|

市場調查報告書

商品編碼

1435975

智慧清潔與衛生:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smart Cleaning And Hygiene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

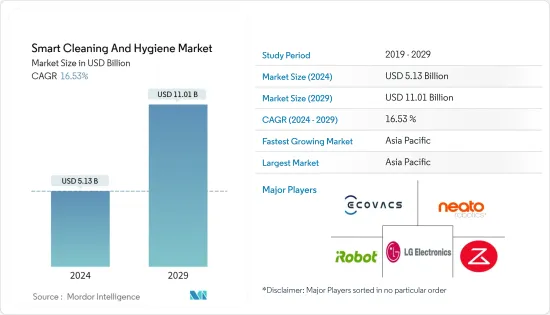

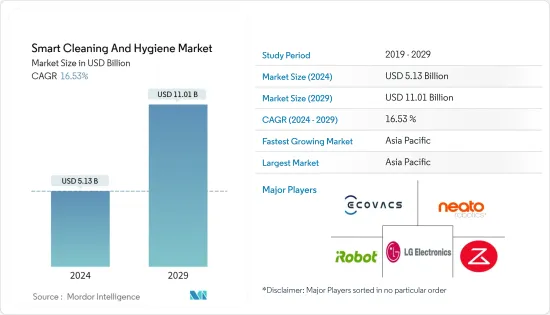

智慧清潔和衛生市場規模預計到 2024 年為 51.3 億美元,預計到 2029 年將達到 110.1 億美元,在預測期內(2024-2029 年)成長 16.53%,複合年成長率為

保持清潔在任何地方都至關重要,尤其是在醫院。大約 50% 至 70% 的院內感染 (HAI) 是透過受污染的手傳播的。智慧清潔可協助您識別醫院內的常見接觸點,並找到消除所有細菌的正確解決方案。醫療保健領域的智慧清潔對於減少疾病和改善醫院衛生至關重要。

主要亮點

- 酒店業擴大利用機器人技術來改善業務並增強賓客體驗。例如,紐約花園城酒店採用了 Whiz,該系統由Softbank Robotics的人工智慧 (AI) 平台提供支援。酒店工作人員聲稱這很方便,因為他們可以將宴會廳家具放在一側,並安裝 Whiz 來清潔地毯。

- 2023 年 1 月,Mero Technologies Inc 透過就業成長基金獲得加拿大政府 150 萬美元的資金。 Mero 為商業建築提供智慧清潔解決方案,測量建築入住率和清潔度,幫助租戶安全返回工作崗位。這筆資金將幫助 Mero 將其智慧清潔平台業務擴展到加拿大西部和美國。

- 過去兩年,清潔行業發生了重大變化,感染疾病 ( COVID-19) 大流行加速了這一轉變。智慧清潔趨勢已成為一種必然,因為它提供了讓員工重返辦公室的強大動力。資料驅動的智慧清潔使供應商能夠比以往更有效地提供高品質的服務,使客戶滿意。與人工智慧整合的智慧清潔解決方案現在可以更有效地清潔會議室和工作空間。

- 資料安全和保護是智慧清潔公司面臨的關鍵問題。同樣重要的是能夠智慧地清理感測器收集的資料並保護這些資料免受損害活動。例如,駭客可以存取清潔機器人的攝影機並獲取有關建築物內部樓層平面圖的知識。

智慧清潔和衛生市場趨勢

機器人吸塵器佔據主要市場佔有率

- 預計2027年機器人市場將達到1,000億美元。人工智慧整合使機器人能夠在環境中導航。 ICE 開發了一款使用測繪和雷射技術來清潔複雜環境的機器人。人員配備可能很困難,因為昂貴的夜班和不合群的工作時間消耗了大量低效率的管理時間。引入機器人技術進行清潔可以節省金錢並改善時間管理。儘管初始成本可能很高,但使用機器人是具有成本效益的。

- 掃地機器人是世界上生產和銷售最廣泛的家用機器人。清潔專家 Roomba 專門用於吸塵,具有地板類型之間的內置自動調節功能以及去除寵物毛髮的重要清潔功能。

- 2022年6月,Anker旗下Eufy推出了Robovac G20。它與 UltraPak 灰塵壓縮技術配合使用,提供四種抽吸模式,增加氣流,在家中安靜運行。有效利用隨附的垃圾箱並檢測何時需要額外的真空動力。

- 2022年5月,海爾在印度半島推出乾濕拖二合一機器人吸塵器。該公司表示,該機器人可以強制清潔所有類型的地板,避開障礙物,並防止損壞和刮傷。

亞太地區將經歷最高的成長

- 亞太地區(APAC)是全球成長最快的人工智慧(AI)市場。到2023年,亞太地區對人工智慧等新技術的投資預計將佔資訊和通訊技術(ICT)總投資的40%。人工智慧和機器學習正在造成重大破壞,並改變幾乎每個行業領域的技術形勢。清潔業正在逐漸趕上這項變化。

