|

市場調查報告書

商品編碼

1433849

ICS(工業控制系統)安全:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Industrial Control Systems (ICS) Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

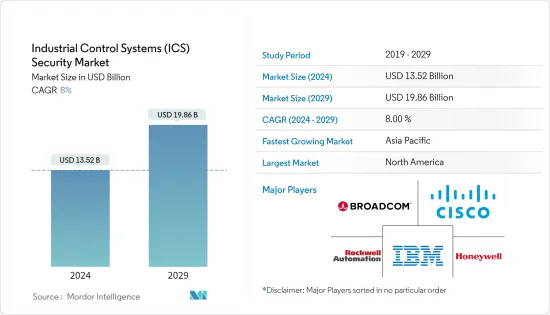

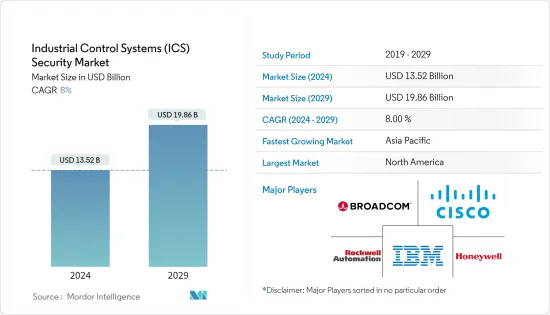

ICS(工業控制系統)安全市場規模預計到 2024 年為 135.2 億美元,預計到 2029 年將達到 198.6 億美元,預測期內(2024-2029 年)複合年成長率為 8。經過 %。

主要亮點

- 向工業 4.0 的過渡預計將帶來效率和生產力的許多進步,以及工業流程工作方式的許多變化。與傳統製造流程相比,效率的提高和生產成本的降低正在推動自動化的採用,並推動對 ICS 的需求。然而,隨著網路攻擊和網路安全威脅呈指數級成長,ICS解決方案的採用帶來了安全需求。

- 網路威脅的增加正在推動全球工業控制系統和安全市場的銷售成長。網路攻擊的增加導致製造、化學、能源和其他行業擴大採用 ICS。隨著駭客試圖闖入商業網路,ICS 安全性的使用顯著增加。此外,先進技術的採用正在產生大量資料,增加了對ICS安全的需求,從而推動了全球市場的收益成長。

- 政府與持續改進計劃 (CIP) 相關的嚴格規則和法規,旨在增加 ICS 安全解決方案的採用,以及工業中物聯網 (IoT) 等先進技術的採用,正在增加對 ICS 安全市場的需求。工業網路基礎設施連接大量感測器和控制器,安全性難以保證。物聯網技術和其他網路設備在工業中的日益使用正在擴大犯罪分子的威脅面。組織的物聯網應用需要 ICS 安全性,這將推動市場發展。

- COVID-19 大流行和全部區域封鎖規定影響了工業活動。疫情增加了消費者對網路的依賴,進一步擴大了ICS市場。 COVID-19 的爆發迫使製造業重新評估傳統生產流程,主要推動整個生產線的數位轉型和智慧製造實踐。製造商也被迫設計和實施多種新的敏捷方法來監控產品和品管。

- 許多組織中 ICS 硬體和軟體的老化加劇了複雜性。由於傳統 ICS 對工廠功能的重要性,大多數組織仍然使用傳統 ICS。 ICS 的老化為網路攻擊留下了充足的機會並增加了複雜性。此外,安全系統和平台的成本是阻礙組織部署ICS保全服務的另一個因素。由於多種原因,證明安全解決方案成本的合理性非常困難。

