|

市場調查報告書

商品編碼

1433933

調色板:市場佔有率分析、行業趨勢和統計數據、成長預測(2024-2029)Pallets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

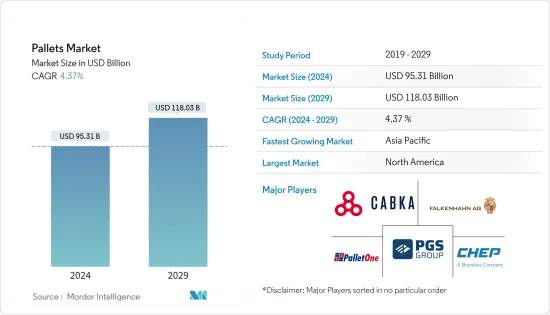

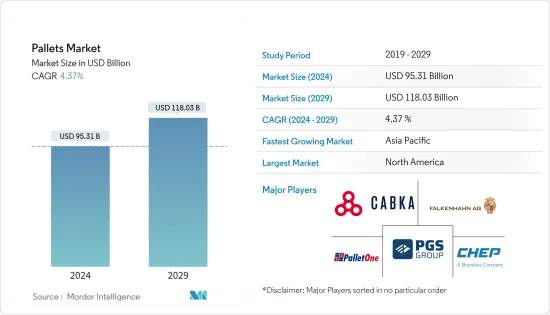

托盤市場規模預計到2024年為953.1億美元,預計到2029年將達到1180.3億美元,在預測期內(2024-2029年)複合年成長率為4.37%。

主要亮點

- 整個產業對塑膠托盤的需求正在迅速成長,預計將帶動市場需求。在過去的幾十年裡,木棧板因其強度高且易於製造程序而被廣泛使用。然而,由於塑膠托盤有吸濕性、耐久性差、易碎等缺點,其需求量不斷增加。

- 此外,由於環保、輕量化等優勢以及減少碳排放意識的增強,物流運輸企業對托盤的需求也從木棧板托盤轉向塑膠托盤。此外,2023年6月,C&T Matrix向客戶推出了專門針對包裝行業要求量身定做的新型塑膠托盤。自推出以來,已售出 1,000 多個托盤,客戶將提高安全性和衛生生產視為主要優勢。

- 此外,由於HDPE材料能夠處理重載,汽車和運輸業對HDPE材料的需求不斷增加,對托盤的需求也在增加。一次性塑膠托盤也廣泛應用於食品和飲料行業,因為它們在常溫下能耐受有機和無機化學品。

- 運輸托盤的採用增加預計將在預測期內推動市場發展。此外,跨境貿易的主要運輸方式是水路(海上運輸),約佔貿易貨物的90%。這說明海洋是世界貿易的運輸大動脈。此外,根據經濟合作暨發展組織(OECD) 的數據,隨著全球貨運需求的增加,到 2050 年海運貿易量預計將增加兩倍。

- 然而,托盤製造原料的供應有限且價格高昂預計將阻礙市場成長。隨著木棧板佔領市場,價格波動對市場成長構成挑戰。木材價格上漲、卡車運輸問題和高需求也造成了全球木棧板短缺,導致原料價格幾乎翻倍。

- 此外,COVID-19感染疾病對飯店、旅遊業、製造業和建築業產生了重大影響。製造業務已停止或受到限制。在全球範圍內,建設產業和運輸業的供應鏈需要改進。結果,托盤產量和市場需求均減少,抑制了市場擴張。同時,企業生產和服務也逐漸恢復正常。托盤市場企業已滿載恢復運作,預計有助於市場復甦。

托盤市場趨勢

各行業對塑膠托盤的需求增加

- 塑膠托盤是剛性結構,可在搬運過程中為散裝貨物提供機械穩定性,以維持品質。搬運包括與起重、從一處移動到另一處、堆疊、儲存產品以及透過陸地或海上遠距運輸相關的所有活動。塑膠托盤設計用於透過堆高機、托盤搬運車和前置裝載機等設備移動,以方便貨物的移動。強烈建議食品和飲料、製藥、化學和其他化學污染風險非常高的行業使用塑膠托盤。

- 此外,塑膠托盤比木棧板具有一定的優勢,使其成為市場上成長最快的托盤類型之一。製造商可以回收它們或將它們熔化並轉化為其他製造用品,使這種選擇受到尋求減少廢棄物的公司的歡迎。塑膠托盤的需求和受歡迎程度越來越高,因為它們可以讓您儲存產品而沒有害蟲和白蟻的風險。

