly.

- Also, the export value of bottled wine from Italy increased significantly between the first quarter of 2012 to the first quarter of 2022. After facing a decline slightly in 2020, the value of bottled wine exports returned to growth. It reached nearly EUR 2.6 billion (~USD 2.74 billion) in the first half of 2022, compared to EUR 1.7 billion (~USD 1.80 billion) in the first half of 2012, according to ISTAT. The growing export is expected to support the demand for the wine packaging market.

- Alternative packaging has already seen a growing interest for several reasons, such as lighter materials, easier to ship, less likely to break, and still offering a bit of novelty for consumers. This creates an opportunity for recyclable plastic and aluminum to enter the market.

- Additionally, the factor affecting the price of wine is the glass bottle. Reasons behind these broad price increases are equally diverse things such as labor issues, shipping issues, and since Russia's invasion of Ukraine, fuel costs. Not only does shipping heavy wine bottles require more fuel, but they're also energy-intensive. With oil prices reportedly up as much as 70% in the past year, wine manufacturers are looking for other packaging solutions for wine, such as Cans. For instance, in October 2021, Ball Corporation Argentina and Mosquita muerta wines presented Argentina's first canned sparkling wine.

North America to Account for a Major Share

- Premiumization of wines in the United States is nearing maturity, and wine manufacturers are looking towards consumers that use the wine regularly instead of an occasional drink to toast. In addition, advances are spurred by surging disposable personal incomes and changing alcoholic beverage preferences among younger consumers. These changes include the preference for wine over beer among boomers and a larger share of boomers consuming wine daily than in other age groups. Also, according to Wine Institute, the Average wine consumption per United States resident has increased from 2.82 gallons in 2014 to 3.18 gallons in 2021.

- Millennial and boomer demographics are already impacting the wine market, which has thrust the wine packaging market to look for new solutions. For instance, according to Silicon Valley Bank, the wine sales share of millennials in the United States was 19.8% compared to boomers, which was 47.3% in 2021. Also, to meet the demand from the US winemakers and other newcomers in the flourishing organic market, companies like Gallo Glass are investing in their facilities to service the Californian wine industry, which continues to grow steadily, and currently accounts for roughly 81% of the country's wine.

- Due to the attractive wine market in the United States and the efforts made by the government to manufacture locally, local wine packaging providers are providing product innovations to attract customers. For instance, Ardagh Group is innovating its products, including options like its ECO Series collection, which achieves the same standards of technical and aesthetic quality as traditional bottles while resulting in transportation savings for wineries.

- Moreover, the wine packaging is also supported by the growing sales of wine in Canada. According to StatCan, approximately 537.41 million liters of wine were sold in Canada in 2021, which increased from 527 million liters in 2020.

Wine Packaging Industry Overview

The wine packaging market is highly fragmented due to the large number of small players operating in regional markets and the mass of prominent players with a global presence."Players are introducing innovative methods of packaging that are not only attractive but also eco-friendly."Major players are Amcor Limited, Ardagh Group SA, etc. Recent key developments in the market are as below-

- July 2022: New wine brand "Juliet" "has launched its luxury boxed wines, which come in a cylindrical container called Eco-Magnum. Debuting with a 2021 Sauvignon Blanc and 2021 Grenache Rose, Juliet hails from a Certified California Sustainable Winery in the Happy Canyon of Santa Barbara AVA. The wine is housed in a first-to-market cylindrical container named the ' co-Magnum, which holds two standard bottles of wine (1.5L). Developed by female entrepreneurs with women in mind, Juliet delivers an elevated day-to-day experience for discerning wine drinkers who prioritize sustainability.

- June 2022: Packamama has collaborated with winemakers Accolade Wines and Taylors Wines on the Australian market launch of wine bottles made from 100% recycled and recyclable PET with a flatter profile that reportedly allows twice as many bottles to fit in a standard wine case, reducing carbon emissions linked with transit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Innovative Packaging and Attractive Marketing

- 4.5 Market Challenges

- 4.5.1 Stringent Environmental Regulations

- 4.5.2 Wine-related Human Health Concerns

- 4.6 Impact of COVID-19 on the Wine Packaging Industry

5 GLOBAL WINE MARKET LANDSCAPE

- 5.1 Global Wine Production (2021 - 2021) (in Million hectoliters)

- 5.2 Global Wine Consumption (2020 - 2021) (in Million hectoliters)

- 5.3 Global Wine Consumption, By Country, 2021 (in Million hectoliters)

- 5.4 Major Wine Exporters (2020 - 2021) (Volume & Value)

- 5.5 Major Wine Importers (2020- 2021) (Volume & Value)

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Glass

- 6.1.2 Plastic

- 6.1.3 Metal

- 6.1.4 Paper Board

- 6.2 Product Type

- 6.2.1 Glass Bottles

- 6.2.2 Plastic Bottles

- 6.2.3 Bag in Box

- 6.2.4 Closures (Natural Corks, Synthetic Corks,

Aluminum Screw Caps, and Others)

- 6.2.5 Other Product Types

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Australia and New Zealand

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Ardagh Group

- 7.1.2 Ball Corporation

- 7.1.3 Encore Glass

- 7.1.4 G3 Enterprises

- 7.1.5 Guala Closures

- 7.1.6 International Paper

- 7.1.7 Liqui-Box Corporation ( Dow Chemical Company)

- 7.1.8 Maverick Enterprises

- 7.1.9 Owens-Illinois Group

- 7.1.10 Saverglass SAS

- 7.1.11 Scholle Corporation

- 7.1.12 Tetra Laval International

- 7.1.13 TricorBraun Incorporated