|

市場調查報告書

商品編碼

1435808

人工智慧管治:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)AI Governance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

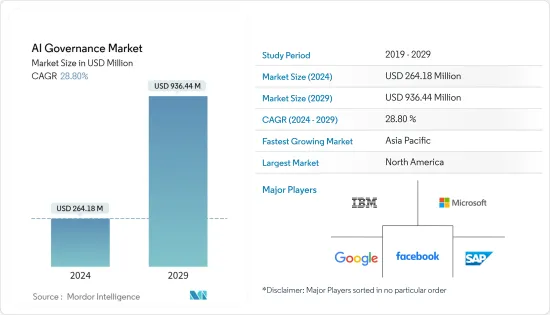

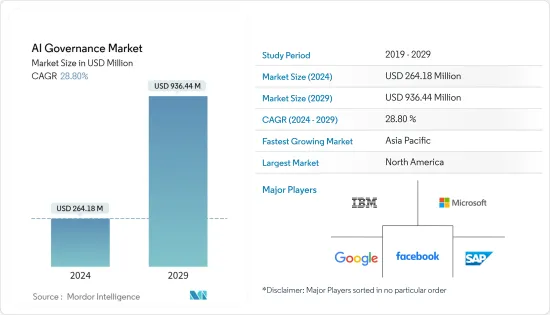

人工智慧管治市場規模預計2024年為2.6418億美元,預計到2029年將達到9.3644億美元,在預測期內(2024-2029年)複合年成長率為28.80%成長。

消費者對隱私、濫用和偏見日益增加的擔憂是推動人工智慧管治需求的關鍵因素。人工智慧管治的主要目標之一是提供道德和透明的人工智慧,並建立責任、監督和問責。

主要亮點

- 公司越來越認知到將人工智慧 (AI) 涵蓋其業務流程的價值,以透過自動化流程來提高業務效率並降低成本。

- 透過這種方式,公司可以使用自主流程來改善業務,改變客戶服務的面貌(例如透過人工智慧驅動的聊天機器人),並將創新推向新的高度。人工智慧是一組能夠解決特定問題並且最適合大量高品質巨量資料的演算法。聊天機器人可以將企業的營運成本降低高達 30%。

- 企業對人工智慧管治框架的興趣增加也鼓勵供應商和新興企業開發滿足客戶需求的創新框架。例如,2021年10月,總部位於舊金山的Credo AI公司宣布將專注於建構道德AI,協助企業管理人工智慧產品的監管和道德風險。該公司的目標是透過提供創建、測試、部署和監控人工智慧產品的資料和決策的「審核記錄」來實現這一目標。

- 人工智慧和機器學習 (ML) 極大地幫助了分析與 COVID-19感染疾病的資料。 2020 年 4 月,Amazon Web Services 推出了 Cord-19 Search,這是一個由 ML 驅動的新網站。這使得研究人員能夠快速、輕鬆地使用自然語言問題搜尋數以萬計的研究論文和文件。由於研究論文和其他文件通常包含敏感資訊,因此對有效管治框架的需求預計會增加。

人工智慧管治市場趨勢

人工智慧在零售業的廣泛應用預計將為市場成長開闢新途徑

- 全球零售業正經歷巨大變革。隨著客戶成為數位原民,他們的通路偏好和購買習慣也會改變。向數位化的轉變引發了人們對推動數位轉型的資料的擔憂。

- 良好的人工智慧管治對於提高整體零售績效、克服通用挑戰並領先於更強大的零售競爭對手和更敏捷的直接面對消費者的品牌至關重要。管治消除了需要快速存取資料的人員的摩擦,並為決策者提供更多資料。

- 人工智慧和機器學習是零售商正在採用的強大技術。但是,如果公司在此過程中需要製定並實施全面的道德計劃。制定行為準則有望建立結構和課責,帶來良好的資料管理實踐,並有助於建立指導整個公司的框架。

- 人工智慧道德互動日益推動消費者的信任、滿意度和決策。根據凱捷研究公司 (Capgemini SA Research) 的一項研究,那些被認為以合乎道德的方式使用人工智慧和機器學習的公司比那些沒有這樣做的公司擁有 44 點的淨推薦值 (NPS) 優勢。

- 世界各地的零售商也正在準備其員工實施端到端人工智慧主導的解決方案。預計這將在未來創造重大市場機會。一家大型零售商最近制定了一項全面培訓計劃,幫助其 40,000 名員工做好人工智慧轉型的準備。