- PVpallet 是活躍於托盤市場的公司之一,利用廢棄的再生塑膠製造托盤。 2022年9月,該公司推出了首款可回收、可重複使用、可調節和折疊式的托盤系統,專為光伏組件的運輸和保護而設計。該公司的目標是透過取代傳統的木製運輸托盤,有效且有意義地徹底改變太陽能運輸產業。預計此類舉措將增加對塑膠托盤的需求。

- 此外,由於農業及相關產業跨境進出口的增加,對塑膠托盤的需求也增加。這些托盤不像木棧板那樣有吸濕、蟲害、燻蒸、腐爛或吸臭問題,並且每次使用後都可以輕鬆徹底地清洗。這些托盤非常適合有監管和衛生要求的行業,例如食品、飲料和藥品。

- 同樣,印度向其他國家出口商品的增加將推動塑膠托盤的成長。根據 DGCI&S 的數據,2022 會計年度印度出口了價值 5,790 億盧比(70.5 億美元)的水產品。水產品出口額在農業及相關部門出口較高。接下來是非印度香米、砂糖、印度香米和香辛料。

- 然而,塑膠托盤容易受到溫度和天氣快速變化的影響,從而降低運輸過程中的效率。與木棧板或回收托盤的成本相比,塑膠托盤的成本也相當高。公司最終使用租用的、回收的或白色的木質材料來計算預計成本並確定托盤的最佳材料。這會阻礙塑膠托盤的成長。

亞太地區將帶來顯著的市場成長

- 製造業在印度經濟成長中扮演重要角色。汽車、工程、化學、製藥和耐用消費品等關鍵產業對國家製造業產出做出了巨大貢獻。印度製造業預計將成為該地區成長最快的產業之一。旨在促進國內製造業和吸引外國投資的「印度製造」等政府宣傳活動為這一成長軌跡做出了貢獻。製造業成長是由國內消費增加、可支配收入、中階不斷壯大以及有利的政府政策所推動的。此外,印度的人口優勢和年輕勞動力為製造業成長提供了堅實的基礎。

- 印度品牌股權基金會(IBEF)預計,到 2030 年,印度將出口價值 1 兆美元的商品,成為世界領先的製造地。製造業佔印度GDP的17%,僱用了超過2,730萬名工人,在印度經濟中發揮關鍵作用,並支持托盤市場的成長。此外,印度是一個以農業為主的國家,農產品出口額從2020年的350.9億美元增加到2022年的502.1億美元。

- 此外,根據歐洲化學工業理事會Cefic的數據,中國以1.729兆歐元(18.9334億美元)的化學品生產量,成為全球最大的化學品生產國,並將於2021年成為全球最大的化學品生產國。這佔化學品生產量的43%銷售量。 2017年,中國成為全球最大的化學品生產國。化學品銷售經歷了正成長(即使在 COVID-19 期間),自 2020 年以來成長了 11.9%。此外,根據聯合國COMTRADE國際貿易資料庫,2022年中國對印度有機化學品出口額為130.5億美元。預計這些因素將有助於預測期內托盤市場的成長。

- 此外,該地區的投資也推動了市場成長。 2021年1月,專注於基礎設施的基金Leading Enterprise in Advanced Pooling (LEAP India)獲得摩根士丹利印度基礎設施公司2,500萬美元的投資。 LEAP India 是國內托盤共享市場的主要參與者。其重點是增加公司的資產,包括托盤、大型折疊式貨櫃、板條箱和公用箱,從 400 萬個增加到 600 萬個。

托盤產業概況

由於存在多個大大小小的製造商,托盤市場分散。國家之間貿易的增加正在推動瓦楞托盤作為永續包裝材料的成長。主要企業包括 Falkenhahn AG、CABKA Group GmbH 和 CHEP。市場的最新發展包括:

2022 年 1 月,托盤回收商和供應商 Kamps Inc. 收購了 Tritz Pallet,以提供托盤回收和全方位服務托盤解決方案。此次收購將 Kamps 的實體足跡擴大到 40 多個基於資產的地點,並鞏固了其在大平原地區的影響力。

2022 年 1 月,供應鏈供應商喬達宣布與 Unilode Aviation Solutions 簽署了為期五年的單位負載設備 (ULD) 供應、管理和維修協議。 Unilode 為喬達提供貨櫃和托盤,並提供全套 ULD 管理解決方案,包括採購、規劃、物流、維修和數位化。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 各行業對塑膠托盤的需求增加

- 採用托盤運輸

- 市場限制因素

- 原料供應有限且高成本

第6章市場區隔

- 按類型

- 木頭

- 塑膠

- 其他類型

- 按最終用戶

- 運輸/倉儲

- 食品和飲料

- 藥品

- 零售

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Brambles Limited

- CABKA Group GmbH

- Craemer Holding GmbH

- CHEP

- Schoeller Allibert

- Rehrig Pacific Company

- Loscam International Holdings Co., Limited

- UFP Industries, Inc.

