|

市場調查報告書

商品編碼

1433903

高能量雷射:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)High Energy Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

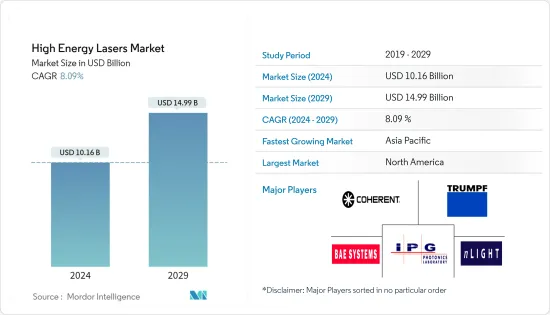

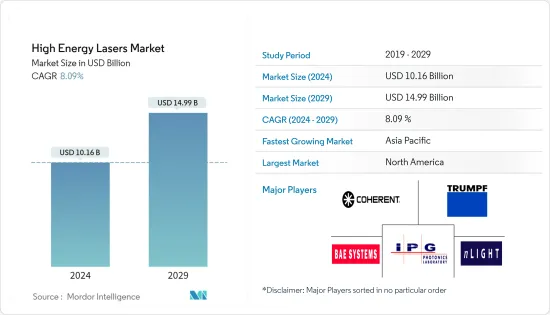

高能量雷射市場規模預計到2024年為101.6億美元,預計到2029年將達到149.9億美元,在預測期內(2024-2029年)成長8.09%,以年複合成長率成長。

該行業是受冠狀病毒感染疾病(COVID-19)大流行打擊最嚴重的行業之一。隨著機械庫存需求的減少,2020年高階雷射的需求也隨之減少。在經濟放緩和中國需求增加之後,市場最終開始復甦。

主要亮點

- 雷射已被證明可以有效對抗飛彈,現在被用作第一道防線。隨著國防預算和研究津貼的增加,世界各地的軍隊正在部署基於高能量雷射的設備,並大力投資研發。

- 高能量雷射在現代社會中發揮重要作用,在製造、通訊和國防領域的應用越來越多。隨著國防預算和研究津貼的增加,世界各地的軍隊正在部署基於高能量雷射的設備,並大力投資研發。例如,2021年5月,美國開始測試用於短程防空的雷射武器原型。該武器是安裝在 Stryker A1 車輛上的 50 千瓦高能量雷射器,可偵測、鎖定、追蹤和摧毀空中威脅。

- 國防工業在這項技術的研究、開發和應用中佔有很大佔有率。主要支出國熱衷於開發和部署這項技術,作為其軍事和行動的一部分。 SIPRI預計,2021年全球軍費總額預計將實際成長0.7%,達到2.1兆美元。全球軍費開支新資料顯示,2021年最大的五個支出國為美國、中國、印度、英國和俄羅斯,佔總支出的62%。這些發展應該為新技術和現代化鋪平道路。

- 隨著無人機在國防部門的普及,對能夠追蹤和摧毀無人機的解決方案的需求不斷成長。例如,2021年3月,歐洲飛彈製造商MBDA和法國公司CILAS與電子戰和情報專家SIGN4L聯手探索共同開發高能量雷射武器系統以摧毀無人機的機會,並達成協議。預計此類發展在未來幾年將進一步增加。

- 高能量雷射作為導彈防禦系統一部分的應用預計將會增加,主要國防支出者擴大採用並表達了開發此類解決方案的興趣。例如,2021 年 3 月,以色列國防部表示有興趣尋求美國在防空和飛彈防禦雷射方面的資金和專業知識。以色列目前的原型機實現了近100千瓦的功率束,而美國正在研究能夠摧毀巡航飛彈的300千瓦武器。

- 研究人員面臨的最困難的課題是創造一種可以同時追蹤多個物體的雷射器,同時達到足夠高的水平以部分損壞或摧毀目標。在灰塵和潮濕等湍流環境中,雷射必須有效傳播並保持精確聚焦在目標上。系統必須考慮到目標移動、平台移動以及由天氣和環境條件引起的光束畸變。

