|

市場調查報告書

商品編碼

1435980

資料庫自動化:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Database Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

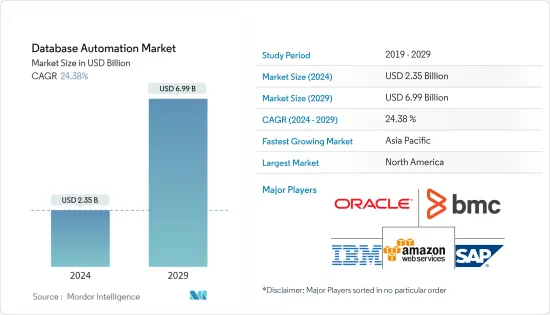

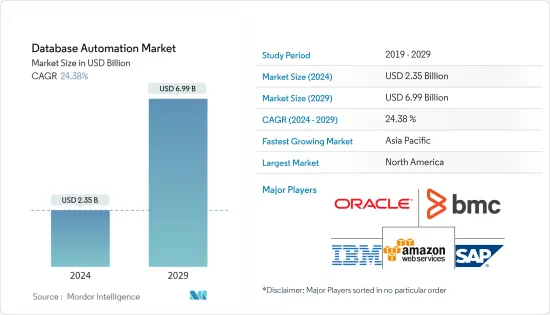

資料庫自動化市場規模預計到 2024 年為 23.5 億美元,預計到 2029 年將達到 69.9 億美元,預測期內(2024-2029 年)複合年成長率為 24.38%。

由於各行業資料量的增加、自動化冗餘資料庫管理流程、對自動化測試解決方案的需求以及縮短上市時間的需求不斷成長,預計資料庫行業對資料庫自動化的需求將會增加。然而,資料建模和模式生成的人工干預需求可能會阻礙成長。

主要亮點

- 雖然一些技術專業人員仍然忙於備份、擴展、調整、監控和保護關鍵資訊系統等日常任務,但自治資料庫降低了這些任務的複雜性和時間。它將會減少。

- 現代資料管道比傳統數據管道更加複雜。 IoT 等新資料來源、非結構化資料等格式以及 Apache Kafka 和 Python 等平台和語言正在創建更複雜的管道。資料庫自動化利用人工智慧和機器學習來提供配置、安全性、更新、可用性、效能、變更管理和錯誤預防的完整端到端自動化。它還提供完整的資料庫自動化,包括查詢最佳化、自動記憶體管理和儲存管理。自調整資料庫。

- 市場上的供應商基於靈活的付費使用制定價模式對其產品進行定價,這降低了維護本地資料倉儲的維修成本。例如,中國的物流、航運、物流公司嘉里大通就使用Oracle的自主資料庫。該公司將分析超過 1 億筆資料記錄的時間從 30 分鐘縮短到 10 秒,透過付費使用制模式顯著降低了 IT 管理成本並提高了投資收益。

- 冠狀病毒感染疾病(COVID-19) 的傳播導致世界各地實施封鎖,任務關鍵型應用程式和資料庫的數位化壓力增加,而且對資料庫自動化的需求激增,給 IT 團隊帶來了巨大的需求。壓力。為了滿足這種不斷成長的需求並吸引更多客戶,供應商以低成本提供免費工具和其他產品。隨著各行業資料的增加,預計該市場將在長期內快速成長。

資料庫自動化市場趨勢

IT和通訊業預計將顯著成長

- 通訊業是資料產生率最高的行業之一,企業主要提供針對大規模資料整合的雲端服務。隨著通訊客戶對雲端運算的需求不斷成長,資料庫自動化以及與電信業者的合作夥伴關係正在成為普遍趨勢。例如,位於義大利的義大利電信業者Sielte SPA選擇了Somenines Cluster Control,這是一個資料庫解決方案,該解決方案24/7運作並提供自動容錯移轉和復原以最大限度地減少停機時間,即使在資料中心中斷的情況下也能確保穩定的服務。在下面。

- 預計,對大規模利用機器學習(ML)和深度學習(DL)的應用程式的需求不斷成長,將擴大推動資料庫自動化供應商建立更全面的人工智慧(AI)。根據 Liquibase 進行的「應用傳輸中的資料庫配置狀態」研究,57% 的應用程式變更需要相應的資料庫變更。針對大型稀疏資料集的機器學習和深度學習需要能夠儲存Terabyte資料並執行高速平行運算的資料管理系統。資料自動化解決方案非常適合這項任務。因此,它在IT和通訊業的成長速度更快。

- 此外,它還自動化了軟體開發人員和維運工程師之間的開發、部署、文件、測試和監控流程,以整合開發和維運流程,從而有效地同步、檢驗、管理和應用資料庫變更。實施DevOps 的重要性也在增加,資料庫自動化預計將在該行業中成長。

- 此外,擴大採用公共雲端雲和私有雲端來有效管理大量資料,也增加了對更好、更具成本效益的資料庫自動化解決方案的需求。例如,Oracle自治資料庫將雲端的彈性與機器學習的強大功能結合在一起。該公司表示,該解決方案透過完全自動化和操作調整,可將管理成本降低高達 80%,並透過僅對當時所需的資源申請,將營運成本降低高達 90%。

