|

市場調查報告書

商品編碼

1433853

汽車物流:全球市場佔有率分析、產業趨勢/統計、成長趨勢預測(2024-2029)Global Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

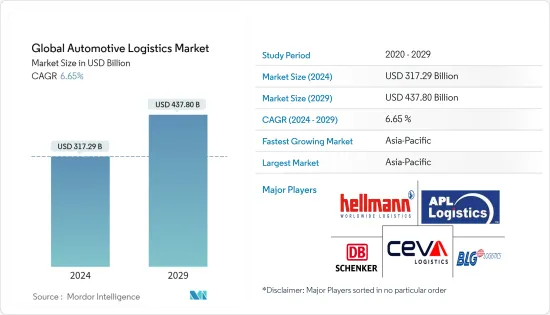

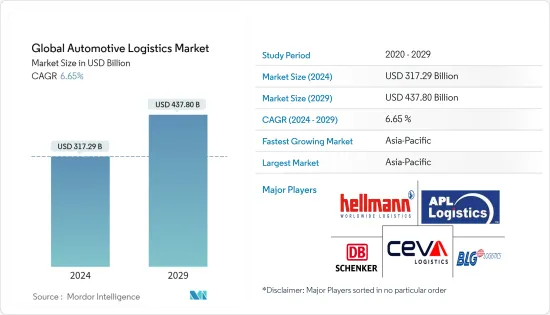

預計2024年全球汽車物流市場規模為3,172.9億美元,預估2029年將達4,378億美元,預測期(2024-2029年)複合年成長率為6.65%。

COVID-19 問題對許多行業產生了重大影響,包括旅遊業、醫療保健和零售業。汽車產業也因疫情造成的供應鏈大規模中斷而受到嚴重影響。儘管政府限制逐漸取消,健康問題仍對汽車產業產生重大影響。隨著汽車產業的不斷發展,物流變得更加複雜。汽車公司正在轉向供應鏈策略來開發新的市場機會、降低成本並保持競爭優勢。

主要亮點

- 此外,電動車的引入預計將為全球汽車物流市場帶來顯著的成長。物流業的公司也為OEM製造商以及層級和層級零件製造商提供倉儲和庫存管理服務。對這些服務的需求取決於汽車的生產數量。

- 因此,汽車產量高的地區很可能在汽車倉儲領域佔有較大佔有率。除了倉儲和配送之外,物流服務供應商(LSP)也為OEM提供組裝服務。

- 世界各地的汽車製造商正在透過創新的運輸解決方案顛覆傳統的供應鏈。例如,2019 年 1 月,雷諾宣布計劃為俄羅斯透過線上展示室銷售的車輛推出宅配服務。線上展示室的推廣是雷諾在俄羅斯銷售發展策略的一部分。雷諾已透過該網站銷售了 27,000 輛整車,主要是雷諾 Captur 和雷諾 Duster。

- 運輸整車的傳統方法是滾裝/滾裝(RORO),但隨著汽車行業的分散化和電動車的不斷引入,貨櫃運輸變得越來越可行。中國和東南亞的成長為運輸和物流公司帶來了機會。

- 此外,從中國出發的開發航線也正在採用貨櫃,特別是在中國和歐洲之間的鐵路上。東南亞對汽車銷售和物流服務的需求不斷成長,被認為是實施容器化的有利地區之一。

- 菲律賓、馬來西亞、泰國、越南、柬埔寨等東協市場自貿協定簽署後,整車以舊換新不斷增加。汽車運輸服務提供商 CFR Rinkens 已獲得一份契約,透過貨櫃將寶馬汽車從歐洲運輸到越南。

汽車物流市場趨勢

汽車產銷前景廣闊,需要高效率的物流服務

儘管存在一些阻力,全球汽車產業的前景仍然樂觀。據業內人士透露,全球輕型汽車產量令人印象深刻,並且仍在持續成長。預計亞太地區的產量成長率最高,其次是北美。此外,電動車的生產和銷售正以創紀錄的速度成長,需要專業的物流。

COVID-19大流行和汽車半導體短缺導致2020年起全球汽車產業需求下降和生產停頓。由於晶片短缺,2021 年全球將有約 1,130 萬輛汽車停產,由於汽車產業供應鏈中斷,預計 2022 年還將有 7 輛汽車停產。因疫情而下降的全球汽車銷售開始復甦,2021年達到6,670萬輛。這一銷量預計將在 2022 年下降,2023 年的銷量預計仍將低於 2019 年的水平。

