|

市場調查報告書

商品編碼

1435901

公民服務人工智慧 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Citizen Services AI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

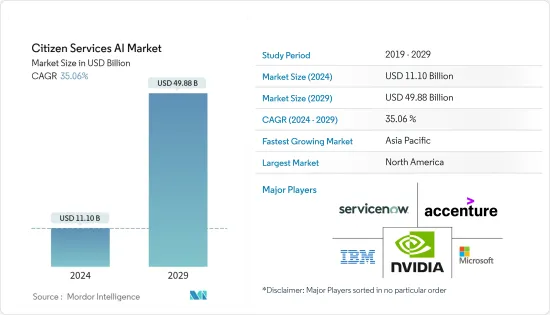

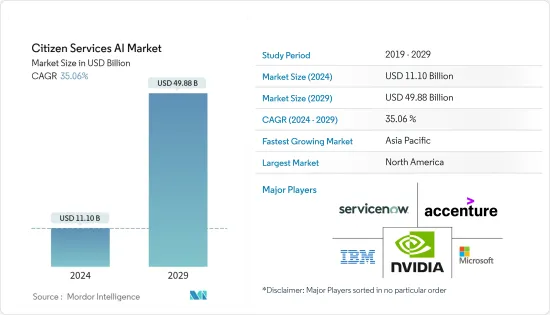

公民服務人工智慧市場規模預計到2024年為 111 億美元,預計到2029年將達到 498.8 億美元,在預測期內(2024-2029年)CAGR為 35.06%。

世界各地的政府擴大採用人工智慧(AI)等先進技術,為人們提供更好的服務並減少分析所需的勞動力。

主要亮點

- 世界各地的公民一直要求從政府服務到商業部門的標準增強體驗。根據公民服務人工智慧解決方案供應商Accenture最近發布的統計資料,美國超過85%的人口是公民,期望政府的數位服務等於或優於商業組織提供的服務。這為所研究的市場創造了更大的需求。

- 此外,Cisco Systems也提到,超過 22%的英國人口定期使用數位政府服務。它還提到,如果可以從單一入口網站存取這些解決方案,公民期待使用這些解決方案。因此,人工智慧、機器學習、人臉辨識等先進技術在政府服務領域有機會。

- 在全球爆發新冠肺炎(COVID-19)疫情期間,世界上大多數政府都依靠人工智慧和機器學習來密切監控嬰兒和傳播群聚。例如,在印度,政府開發了一款 Aarogta Setu 行動應用程式,用於監控個人、群體並提供與當地 COVID-19 傳播相關的最新資訊。截至2020年5月,申請已收到1億次

公民服務人工智慧市場趨勢

採用基於雲端的人工智慧進行公民服務預計將推動市場發展

- 雲端人工智慧也在增強基於雲端的服務和應用程式;這是公民服務領域對雲端人工智慧服務和解決方案需求不斷成長的重要因素。2019年,美國銀行轉向 Microsoft 雲端作為其數位轉型的一部分,以幫助提高新的業務效率、支援數位文化變革並更佳滿足客戶需求。

- 據 SAP表示,中東和北非地區近 60%的公司和 75%的數位化領導者計劃到2019年投資雲端。此外,由於交付時間更快,大多數公司從本地 AI 轉向雲端具有低延遲和即時追蹤的特點。這可能會促進預測期內所研究的市場成長。

- 2019年3月,多雲資料儲存和管理供應商SwiftStack推出了經過客戶驗證的邊緣到核心到雲端解決方案,支援大規模人工智慧/機器和深度學習(AI/ML/DL) ) 工作流程。最近,該公司還在兩個自動駕駛汽車用例中部署了新的解決方案堆疊。

預計北美將主導市場

- 由於北美是該技術的早期採用者之一,預計將主導全球公民服務人工智慧市場。另一個因素是市場上大多數的主要參與者都位於美國。區域最終用戶的雲端採用率也相當高。因此,對所研究市場的投資過高。

- 該地區許多被研究的市場供應商也在投資創新其產品的附加和獨特功能,主要是為了獲得競爭優勢並擴大其客戶目標群。預計這也將帶來區域和全球市場的進步。這項因素進一步擴大了市場範圍。

- 例如,總部位於美國的SoundHound Inc. 提供Houndify,這是一個獨立的人工智慧平台,使開發人員和企業主能夠在任何地方部署對話介面,以保留對其品牌和用戶的控制,同時實現差異化和創新。該公司最近在其 Houndify 語音人工智慧平台中添加了 SoundHound 音樂辨識技術。並與美國政府建立戰略夥伴關係,加速發展。

公民服務人工智慧產業概況

公民服務人工智慧市場傾向整合,許多老牌企業在市場上競爭。此外,市場不斷有新進入者。因此,老牌企業期待積極進行併購活動,而新企業則更注重產品創新,以獲取更多市場佔有率。下面提到了一些最近的進展。

- 2019年6月- Amazon Web Service 宣布與加拿大政府合作開發Citizen Care Pod,這是一種智慧篩選和測試艙,將智慧技術整合到模組化設計中,以支援政府、企業和社區安全、負責任的恢復。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 對 IT 現代化和自動化的需求不斷成長

- 人工智慧和分析與公民服務的整合

- 市場限制

- 政府組織對新技術缺乏認知

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對市場的影響評估

第5章 新興科技趨勢

第6章 市場細分

- 依技術

- 機器學習

- 自然語言處理

- 影像處理

- 人臉辨識

- 依應用

- 交通運輸管理

- 衛生保健

- 公共安全

- 公用事業

- 其他應用

- 地理

- 北美洲

- 歐洲

- 亞太

- 世界其他地區

第7章 競爭格局

- 公司簡介

- ServiceNow Inc

- Microsoft Corporation

- IBM Corporation

- Accenture PLC

- Nvidia Corporation

- Intel Corporation

- Alibaba Group Holding Limited

- Tencent Holdings Ltd.

