|

市場調查報告書

商品編碼

1433932

商業印刷:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Commercial Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

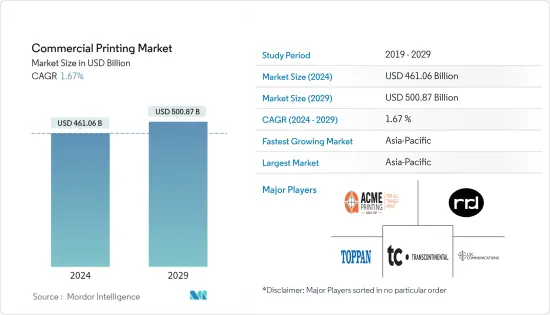

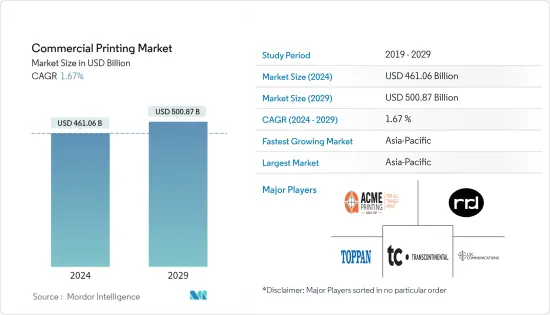

商業印刷市場規模預估2024年為4,610.6億美元,預估至2029年將達5,008.7億美元,預測期間(2024-2029年)複合年成長率為1.67%成長。

全球企業不斷成長的廣告需求和技術的廣泛普及是推動市場成長的關鍵因素。許多組織都使用商業印表機,因為它們對於大量列印來說經濟高效且高效。

主要亮點

- 將客製化的行銷訊息涵蓋促銷和行銷策略是商業印刷行業的驅動力之一。對個人化印刷內容的巨大需求,使用數位印刷技術的商業印刷公司正在做出回應。此類技術包括可變資料印刷 (VDP),它允許在每個印刷件上定製圖像、文字和圖形。由於數位印刷的訂購彈性、最佳化的庫存處理以及最短的印刷內容上市時間,小型自助出版業對數位印刷的需求很高。這也可能有助於增加商業行業的支出。

- 各種短期生產應用正在興起。這些應用程式的範例包括書籍、直郵郵件、小冊子和目錄。傳統的直郵通常涉及向許多客戶發送相同的訊息。然而,數位行銷可以透過利用資料和客製化印刷訊息來滿足人們的興趣,從而提高客戶滿意度。

- 永續性在當今的商業中變得越來越重要。商用噴墨產品之所以受到關注,是因為它們消耗更少的電力,產生更少的二氧化碳,並且不排放碳粉粉塵,從而使空氣更乾淨。許多公司投資噴墨印表機來增強其產品、個人化包裝和通訊、幫助客戶推廣其品牌並應對季節性需求。例如,2021 年,DS Smith Iberia 在其位於葡萄牙里斯本的工廠安裝了一台 EFI Nozomi C18000 Plus 6 色單一途徑LED 噴墨印表機。 Nozomi 的生產力預計將縮短上市時間,並提供與膠印相當的印刷質量,而無需平版層壓。

- 印刷業歷來都是集中產業,銷售趨勢與就業之間存在密切關係。機械設計、數位化和電腦化為提高生產力和改變行業做出了巨大貢獻,使成長能力不再與直接工作掛鉤。然而,採購過程中原物料成本的上漲限制了多家企業的經營。商業印刷所使用的原料包括紙張、油墨、印刷材料和其他化學產品。原料價格是動態的,並且會根據多種社會經濟因素而波動,這阻礙了在所研究的市場中營運的公司的業務活動。過去幾年,油墨製造商的採購部門經歷了一段動盪時期。

- COVID-19 病毒感染疾病減少了對商業印刷的需求。許多活動被取消,對促銷資料的需求也減少了。許多組織也正在轉向遠距工作,這可能會加劇無紙化趨勢。此外,隨著客戶在網路上花費的時間越來越多,廣告商開始選擇數位媒體而不是其他形式的媒體。儘管在 COVID-19 疫情得到控制之前,活動取消和遠端工作預計將只是臨時措施,但對印刷材料的需求可能會永久消失。

商業印刷市場趨勢

包裝產業預計將顯著成長

- 折疊紙盒、軟包裝和標籤印刷是需要印刷和切割的三種包裝應用。對於折疊紙盒,文件準備(結構 CAD 文件)和精加工(模切、折疊和黏合)涉及多個附加流程。

- 隨著資訊數位傳遞的增加,商業印刷商已經開始採用數位技術來提高包裝的印刷品質。快速反應 (QR) 碼已成為產品包裝上基本且主流的印刷材料,可使用智慧型手機掃描以顯示產品資訊或促銷內容等附加資料。