ICS安全市場趨勢

汽車產業預計將佔據較大佔有率

- ICS 為汽車產業提供了快速回應市場需求、減少製造停機時間、提高供應鏈效率和擴大生產力的機會。

- 機器人和感測器等現場設備和 ICS 為汽車行業提供了快速響應市場需求、減少製造停機時間、提高效率和擴大生產力的機會。

- 汽車產業是重要產業之一,在全球自動化製造設備中佔有很大佔有率。各種汽車製造商的生產設施都實現了自動化,以保持效率。以電動車(EV)取代傳統汽車的趨勢日益成長,預計將進一步增加汽車產業的需求。例如,IEA表示,全球電動車銷量將從2020年的300萬輛翻倍至2021年的660萬輛。

- 多家汽車相關企業正在與 ICS 供應商合作升級其設備。例如,ICONICS 與 S&T Technologies 簽署了合作協議,後者提供物聯網軟體框架 SUSiEtec。該協議規定,S&T Technologies 將把 SCADA 功能整合到 SUSiEtec 軟體框架中。

- 儘管汽車產業大幅放緩,但主導電動車製造商為首的汽車生產設施中安裝的智慧/網路連線 ICS 解決方案的數量不斷增加,這顯著增加了對 ICS 安全解決方案的需求。

預計北美將佔據最大佔有率

- 北美是實施 ICS 安全解決方案的先驅。該地區對最新技術進步也高度敏感,例如將雲端和物聯網與ICS安全解決方案相整合,以建立整體安全存取機制並實施安全管治框架。官民合作關係和國際合作正在為該地區帶來有效的工業控制系統安全和復原力。

- 據國防安全保障部 (DHS) 稱,私營部門擁有美國85% 的關鍵基礎設施,包括石油和天然氣、銀行和金融、交通、公共產業、電網和國防。同時,公共部門負責監管其餘部分。例如,在該地區的能源和電網領域,國土安全部、能源部(DOE)和國防部(DOD)要求公私監管合作,以保護操作技術和工業控制系統來自網路威脅。此外,雲端基礎的ICS 安全解決方案和服務在該地區越來越受歡迎。

- 加拿大製造商依靠創新和技術投資來保持競爭力。不斷上升的投入和人事費用,以及來自全球大型製造商的競爭,促使加拿大投資 ICS 和相關技術,以保持競爭力並維持營運報酬率。

- 此外,根據加拿大政府2021年版本,預計製造業對加拿大GDP的貢獻率將超過10%。製造業是加拿大新技術研究、開發和實施的最大投資者。

- 最近,MITRE 公司發布了工業控制系統 ATT&CK,這是針對 ICS 的網路攻擊行為的分類。該攻擊針對金融和間諜動機的攻擊以及行業意識,推出解決製造業和公共產業領域的關鍵基礎設施營運問題。

- 然而,國家對監管的抵制以及確保工業控制系統安全的日益複雜性可能會阻礙關鍵基礎設施網路安全立法的通過。

ICS安全產業概述

ICS 安全市場競爭激烈,由多家大型企業組成。許多公司透過推出新產品、建立合作夥伴關係和收購公司來擴大市場佔有率。

- 2021 年 9 月Honeywell收購了非上市公司 Performix Inc.,該公司是一家面向製藥製造和生物技術行業的製造執行系統 (MES) 軟體提供商。此次收購建立在Honeywell的策略之上,即為生命科學客戶打造全球領先的整合軟體平台,以最高的品質水準提供更快的合規性、更高的可靠性和更高的生產量。我們正在努力實現這一目標。

- 2021 年 8 月 - 總部位於美國加州的領先網路安全解決方案供應商 CyberProof 宣布與總部位於以色列特拉維夫-雅法的工業網路網路安全解決方案供應商 Radiflow 建立合作夥伴關係。此次合作也增強了 Cyber Proof 提供整合到資訊技術 (IT) 或操作技術(OT) 系統中的全面託管檢測和回應 (MDR) 服務的能力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 網路攻擊增加

- IT 與 OT 網路融合

- 市場限制因素

- 安全系統實施的複雜性

- ICS安全產業各種經營模式的出現

第6章市場區隔

- 最終用戶產業

- 汽車產業

- 化工/石化

- 電力/公用事業

- 藥品

- 食品和飲料

- 油和氣

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Darktrace Ltd

- FireEye Inc.

