|

市場調查報告書

商品編碼

1433821

非彈性地板材料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Non-Resilient Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

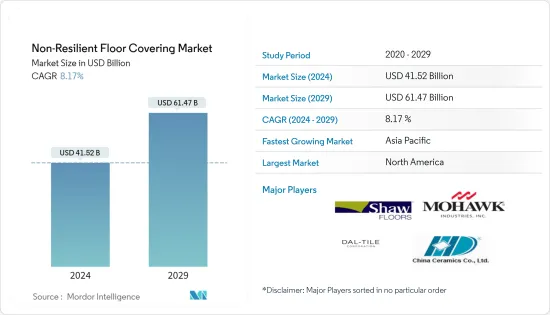

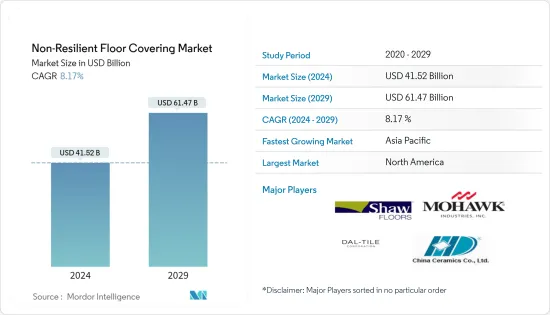

非彈性地板材料市場規模預計到2024年為415.2億美元,預計到2029年將達到614.7億美元,在預測期內(2024-2029年)複合年成長率為8.17%。

COVID-19 對市場產生了重大影響,停止了所有建築類型的建設和開發計劃。不過,隨著市場放寬、各項規定解除後,非彈性地板材料市場又重新恢復了節奏。非彈性地板材料產品在壓力下不會下垂。由有機硬表面地板材料陶瓷和陶瓷瓷磚、實心硬木和工程硬木、層壓板、天然石材、板岩和磚。由於發展中經濟體新住宅和商業設施建設活動的活性化,該市場預計在未來幾年內將實現高速成長。房地產轉售的增加刺激了住宅裝修、住宅改善計劃以及全球住宅的上漲。陶瓷和石材產品供應商增加了對線上零售通路的依賴。採礦技術的進步降低了天然石材和人造石材的價格,從而推動了產業成長。

有幾個因素也推動了對非彈性地板材料產品的需求,例如防水性、易於清潔、提高舒適度和地板耐用性。由於瓷磚的各種優勢,預計瓷磚細分市場將在預測期內迅速擴張。

非彈性地板材料市場趨勢

磁磚細分市場驅動市場

瓷磚廣泛用於新建住宅和住宅維修。此外,瓷磚也用於商業應用,例如商場和購物中心、職場和辦公空間。陶瓷地板材料是彈性地板材料市場的主要驅動力。在亞太地區,對美國、墨西哥、中國、義大利等已開發國家的陶瓷地板產品的需求不斷增加。陶瓷地板產品很受歡迎,因為它們可以模仿木材和石材的飾面。供應商正在利用先進的數位印刷技術來提供具有廣泛設計美學的瓷磚。

亞太地區是成長最快的地區

亞太地區建築業的擴張正在推動市場。該地區支持促進基礎設施和住宅建設市場發展的政府政策和措施。該國為建設公司提供設立自己公司的機會,以及各種補貼和豁免。此外,地板材料近年來在亞洲市場越來越受歡迎。

非彈性地板材料行業概況

該報告涵蓋了非彈性地板材料市場上營運的主要國際公司。市場分散,較大的公司獲得更大的市場佔有率。然而,隨著技術進步和產品創新的出現,中小企業正在透過贏得新契約和開發新市場來增加其市場佔有率。主要公司包括中國陶瓷、Mohawk Industries Inc.、Kajaria Ceramic、Shaw Industries, Inc. 和 Dal Tiles。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 市場限制因素

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 洞察創新

- COVID-19 對市場的影響

第5章市場區隔

- 依產品

- 磁磚地板

- 石材磁磚地板

- 強化木地板

- 木地板磚

- 其他

- 按分銷管道

- 委託

- 專賣店

- 家居中心

- 其他

- 按最終用戶

- 住宅

- 商業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 澳洲

- 印度

- 韓國

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 南美洲

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 市場集中度概覽

- 公司簡介

- Mannington Mills, Inc.

