|

市場調查報告書

商品編碼

1434287

滅鼠劑 -市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Rodenticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

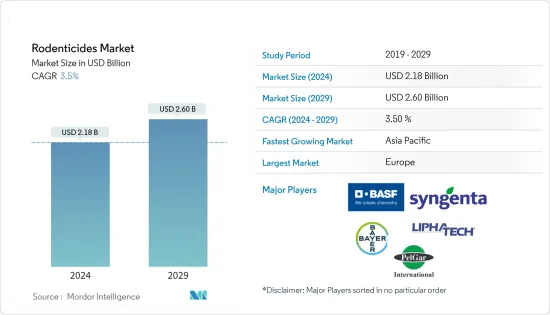

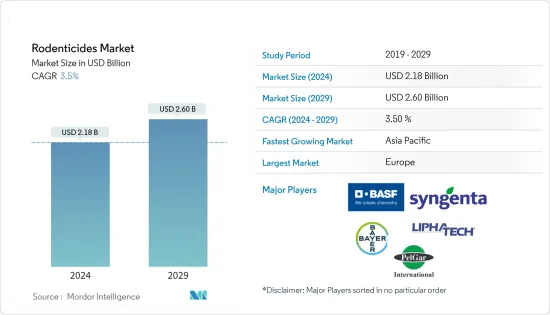

預計2024年滅鼠劑市場規模為21.8億美元,預計到2029年將達到26億美元,在預測期內(2024-2029年)複合年成長率為3.5%。

主要亮點

- 2019 年,亞太地區的成長率領先市場。這是因為農地、倉庫和市場出現老鼠出沒,導致對滅鼠劑的需求增加,如印度和日本等國所見。

- 然而,美國、歐洲等已開發國家和地區對第二代抗凝血滅鼠劑使用的嚴格規定預計將抑制整體市場成長。

- 滅鼠劑市場分散,國際和地區公司爭奪該行業更高的市場佔有率。該市場的主要企業包括BASF股份公司、拜耳股份公司、先正達、Liphatech Inc.、PelGar International、JT Eaton、Neogen Corporation 和 Rentokil Initial plc。

滅鼠劑市場趨勢

嚴格的法規和政府禁令限制了市場

近年來,一些嚴格的法規和隨之而來的滅鼠劑禁令建議影響了整個市場。實證研究證明,抗凝血劑是猛禽和其他腐肉物種在食用有毒屍體時死亡的主要原因。此外,人類也面臨因接觸滅鼠劑而中毒的風險。美國環保署 (EPA) 於 2013 年限制了溴鼠靈和Bromadiolone等第二代長效抗凝血 (LAA) 滅鼠劑的銷售。 AB 1788法案也將禁止第二代抗凝血滅鼠劑(SGAR),該藥物曾因非目標野生動物中毒而在加州受到監管,但參議院於2019年8月批准了該禁令。他被從撥款委員會除名。此外,歐盟的生物殺滅劑產品法規(BPR)影響了全部區域的大多數滅鼠劑,這進一步導致害蟲爆發。滅鼠劑企業和滅鼠人員應遵守滅鼠劑管理制度。根據英國國家統計局和英國稅務海關總署的數據,英國從歐盟和非歐盟市場的殺鼠劑和殺軟體動物劑出口總額大幅成長,從2013年的4,360萬美元大幅成長至2018年的470萬美元。因此,這些因素預計將影響預測期內農用滅鼠劑的供需比和價格,從而抑制市場成長。

亞太地區-成長最快的市場

亞太地區是全球滅鼠劑市場成長最快的地區。該地區新興國家的農業用地遭受囓齒動物攻擊的頻率非常高。根據國際水稻研究所 (IRRI) 估計,新興國家的糧食總量中有 3% 至 5% 受到大鼠和小鼠的破壞。 2015年,昆蟲學家發現,在印度最大的稻米作物邦之一泰米爾納德邦的Cherampatti和附近地區,高達54%的水稻作物因鼠患而損失。我已經明確表示過。此外,印度消費者事務部的一份報告稱,印度食品公司(FCI)倉庫中儲存的約57,676噸糧食因害蟲和囓齒動物襲擊、倉庫滲漏、雨水和洪水而受損。到。包括其他原因。 2018年,擁有480種魚貝類和270種水果和蔬菜商店的東京築地市場因大規模鼠患而關閉並搬遷。因此,預計該地區對滅鼠劑的需求在預測期內將會增加。

滅鼠劑產業概況

全球滅鼠劑市場高度分散,少數國際參與者和許多新興參與者競相爭奪全球滅鼠劑市場的公平佔有率。最活躍的公司包括BASF股份公司、拜耳股份公司、先正達、Liphatech Inc.、PelGar International、JT Eaton、Neogen Corporation 和 Rentokil Initial plc。這些公司瞄準了他們希望透過研究、開發和現場測試其產品,然後引入新產品線或收購生產單位來擴張的國家。例如,BASF於2018年推出了Selontra囓齒動物誘餌,由於其取得專利的配方含有活性成分“膽鈣化醇”,因此提供了高效、有效的囓齒動物控制解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 種類

- 非抗凝血滅鼠劑

- Bromethalin

- 膽鈣化醇

- 磷化鋅

- 士的寧

- 抗凝血滅鼠劑

- 第一代抗凝血劑

- Warfarin

- Chlorophacinone

- 敵鼠酮

- Coumatetralyl

- 第二代抗凝血劑

- 吉費納科姆

- 布羅迪法康

- Flocoumafen

- Bromadiolone

- 非抗凝血滅鼠劑

- 形狀

- 堵塞

- 顆粒

- 粉末

- 其他用途

- 目的

- 農地

- 倉庫

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- BASF SE

- Bayer AG

- Syngenta

- Liphatech, Inc.