- 中國和日本是最大的工業機器人供應商,正在推動人工智慧研究領域的商業化。中國正在投資並推動「中國製造2025」、「促進巨量資料發展行動指南」、「下一代人工智慧發展規劃」等計劃。

- 印度也在 NITI Aayog 政策下啟動了國家人工智慧策略,以指導新興人工智慧技術的研發。印度不斷發展的Start-Ups文化影響了該國人工智慧的發展。

- 根據最近的智慧職場清潔度調查,75%的新加坡工人認為機器人是清潔工的理想補充,可確保工作場所清潔。

- Softbank Robotics與 InfoGrid 合作推出清潔機器人「Whiz」。 Whiz 的智慧 AI 清潔功能使用 Infogrid 感測器及其分析儀表板提供室內空氣品質的即時資料,消除了辦公室中空氣傳播病毒傳播的威脅。

智慧清潔衛生產業概況

智慧清潔和衛生市場有適度競爭。許多設施管理平台和基於技術的清潔服務供應商都是清潔和消毒方面的專家,並且透過新產品發布、合作和收購獲得了發展勢頭。服務該領域的主要企業包括 Neato Robotics、iRobot Corporation、Ecovacs Robotics、LG Electronics 等。

- 2023 年 3 月,德國清洗解決方案公司 Karcher 開始在印度製造消費清洗機,產能翻倍。凱馳為客戶提供既能清洗又能節省能源和資源的機器。凱馳印度公司在印度各地擁有 13 家分店和 19 個服務點,並擁有訓練有素的銷售和服務人員。

- 2023年2月,智慧清潔解決方案供應商Obode推出智慧吸塵機器人系列,擴大在北美的足跡。吸塵機器人自動清洗拖把墊片,防止發黴和產生異味。這些產品與雷射雷達技術整合,可識別不同的表面類型,並根據需要應用適當的吸塵、拖地、邊緣清潔和完整的測繪功能。它在房間內無縫移動,並在掃地和拖地之間智慧切換,以實現安全有效的地板清潔。

- 2022年10月, Softbank Robotics America(SBRA)與領先的自主清潔和服務機器人解決方案提供商Gausium合作,向美國市場銷售室內自主機器人解決方案。此次合作旨在幫助客戶在其組織內部署、整合和擴展機器人解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 分銷通路分析(線上與線下)

- 市場促進因素

- 隨著單價下降,消費者偏好和社會經濟因素發生變化

- 市場限制因素

- 安全擔憂和廣泛的流行病擾亂了供應鏈活動

- 評估 COVID-19感染疾病對市場的影響

第5章市場區隔

- 產品

- 機器人吸塵器

- 泳池清潔機器人

- 窗戶清潔機器人

- 其他衛生相關產品

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Ecovacs Robotics Co. Ltd

- Roborock Technology Co. Ltd

- LG Electronics Inc.

- iRobot Corporation

- Cecotec Innovaciones SL

- Neato Robotics Inc.

- Electrolux AB

- SharkNinja Operating LLC

- Panasonic Corporation

- Haier Group Corporation

- Hitachi Ltd

- Samsung Electronics Co. Ltd

第7章 投資分析

第8章市場機會及未來趨勢

The Smart Cleaning And Hygiene Market size is estimated at USD 5.13 billion in 2024, and is expected to reach USD 11.01 billion by 2029, growing at a CAGR of 16.53% during the forecast period (2024-2029).

Maintaining cleanliness is essential in all places, especially in hospitals. Around 50% to 70% of hospital-acquired infections (HAI) are spread through contaminated hands. Smart cleaning can help identify common touchpoints in hospitals and find the right solutions to eradicate all germs. Smart cleaning in the healthcare sector is essential to reduce diseases and improve the hospital's hygiene.

Key Highlights

- The hospitality industry increasingly utilizes robotic technology to improve operations and enhance the guest experience. For instance, the Garden City Hotel in New York adopted Whiz by SoftBank Robotics' artificial intelligence (AI)-driven platform. The hotel staff claims it is convenient to use as they can keep the banquet hall furniture on one side and deploy Whiz to clean the carpets.

- In January 2023, Mero Technologies Inc received a fund of USD 1.5 million from the Canadian Government through the Jobs and Growth Fund. Mero offers smart cleaning solutions for commercial buildings to help measure building occupancy and cleanliness, helping tenants return to work safely. The funding will help Mero to expand its smart cleaning platform efforts into Western Canada and the US.

- The past two years saw a significant upheaval in the cleaning sector as the COVID-19 pandemic accelerated this transformation. The trend of smart cleaning became a necessity as it was a powerful incentive to get workers back into the office. Data-driven smart cleaning made it more efficient than ever for providers to offer a high-quality service that satisfies their customers. AI-integrated smart cleaning solutions enabled more efficient cleaning of meeting rooms and workspaces.

- Data security and protection will be a significant challenge for smart cleaning companies. Smart cleaning functions on data collected by sensors and protecting this data from breaching activities are equally important. For instance, a hacker can access the cameras of a cleaning robot and, in this way, gain knowledge of the internal floor plans of a building.