高能量雷射市場趨勢

海軍對雷射武器系統的需求不斷增加以及非致命性阻礙力的成長

- 世界各地海軍對雷射武器系統的需求正在迅速增加,以應對導彈和無人機等空中威脅。作為防禦導彈的第一道防線,使用了雷射,事實證明雷射是有效的。例如,IIA DDG Arleigh Burke驅逐艦將於2021年永久裝備洛克希德·馬丁公司的具有整合光學眩目器和監視功能的高能量雷射(HELIOS)。該雷射被美國正式整合到Aegis作戰系統中。海軍。

- 另外,正在測試基於雷射的武器,透過將其整合到海軍艦艇中來消滅無人機。例如,在新型冠狀病毒感染的COVID-19期間,波特蘭號航空母艦在測試新型高能量雷射武器系統時成功摧毀了一架無人機。諾斯羅普·格魯曼公司開發了該系統,並在中國驅逐艦發生事故後進行了測試,當時美國P-8A 海神巡邏機發射了武器級雷射。

- 除美國外,其他國家也在尋求擴大其海軍能力以威懾和消除威脅。中國是這一領域與美國爭奪霸主地位的國家之一。中國人民解放軍海軍(PLA Navy)測試了一種戰術雷射系統,該系統與美國的雷射武器系統(LaWS)驚人相似。

- 由於海軍客戶國很容易受到飛彈和其他空中威脅的攻擊,國防部門正在開發和部署可以防禦此類威脅的技術。 2021 年 3 月,有消息指出艦載雷射武器正在逐步接近實現精確精度。

亞太地區將經歷最高成長

- 亞太地區已成為各領域高能量雷射的主要採用地區,市場成長由中國、印度和日本等主要國家推動。中美緊張局勢、邊境爭端以及對核能的關注正在推動包括印度在內的該地區各國在國防和軍事系統中使用高能量雷射。

- 作為印度陸軍和空軍戰術高能量雷射系統的一部分,作為國防部技術展望和能力藍圖的一部分,印度已在武裝部隊中採用和推廣高能量雷射。

- 印度國防研究與發展組織宣布計劃制定國家定向能量武器,其中包括高能量雷射。 DRDO正在致力於化學氧碘雷射和高功率光纖雷射的開發,並正在考慮國防部在2021-2022會計年度提供1億美元的預算,用於製造高功率雷射武器。這種在高能量雷射上的支出預計將對國家的成長產生積極影響。

- 據SIPRI稱,作為全球第二大消費國,中國2021年的軍事開支增加了4.7%,達到約2,930億美元。中國連續27年增加軍費開支。 2021年至2025年的「十四五」規劃首先以2021年中國預算案開始實施。作為新概念武器的一部分,中國預計將推進高能量雷射並將其引入其防禦系統。國家軍費開支和高能量雷射整合趨勢顯示所研究市場的正面成長。

- 由於強調從軍事優勢角度控制太空,所研究的市場預計將受益於中國透過政府資助的研發投資所取得的技術進步。

高能量雷射產業概況

高能量雷射市場競爭適中,由多家大型企業組成。從市場佔有率來看,許多大公司繼續在整個市場中佔有重要佔有率,特別是在北美等已開發國家。領導者不斷利用新技術進行創新並投資研發。此外,這些公司正在利用策略合作舉措來擴大市場佔有率並提高盈利。

- 2022 年 9 月 - 雷射切割公司 (TLCC) 發布了採用通快解決方案 EdgeLine Bevel 的高能量 Trumpf TruLaser 5040 光纖平板雷射切割機。這使得使用者可以在切割過程中自動對零件的邊緣進行倒角或埋頭孔,而無需進行昂貴且耗時的二次加工。

- 2022 年 9 月 - 雷射切割和焊接製造解決方案的領導者 Precitec 與雷射和水刀切割機製造商 TCI Cutting 有著悠久的合作歷史。 TCI Cutting 與 Precitec 合作開發了光纖雷射切割機,包括具有 4G 最大加速度的 Dynamicline Fiber 20kW、碳纖維橋和線性馬達以及高能量雷射 ProCutter 2.0 切割頭。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 海軍對雷射武器系統的需求不斷增加以及非致命性威懾力量的成長

- 市場限制因素

- 監理合規性和高成本

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介 - 產品類型

- 氣體雷射

- 化學雷射

- 準分子雷射

- 固體雷射

- 光纖雷射

- COVID-19 對市場的影響

第5章市場區隔

- 目的

- 切割、焊接、鑽孔

- 軍事/國防

- 通訊

- 其他用途

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- TRUMPF Pvt. Ltd.