- 此外,由於企業需要遵守動態的政府法規並防止假冒,預計藥品、菸草產品和酒精飲料的包裝和標籤印刷需求將會增加。

- 加工商和零售商在包裝方面的合作增加,從而開發出吸引客戶的創新方法。網路購物和個人化體驗的策劃進一步支持了包裝行業的商業印刷市場。因此,許多包裝公司正在投資商業印刷解決方案,推動市場成長。

- 此外,全球快速成長的電子商務市場已成為電子商務印刷提供商的利潤豐厚的機會,因為電子商務公司正在為其日常包裝迅速採用創新的印刷解決方案。隨著電子商務的發展及其在實體零售額中的相對佔有率的增加,從物流到倉儲再到零售品牌的相關人員將專注於電子商務的特定需求。我們開始投資於技術

- 2021 年 10 月,賽康宣布推出兩款新型標籤印刷機:賽康 PX3300 和賽康 PX2200,以擴展其 Panther UV 噴墨技術產品組合,並協助推動印刷製造的數位化。 Xeikon PX2200 和 PX3300 使用該公司的 Panther DuraCure UV 技術來生產高度防刮、高光澤的標籤。據報道,這為工業、化學、家庭、飲料、健康和美容行業的高級標籤等應用提供了廣泛的顏色範圍和長期耐用性。

- 這種創新和永續的印刷發展為包裝行業的商業印刷帶來了光明的未來。此外,商業印刷和包裝供應商之間增加投資、合併和合作活動可能會加強產品供應,滿足更高水準的需求,並推動所研究市場的成長。

亞太地區主導市場

- 由於中國、印度、菲律賓、越南和泰國等主要地區的需求不斷成長,亞太地區佔據了主要市場佔有率佔有率。新技術的出現、生活方式的改變、電子商務的興起和都市化等因素正在推動該地區印刷市場的成長。

- 新技術的引入、生活方式的改變、電子商務的發展和都市化等因素正在推動該地區商業印刷市場的成長。此外,中國和印度等新興食品對加工食品和食品的需求不斷增加,預計將對該地區的市場產生積極影響。此外,該地區可支配收入的增加也增加了使用客製化壁紙進行室內設計的需求。

- 中國經濟在過去幾十年中經歷了顯著成長,使該國成為世界第二大經濟體。中國人口是世界上最多的。同時,經濟持續高速成長。作為主要製造商的所在地並吸引了多家財富 500 強企業,中國的商業印刷市場和採用數位印刷技術的機會正在擴大。

- 印度工業聯合會(CII)預計,到2025年,印度將成為第五大消費市場。此外,根據 ASSOCHAM-EY 聯合研究,印度印刷和包裝產業預計到 2025 年將成長至 726 億美元。 2020年,複合年成長率為18%。全印度印刷大師聯合會 (AIFMP) 估計,印度可能有超過 25 萬家中小微型企業和大型印刷商。 AIFMP資料還表明,國內商業印刷每年以 10% 左右的速度成長,而數位印刷則以 30% 的強勁速度成長。

- 印度印刷、包裝及聯合機械製造商協會 (IPAMA) 表示,由於行業相關人員的快速變化,包裝行業可能會繼續成長。該國電子商務的繁榮和有組織的零售業為包裝行業提供了巨大的成長潛力,從而支持了商業印刷行業。其他因素,如強勁的經濟、不斷上升的消費主義、全球品牌的進入以及外國投資者興趣的增加,也必將為該行業提供成長機會。

商業印刷業概況

由於有許多全球和區域參與者,商業印刷市場呈現碎片化狀態。鑑於市場產品的同質化,許多在市場上經營的企業進一步被迫進行價格競爭。

- 2022 年 7 月:凸版因其出色的環境、社會和管治(ESG) 表現而在多項頂級指標中獲得認可。 FTSE4Good 指數係列、FTSE Blossom Japan 指數和 FTSE Blossom Japan 產業相對指數由 FTSE Russell 創建。 MSCI Inc. 創建了 MSCI 日本賦權女性指數 (WIN),並與日本交易所集團合作創建了 S&P/JPX 碳效率指數。

- 2022 年 5 月:RRD 宣布推出 Helium,這是一項編輯解決方案服務,可提供專家文案、內容策略和計劃管理專家的協助。該服務使品牌可以透過單網路基地台數百名主題專家來產生內容。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對產業的影響

第5章市場動態

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 零售和食品和飲料行業對促銷材料的需求增加

- 環保實踐簡介

- 市場限制因素

- 數位化的進步和對原物料價格的依賴增加

- 市場機會

第6章市場區隔

- 按類型

- 平版膠印

- 噴墨

- 彈性凸版印刷

- 螢幕

- 凹版印刷

- 其他

- 按用途

- 包裝

- 廣告

- 出版品

- 圖書

- 雜誌

- 報紙

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- ACME Printing

- Cenveo Corporation

- RR Donnelley & Sons

- Vistaprint(CIM PRESS PLC)

- Toppan Co. Limited

- Transcontinental Inc.