- PelGar International

- JT Eaton

- Neogen Corporation

- Rentokil Initial plc

- SenesTech, Inc.

- Anticimex

- Bell Labs

- Terralink Horticulture Inc.

第7章 市場機會及未來趨勢

The Rodenticides Market size is estimated at USD 2.18 billion in 2024, and is expected to reach USD 2.60 billion by 2029, growing at a CAGR of 3.5% during the forecast period (2024-2029).

Key Highlights

- Asia-Pacific led the market in terms of rate of growth in 2019, owing to a higher demand for rodenticides witnessed in countries such as India and Japan, resulting from rat infestations inagricultural fields,warehouses, and markets.

- However, rigid regulations against the use of second-generation anticoagulant rodenticides in developed countries and regions such as the United States and Europe, are expected to restrain the growth of the overall market.

- The market for rodenticides is fragmented with both international players and regional companies vying for a higher market share in the industry. Some of the major players in the market areBASF SE, Bayer AG, Syngenta, Liphatech Inc., PelGar International,JT Eaton, Neogen Corporation, and Rentokil Initial plc,among others.

Rodenticides Market Trends

Stringent Regulations and Government Ban Restraining the Market

Several stringent regulations and subsequent recommendations for a ban on rodenticides have impacted the overall market in recent years. Empirical studies have proven that anticoagulants are the leading cause of deaths of birds of prey and other scavenger species when they eat their poisoned carcasses. Moreover, humans are also posed with intoxication risks due to rodenticide exposure. The United States Environment Protection Agency (EPA) restricted the sale of the second-generation long-acting anticoagulant (LAA) rodenticides such as Brodifacoum and Bromadiolone, in 2013. The AB 1788 Bill was also supposed to ban the second-generation anticoagulant rodenticides (SGARs) in California on account of non-target wildlife poisoning but was pulled away from the Senate Appropriations Committee in August 2019. Moreover, the Biocidal Products Regulation (BPR) of the European Union affects most rodenticides across the region which has further given rise to the Rodenticides Stewardship Regime to be followed by the rodenticide companies and pest controllers. According to the Office for National Statistics (UK) and HM Revenue and Customs, the total export value of rodenticides and molluscicides from EU and non-EU markets in the United Kingdom fell significantly from USD 43.6 million in 2013 to USD 4.7 million in 2018. As such, these factors are expected to affect the demand-supply ratio and prices of rodenticides for agricultural purposes, thus, restraining the growth of the market, during the forecast period.

Asia-Pacific - The Fastest Growing Market

Asia-Pacific registered the fastest growth in the rodenticide market, globally. The frequency of rodent attacks on agricultural fields has been immense in developing countries across the region. According to the International Rice Research Institute (IRRI), rats and mice are estimated to damage 3%-5% of the total cereal crops in developing countries. In 2015, entomologists revealed that up to 54% of the paddy crops were being lost due to rat infestation in Chellampatti and its neighboring areas in Tamil Nadu, one of the largest rice-producing states in India. Moreover, according to a report by the Indian Ministry of Consumer Affairs, about 57,676 metric tons of foodgrains stored in Food Corporation of India (FCI) godowns were damaged due to pest and rodent attacks, leakage of godowns, and exposure to rain and floods, among other reasons. In 2018, Tokyo's Tsukiji fish market with 480 kinds of seafood and 270 types of fruit and vegetable businesses closed down and relocated due to massive rat infestation. As such, the demand for rodenticides in the region is expected to grow during the forecast period.

Rodenticides Industry Overview

The market for global rodenticides is fragmented with the presence of a few international players and numerous emerging players competing to gain a fair share in the rodenticides market, globally. Some of the most active players are BASF SE, Bayer AG, Syngenta, Liphatech Inc., PelGar International, JT Eaton, Neogen Corporation, and Rentokil Initial plc, among others. These companies are targeting countries for business expansion, either by introducing a new product range upon researching, developing and field-testing the product or by acquiring a production unit. For instance, in 2018, BASF launched Selontra rodent bait that provides an efficient and effective rodent control solution through its patented formulation using the active ingredient 'cholecalciferol'.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Non-Anticoagulant Rodenticides

- 5.1.1.1 Bromethalin

- 5.1.1.2 Cholecalciferol

- 5.1.1.3 Zinc phosphide

- 5.1.1.4 Strychnine

- 5.1.2 Anticoagulant Rodenticides

- 5.1.2.1 First-Generation Anticoagulants

- 5.1.2.1.1 Warfarin

- 5.1.2.1.2 Chlorophacinone

- 5.1.2.1.3 Diphacinone

- 5.1.2.1.4 Coumatetralyl

- 5.1.2.2 Second-Generation Anticoagulants

- 5.1.2.2.1 Difenacoum

- 5.1.2.2.2 Brodifacoum

- 5.1.2.2.3 Flocoumafen

- 5.1.2.2.4 Bromadiolone

- 5.1.1 Non-Anticoagulant Rodenticides

- 5.2 Form

- 5.2.1 Blocks

- 5.2.2 Pellets

- 5.2.3 Powders

- 5.2.4 Other Modes of Application

- 5.3 Application

- 5.3.1 Agricultural Fields

- 5.3.2 Warehouses

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer AG

- 6.3.3 Syngenta

- 6.3.4 Liphatech, Inc.

- 6.3.5 PelGar International

- 6.3.6 JT Eaton

- 6.3.7 Neogen Corporation

- 6.3.8 Rentokil Initial plc

- 6.3.9 SenesTech, Inc.

- 6.3.10 Anticimex

- 6.3.11 Bell Labs

- 6.3.12 Terralink Horticulture Inc.