- IPG Photonics

- Coherent, Inc

- nLight, Inc

- Bae Systems Plc

- Alltec Gmbh

- Lockheed Martin Corporation

- Applied Companies Inc.

- The Boeing Company

- Lumentum Holdings

- Bystronic Laser AG

- Wuhan Raycus Fiber Laser Technologies Co. Ltd.

- Raytheon Company

- Northrop Grumman Corporation

- Han's Laser Technology Co. Ltd.

第7章 投資分析

第8章市場的未來

The High Energy Lasers Market size is estimated at USD 10.16 billion in 2024, and is expected to reach USD 14.99 billion by 2029, growing at a CAGR of 8.09% during the forecast period (2024-2029).

The industry is one among the ones hit by the COVID-19 pandemic. As the demand for machine inventory declined, the demand for high-end lasers declined in the year 2020. The market started recovering eventually after a slowdown and increased demand from China.

Key Highlights

- Lasers have demonstrated their effectiveness against missiles and are now used as the first line of defense. Because of rising defense budgets and research grants, militaries around the world are adopting high-energy laser-based equipment and investing heavily in R&D.

- High-energy lasers have played a crucial role in modern society, with increasing applications in manufacturing, communication, and defense. With the growing defense budget and research grants, militaries worldwide are adopting high-energy laser-based equipment and investing heavily in research and development. For example, in May 2021, the US army began testing a prototype laser weapon for close-range air defense; the weapon is a 50-kilowatt high-energy laser attached to a Stryker A1 vehicle that can locate, lock on, track, and destroy airborne threats.

- The defense industry drives a prominent share of the R&D and application of the technology. Major spending countries are keen on developing and inducting the technology as part of their forces and operation. According to SIPRI, total global military spending will increase by 0.7% in real terms in 2021, reaching USD 2.1 trillion. According to new data on global military spending, the five largest spenders in 2021 will be the United States, China, India, the United Kingdom, and Russia, accounting for 62% of total expenditure. Such developments should pave the way for new technologies and modernization.

- With the proliferation of drones in the defense sector, the demand for solutions that can track and destroy them has gained traction. For instance, in March 2021, European missile-maker MBDA and French firm CILAS agreed to collaborate with electronic warfare and intelligence specialist SIGN4L to explore co-development opportunities in high-energy laser weapons systems to destroy drones. Such developments are expected to increase over the coming years further.

- The application of high-energy lasers as part of missile defense systems is expected to increase, with major defense spenders increasingly adopting these solutions and showing interest in developing such solutions. For example, in March 2021, the Israeli Defense Ministry showed interest by seeking US funding and expertise for their air and missile defense lasers; Israel's current prototypes have achieved an output beam of nearly 100 kilowatts, whereas the United States has been exploring 300-kW weapons capable of killing cruise missiles.

- The most difficult task for researchers is to create a laser capable of reaching high enough levels to partially damage or defeat a target while tracking multiple objects at the same time. In turbulent air conditions such as dust and humidity, the laser must propagate efficiently and remain precisely focused on the target. The system must account for target movement, platform movement, and beam distortion caused by weather or environmental conditions.

High Energy Lasers Market Trends

Rising Demand for Laser Weapons Systems in Navy and Growth for Non-lethal Deterrents

- To combat airborne threats like missiles and drones, the demand for laser weapon systems in the navy is rapidly rising across the globe. As the first line of defense against missiles, lasers are being used because they have proven effective. For instance, a flight IIA DDG Arleigh Burke destroyer is scheduled to have Lockheed Martin's High Energy Laser with Integrated Optical-dazzler and Surveillance, or HELIOS, permanently installed on board in 2021. The Laser was formally integrated into the Aegis Combat System by the US Navy.

- Apart from this, laser-based weapons are being tested for disabling drones by integrating such weapons aboard naval vessels. For example, the USS Portland successfully disabled an uncrewed aerial vehicle during a new high-energy laser weapon system test during COVID-19. Northrop Grumman developed the system, and the test was conducted after the incident with the Chinese destroyer, where a weapons-grade laser was shot by a US Navy P-8A Poseidon patrol aircraft.

- In addition to the United States, various other countries are also aiming at expanding their naval capabilities in deterring and disabling threats. China is among the countries set to race with the United States for supremacy in this field. China's People's Liberation Army Navy (PLA Navy) tested their tactical laser system that bears remarkable similarity to the US Navy's Laser Weapon System (LaWS) .