- LSC Communications US LLC

第8章投資分析

第9章市場展望

The Commercial Printing Market size is estimated at USD 461.06 billion in 2024, and is expected to reach USD 500.87 billion by 2029, growing at a CAGR of 1.67% during the forecast period (2024-2029).

The growing advertising needs of enterprises across the world and extensive technological proliferation are the key factors driving the market growth. Many organizations are adopting commercial printers as they are more cost-effective and efficient for bulk printing.

Key Highlights

- Including customized marketing messages in promotional and marketing strategies is one of the drivers of the commercial printing industry. There is a significant demand for personalized printed content, which is being catered to by commercial printing companies that use digital printing technologies. Such technologies include variable data printing (VDP), which enables the customization of images, text, and graphics on each printed piece. The short-run self-publishing industry witnesses a high demand for digital printing due to order flexibility, optimized stock handling, and minimization of time-to-market for printed content. This may also contribute to the growth of the commercial industry's spending.

- The applications for short-run production for a wide range are increasing. Some examples of these applications are books, direct mail, brochures, and catalogs. In direct mail, the conventional practice was to send the same message to many customers. However, digital marketing utilizes data to customize printed messages according to the person's interests, resulting in higher customer satisfaction.

- Sustainability is becoming increasingly important in businesses today. Commercial inkjet products are gaining traction as they use less power, produce less carbon dioxide, and are associated with cleaner air as they do not emit toner dust. Many companies are investing in inkjet printers to enhance their offerings, personalize packaging and messaging, aid clients in promoting their brands, and meet the seasonality of their demand. For instance, in 2021, DS Smith Iberia installed the EFI Nozomi C18000 Plus six-color single pass-LED inkjet printer in its facility in Lisbon, Portugal. The productivity of the Nozomi is expected to reduce the time to market and offer a printing quality equivalent to that of offset printing without the need for litho lamination.

- The printing industry has historically been labor-intensive, with a strong relationship between the trend in turnover and employment. Machinery design, digitalization, and computerization have significantly contributed to improving productivity and transforming this industry so that growth capacity is no longer linked to direct work. However, the rising raw material costs during the procurement process limit the operability of several players. The raw materials used in commercial printing include paper, ink, printing materials, and other chemical products. The feedstock prices are dynamic and fluctuate based on several socioeconomic factors, thereby hindering the business activity of the companies operating in the studied market. The last few years were tumultuous for the purchasing departments of ink manufacturers.

- The demand for commercial printing reduced during the COVID-19 pandemic. Many events were canceled, leading to a lowered demand for promotional materials. Many organizations have also moved to remote working, which may boost the trend toward paperless operations. Additionally, with customers spending more time online, advertisers are opting for digital media over other forms of media. Although event cancelations and remote work are expected to be temporary measures until the COVID-19 situation is under control, they may cause a lasting loss in demand for printed materials.

Commercial Printing Market Trends

Packaging Segment Expected to Witness Significant Growth

- Folding cartons, flexible packaging, and label printing are the three packaging applications that require printing and cutting, with folding cartons adding a few more processes to the file preparation (structural CAD files) and finishing (die-cutting, folding, gluing).

- With a rise in the digital delivery of information, commercial printers have been observed to be imbibing digital technologies to enhance packaging print quality. Quick response (QR) codes have become a basic/mainstreamed print on product packaging to be scanned with a smartphone for additional display of data, such as product info and promotional content.

- Additionally, the demand for printing from packaging and labels for pharmaceuticals, tobacco products, and alcoholic beverages is expected to increase, as the companies must comply with dynamic government regulations and protect against counterfeiting.

- Increased cooperation among the convertors and retailers surrounding packaging has led to the development of innovative ways of customer enticement. Online shopping and curating personalized experiences have further aided the market for commercial printing in the packaging domain. Owing to this, many packaging companies are investing in commercial printing solutions, thus boosting the market's growth.

- Furthermore, the booming e-commerce market across the world offers a lucrative opportunity for commercial printing providers, as e-commerce players rapidly adopt innovative printing solutions for their daily packaging. As e-commerce grows, its relative share of brick-and-mortar retail sales, the allied stakeholders, from logistics to warehousing to retail brands, have begun to invest in technologies unique to the specific needs of e-commerce.

