|

市場調查報告書

商品編碼

1435799

二丁基羥基甲苯:市場佔有率分析、產業趨勢、成長預測(2024-2029)Butylated Hydroxytoluene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

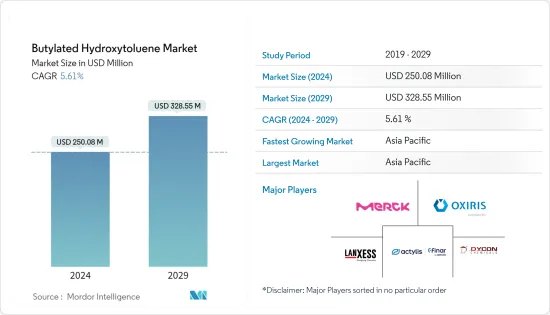

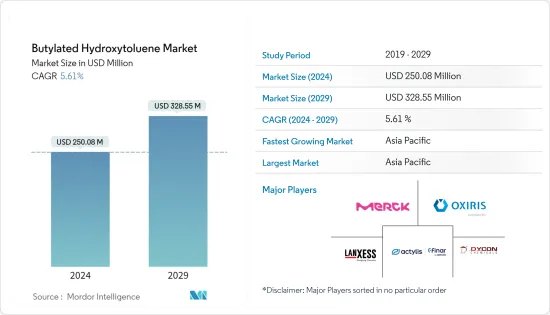

二丁基羥基甲苯市場規模預計到2024年為2.5008億美元,預計到2029年將達到3.2855億美元,在預測期內(2024-2029年)成長5.61%,複合年成長率為

新型冠狀病毒感染疾病(COVID-19)的爆發是2020年塑膠和橡膠製品製造市場的主要限制因素。貿易限制擾亂了供應鏈,世界各國政府實施的封鎖減少了消費。這導致與橡膠、個人護理以及食品和飲料加工行業相關的多個製造單位關閉。這減少了全球二丁基羥基甲苯市場的需求。然而,另一方面,由於大流行情況下對個人防護設備套件以及消毒劑和清潔劑)的需求激增,日益成長的健康問題為二丁基羥基甲苯提供了成長機會。市場。

主要亮點

- 從中期來看,推動二丁基羥基甲苯市場的主要因素是聚合物產業對抗氧化劑的需求不斷增加。塑膠抗氧化劑是在塑膠製造過程中添加的添加劑,用於防止熱分解和劣化,有助於延長產品的保存期限。由於聚丙烯在包裝應用中的使用量不斷增加,預計在預測期內,聚丙烯聚合物樹脂中塑膠抗氧化劑的使用量將達到最高,這將推動塑膠抗氧化劑市場和研究,可能會刺激目標市場的需求。

- 另一方面,由於健康問題日益嚴重而實行的嚴格監管預計將阻礙市場成長。

- 從最終用戶產業來看,塑膠和橡膠產業預計將在預測期內主導調查市場。

- 亞太地區是最大的市場,由於中國、印度和日本等國家的消費增加,預計在預測期內將成為成長最快的市場。

二丁基羥基甲苯市場趨勢

塑膠和橡膠產業的需求不斷增加

- 二丁基羥基甲苯因其抗氧化性能而廣泛應用於塑膠和橡膠工業,預計其使用量在預測期內將迅速增加。

- 過去,橡膠上塗有抗氧化劑以防止氧化,但隨著外塗層的磨損,未受保護的橡膠會迅速氧化。不是透過塗覆橡膠表面來防止這種情況發生,而是在混合過程中將化學物質摻入橡膠中。

- 抗氧化劑在機械混合過程中與橡膠化合物中捕獲的氧氣發生反應,然後浸出到表面,從而完全保護橡膠免受氧化。

- 同樣,塑膠的氧化會導致變色和普遍的定向障礙。它可能是由氧化或自由基形成引起的。自由基是由熱、機械應力和輻射產生的。抗氧化劑與自由基反應,防止塑膠劣化。

- 此外,根據世界經濟論壇的數據,到 2050 年,全球塑膠產量預計將增加兩倍。因此,塑膠需求的上升預計將增二丁基羥基甲苯的市場需求。

- 近年來,對橡膠的需求增加。例如,Bridgestone公司於2022年10月宣布,已核准投資2,670萬美元的計劃,增加對東南亞橡膠種植園的投資。該投資旨在確保輪胎製造所需天然橡膠的永續供應。