預計北美將佔據主要佔有率

- 主要IT公司擴大採用巨量資料解決方案來改善和簡化業務,推動企業辦公室資料中心的擴展。因此,這些公司(主要是中小企業)正在採用容器化微型資料中心,而不是傳統的資料中心基礎設施。由於該地區在技術採用方面佔據主導地位,這些趨勢預計將進一步推動該地區資料庫自動化市場的成長。

- 透過在二線城市投資模組化資料中心,該地區資料中心基礎設施解決方案持續成長。這些投資促進了資料中心基礎設施管理解決方案供應商的崛起。美國為基礎設施現代化做出了多項努力。例如,美國計劃投資約2.49億美元用於部署私有雲端運算服務和資料中心。

- 此外,加拿大政府還採取了「雲端優先」策略,在啟動資訊技術投資、措施、策略和計劃時,雲端服務被確定為主要交付選項並進行評估。雲端預計也將使加拿大政府能夠利用私人提供者的創新來提高資訊技術的敏捷性。

- 此外,加州將於 2020 年初實施《消費者隱私法案》(CCPA),進一步增加對資料庫合規性的需求。所有這些因素結合在一起意味著企業需要適應性強、安全且高效的資料庫系統,以及簡單的資料庫管理工具和流程。

資料庫自動化產業概述

由於市場上有主要參與者且競爭激烈,資料庫自動化市場適度分散。市場參與者正在採取合作和收購等策略,為客戶提供最佳解決方案並獲得競爭優勢。高投資、老牌企業的存在以及不斷發展的技術等因素成為新進者進入市場的障礙。

2022 年 10 月。Oracle與匯豐銀行建立策略夥伴關係,共同加速銀行數位轉型。這項多年協議將使匯豐銀行對多個資料庫系統進行現代化改造並將其遷移到 Oracle Exadata Cloud@Customer,這是一個在匯豐銀行資料中心作為託管基礎設施服務提供的雲端運算平台。該實施預計將幫助該銀行維護和擴展其關鍵系統和服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- COVID-19 對全球資料庫自動化市場的影響

第5章市場動態

- 市場促進因素

- 各行業的資料量持續增加

- 對自動化重複資料庫管理流程的需求不斷成長

- 市場課題

- 需要人類參與

第6章市場區隔

- 成分

- 解決方案

- 資料庫補丁和發布自動化

- 應用程式發布自動化

- 資料庫庫測試自動化

- 服務

- 解決方案

- 部署方式

- 雲

- 本地

- 企業規模

- 主要企業

- 中小企業

- 最終用戶產業

- 銀行、金融服務和保險 (BFSI)

- 資訊科技和電信

- 電子商務與零售

- 製造業

- 政府和國防

- 其他(製造、媒體、娛樂)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Oracle Corporation

- BMC Software, Inc.

- Amazon Web Services, Inc.

- SAP SE

- IBM Corporation

- IDERA, Inc.

- Quest Software Inc.

- Datavail

- CA Technologies(Broadcom Inc)

- Bryter US Inc.

第8章投資分析

第9章市場的未來

The Database Automation Market size is estimated at USD 2.35 billion in 2024, and is expected to reach USD 6.99 billion by 2029, growing at a CAGR of 24.38% during the forecast period (2024-2029).

The increasing volume of data across industries, the need to automate redundant database management processes, automated testing solutions, and the growing need for faster speed to market is expected to grow the demand for database automation across industries. However, the need for human intervention when it comes to data modeling and schema generation might hinder growth.

Key Highlights

- While some technology professionals are still consumed with routine operations such as backing up, scaling, tuning, monitoring, and securing critical information systems, autonomous databases make these activities less complicated and time-consuming.

- Modern data pipelines are more complex than traditional ones. New data sources like IoT, formats such as unstructured data, and platforms and languages such as Apache Kafka and Python are creating more complex pipelines. Database automation leverages AI and machine learning to provide full, end-to-end automation for provisioning, security, updates, availability, performance, change management, and error prevention and includes query optimization, automatic memory management, and storage management to provide a completely self-tuning database.

- Vendors in the market are pricing their products on flexible pay-as-you-go pricing models, which reduces the costs of maintaining on-premises data warehouses. For instance, Kerry EAS, a Logistics, shipping, and logistics company in China, uses Oracle's autonomous database. The company reduced the time taken to analyze its 100 million-plus data records from 30 minutes to 10 seconds and significantly reduced IT management costs, and increased return on investment by leveraging the pay-as-you-go model.

- The spread of COVID-19 led to lockdowns in various parts of the globe, putting the IT teams under tremendous pressure due to increased digital loads on mission-critical applications and databases, spiking the demand for database automation. To acquire more customers during this increased demand, the vendors offered free tools and other offerings at a lower cost. The market is expected to grow rapidly in the long term as data grows across industries.