- Shaw Industries, Inc.

- Mohawk Industries, Inc.

- Ceramic Saloni

- China Ceramics

- Kajaria Ceramics

- Porcelanosa Group

- RAK Ceramics

- Dal Tiles

- Crossville Inc.*

第7章 市場機會及未來趨勢

第 8 章 免責聲明與出版商訊息

The Non-Resilient Floor Covering Market size is estimated at USD 41.52 billion in 2024, and is expected to reach USD 61.47 billion by 2029, growing at a CAGR of 8.17% during the forecast period (2024-2029).

Covid-19 greatly impacted the market as all the construction and development plans for all building types were stopped. But after the market was opened and all the restrictions were lifted, the non-resilient floor-covering market again gained pace. Non-resilient floor cover products do not flex under pressure. They are made of organic hard surfaces flooring materials, such as ceramic and porcelain tiles, solid and engineered hardwood, laminates, natural stone, slate, and bricks. The market is poised for high growth in the future years due to an upward movement in the new home and commercial construction activities in developing economies. Increased property resale stimulated homeowner remodeling, home improvement projects, and the worldwide rise in residential property prices. The ceramic and stone product suppliers increased their dependence on online retail channels. The technological advancements in mining resulted in reduced prices of natural and manufactured stones, which is, in turn, fuelling the growth of the industry.

Several factors, such as water resistance, ease of cleaning, enhanced comfort, and durability of floors, are also driving the demand for non-resilient flooring products. The ceramic tiles segment is expected to expand rapidly over the forecast period, owing to the various benefits of ceramic tiles.

Non-Resilient Floor Covering Market Trends

Ceramic Tile Segment Drives the Market

Ceramic tiles are extensively used in new residential and home improvement activities. Furthermore, ceramic tiles are used in commercial applications like malls, shopping centers, and work and office spaces. Ceramic flooring is the main driver of the resilient floor covering market. In the Asia-Pacific region, there is an increase in the demand for ceramic flooring products from developed countries, such as the United States, Mexico, China, and Italy. The ability of ceramic flooring products to replicate wood and stone finishes is fueling the demand. The vendors are leveraging the advancements in digital printing technology to provide ceramic tiles with a wide range of design aesthetics.

Asia Pacific is the Fastest Growing Region

The expanding construction sector in the Asia Pacific region drives the market. The region saw supportive government policies and regulations to boost the infrastructure and residential construction market. The country offers opportunities for construction companies, along with various subsidies and exemptions, to help the company establish itself. Furthermore, flooring in the last few years gained popularity in the Asian markets.

Non-Resilient Floor Covering Industry Overview

The report covers major international players operating in the non-resilient floor-covering market. The market is fragmented, with major players capturing a larger market share. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Major players include China Ceramics Co. Ltd, Mohawk Industries Inc., Kajaria Ceramic, Shaw Industries, Inc., and Dal Tiles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technology Innovation

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Ceramic Tiles Flooring

- 5.1.2 Stone Tiles Flooring

- 5.1.3 Laminate Tiles Flooring

- 5.1.4 Wood Tiles Flooring

- 5.1.5 Others

- 5.2 By Distribution Channel

- 5.2.1 Contract

- 5.2.2 Specialty Stores

- 5.2.3 Home Centers

- 5.2.4 Others

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 USA

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 Italy

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 India

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 Egypt

- 5.4.4.3 UAE

- 5.4.4.4 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Colombia

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Mannington Mills, Inc.

- 6.2.2 Shaw Industries, Inc.

- 6.2.3 Mohawk Industries, Inc.

- 6.2.4 Ceramic Saloni

- 6.2.5 China Ceramics

- 6.2.6 Kajaria Ceramics

- 6.2.7 Porcelanosa Group

- 6.2.8 RAK Ceramics

- 6.2.9 Dal Tiles

- 6.2.10 Crossville Inc.*