- 此外,汽車和包裝等各行業對塑膠和橡膠的需求不斷成長預計將推動二丁基羥基甲苯市場。例如,根據OICA的數據,2022年全球汽車產量將達到約8,500萬輛,比2021年成長6%。因此,由於汽車產量增加,橡膠輪胎的需求預計將增加,二丁基羥基甲苯市場呈現上升趨勢。

- 此外,RMKH Gloves 於 2022 年 10 月在巴域曼哈頓經濟特區推出了柬埔寨王國第一家手套製造工廠。該生產設施年生產能力超過6億套,將幫助當地農民銷售天然橡膠,擴大區域橡膠市場。

- 所有上述因素都可能成為預測期二丁基羥基甲苯市場的驅動力。

亞太地區主導市場

- 由於印度和中國等國家的消費量增加,預計亞太地區將在預測期主導二丁基羥基甲苯市場。

- 一些最大的二丁基羥基甲苯生產商位於亞太地區。

- 二丁基羥基甲苯是一種抗氧化食品添加劑,可保護食品和油中的不飽和有機化合物免受大氣氧化。

- 根據天然橡膠生產國協會(ANRPC)的數據,2022年馬來西亞橡膠出口總額將為359.9億令吉,而2021年為710.1億令吉(161.1億美元)(81.69億美元)。因此,橡膠出口量的下降預計將影響橡膠出口量的下降。研究市場成長。

- 此外,中國汽車產量的增加可能會推動對橡膠輪胎的需求,並為二丁基羥基甲苯市場創造上行需求。例如,2022年,該國生產了約27,020,615輛汽車,比2021年增加了3%。

- 根據中國國家統計局數據,2022年1月,中國化妝品零售業收入約91.8億美元。 2023年1月,達到約97.6億美元。隨著中國二、三線城市化妝品需求進一步擴大,預計近期二丁基羥基甲苯市場將維持成長動能。此外,男性對護膚態度的改變正在推動中國男性化妝品市場的繁榮。

- 大多數橡膠產品(例如輪胎)都是天然橡膠和合成橡膠的混合物。印度是全球第六大天然橡膠生產國,2022年產能約77.5萬噸。此外,2021年印度成為僅次於中國的全球第二大天然橡膠消費國。 2020年印度天然橡膠消費量下降近10%,但2021年恢復21%至130萬噸。

- 此外,根據印度品牌資產基金會(IBEF)的數據,印度的電子商務產業正處於向上成長的軌道,預計到2034年將超越美國,成為全球第二大電子商務市場。因此,電子商務行業的成長預計將為國內二丁基羥基甲苯市場創造上行需求。

- 此外,未來五年,印度電子零售業的購物者數量預計將突破約300-3.5億,到2025年線上商品總價值(GMV)預計將達到100-1200億。達到美元。政府政策變化允許電子商務領域 100% 外國直接投資,預計將增加塑膠消費。

- 因此,上述因素和政府支持預計將有助於預測期內亞太地區二丁基羥基甲苯市場需求的增加。

二丁基羥基甲苯產業概況

二丁基羥基甲苯市場本質上是部分分散的。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 聚合物產業對抗氧化劑的需求增加

- 其他司機

- 抑制因素

- 由於健康問題日益嚴重,監管更加嚴格

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 類型

- 食品級

- 技術等級

- 最終用戶產業

- 塑膠/橡膠

- 食品和飲料

- 個人護理/化妝品

- 動物飼料

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- Anmol Chemicals

- Dycon Chemicals

- FINAR

- Guangzhou ZIO Chemical Co.,Ltd

- Honshu Chemical Industry Co., Ltd.