在經歷了多年的兩位數成長之後,中國經濟開始放緩。從銷量來看,2020年中國擁有最大的汽車市場,約1,980萬輛。然而,由於國內冠狀病毒的爆發以及對即將到來的景氣衰退的擔憂,2021年中國的月度汽車銷量大幅下降。在有效的遏制措施下,4月市場開始出現復甦跡象,為各大廠商提供了救命稻草。

亞太地區主導市場

根據行業分析,亞太地區預計將佔據主要市場佔有率。這主要歸功於中國和印度等新興經濟體。預計有許多因素將推動該地區的汽車物流市場,包括原料的容易取得、該地區汽車需求的增加、人口的成長以及低工資勞動力的供應。

亞太地區是豐田、馬魯蒂鈴木、現代汽車和上汽汽車等主要汽車OEM商的所在地。隨著生產和貿易活動的增加,對物流公司管理採購、運輸和儲存活動以更有效地最佳化OEM供應鏈的需求越來越大。

全球物流公司擴大進入亞太地區,以利用市場相關的成長。例如,2019年6月,法國物流供應商捷富凱在中國重慶設立了一家專門子公司,專門從事歐洲、俄羅斯和中國之間的鐵路車輛進出口業務。此外,本集團的其他物流活動均位於華中地區。

捷富凱計劃透過整車行業的活動以及目前在中國汽車行業的入境和售後服務來加強其在中國的OEM供應鏈。這包括整車的上門服務、預運輸、車輛運輸、儲存、複合設計、營運管理以及國內經銷商交付。此外,集團預計中國基礎設施驅動的「一帶一路」主導將帶來對新一代汽車物流的需求增加以及其他發展機會。

「一帶一路」影響到該地區大多數國家並制定了重大發展計劃。由於多個國家的環境和永續性目標,該地區的電動車銷量將顯著成長。有能力處理電動車及其零件的物流公司可以從這種情況中受益。

汽車物流行業概況

汽車物流市場較為分散,有大型的全球參與者、較小的本地參與者以及少數擁有市場佔有率的參與者。大多數全球物流公司都設有汽車物流部門來滿足市場需求和需求。此外,本地企業在庫存處理、服務提供、處理產品和技術方面的能力也越來越強。

市場上的第三方物流(3PL)服務供應商在可靠性和供應鏈能力的基礎上展開激烈競爭。公司正試圖透過提供高付加服務來使他們的服務脫穎而出。電子商務銷售的成長為物流公司在速度、交付等方面帶來了機會和挑戰。

擁有高資產和資本的全球企業可以投資先進的技術和物流中心,並從上述場景中受益。同時,區域和當地企業正在提出更好的行業解決方案來支援製造商、零售商和經銷商的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 產業價值鏈分析

- 政府法規和舉措

- 全球物流行業(概述、LPI 分數、主要貨運統計數據等)

- 關注全球汽車產業(概況、發展與趨勢、統計等)

- 聚焦-電子商務對傳統汽車物流供應鏈的影響

- 逆向物流的回顧與說明(概述、與正向物流相比的挑戰等)

- 深入了解汽車售後市場及其物流活動

- 合約物流與綜合物流需求聚焦

- COVID-19 對汽車物流市場的影響

第5章市場動態

- 市場促進因素

- 市場限制因素

- 市場機會

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章市場區隔

- 按服務

- 運輸

- 倉儲、配送、庫存管理

- 其他

- 按類型

- 成品車

- 汽車零件

- 其他

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 義大利

- 俄羅斯

- 法國

- 其他歐洲國家

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 亞太地區

第7章 競爭形勢

- 公司簡介

- Hellmann Worldwide Logistics SE & Co. KG

- APL Logistics Ltd

- BLG Logistics Group AG & Co. KG

- CEVA Logistics

- DB Schenker

- DHL Group

- GEFCO SA

- Kerry Logistics Network Ltd

- Kuehne+Nagel International AG

- Penske Logistics Inc.

- Ryder System Inc.

- DSV Panalpina AS

- Expeditors

- Panalpina

- XPO Logistics Inc.

- Tiba Group

- Bollore Logistics

- CFR Rinkens*

第8章市場的未來

第9章 附錄

The Global Automotive Logistics Market size is estimated at USD 317.29 billion in 2024, and is expected to reach USD 437.80 billion by 2029, growing at a CAGR of 6.65% during the forecast period (2024-2029).