Smart Cleaning And Hygiene Market Trends

Robotic Vacuum Cleaner Holds Significant Market Share

- The robotics market is expected to reach USD 100 billion by 2027. The integration of AI allows robots to navigate their environment. ICE developed robots that use mapping and laser technology to clean complex environments. Staffing may be challenging due to expensive night shifts and unsociable hours, which consume a lot of ineffective management time. Adopting robotic techniques for cleaning can save expenses and improve time management. Start-up costs may be high, but they are cost-effective once the robots are used.

- Robot vacuum cleaners are the world's most widely produced and sold robots for domestic tasks. The cleaning expert Roomba specializes in vacuum cleaning, featuring a great built-in automatic adjustment between floor types and vital cleaning functions to pick up pet hair.

- In June 2022, Eufy by Anker launched the Robovac G20, which runs on ultra-pack dust compression technology and offers four suction modes, increased airflow, and quiet operation around the house. It efficiently utilizes the attached dust box and can detect when extra vacuuming power is needed.

- In May 2022, Haier launched the 2-in-1 dry & wet mop Robot Vacuum Cleaner in the Indian subcontinent. The company claims the robot can forcefully clean all floor types, avoiding obstructions and preventing damage and scratches.

Asia-Pacific to Witness Highest Growth

- The Asia-Pacific (APAC) region is the fastest-growing artificial intelligence (AI) market globally. By 2023, APAC's investments in new technologies, including AI, are anticipated to account for 40% of its total information communication technology (ICT) investments. AI and ML are causing significant disruptions and transforming the technological landscape in almost every industry domain. The cleaning industry is gradually catching up to adopt this change.

- China and Japan are among the largest suppliers of industrial robots, and they are commercializing research domains for AI. China is investing and promoting projects such as 'Made in China 2025,' 'Action Outline for Promoting the Development of Big Data,' and 'Next Generation Artificial Intelligence Development Plan.'

- India also initiated a National AI Strategy under its NITI Aayog policy to guide the research and development of emerging AI technologies. The growing startup culture in India influenced the growth of AI in the country.

- According to a recent Workplace Smart Cleanliness Study, 75% of workers in Singapore believe that robots are an ideal complement to janitorial staff in ensuring the cleanliness of their workspace.

- SoftBank Robotics partnered with Infogrid to launch the Whiz cleaning robot. Whiz's smart AI cleaning with real-time data on indoor air quality using Infogrid sensors and its analytical dashboard can eliminate the fear of transmission of airborne viruses in the office.

Smart Cleaning And Hygiene Industry Overview

There is moderate competition in the smart cleaning and hygiene market. Many facility management platforms and tech-based cleaning service providers are experts in cleaning and disinfecting and are gaining momentum with new product launches, partnerships, and acquisitions. Some significant players offering services in this sector include Neato Robotics, iRobot Corporation, Ecovacs Robotics Co. Ltd, LG Electronics, and more.

- In March 2023, the German cleaning solutions company Karcher began manufacturing more consumer cleaning machines in India to double its production capacity. Karcher offers customers machines that can clean while saving energy and conserving resources. Karcher India includes 13 branches and owns 19 service points throughout India with trained sales and service staff.

- In February 2023, Obode, the smart cleaning solution provider, extended its footprint in North America by launching its smart vacuum robot series. The vacuum robot can self-clean its mop pads, warding off mold and bad smells. The products are integrated with LiDAR technology that identifies different surface types and then applies proper vacuuming, mopping, edge cleaning, and complete mapping functions as needed. It moves seamlessly across rooms and can intelligently switch between sweeping and mopping for safe and effective floor cleaning.

- In October 2022, Softbank Robotics America (SBRA) collaborated with Gausium, a leading autonomous cleaning and service robot solution provider, to distribute indoor automated robotic solutions to the US market. The partnership aims to help clients adopt, integrate, and scale robotic solutions within their organizations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Distribution Channel Analysis (Online vs Offline)

- 4.4 Market Drivers

- 4.4.1 Changing Consumer Preferences and Socio-economic Factors Along with Reduced Unit Prices

- 4.5 Market Restraints

- 4.5.1 Security Concern and Prevailing Pandemic Disrupt Supply Chain Activities

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Robotic Vacuum Cleaner

- 5.1.2 Pool Cleaning Robot

- 5.1.3 Window Cleaning Robot

- 5.1.4 Other Hygiene-based Products

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ecovacs Robotics Co. Ltd

- 6.1.2 Roborock Technology Co. Ltd

- 6.1.3 LG Electronics Inc.

- 6.1.4 iRobot Corporation

- 6.1.5 Cecotec Innovaciones SL

- 6.1.6 Neato Robotics Inc.

- 6.1.7 Electrolux AB

- 6.1.8 SharkNinja Operating LLC

- 6.1.9 Panasonic Corporation

- 6.1.10 Haier Group Corporation

- 6.1.11 Hitachi Ltd

- 6.1.12 Samsung Electronics Co. Ltd