- Pegasystems Inc.

- Baidu, Inc.

第8章 投資分析

第9章 市場機會與未來趨勢

The Citizen Services AI Market size is estimated at USD 11.10 billion in 2024, and is expected to reach USD 49.88 billion by 2029, growing at a CAGR of 35.06% during the forecast period (2024-2029).

The government across the world is increasingly adopting advanced technology such as Artificial Intelligence (AI) to offer better service to people and reduce the workforce required to do the analysis.

Key Highlights

- The citizens across the world have been demanding enhanced experience from the government service to the par of the commercial sector. According to the recently published statistics by Accenture, a vendor for citizen service AI solutions, over 85% of the population in the United States are citizens expect government digital services to be equal to or better than those they receive from commercial organizations. This creates a greater demand for the studied market.

- Additionally, Cisco Systems has mentioned that over 22% of the population in the United Kingdom regularly uses digital government services. It also mentioned that the citizens are looking forward to using these solutions if they are accessible from the single portal. Hence, there is an opportunity for advanced technolgies like AI, ML, face recognition, etc. in the government service sector.

- Amid the COVID-19 outbreak across the world, most of the governments worldwide have relied on AI and ML to monitor infants closely and spreading clusters. For instance, in India, the government developed an Aarogta Setu mobile app for monitoring individuals, clusters as well as offering updates related to the COVID-19 spread locally. Till May 2020, the application has received 100 million do

Citizen Services AI Market Trends

Adoption of Cloud-based AI for Citizen Service to Expected to Drive the Market

- The cloud AIs are also enhancing cloud-based service and applications; It is a significant factor for the growing demand for cloud AI services and solutions in the citizen service sector. In 2019, Bank of America turned to the Microsoft Cloud, as a part of its digital transformation to help deliver new business efficiencies, support digital culture change, and better meet customer needs.

- According to SAP, nearly 60% of companies and 75% of digital leaders in the MENA region plan to invest in the cloud by 2019. In addition, most of the companies are shifting to cloud from on-premise AI, due to faster delivery time with low latency and real-time tracking. This is likely to foster the studied market growth during the forecast period.

- In March 2019, SwiftStack, a provider of multi-cloud data storage and management, launched a customer-proven edge-to-core-to-cloud solution that supports large-scale Artificial Intelligence/Machine and Deep Learning (AI/ML/DL) workflows. Recently, the company also deployed the new solution stack in two autonomous vehicle use cases.

North America is Expected to Dominate the Market

- North America is expected to dominate the global citizen service AI market, owing to its status as one of the early adopters of the technology. The other factor is that most of the major players in the market are US-based. The cloud adoption among the regional end-user is also quite high. Hence, the investment in the studied market is too high.

- Many of the studied market vendors in the region are also investing in innovating additional and unique features to their offering, mainly to gain a competitive advantage as well as to expand their customer target base. This is also expected to bring advancement in the regional and global markets. This factor expands the market scope further.

- For instance, US-based SoundHound Inc. offers Houndify, an independent AI platform that enables developers and business owners to deploy a conversational interface anywhere to retain control of their brand and users, while differentiating and innovating. The company recently added SoundHound music recognition technology to its Houndify voice AI platform. It also made a strategic partnership with the US government to accelerate development.

Citizen Services AI Industry Overview

The citizen service AI market inclined towards consolidation with the presence of many established players competing in the market. Additionally, the market is experiencing continuous new entrants in the market. Hence, the established are looking forward to making active M&A activities, while new players are more focused on product innovations to gain more market share. Some of the recent developments are mentioned below.

- June 2019 - Amazon Web Service announced to partner with the Canadian government for the development of Citizen Care Pod, a smart screening and testing pod that integrates intelligent technology within a modular design to support a safe, responsible recovery for governments, businesses, and communities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for IT Modernization and Automation

- 4.2.2 Integration of AI and Analytics With Citizen Services

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness Among Government Organizations About New Technologies

- 4.4 Industry Value Chain Analysis

- 4.5 Porters FIve Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment on the Impact of COVID-19 on the market

5 EMERGING TECHNOLOGY TRENDS

6 MARKET SEGMENTATION

- 6.1 By Technology**

- 6.1.1 Machine Learning

- 6.1.2 Natural Language Processing

- 6.1.3 Image Processing

- 6.1.4 Face Recognition

- 6.2 By Application

- 6.2.1 Traffic and Transportation Management

- 6.2.2 Healthcare

- 6.2.3 Public Safety

- 6.2.4 Utilities

- 6.2.5 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 ServiceNow Inc

- 7.1.2 Microsoft Corporation

- 7.1.3 IBM Corporation

- 7.1.4 Accenture PLC

- 7.1.5 Nvidia Corporation

- 7.1.6 Intel Corporation

- 7.1.7 Alibaba Group Holding Limited

- 7.1.8 Tencent Holdings Ltd.

- 7.1.9 Pegasystems Inc.

- 7.1.10 Baidu, Inc.