- MENASHA Corporation

- Palettes Gestion Services(PGS)Group

- World Steel Pallet Co., Ltd.

- Falkenhahn AG

第8章投資分析

第9章 市場機會及未來趨勢

The Pallets Market size is estimated at USD 95.31 billion in 2024, and is expected to reach USD 118.03 billion by 2029, growing at a CAGR of 4.37% during the forecast period (2024-2029).

Key Highlights

- Surging demand for plastic pallets across industry verticals is expected to drive the market demand. In the past decades, wooden pallets have been used due to their strength and easy manufacturing process; however, due to certain disadvantages such as moisture absorption, less durability, and breakage of splinter, the demand for plastic pallets is growing.

- Additionally, advantages such as being environmentally friendly and lightweight and increasing awareness of reducing carbon footprint are propelling the demand for pallets in logistics and shipment companies as they are shifting from wood pallets to plastic pallets. Further, in June 2023, C&T Matrix introduced its customers to a new range of plastic pallets specifically tailored to the requirements of the packaging industry. With over 1,000 pallets sold since its launch, customers cite improved safety and hygienic production as key benefits.

- Moreover, due to its ability to handle heavy loads, the increasing demand for HDPE material in the automotive and shipping industry is boosting pallet demand. Also, disposable plastic pallets are widely used in the F&B industry as they resist organic and inorganic chemicals at normal temperatures.

- The increasing adoption of pallets for transportation use is expected to drive the market in the forecast timeframe. Also, the primary transport mode for cross-border trade is through waterways (shipping), contributing to ~90% of traded goods. This, in turn, indicates that oceans provide the main transport arteries for global trade. Furthermore, according to the Organization for Economic Cooperation and Development (OECD), maritime trade volumes are set to triple by 2050 as demand for global freight increases.

- However, Limiting availability and the high price of the raw materials for manufacturing pallets are anticipated to hinder market growth. As wooden pallets capture the market, price fluctuations challenge market growth. Also, rising lumber prices, trucking issues, and high demand contribute to the worldwide shortage of wood pallets, nearly doubling raw materials prices.

- Additionally, the COVID-19 pandemic significantly impacted the hotel, tourism, manufacturing, and construction sectors. Manufacturing operations were suspended or limited. Globally, supply chains for the construction and transportation industries called for improvement. This resulted in a decrease in both pallet production and market demand, which restrained the market's expansion. On the other hand, businesses are gradually returning to their normal production and services. The pallet market companies restarted operations at full capacity, which is anticipated to aid in the market's recovery.

Pallet Market Trends

Increasing Demand for Plastic Pallets Across the Industry Verticals

- Plastic pallets are rigid structures that provide mechanical stability to bulk goods during handling to preserve quality. Handling includes all activities related to lifting, moving from one point to another, stacking, product storage, and long-distance transportation by land or sea. Plastic pallets are designed to be moveable by equipment such as forklifts, pallet jacks, and front loaders to facilitate the mobility of goods. Plastic pallets are highly recommended in food & beverage, pharmaceutical, chemicals, and other industries, where the risk of chemical contamination is significantly high.

- Moreover, Plastic pallets offer certain benefits over wooden pallets, which makes it one of the fastest-growing pallet types on the market. Since manufacturers can recycle them or melt and reform them into other manufacturing supplies, this option is popular among businesses looking to reduce waste. Plastic pallets have also risen in demand and popularity because they can store products without the risk of pests or termites.

- PVpallet, one of the players operating in the pallets market, is using discarded, recycled plastic to manufacture pallets. In September 2022, the company launched the first recyclable, reusable, adjustable, and collapsible pallet system specifically designed for shipping and protecting solar PV modules. The company aims to revolutionize the solar shipping industry efficiently and meaningfully by replacing traditional wood shipping pallets. Such initiatives are expected to boost the demand for plastic pallets.

- Further, increasing cross-border agricultural and allied sector import-export has helped boost the demand for plastic pallets. These pallets do not absorb moisture or have issues such as infestation, fumigation, rot, and odor absorption like wood pallets, and they can be easily and thoroughly cleaned between uses. These pallets are perfect for industries with regulatory and hygiene requirements, such as food, beverage, and pharmaceutical.