- As navy vassals are prone to attacks from missiles and other airborne threats against whom the defense section is increasingly developing and inducting technologies that can defend against such threats. In March 2021, announced that the ship-borne laser weapon is edging closer to achieving pinpoint accuracy.

Asia Pacific to Witness the Highest Growth

- The Asia-Pacific region is a leading adopter of high-energy lasers across various fields due to the growth of the market, driven by major countries like China, India, and Japan. The US-China tensions, inter-border conflicts, and the focus on nuclear power have furthered high-energy lasers in the defense and military systems of various countries in the region, like India.

- As part of the Tactical High Energy Laser System for the Army and Air Force of India, the country has adopted and encouraged high-energy lasers in the military as part of the TechnologyPerspective and Capability Roadmap by the Ministry of Defence.

- The Defence Research and Development Organisation of India announced plans to form a national program on directed energy weapons, including high-energy lasers. The DRDO is working on chemical oxygen-iodine lasers and high-power fiber lasers and is eyeing a budget of USD 100.0 million from the Ministry of Defence for the 2021-2022 budget, which is aimed at the production of high-power laser weapons. Such spending on high-energy lasers is expected to impact the country's growth positively.

- According to SIPRI, China, the second-largest consumer in the world, increased its military spending by 4.7% in 2021 to an estimated USD 293 billion. China has increased its military spending for 27 years running. The 14th Five-Year Plan, which runs from 2021 to 2025, was first implemented with the Chinese budget for 2021. As part of its New Concept Weapons, China is expected to advance and implement high-energy lasers in its defense systems. The military spending and the country's inclination toward integrating HELs indicate the studied market's positive growth.

- With the focus on controlling the space in terms of military dominance, the studied market is expected to benefit from technological advancements made by China with government-funded investments in research and development.

High Energy Lasers Industry Overview

The high-energy laser market is moderately competitive and consists of numerous major players. Many major players continue to hold a considerable share in the overall market in terms of market share, especially across developed economies in regions such as North America. The leaders constantly innovate with new technology and invest in research and development. In addition, these companies are leveraging their strategic collaborative initiatives to increase their market share and increase their profitability.

- September 2022 - The Laser Cutting Company (TLCC) has released a high-energy Trumpf TruLaser 5040 fiber flat-bed laser cutter with EdgeLine Bevel, a Trumpf solution, that allows users to automatically bevel or countersink part edges during the cutting process, eliminating the need for pricey and time-consuming secondary processes.

- September 2022 - Precitec, a leader in laser cutting and welding manufacturing solutions, and TCI Cutting, a manufacturer of laser and waterjet cutting machines, have a long history of collaboration. TCI Cutting has developed fibre laser cutting machines in collaboration with Precitec, such as the Dynamicline Fiber 20kW with 4G maximum acceleration, carbon fiber bridge and linear motors, and the high-energy laser ProCutter 2.0 cutting head.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Laser Weapons Systems in Navy & Growth for Non-lethal Deterrents

- 4.3 Market Restraints

- 4.3.1 Regulatory Compliance & High Cost

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot - Product Type

- 4.5.1 Gas Laser

- 4.5.2 Chemical Laser

- 4.5.3 Excimer Laser

- 4.5.4 Solid State Laser

- 4.5.5 Fiber Laser

- 4.6 Impact of Covid-19 on the market

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Cutting, Welding & Drilling

- 5.1.2 Military and Defense

- 5.1.3 Communications

- 5.1.4 Other Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 TRUMPF Pvt. Ltd.

- 6.1.2 IPG Photonics

- 6.1.3 Coherent, Inc

- 6.1.4 nLight, Inc

- 6.1.5 Bae Systems Plc

- 6.1.6 Alltec Gmbh

- 6.1.7 Lockheed Martin Corporation

- 6.1.8 Applied Companies Inc.

- 6.1.9 The Boeing Company

- 6.1.10 Lumentum Holdings

- 6.1.11 Bystronic Laser AG

- 6.1.12 Wuhan Raycus Fiber Laser Technologies Co. Ltd.

- 6.1.13 Raytheon Company

- 6.1.14 Northrop Grumman Corporation

- 6.1.15 Han's Laser Technology Co. Ltd.