- In October 2021, Xeikon announced two new label presses, the Xeikon PX3300 and Xeikon PX2200, to expand its Panther UV inkjet technology portfolio and help in advancing the digitization of print manufacturing. The Xeikon PX2200 and PX3300 use the company's Panther DuraCure UV technology to produce high-gloss labels with high scruff resistance. This reportedly offers a wide color range and long-term durability for applications, including industrial, chemical, household, and high-end labels for the premium beverage, health, and beauty sectors.

- Such developments in innovative and sustainable printing offer a promising future for commercial printing in the packaging industry. In addition, the growing number of investments, mergers, and collaboration activities among commercial printing and packaging providers may enhance the product offerings and cater to a higher level of demand, thereby boosting the growth of the studied market.

Asia-Pacific Dominates the Market

- The Asian-Pacific region accounts for a significant market share due to increasing demand from critical regions like China, India, the Philippines, Vietnam, and Thailand. Factors such as the inception of new technologies, changing lifestyles, rise in e-commerce, and urbanization, are driving the growth of the printing market in the region.

- Factors such as the inception of new technologies, changing lifestyles, and the rise in e-commerce and urbanization are driving the growth of the commercial printing market in the region. Moreover, the increasing demand for processed and canned food in emerging markets such as China and India is expected to impact the market in the region positively. Also, the increasing disposable income in the region is resulting in the growing demand for interior design with customized wallpapers.

- The Chinese economy has experienced significant growth over the last few decades, which made the country the world's second-largest economy. The Chinese population is the largest in the world. Simultaneously, the economy is growing at a consistently high rate. Being the home of major manufacturers and attracting multiple Fortune 500 companies, the Chinese commercial printing market and the opportunities for the adoption of digital printing technologies have grown.

- According to the Confederation of Indian Industry (CII), India is anticipated to become the fifth-largest consumer market by 2025. Also, according to an ASSOCHAM-EY joint study, India's print and packaging industry is expected to grow to USD 72.6 billion by 2020, registering a CAGR of 18%. The All-India Federation of Master Printers (AIFMP) estimates that the country may have more than 250,000 MSMEs and big printers. The data from AIFMP also suggests that commercial printing in the country is growing at an annual rate of around 10%, while digital printing is growing at a robust growth rate of 30%.

- According to the Indian Printing, Packaging, and Allied Machinery Manufacturers' Association (IPAMA), the packaging industry may continue to grow due to the rapid changes undertaken by the industry players. The country's e-commerce boom and organized retail sector offer massive potential for the packaging sector's growth, thereby supporting the commercial printing industry. Other factors, such as the booming economy, increasing consumerism, entry of global brands, and rising interest of foreign investors, are bound to offer growth opportunities to the industry.

Commercial Printing Industry Overview

The commercial printing market is fragmented due to the presence of many global and regional players. Considering the homogenous nature of market products, many firms operating in the market are further being driven to compete on price.

- July 2022: Toppan was recognized for consideration in several top indexes for its exceptional Environmental, Social, and Governance (ESG) performance. The FTSE4Good Index Series, the FTSE Blossom Japan Index, and the FTSE Blossom Japan Sector Relative Index were created by FTSE Russell. MSCI Inc. created the MSCI Japan Empowering Women Index (WIN), and the S&P/JPX Carbon Efficient Index was created in collaboration with the Japan Exchange Group.

- May 2022: RRD announced the launch of Helium, an editorial solution service providing access to specialized copywriting, content strategy, and project management professionals. This service could give brands a centralized access point to hundreds of subject matter experts in content generation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increased Demand for Promotional Materials from the Retail, Food, and Beverage Industries

- 5.2.2 Introduction of Eco-friendly Practices

- 5.3 Market Restraints

- 5.3.1 Increase in Digitization and Rising Dependence on Feedstock Prices

- 5.4 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Offset Lithography

- 6.1.2 Inkjet

- 6.1.3 Flexographic

- 6.1.4 Screen

- 6.1.5 Gravure

- 6.1.6 Other Types

- 6.2 By Application

- 6.2.1 Packaging

- 6.2.2 Advertising

- 6.2.3 Publishing

- 6.2.3.1 Books

- 6.2.3.2 Magazines

- 6.2.3.3 Newspapers

- 6.2.3.4 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ACME Printing

- 7.1.2 Cenveo Corporation

- 7.1.3 R. R. Donnelley & Sons

- 7.1.4 Vistaprint (CIM PRESS PLC)

- 7.1.5 Toppan Co. Limited

- 7.1.6 Transcontinental Inc.

- 7.1.7 LSC Communications US LLC