The COVID-19 problem has significantly impacted numerous industries, including tourism, healthcare, and retail. Due to the pandemic's extensive disruption of its supply chain, the automotive industry has also been severely impacted. The health issue continues to significantly influence the automotive industry despite a gradual lifting of government restrictions. With the automotive industry continually evolving, logistics are getting complex. Automotive companies are looking toward supply chain strategies to exploit new market opportunities, reduce costs, and maintain competitive advantage.

Key Highlights

- Additionally, the introduction of electric vehicles is projected to offer a key uplift to the global automotive logistics market. The players operating in the logistics industry also offer warehousing and inventory management services to OEMs and Tier I and Tier II component manufacturers. The demand for these services depends on vehicle production.

- Hence, the regions with more vehicle production are likely to have a significant share in the automotive warehousing sector. In addition to warehousing and distribution, logistics service providers (LSPs) also offer assembly services for OEMs.

- Global car makers are disrupting the traditional supply chain with innovative transport solutions. For instance, in January 2019, Renault announced plans to start a home delivery service in Russia for vehicles sold via its online showroom. Promoting the online showroom is part of Renault's sales development strategy in Russia. It has already sold 27,000 finished vehicles via the site, primarily Renault Kaptur and Renault Duster units.

- While roll-on/roll-off (ro-ro) is the traditional method of shipping finished vehicles, containerization is becoming increasingly viable as the automotive industry decentralizes and introduces more EVs. Growth in China and Southeast Asia offers shipping and logistics companies good opportunities.

- Furthermore, the use of containers on developing routes out of China is also being adopted, especially by rail between China and Europe. Southeast Asia is considered one of the favorable regions to make containerization feasible, as the region witnesses growth in vehicle sales and demand for logistics services.

- Following the free trade agreement signed in the ASEAN markets, including the Philippines, Malaysia, Thailand, Vietnam, and Cambodia, trade-in finished vehicles has grown. CFR Rinkens, a vehicle transportation service provider, won a contract to ship BMWs from Europe to Vietnam in containers.

Automotive Logistics Market Trends

Positive Outlook for the Automotive Sales and Production Demands Efficient Logistics Services

Despite some headwinds, the automotive industry looks bright globally. According to industry sources, global light vehicle production unit sales have been remarkable and continue to grow. APAC is expected to register the highest growth rate in terms of production volumes, followed by North America. Furthermore, electric vehicle production and sales are increasing at a record pace, which needs specialized logistics.

The COVID-19 pandemic and automotive semiconductor shortages have resulted in lower demand and production halts for the worldwide automobile sector since 2020. Around 11.3 million vehicles were removed from production globally in 2021 due to the chip shortage, and predictions predict that seven more vehicles will be removed from production in 2022 due to supply chain disruptions in the automotive industry. After experiencing a decline during the pandemic, global auto sales began to rebound, reaching 66.7 million units sold in 2021. It was anticipated that this sales volume would drop in 2022, and the 2023 sales volume is expected to still be below the 2019 levels.

China's economy started to slow down after years of double-digit growth. Based on sales, China had the largest vehicle market, with about 19.8 million units in 2020. However, the coronavirus outbreak in the nation and worries about an impending recession caused monthly auto sales in China to plunge in 2021. Because of effective containment measures, the market began to show indications of recovery in April, giving key manufacturers a lifeline.

Asia-Pacific dominates the Market

As per the industry analysis, the Asia-pacific region is estimated to hold the major market share in the market. This is primarily because of emerging economies such as China and India. Numerous factors, like easy availability of raw materials, increased demand for vehicles in the region, rising population, and availability of low-wage workers, are anticipated to drive the automotive logistics market in the region.

APAC is home to some of the major automotive OEM companies, like Toyota, Maruti Suzuki, Hyundai, and SAIC Motor Corporation Limited, among others. With the increasing production and trading activities, there is a demand for logistics companies to manage the procurement, transport, and storage activities of the OEMs to optimize the latter's supply chain more efficiently.

Global logistics companies are increasingly entering the APAC region to tap the growth associated with the market. For instance, in June 2019, French logistics provider GEFCO set up a dedicated subsidiary in Chongqing (China) to specialize in importing and exporting vehicles by rail between Europe, Russia, and China. Additionally, it is developing the group's other logistics activities in Central China.