預計北美將佔據主要佔有率

- 北美地區是最早採用人工智慧技術的地區之一,預計將為市場創造最大的機會。例如,美國國家人工智慧研發計畫建議制定人工智慧研發實施框架,以幫助美國各地的組織將道德考慮涵蓋研發,同時不影響公眾參與或如何更有效地推銷其組織的行為。

- 美國政府也積極研究人工智慧管治措施。政府宣布採用與國防部人工智慧戰略目標一致的人工智慧道德原則,這將促進美國軍隊和相關產業道德和合法地使用人工智慧系統。

- 北美(尤其美國)的組織繼續利用人工智慧、機器學習和深度學習技術的優勢來獲得行業優勢。該國擁有成熟的經濟,允許人工智慧和管治供應商投資新技術。此外,它還被認為是一個創新中心,主要 IT 參與者在此部署智慧型設備並與人工智慧管治市場的其他公司合作。

- 最近對臉部辨識等大型科技和科技影響的擔憂,引起了人們對美國人工智慧監管前景的極大關注。美國人工智慧戰略是學術界、政策制定者和工業界一致感興趣的議題。

- 相關人員的各種活動塑造了市場形勢。例如,NRCan 於 2021 年 3 月宣布與微軟加拿大建立合作夥伴關係,共用專業知識並利用雲端、資料和人工智慧 (AI) 服務開發國家和全球科學協作平台。

人工智慧管治產業概況

市場競爭對手之間的敵意強度中等偏高,預計在預測期內保持不變。市場的最新發展包括:

- 2021 年 11 月 - Everyday AI 的平台 Dataiku 引入了新的人工智慧治理和管治,作為公司統一人工智慧平台的一部分,允許組織在一個中央管理塔下擴展其人工智慧工作和分析。宣布的監視。

- 2021 年 3 月 - 印度-美國科技論壇 (IUSSTF) 啟動了其旗艦計畫—美國-印度人工智慧舉措。這項活動匯集了印度和美國的主要相關人員,共用想法和經驗,發現研發方面的新機遇,並促進雙邊合作以加速人工智慧創新。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對人工智慧決策透明度的需求不斷成長

- 擴大政府利用人工智慧技術的舉措

- 市場限制因素

- 人工智慧專業知識和技能不足可能會成為阻礙因素

第6章市場區隔

- 按成分

- 解決方案

- 按服務

- 按發展

- 本地

- 雲

- 最終用戶產業

- 衛生保健

- 政府/國防

- 車

- 零售

- BFSI

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Google LLC(Alphabet Inc.)

- SAP SE

- Microsoft Corporation

- FICO Inc.

- Salesforce.com, Inc.

- Pymetrics Inc.

- SAS Institute Inc.

- H2O.ai, Inc.

- Integrate.ai Inc.

- Facebook, Inc.(Meta Platforms Inc.)

第8章投資分析

第9章市場的未來

The AI Governance Market size is estimated at USD 264.18 million in 2024, and is expected to reach USD 936.44 million by 2029, growing at a CAGR of 28.80% during the forecast period (2024-2029).

The growing consumer concerns about privacy, misuse, and bias climb is among the key factors driving the demand for AI governance. One of the primary objectives of AI governance is to deliver ethical and transparent AI to establish accountability, oversight, and responsibility.

Key Highlights

- Enterprises increasingly recognize the value of incorporating artificial intelligence (AI) into their business processes to improve operational efficiency and reduce cost by automating process flows.

- Thus, companies have been using autonomous processes to improve operations and change the face of customer service (for example, through AI-powered chatbots) while spurring innovation to new heights. AI is a set of algorithms that can solve specific problems and works best with a significant volume of high-quality Big Data. Chatbots can cut down the operational costs for businesses by up to 30%.

- The growing interest of enterprises in AI Governance frameworks is also encouraging vendors and startup companies to develop innovative frameworks that can meet the demand of their customers. For instance, in October 2021, Credo AI, a San Francisco-based company, announced its focus on building ethical AI to help companies manage their artificial intelligence products' regulatory and ethical risks. The company tries to do that by providing an "auditable record" of the data and decisions that go into creating, testing, deploying, and monitoring AI products.