- IBM Corporation

- Cisco Systems Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd

- Honeywell International Inc.

- Broadcom Inc.(Symantec Corporation)

- AhnLab Inc.

- McAfee LLC(TPG Capital)

- Rockwell Automation Inc.

- Dragos Inc.

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 66569

The Industrial Control Systems Security Market size is estimated at USD 13.52 billion in 2024, and is expected to reach USD 19.86 billion by 2029, growing at a CAGR of 8% during the forecast period (2024-2029).

Key Highlights

- The transition to Industry 4.0 is expected to bring many advances in efficiency and productivity, as well as many changes in the way the industrial processes work. Compared to the conventional manufacturing process, improved efficiency and reduction in production costs have boosted the adoption of automation, driving the demand for industrial control systems. However, the adoption of ICS solutions brings along the need for security, as there is an exponential rise in cyber-attacks and network security threats.

- The growing number of cyber threats has fueled revenue growth in the worldwide industrial control systems security market. With the increasing number of cyber-attacks, the adoption of industrial control systems is increasing in the manufacturing, chemical, energy, and other industries. With increasing attempts by hackers to enter business networks, the use of ICS security is growing significantly. Furthermore, the adoption of advanced technologies is resulting in the generation of massive amounts of data, increasing demand for ICS security, and as a result, driving revenue growth in the global market.

- The stringent government rules and regulations related to the Continuous Improvement Programme (CIP) to increase the adoption of ICS security solutions and the adoption of advanced technologies such as the Internet of Things (IoT) in industries has increased demand for the ICS security market. The industrial network infrastructure's large number of connected sensors and controllers has made security more difficult. The growing use of IoT technology and other network devices in industries has expanded the threat surface for criminals. ICS security is necessary for organizations' IoT applications, which will drive the market.

- The COVID-19 pandemic and lockdown restrictions across the region have affected industrial activities. The pandemic increased consumers' dependence on the internet, further increasing the market for industrial control systems. The outbreak of COVID-19 has forced manufacturing industries to re-evaluate their traditional production processes, primarily driving the digital transformation and smart manufacturing practices across the production lines. The manufacturers are also forced to devise and implement multiple new and agile approaches to monitor product and quality control.

- The aging hardware or software of the ICS in many organizations is another factor responsible for increased complexity. Most organizations still use legacy ICS, owing to their importance in the functioning of the plant. This increased age of ICS leaves ample opportunities for cyberattacks and increases complexity. Also, the cost of a security system or platform is another factor hindering the deployment of ICS security services in organizations. Justifying the cost incurred for the security solutions is quite difficult for various reasons.

Industrial Control Systems Security Market Trends

Automotive is Expected to Hold a Significant Share

- ICS offers opportunities to the automotive industry to react faster to the market requirements, reduces manufacturing downtimes, enhances the efficiency of supply chains, and expands productivity.

- Field devices, such as robotics and sensors, and ICS offer opportunities to the auto sector to react faster to market requirements, reduce manufacturing downtimes, enhance efficiency, and expand productivity.

- The automotive industry is among the prominent sectors that hold a significant share of automated manufacturing facilities worldwide. The production facilities of various automakers are automated to maintain efficiency. The rising trend of replacing conventional vehicles with electric vehicles (EVs) is expected to augment the automotive industry's demand further. For instance, IEA states global electric car sales doubled from 3.0 million in 2020 to 6.6 million in 2021.

- Various automotive enterprises are forming partnerships with the ICS providers to upgrade their facilities. For example, S&T Technologies, a provider of IoT software framework, SUSiEtec, and ICONICS signed a collaboration agreement. The contract specifies that S&T Technologies will integrate SCADA capabilities into the SUSiEtec software framework.