Beyond current inbound and aftermarket services in the Chinese automotive sector, GEFCO plans to boost OEM supply chains in China with activity in the finished vehicle sector. These include door-to-door services for complete built-up units, pre-carriage, car transport, storage, compound design, operation management, and domestic distribution to dealers. Furthermore, the group anticipates increasing demand for new-generation automotive logistics and other development opportunities resulting from China's Belt and Road infrastructure-led initiative.

OBOR extends to most of the countries in the region with major development plans. Electric Vehicle sales will witness significant growth in the region, owing to several nation's environmental and sustainability goals. Logistics companies with capabilities to handle EVs and their parts can benefit from this scenario.

Automotive Logistics Industry Overview

The automotive logistics market is fragmented in nature, with large global players, small- and medium-sized local players, and few players who occupy the market share. Most global logistics players have an automotive logistics division to meet the market needs and demand. Additionally, local players are increasingly enhancing their capabilities in terms of inventory handling, service offerings, products handled, and technology.

The third-party logistics (3PL) service providers in the market compete intensely based on reliability and supply chain capacity. By offering value-added services, companies would differentiate their service offerings. The growing e-commerce sales are creating opportunities and challenges for logistics firms in terms of speed, delivery, etc.

Global companies with high assets and capital can invest in advanced technology and distribution centers and benefit from the scenario mentioned above. On the other hand, regional and local players are coming up with better sector solutions to support the needs of manufacturers, retailers, as well as dealers. This industry's major players include Hellmann Worldwide Logistics, APL Logistics, BLG Logistics Group, CEVA Logistics, and DB Schenker.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Industry Value Chain Analysis

- 4.3 Government Regulations and Initiatives

- 4.4 Global Logistics Sector (Overview, LPI Scores, Key Freight Statistics, etc.)

- 4.5 Focus on the Global Automotive Industry (Overview, Development and Trends, Statistics, etc.)

- 4.6 Spotlight - Effect of E-commerce on Traditional Automotive Logistics Supply Chain

- 4.7 Review and Commentary on Reverse Logistics (Overview, Challenges in Comparison with Forwards Logistics, etc.)

- 4.8 Insights on Automotive Aftermarket and its Logistics Activities

- 4.9 Spotlight on the Demand for Contract Logistics and Integrated Logistics

- 4.10 Impact of COVID 19 on Automotive Logistics Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

- 5.3 Market Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Powers of Buyers/Consumers

- 5.4.2 Bargaining Power of Suppliers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing, Distribution, and Inventory Management

- 6.1.3 Other Services

- 6.2 By Type

- 6.2.1 Finished Vehicle

- 6.2.2 Auto Components

- 6.2.3 Other Types

- 6.3 Geography

- 6.3.1 Asia-Pacific

- 6.3.1.1 China

- 6.3.1.2 Japan

- 6.3.1.3 India

- 6.3.1.4 South Korea

- 6.3.1.5 Rest of Asia-Pacific

- 6.3.2 North America

- 6.3.2.1 United States

- 6.3.2.2 Canada

- 6.3.2.3 Mexico

- 6.3.3 Europe

- 6.3.3.1 United Kingdom

- 6.3.3.2 Germany

- 6.3.3.3 Italy

- 6.3.3.4 Russia

- 6.3.3.5 France

- 6.3.3.6 Rest of Europe

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 South Africa

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Hellmann Worldwide Logistics SE & Co. KG

- 7.2.2 APL Logistics Ltd

- 7.2.3 BLG Logistics Group AG & Co. KG

- 7.2.4 CEVA Logistics

- 7.2.5 DB Schenker

- 7.2.6 DHL Group

- 7.2.7 GEFCO SA

- 7.2.8 Kerry Logistics Network Ltd

- 7.2.9 Kuehne + Nagel International AG

- 7.2.10 Penske Logistics Inc.

- 7.2.11 Ryder System Inc.

- 7.2.12 DSV Panalpina AS

- 7.2.13 Expeditors

- 7.2.14 Panalpina

- 7.2.15 XPO Logistics Inc.

- 7.2.16 Tiba Group

- 7.2.17 Bollore Logistics

- 7.2.18 CFR Rinkens*

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 GDP Distribution (by Activity - Key Countries)

- 9.2 Insights on Capital Flows - Key Countries

- 9.3 Economic Statistics - Transport and Storage Sector, Contribution to Economy (Key Countries)

- 9.4 Global Automotive Industry Statistics