- LANXESS

- Merck KGaA

- Milestone Preservatives Pvt. Ltd.

- OXIRIS CHEMICALS

- Ratnagiri Chemicals Pvt. Ltd

- VDH CHEM TECH PVT. LTD

- Wuxi Yufeng International Trade Co. Ltd

第7章 市場機會及未來趨勢

The Butylated Hydroxytoluene Market size is estimated at USD 250.08 million in 2024, and is expected to reach USD 328.55 million by 2029, growing at a CAGR of 5.61% during the forecast period (2024-2029).

The outbreak of coronavirus disease (COVID-19) has acted as a massive restraint on the plastics and rubber products manufacturing market in 2020. The supply chains were disrupted due to trade restrictions, and consumption declined due to lockdowns imposed by governments globally, which eventually led to the closure of various manufacturing units pertaining to rubber, personal care, and food and beverage processing industries. This has led to a decrease in the demand in the butylated hydroxytoluene market globally. However, on the flip side, due to rising health concerns, the sudden increase in demand for PPE kits and personal care and hygiene products such as sanitizers, detergents, etc., in the pandemic scenario has provided opportunities for the growth of the butylated hydroxytoluene market.

Key Highlights

- Over the medium term, the major factor driving the butylated hydroxytoluene market is the increasing demand for antioxidants from the polymer industry. Plastic antioxidants are additives that are added during plastic production to eliminate thermal and oxidation degradation, and they help in increasing the shelf-life of products. The usage of plastic antioxidants in polypropylene polymer resin is projected to be the highest during the forecast period as polypropylene usage has increased in packaging applications, which is likely to drive the plastic antioxidant market, stimulating the demand for the market studied.

- On the flip side, stringent regulations due to increasing health concerns are expected to hinder the growth of the market.

- By end-user industry, the plastics and rubber industry is expected to dominate the market studied over the forecast period.

- The Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan, among others.

Butylated Hydroxytoluene Market Trends

Increasing Demand from the Plastics and Rubber Industry

- Butylated hydroxytoluene is widely used in the plastics and rubber industry owing to its antioxidant characteristics, and its usage is expected to grow rapidly during the forecast period.

- Earlier, rubber was coated with antioxidants to protect it from oxidation, and once the outer coating wears off, the unprotected rubber will instantly undergo oxidation. Chemicals are incorporated into the rubber during mixing instead of coating the rubber surface to prevent this.

- Antioxidants react with oxygen trapped in the rubber compound during mechanical mixing and later bleed to the surface, thereby providing complete protection for rubber from oxidation.

- Similarly, in plastics, oxidation leads to discoloration and general disorientation. It can either be caused by oxidation or free radical generation. Free radicals are generated due to heat, mechanical stress, and radiation. Antioxidants react with free radicals and prevent the degradation of plastics.

- Moreover, according to the World Economic Forum, by the year 2050, global plastic production is expected to reach three times. Therefore, the growing demand for plastics is expected to drive the market demand for butylated hydroxytoluene.

- The demand for rubber is increasing in recent years. For instance, on October 2022, Bridgestone Corporation announced that it approved plans to invest USD 26.7 million to strengthen its investments in its rubber plantations in South East Asia. The investments aim to ensure a sustainable natural rubber supply for producing tires.

- Furthermore, the growing demand for plastics and rubber from various industries, such as automotive and packaging, is expected to drive the butylated hydroxytoluene market. For instance, according to OICA, in 2022, almost 85 million motor vehicles were produced worldwide, which shows an increase of 6% compared with 2021. As a result, an increase in automobile production is expected to increase demand for rubber tires, creating an upside for the butylated hydroxytoluene market.

- Moreover, in October 2022, RMKH Glove launched the first glove manufacturing facility in the Kingdom of Cambodia at the Manhatten Special Economic Zone in Bavet. The manufacturing facility contains an annual capacity of over 600 million pieces and helps the local farmers to market their natural rubber and increases the rubber market in the region.