- Despite a considerable slowdown in the automotive industry, automotive production facilities led by electric vehicle manufacturers are expected to increase the number of smart/internet-connected ICS solutions installed in a facility, significantly increasing the demand for ICS Security solutions.

North America is Expected to Hold the Largest Share

- North America has been a pioneer in implementing ICS security solutions. This region has also been extremely responsive to the latest technological advancements, such as integrating cloud and IoT with ICS security solutions to set a holistic secure access mechanism and enforce a security governance framework. The Public-Private Partnerships and international partnerships have led to effective ICS security and resilience in the region.

- According to the Department of Homeland Security (DHS), The private sector owns 85% of critical infrastructure in the United States, including oil and gas, banking and finance, transportation, utilities, electric power grids, and defense. In contrast, the public sector regulates the rest. For instance, the region's energy and power grid sectors require public, private, and regulatory collaboration among DHS, the Department of Energy (DOE), and the Department of Defense (DOD) to protect their operational technology and Industrial Control Systems from cyber threats. Furthermore, cloud-based ICS security solutions and services are becoming increasingly popular in this region.

- Canadian manufacturers rely on innovation and investment in technologies to be competitive. The increasing input, labor cost, and competition from large global manufacturers enabled the country to invest in ICS and allied technologies to remain competitive and maintain its operating margins.

- Furthermore, according to the Government of Canada 2021, the manufacturing industry is estimated to contribute more than 10% to the Canadian GDP. The manufacturing sector is the largest investor in the R&D and implementation of new technologies in Canada.

- Recently, MITRE Corporation released ATT&CK for Industrial Control Systems, a taxonomy of cyber attack behavior targeting ICS. The company was launched to address critical infrastructure operations in manufacturing and utility industries with financial and espionage-motivated attacks and industry awareness.

- However, the country's resistance to regulation and growing complexities in securing ICS systems may act as a roadblock to the passage of critical infrastructure cybersecurity legislation.

Industrial Control Systems Security Industry Overview

The Industrial Control System Security Market is highly competitive and consists of several major players. Many companies have been increasing their market presence by introducing new products, entering partnerships, or acquiring companies.

- September 2021 - Honeywell acquired privately held Performix Inc., a manufacturing execution system (MES) software provider for the pharmaceutical manufacturing and biotech industries. The acquisition builds on Honeywell's strategy to create the world's leading integrated software platform for customers in the life sciences industry, striving to achieve faster compliance, improved reliability, and better production throughput at the highest levels of quality.

- August 2021 - CyberProof, a leading provider of cyber security solutions based in California, United States., announced a collaboration with Radiflow, a Tel Aviv-Yafo, Israel-based provider of cyber security solutions for industrial networks. In addition, the partnership strengthens CyberProof's ability to provide comprehensive Managed Detection and Response (MDR) services for converged Information Technology (IT) or Operational Technology (OT) systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Incidence of Cyberattacks

- 5.1.2 Convergence of IT and OT Networks

- 5.2 Market Restraints

- 5.2.1 Complexity in Implementing the Security Systems

- 5.2.2 Emergence of Various Business Models in ICS Security Industry

6 MARKET SEGMENTATION

- 6.1 End-user Industry

- 6.1.1 Automotive

- 6.1.2 Chemical and Petrochemical

- 6.1.3 Power and Utilities

- 6.1.4 Pharmaceuticals

- 6.1.5 Food and Beverage

- 6.1.6 Oil and Gas

- 6.1.7 Other End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles *

- 7.1.1 Darktrace Ltd

- 7.1.2 FireEye Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Fortinet Inc.

- 7.1.6 Check Point Software Technologies Ltd

- 7.1.7 Honeywell International Inc.

- 7.1.8 Broadcom Inc. (Symantec Corporation)

- 7.1.9 AhnLab Inc.

- 7.1.10 McAfee LLC (TPG Capital)

- 7.1.11 Rockwell Automation Inc.

- 7.1.12 Dragos Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219