- In line with the same, the increasing export of commodities from India to other countries will propel growth for plastic pallets. According to DGCI&S, marine products worth INR 579 billion (USD 7.05 billion) were exported from India in the financial year 2022. Marine products export value was higher among agricultural and allied sector exports. This was followed by non-basmati rice, sugar, basmati rice, and spices.

- However, plastic pallets are also susceptible to drastic changes in temperature and weather, making them less effective during transportation. The cost of plastic pallets is also considerably higher compared to the cost of wooden and recycled pallets. Businesses ultimately alternate between calculating projected costs using rental, recycled, or whitewood materials to determine the best material for their pallets. This can hinder the growth of plastic pallets.

Asia-Pacific Account for Significant Market Growth

- The manufacturing industry plays a vital role in India's economic growth. Key sectors such as automotive, engineering, chemicals, pharmaceuticals, and consumer durables have significantly contributed to the country's manufacturing output. India's manufacturing industry has been projected to be among the fastest-growing sectors in the region. The government's initiatives, such as the "Make in India" campaign to boost domestic manufacturing and attract foreign investments, have contributed to this growth trajectory. Manufacturing sector growth is driven by increasing domestic consumption, disposable incomes, a growing middle class, and favorable government policies. Additionally, India's demographic advantage, with a large and young workforce, provides a strong foundation for the growth of the manufacturing industry.

- According to India Brand Equity Foundation (IBEF), India can export goods worth USD 1 trillion by 2030 and is on its path to becoming a major global manufacturing hub. With 17% of the nation's GDP and over 27.3 million workers, manufacturing plays a significant role in the Indian economy, supporting the growth of the pallets market. Further, India is an agricultural-centric country, and its export value of agriculture increased from USD 35.09 billion in 2020 to USD 50.21 billion in 2022.

- Moreover, according to Cefic, the European Chemical Industry Council, with EUR 1,729 billion ( USD 1893.34 billion) worth of chemicals produced, China was the largest chemicals producer in the world, contributing 43% of global chemical sales in 2021. During 2017, China experienced positive growth in chemical sales (even during COVID-19 )and has grown by 11.9% since 2020. Further, according to the United Nations COMTRADE database on international trade, China's exports of organic chemicals to India were USD 13.05 Billion in 2022. Such factors are anticipated to contribute to the growth of the Pallets market during the forecast timeframe.

- Furthermore, the region witnessed investment fueling the market's growth. In January 2021, Leading Enterprise in Advanced Pooling (LEAP India), a fund focusing on infrastructure, received a USD 25 million investment from Morgan Stanley India Infrastructure. A significant player in the nation's pallet pooling market is LEAP India. It focuses on increasing the company's assets, which include pallets, sizable foldable containers, crates, and utility boxes, from 4 million to 6 million units.

Pallet Industry Overview

The pallet market is fragmented due to the presence of several small and large manufacturers. The increased trade between countries is boosting the growth of corrugated pallets as sustainable packaging.Key players are Falkenhahn AG, CABKA Group GmbH, CHEP, etc. Recent developments in the market are -

In January 2022, Kamps Inc., a pallet recycler and supplier, acquired Tritz Pallet, offering pallet recycling and full-service pallet solutions. The acquisition enhanced Kamps' physical footprint to over 40 asset-based locations solidifying its presence in the Great Plains region.

In January 2022, Geodis, a supply chain provider, announced that it entered into a five-year unit load device (ULD) supply, management, and repair agreement with Unilode Aviation Solutions. Unilode supplied containers and pallets to Geodis, providing its full range of ULD management solutions, including procurement, planning, logistics, repair, and digitalization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Plastic Pallets Across the Industry Verticals

- 5.1.2 Adoption of Pallets for Transportation Purpose

- 5.2 Market Restraints

- 5.2.1 Limiting Availability and High Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Types

- 6.1.1 Wood

- 6.1.2 Plastic

- 6.1.3 Other Types

- 6.2 By End User

- 6.2.1 Transportation and Warehousing

- 6.2.2 Food and Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Retail

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 South Africa

- 6.3.5.3 Egypt

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Brambles Limited

- 7.1.2 CABKA Group GmbH

- 7.1.3 Craemer Holding GmbH

- 7.1.4 CHEP

- 7.1.5 Schoeller Allibert

- 7.1.6 Rehrig Pacific Company

- 7.1.7 Loscam International Holdings Co., Limited

- 7.1.8 UFP Industries, Inc.

- 7.1.9 MENASHA Corporation

- 7.1.10 Palettes Gestion Services (PGS) Group

- 7.1.11 World Steel Pallet Co., Ltd.

- 7.1.12 Falkenhahn AG