- All the factors above will likely be the driving forces behind the butylated hydroxytoluene market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for butylated hydroxytoluene during the forecast period, owing to the increase in consumption from countries like India and China.

- Some of the largest butylated hydroxytoluene producers are in the Asia-Pacific region. Some of them include Honshu Chemical Industry Co. Ltd, Milestone Preservatives Pvt. Ltd, Ratnagiri Chemicals Pvt. Ltd, Dycon Chemicals, VDH Chem Tech Pvt. Ltd, and FINAR, among others.

- Butylated hydroxytoluene is an antioxidant food additive that protects unsaturated organic compounds in foods and oils from atmospheric oxidation.

- Association of Natural Rubber Producing Countries (ANRPC), Malaysia's rubber exports dropped to RM 35.99 billion ( USD 8.169 billion) in 2022 compared with RM 71.01 billion ( USD 16.11 billion) in 2021. Therefore, a decrease in rubber exports is expected to affect the studied market's growth.

- Moreover, the growth in automobile production in China will likely promote the demand for rubber tires, creating an upside demand for the butylated hydroxytoluene market. For instance, in 2022, around 2,70,20,615 units of automobiles were produced in the country, which shows an increase of 3% compared with 2021.

- According to the National Bureau of Statistics of China, in January 2022, the retail trade revenue of cosmetics in China amounted to about USD 9.18 billion. It reached about USD 9.76 billion in January 2023. As the demand for cosmetic products expands further in second-and third-tier cities of China, the butylated hydroxytoluene market is expected to maintain its growth momentum shortly. In addition, the changing attitude among men toward skin care fosters the booming men's cosmetics market in China.

- Most of the rubber products, such as tires, are a blend of natural and synthetic rubber. India is the sixth-largest producer of natural rubber globally, with a production capacity of approximately 775,000 metric tons in 2022. Furthermore, India was the second largest consumer of natural rubber worldwide in 2021, behind China. India's natural rubber consumption decreased by almost 10% in 2020 but rebounded by 21% in 2021 to 1.3 million metric tons.

- Moreover, according to India Brand Equity Foundation (IBEF), the Indian e-commerce industry is on an upward growth trajectory, and it is expected to surpass the United States to become the second-largest e-commerce market in the world by 2034. Therefore, the growth of the e-commerce industry is expected to create an upside demand for the butylated hydroxytoluene market in the country.

- Furthermore, over the next five years, the Indian e-retail industry is projected to exceed ~300-350 million shoppers, propelling the online Gross Merchandise Value (GMV) to USD 100-120 billion by 2025. The increase in internet penetration and the change in government policies allowing 100% foreign direct investments in the e-commerce sector are expected to boost the consumption of plastics.

- Therefore, the factors above, coupled with government support, are expected to contribute to the increasing demand for the butylated hydroxytoluene market in the Asia-Pacific region during the forecast period.

Butylated Hydroxytoluene Industry Overview

The Butylated Hydroxytoluene Market is partially fragmented in nature. The major players in this market (not in a particular order) include LANXESS, Merck KGaA, OXIRIS CHEMICALS, FINAR, and Dycon Chemicals.Hydroxytoluene

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Antioxidants from the Polymer Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Due to Increasing Health Concerns

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Food Grade

- 5.1.2 Technical Grade

- 5.2 End-user Industry

- 5.2.1 Plastics and Rubber

- 5.2.2 Food and Beverage

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Animal Feed

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anmol Chemicals

- 6.4.2 Dycon Chemicals

- 6.4.3 FINAR

- 6.4.4 Guangzhou ZIO Chemical Co.,Ltd

- 6.4.5 Honshu Chemical Industry Co., Ltd.

- 6.4.6 LANXESS

- 6.4.7 Merck KGaA

- 6.4.8 Milestone Preservatives Pvt. Ltd.

- 6.4.9 OXIRIS CHEMICALS

- 6.4.10 Ratnagiri Chemicals Pvt. Ltd

- 6.4.11 VDH CHEM TECH PVT. LTD

- 6.4.12 Wuxi Yufeng International Trade Co. Ltd