- AI and Machine learning (ML) has significantly helped in analyzing data related to COVID-19. In April 2020, Amazon Web Services launched Cord-19 Search, a new website powered by ML that could help researchers quickly and easily utilize natural language questions to search tens of thousands of research papers and documents. Since research papers and other documents often involve confidential information, the demand for effective governance frameworks is expected to grow.

AI Governance Market Trends

Growing use of AI in Retail is Expected to Open Up New Avenues for Market Growth

- The global retail industry is witnessing a massive transformation. As customers become digital natives, their channel preferences and buying habits change. The shift to digital has created concerns about data that drive digital transformation.

- Proper AI governance is critical to improving overall retail performance, overcoming common challenges, and staying ahead of more powerful retail competitors and more nimble direct-to-consumer brands. Governance eliminates friction for those requiring fast access to data, making more data available to decision-makers.

- AI and ML are powerful technologies that retail firms are increasingly deploying. However, when the companies should deploy them with a comprehensive ethics plan in the process. Developing a code of conduct is expected to create structures and accountability, leading to good data-management practices and facilitating the establishment of a framework that guides the entire company.

- Ethical AI interactions are increasingly driving consumer trust, satisfaction, and decision-making. According to the Capgemini Research Institute research, the companies that are perceived to be ethically using AI and ML have a 44-point Net Promoter Score (NPS) advantage over those that are not.

- Retailers across the globe are also preparing their workforce for deploying end-to-end AI-driven solutions. This is expected to create significant opportunities for the market in the future. A major retailer recently developed a comprehensive training program to equip its 40,000 employees for AI transformation.

North America is Expected to hold the Major Share

- The North American region is one of the early adopters of AI technology and is expected to generate maximum opportunities for this market. For instance, the United States National AI R&D Plan has recommended the development of an AI R&D implementation framework that helps organizations across the country incorporate ethical considerations into the R&D without compromising on public engagement and how to market one's organization better.

- The government in the United States is also proactively adopting measures for AI Governance. The government announced the adoption of AI ethical principles in line with the Department of Defense AI strategy objective, thereby facilitating the moral and lawful use of AI systems by the United States military and associated industries.

- Organizations in North America, particularly in the United States, leveraged the benefits of AI, ML, and deep learning technologies to stay ahead in the industry. The country has well-established economies, which enable AI, and governance vendors to invest in new technologies. Furthermore, it is regarded as the center of innovation where major IT players are rolling out intelligent devices and collaborating with other companies in the AI governance market.

- Recent concerns over big tech and the impacts of technologies like facial recognition have drawn significant attention to the prospects for artificial intelligence regulation in the United States. The United States AI strategy has been a consistent topic of interest among academics, policymakers, and industry.

- Various activities by the stakeholders are shaping the market landscape. For instance, in March 2021, NRCan announced a collaboration with Microsoft Canada to share expertise and use the cloud, data, and artificial intelligence (AI) services to develop a national and global scientific cooperation platform.

AI Governance Industry Overview

The intensity of competitive rivalry in the market is expected to be moderately high and remain the same during the forecast period. The recent developments in the market are as follows:-

- November 2021 - Dataiku, the platform for Everyday AI, announced its new AI governance and oversight as part of the company's unified AI platform to allow organizations to scale AI initiatives and analytics under one centralized control tower.

- March 2021 - Indo-US Science and Technology Forum (IUSSTF) launched its flagship program, the US-India Artificial Intelligence Initiative. The activity will bring together key stakeholders from India and the USA to foster AI innovation by sharing ideas and experiences, identifying new opportunities in research and development, and bilateral collaboration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Transparency in AI Decision Making

- 5.1.2 Expanding Government Initiatives to Leverage the AI Technology

- 5.2 Market Restraints

- 5.2.1 Inadequate AI Expertise and Skills can Act as a Restraint

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Service

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-user Vertical

- 6.3.1 Healthcare

- 6.3.2 Government and Defense

- 6.3.3 Automotive

- 6.3.4 Retail

- 6.3.5 BFSI

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 SAP SE

- 7.1.4 Microsoft Corporation

- 7.1.5 FICO Inc.

- 7.1.6 Salesforce.com, Inc.

- 7.1.7 Pymetrics Inc.

- 7.1.8 SAS Institute Inc.

- 7.1.9 H2O.ai, Inc.

- 7.1.10 Integrate.ai Inc.

- 7.1.11 Facebook, Inc. (Meta Platforms Inc.)