Database Automation Market Trends

IT and Telecommunication industry is Expected to Witness Significant Growth

- Telecom is among the sectors with the highest rate of data generation, and companies are offering cloud services mainly oriented to large-scale data integration. As the need for cloud is expanding among telecom clients, the partnership between database automation and telecom companies is becoming a common trend. For instance, Sielte S.P.A., an Italian Telecommunications company located in Italy, opted for Severalnines Cluster Control, a database solution that can operate 24x7 and offered automatic failover and recovery to minimize downtime and ensure a stable service even in the event of a data center going down.

- The increasing demand for applications leveraging machine learning (ML) and deep learning (DL) on a gigantic scale is anticipated to increasingly push database automation vendors to establish a more comprehensive array of artificial intelligence (AI). According to the State of Database Deployments in Application Delivery survey conducted by Liquibase, 57% of all application changes require a corresponding database change. Machine learning and deep learning on large, sparse data sets require a data management system that can store terabytes of data and perform fast parallel computations-tasks for which data automation solutions are ideally suited; hence is growing more rapidly in the IT and telecommunications industry.

- Moreover, increasing emphasis on implementing DevOps to automate the development, deployment, documentation, testing, and monitoring processes between software developers and operations engineers for integrating the development and operations processes to synchronize efficiently, validate, manage, and apply database changes is also proliferating the growth of database automation in the industry.

- Furthermore, the increasing adoption of public and private clouds to efficiently manage humongous data also increases the need for better and cost-effective database automation solutions. For instance, Oracle Autonomous Database combines the cloud's flexibility with machine learning's power. The company claims the solution can reduce administration costs by up to 80% with full operations automation and tuning and runtime costs by up to 90% by billing only for resources needed at any given time.

North America is Expected to Hold Major Share

- The increasing deployment of Big Data solutions by major IT enterprises to enhance efficiency and streamline their business operations is driving the expansion of data centers in corporate offices. Hence, these enterprises, mainly small and medium enterprises, are adopting containerized and micro data centers over conventional data center infrastructures. These trends are expected to augment further the growth of the database automation market in the region, owing to the dominance of the area in technology adoption.

- The region has maintained continued growth in data center infrastructure solutions through modular data center investments in tier-2 cities. These investments will enable data center infrastructure management solutions providers to rise. The United States has made several efforts to modernize its infrastructure. For instance, the US Army plans to invest approximately USD 249 million to deploy private cloud computing services and data centers.

- Moreover, the Government of Canada has a 'cloud-first' strategy, whereby cloud services are identified and evaluated as the principal delivery option when initiating information technology investments, initiatives, strategies, and projects. The cloud is also expected to allow the Government of Canada to harness the innovation of private-sector providers to make its information technology more agile.

- Moreover, Consumer Privacy Act (CCPA) takes effect at the start of 2020 in California, adding to the need for database compliance. The combination of all these factors indicates that companies will need adaptable, secure, efficient database systems, and simple database management tools and processes.

Database Automation Industry Overview

The database automation market is moderately fragmented owing to the presence of big players in the market and intense competition. The players in the market are adopting strategies such as partnerships and acquisitions to offer the best solutions to the customers and gain a competitive advantage. Factors such as high investment, the presence of established players, and continuously evolving technology act as barriers for new entrants in the market.

In October 2022. Oracle and HSBC launched a strategic partnership to hasten the bank's digital transformation. By the multi-year contract, HSBC was to modernize and move a few database systems to Oracle Exadata Cloud@Customer, a cloud computing platform provided as a managed infrastructure service in HSBC's data centers. The deployment was likely to aid in maintaining and scaling the bank's vital systems and services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 IMPACT OF COVID-19 ON THE GLOBAL DATABASE AUTOMATION MARKET

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuously Growing Volumes of Data Across Verticals

- 5.1.2 Increasing Demand for Automating Repetitive Database Management Processes

- 5.2 Market Challenges

- 5.2.1 The Need for Human Involvement

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Solution

- 6.1.1.1 Database Patch and Release Automation

- 6.1.1.2 Application Release Automation

- 6.1.1.3 Database Test Automation

- 6.1.2 Services

- 6.1.1 Solution

- 6.2 Deployment Mode

- 6.2.1 Cloud

- 6.2.2 On-Premises

- 6.3 Enterprise Size

- 6.3.1 Large Enterprises

- 6.3.2 Small and Medium-Sized Enterprises

- 6.4 End-user Industry

- 6.4.1 Banking, Financial Services and Insurance (BFSI)

- 6.4.2 IT and Telecom

- 6.4.3 E-commerce and Retail

- 6.4.4 Manufacturing

- 6.4.5 Government and Defense

- 6.4.6 Others (Manufacturing, Media and Entertainment)

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 BMC Software, Inc.

- 7.1.3 Amazon Web Services, Inc.

- 7.1.4 SAP SE

- 7.1.5 IBM Corporation

- 7.1.6 IDERA, Inc.

- 7.1.7 Quest Software Inc.

- 7.1.8 Datavail

- 7.1.9 CA Technologies (Broadcom Inc)

- 7.1.10 Bryter US Inc.